Table of Contents

Overview

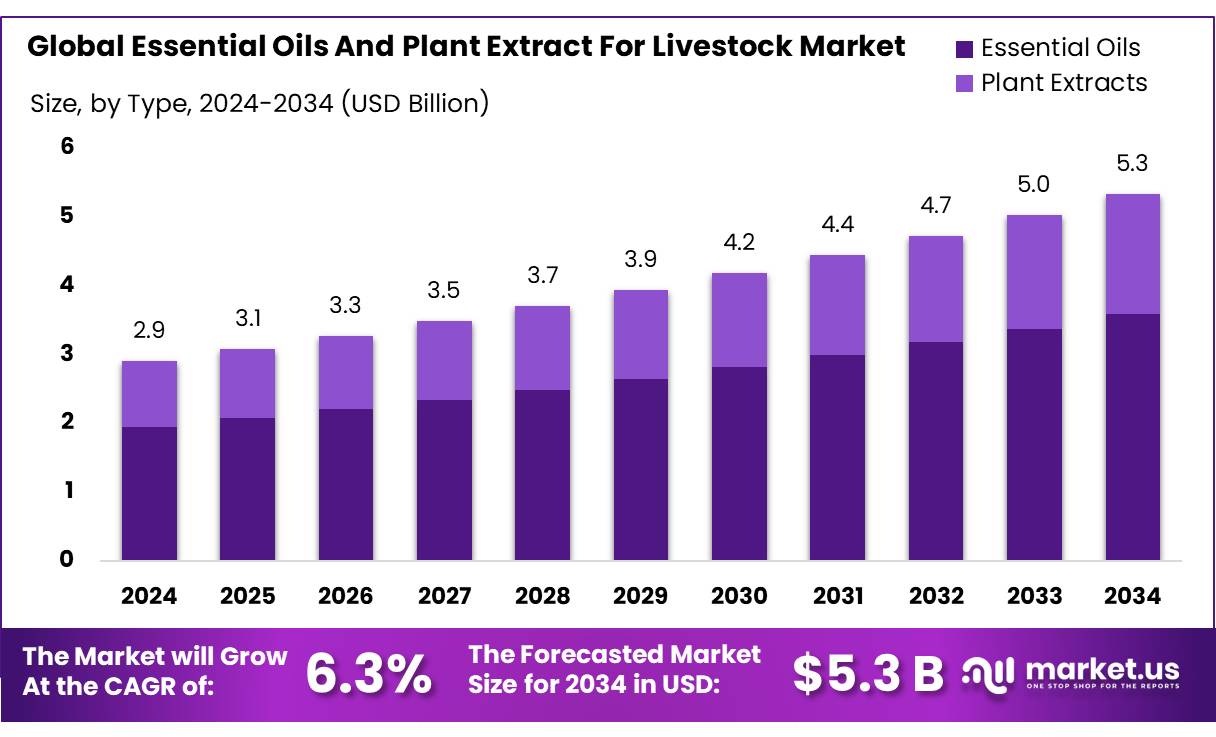

New York, NY – September 01, 2025 – The Global Essential Oils and Plant Extracts for Livestock Market is projected to grow from USD 2.9 billion in 2024 to USD 5.3 billion by 2034, with a CAGR of 6.3% during the forecast period (2025–2034). In 2024, the Asia-Pacific region led the market, holding a 44.7% share, equivalent to USD 1.2 billion in revenue.

Essential oils and plant extracts are gaining traction in livestock feed due to their role in addressing animal health, antimicrobial resistance, and climate goals. Livestock farming contributes significantly to global methane emissions, accounting for ~32% of human-related methane, with cattle responsible for ~75% of enteric methane. Phytogenic additives like oregano, thyme, cinnamon, citrus, and saponin-rich botanicals help optimize rumen fermentation, improve gut health, and reduce pathogen loads, offering a natural alternative to antibiotic growth promoters.

Key drivers include rising demand for antibiotic-free livestock products, growing awareness of antimicrobial resistance (AMR), and the need for sustainable farming practices. These additives enhance animal immunity, gut health, and productivity, aligning with consumer preferences for naturally raised livestock.

