Table of Contents

Overview

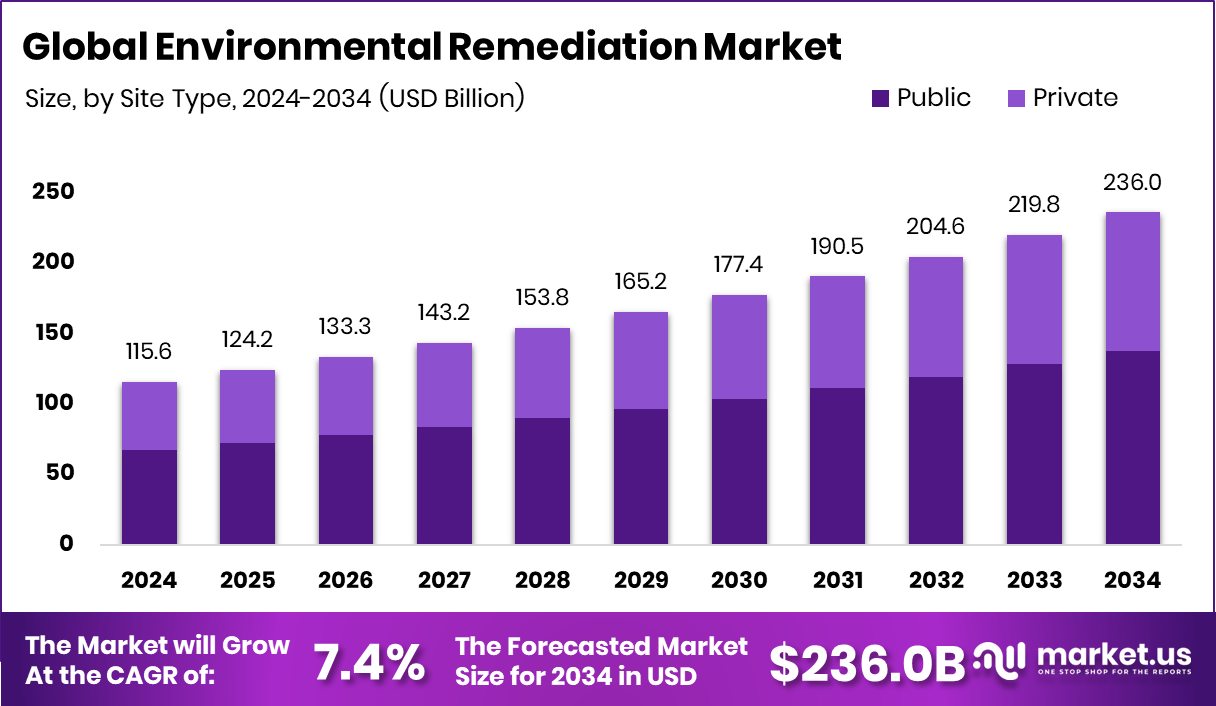

New York, NY – Nov 05, 2025 – The Global Environmental Remediation Market, valued at USD 115.6 billion in 2024, is projected to reach USD 236.0 billion by 2034, growing at a 7.4% CAGR. North America leads the market with a USD 53.0 billion share, driven by strict regulations and substantial funding.

Environmental remediation involves removing pollutants or hazardous materials from soil, water, or sediments to restore ecosystems and safeguard public health. The market covers technologies such as soil washing, bioremediation, and groundwater treatment used across industrial and municipal cleanup projects.

Increasing industrialization, urban growth, and recurring contamination incidents continue to boost global demand. Governments are enforcing tougher cleanup laws, pushing industries to adopt sustainable and cost-efficient remediation solutions. Green methods like bioremediation and phytoremediation are gaining traction due to their lower environmental impact.

However, policy contradictions remain—for instance, the U.S. Spending Bill allocates $40 billion in fossil-fuel subsidies, and President Trump’s aid to the fossil-fuel industry totals $80 billion over the next decade. These highlight the tension between supporting polluting sectors and the rising need for cleanup, ultimately spurring innovation toward eco-friendly and efficient remediation technologies worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-environmental-remediation-market/request-sample/

Key Takeaways

- The Global Environmental Remediation Market is expected to be worth around USD 236.0 billion by 2034, up from USD 115.6 billion in 2024, and is projected to grow at a CAGR of 7.4% from 2025 to 2034.

- Public sites account for 58.3%, highlighting government responsibility in driving Environmental Remediation Market initiatives.

- Soil leads with 48.5%, as contamination cleanup remains central to the Environmental Remediation Market scope.

- Oil and gas hold 28.4%, emphasizing industry reliance on the Environmental Remediation Market for compliance.