In India, the market is expanding, supported by government initiatives like the National Livestock Mission Scheme, which offers a 50% capital subsidy (up to Rs. 50 lakh) for feed and fodder infrastructure development. Additionally, the Animal Husbandry Infrastructure Development Fund (AHIDF), with a Rs. 15,000 crore allocation, encourages private investment in animal husbandry infrastructure, including feed plants, further boosting the adoption of essential oils and plant extracts.

Key Takeaways

- Essential Oils and Plant Extracts for the Livestock Market size is expected to be worth around USD 5.3 Bn by 2034, from USD 2.9 Bn in 2024, growing at a CAGR of 6.3%.

- Essential Oils held a dominant market position, capturing more than a 67.2% share in the Essential Oils and Plant Extract for Livestock Market.

- Liquid held a dominant market position, capturing more than a 77.4% share in the Essential Oils and Plant Extract for Livestock Market.

- Gut Health held a dominant market position, capturing more than a 38.3% share in the Essential Oils and Plant Extract for Livestock Market.

- Poultry held a dominant market position, capturing more than a 44.7% share in the Essential Oils and Plant Extract for Livestock Market.

- Asia Pacific held a dominant market position, capturing 44.7% of the Essential Oils and Plant Extract for Livestock market, valued at about USD 1.2 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/essential-oils-and-plant-extract-for-livestock-market/request-sample/

Report Scope

| Market Value (2024) | USD 2.9 Billion |

| Forecast Revenue (2034) | USD 5.3 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Type (Essential Oils, Plant Extracts), By Form (Liquid, Solid), By Function (Gut Health, Immunity, Yield, Others), By Livestock (Poultry, Cattle, Swine, Aquatic, Others) |

| Competitive Landscape | IDENA SAS, Kemin Industries, Inc., Novus International, Inc., DSM N.V., Trouw Nutrition Hifeed BV, Phytosynthese, Olmix S.A., Herbarom Laboratoire, Orffa, Indian Herbs Specialties Pvt. Ltd., Sensnutrition |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155209

Key Market Segments

By Type Analysis

In 2024, Essential Oils commanded a 67.2% share of the Essential Oils and Plant extracts, valued for their antimicrobial, antioxidant, and digestive health benefits. Stricter regulations on antibiotic growth promoters and rising consumer demand for residue-free meat, milk, and eggs have fueled their adoption. Essential oils enhance feed efficiency and animal performance while integrating seamlessly into existing feed systems. By 2025, their dominance is expected to grow, supported by government initiatives promoting sustainable, natural feed additives.

By Form Analysis

In 2024, Liquid formulations captured a 77.4% market share due to their ease of integration into feed and water systems, ensuring uniform distribution and precise dosing across large livestock populations. Liquids offer superior bioavailability, enhancing absorption and efficacy in improving animal health. By 2025, demand for liquid forms is set to remain robust, driven by advancements in emulsification, longer shelf life, and the rise of automated dosing systems in modern livestock operations, making them ideal for both small and large-scale producers.

By Function Analysis

In 2024, Gut Health applications held a 38.3% share, reflecting the industry’s focus on improving nutrient absorption, boosting immunity, and reducing antibiotic use. Essential oils and plant extracts promote balanced gut microbiota, reduce pathogens, and enhance feed conversion ratios in poultry, swine, and ruminants. By 2025, demand for gut health solutions is expected to rise as producers prioritize preventive health measures and comply with stricter antimicrobial resistance and food safety regulations, supporting animal welfare and productivity.

By Livestock Analysis

In 2024, Poultry accounted for a 44.7% market share, driven by its fast production cycles, high feed intake, and vulnerability to gut health issues. Essential oils and plant extracts improve digestion, boost immunity, and reduce enteric diseases without antibiotics. By 2025, poultry’s dominance is expected to persist, fueled by growing global demand for chicken and eggs, particularly in Asia-Pacific and Latin America, and consumer preference for antibiotic-free, naturally raised products.

Regional Analysis

Asia-Pacific leads with a 44.7% share and USD 1.2 billion in 2024

In 2024, Asia-Pacific dominated the Essential Oils and Plant Extracts for Livestock Market, holding a 44.7% share valued at USD 1.2 billion. The region’s leadership is driven by its vast poultry and dairy sectors in countries like China, India, Indonesia, and Thailand, alongside a shift toward antibiotic-stewardship programs promoting natural gut-health solutions.

Liquid essential oil blends are popular in large-scale broiler operations for uniform dosing and consistent flock performance. In swine and ruminants, plant extracts enhance digestion and immunity, integrated into premixes to improve feed conversion and resilience to heat stress. Modern feed mills in India and Southeast Asia are adopting advanced emulsification and microencapsulation to enhance shelf life and palatability, supporting high-throughput production.

Water-soluble formats are favored by contract growers for labor efficiency and rapid production cycles. Asia-Pacific’s lead is expected to strengthen, driven by rising demand for chilled and processed poultry, retailer emphasis on “antibiotic-responsible” sourcing, and tailored blends (e.g., thymol, carvacrol, citrus bioflavonoids) addressing regional challenges like coccidiosis and gut health in high-density settings.

Partnerships among additive formulators, integrators, and veterinary networks, combined with on-farm data and automated dosing, will further enhance distribution and ROI, cementing Asia-Pacific’s role as the market’s growth engine.

Top Use Cases

- Improving Gut Health: Essential oils like oregano and thyme promote healthy gut bacteria, reduce harmful pathogens, and improve nutrient absorption in livestock. This enhances feed efficiency and growth rates, especially in poultry and swine, while reducing the need for antibiotics, aligning with consumer demand for natural, residue-free animal products.

- Boosting Immunity: Plant extracts such as garlic and eucalyptus strengthen livestock immunity by supporting the body’s natural defenses. These additives help animals, particularly poultry and cattle, resist diseases like respiratory infections, reducing medication use and improving overall health, which is vital for sustainable farming practices.

- Enhancing Feed Palatability: Essential oils like citrus and peppermint improve the taste and smell of livestock feed, encouraging higher feed intake. This is especially beneficial for young or stressed animals, such as weaned piglets or dairy calves, leading to better growth and productivity in high-throughput farming systems.

- Reducing Methane Emissions: Plant extracts like saponins and cinnamon modulate rumen fermentation in cattle, cutting down methane production. This supports climate goals by reducing greenhouse gas emissions while maintaining animal health and productivity, making it a key solution for eco-conscious livestock operations.

- Stress Reduction: Essential oils such as lavender and chamomile have calming effects, reducing stress in livestock during transport or environmental changes. This improves animal welfare, minimizes health issues like reduced appetite, and enhances performance in poultry and swine, meeting growing consumer expectations for humane farming.

Recent Developments

1. IDENA SAS

IDENA SAS is advancing its natural plant extract solutions, focusing on zootechnical additives for gut health and methane reduction. Their recent developments include products like Apex, which combines saponins and tannins to improve feed efficiency and reduce environmental impact in ruminants. Research continues into optimizing blends for antibiotic-free production systems.

2. Kemin Industries, Inc.

Kemin has expanded its research into essential oil-based solutions like Clarity for sows, demonstrating benefits for reproductive performance and piglet vitality. Their recent work focuses on synergistic blends of phytogenic compounds to support gut integrity, immune response, and overall animal resilience, providing natural alternatives for productivity in antibiotic-free and conventional systems.

3. Novus International, Inc.

Novus highlights its Activin solution, a blend of essential oils and flavor compounds, to enhance palatability and support digestive health in swine and poultry. Recent trials confirm its role in improving feed intake in early-growth stages and during health challenges, supporting performance in the absence of antibiotic growth promoters.

4. DSM N.V.

Through its Sustell sustainability platform, DSM integrates essential oils like its Crina products to improve feed efficiency and reduce the environmental footprint of livestock production. Recent developments focus on combining these phytogenics with precision nutrition to optimize rumen function, lower methane emissions, and enhance nitrogen utilization for more sustainable farming.

5. Trouw Nutrition Hifeed BV

Trouw Nutrition is researching plant extract blends like Fresta Protect to support gut health and performance in young animals. Recent studies focus on their role in managing oxidative stress and inflammation, improving viability in challenging production phases. Their approach integrates phytogenics into broader nutritional health programs for holistic farm management.

Conclusion

The market for essential oils and plant extracts in livestock is growing rapidly due to their natural benefits in improving gut health, immunity, and feed efficiency while reducing antibiotic use and methane emissions. With rising consumer demand for sustainable, antibiotic-free products and supportive government initiatives, these additives are set to drive innovation and growth in livestock nutrition.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)