- The North American market size reached USD 53.0 Bn, reflecting strong remediation demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159979

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 115.6 Billion |

| Forecast Revenue (2034) | USD 236.0 Billion |

| CAGR (2025-2034) | 7.4% |

| Segments Covered | By Site Type (Public, Private), By Medium (Soil, Water, Air), By End-use (Oil and Gas, Mining and Forestry, Agriculture, Automotive, Waste Management, Manufacturing, Construction, Others) |

| Competitive Landscape | ENTACT, DEME, WSP, CLEAN HARBORS, INC., Sequoia Environmental, Bristol Industries, LLC, In-Situ Oxidative Technologies, Inc., HDR, Inc., AECOM, Tetra Tech Inc., BRISEA, Jacobs |

Key Market Segments

By Site Type Analysis

In 2024, the public segment dominated the By Site Type category of the environmental remediation market, capturing a 49.2% share. This leadership reflects the strong influence of government-led initiatives aimed at cleaning up contaminated lands and ensuring environmental safety.

Publicly managed remediation projects typically target former industrial zones, municipal landfills, and hazardous waste areas, where restoration is crucial for community health and ecosystem balance. The segment’s prominence underscores the vital role of public sector investment in meeting environmental standards and promoting sustainable land use.

Continuous government funding and policy-driven programs highlight the sector’s long-term commitment to pollution management, reflecting a strategic focus on large-scale cleanup and the rehabilitation of public lands to meet both regulatory and ecological objectives.

By Medium Analysis

In 2024, the soil segment led the by-medium category of the environmental remediation market, accounting for a 49.2% share. This dominance stems from the widespread contamination of soil caused by industrial effluents, pesticide use, and poor waste management practices. Soil remediation remains a top environmental priority since it directly influences crop productivity, groundwater purity, and public health.

The segment’s strong position reflects the increasing adoption of cleanup techniques such as excavation, stabilization, and biological treatments that restore land for safe and sustainable use. As soil is often the first medium impacted by pollutants, its significant share emphasizes the urgent global focus on technologies and strategies that prevent further degradation and safeguard ecosystems and nearby communities.

By End-use Analysis

In 2024, the oil and gas sector dominated the end-use segment of the environmental remediation market, securing a 49.2% share. This leadership is attributed to the industry’s high pollution risk from drilling, refining, and transportation activities, which frequently cause soil and groundwater contamination. The sector’s large share reflects ongoing remediation needs to manage oil spills, leakages, and hazardous waste across operations.

With stringent environmental regulations and growing efforts to clean up legacy pollution from extraction and refining sites, oil and gas companies continue to invest heavily in remediation technologies. This dominance emphasizes the sector’s pivotal role in driving cleanup initiatives and influencing global environmental restoration strategies.

Regional Analysis

In 2024, the environmental remediation market showed diverse regional dynamics shaped by industrial intensity, regulations, and public investment levels. North America led with a 45.9% share, valued at USD 53.0 billion, supported by stringent environmental laws and substantial government funding for soil and groundwater cleanup initiatives.

Europe maintained steady growth through its commitment to sustainability and restoration of former industrial zones, while the Asia Pacific region experienced strong momentum driven by rapid urbanization and pollution concerns from expanding manufacturing sectors.

Meanwhile, the Middle East & Africa are increasingly addressing contamination from oil extraction and mining, and Latin America is advancing through policy-backed land restoration efforts. Although North America remains the market leader, both Europe and the Asia Pacific continue to play major roles in global remediation efforts, with emerging regions gradually reinforcing their environmental priorities.

Top Use Cases

- Soil contamination at industrial sites: Industrial operations often leave behind soils rich in heavy metals, oil, or chemicals. Cleaning up involves excavation, soil washing, or stabilization to make it safe again. For example, remediation techniques for contaminated soil help remove PCBs, volatile organics, metals, and pathogens.

- Groundwater cleanup after fuel or chemical leaks: When underground tanks leak or chemicals seep into aquifers, remediation may involve pumping and treating groundwater or injecting reactive substances to neutralize pollutants. One case study shows a comprehensive groundwater remediation investigation and cleanup.

- Bioremediation of polluted soil using microbes or plants: Instead of heavy machinery, some sites use natural processes: microbes break down oil or chemical compounds, or plants absorb heavy metals (phytoremediation). This green method is becoming more popular for cost-effective cleanup.

- Sediment restoration in rivers, lakes, and harbors: Pollutants settle in riverbeds or lake sediments (heavy metals, hydrocarbons), and remediation covers dredging, capping, or treating those sediments so toxins don’t re-enter the ecosystem.

- Remediation of landfill sites and municipal wastes: Legacy landfills may leak leachate or methane, threatening soil and water. Remediation includes soil/groundwater containment, landfill capping, and treating contaminated zones to restore land for safe reuse.

- Site restoration after oil & gas operations: Drilling, refining, or pipeline leaks often contaminate soil and groundwater with hydrocarbons or hazardous chemicals. The oil & gas sector remains a major driver of remediation work to mitigate these risks.

Recent Developments

- In April 2025, DEME signed an agreement to acquire Havfram Wind Holdco AS, a Norway-based offshore wind installation firm; the deal closed in May 2025 valued at ~€900 million. The move aims to bolster DEME’s offshore wind and marine infrastructure capabilities (in addition to its remediation & dredging work).

- In December 2024, ENTACT announced that it acquired new Caterpillar D6 XE electric-drive dozers. The move strengthens ENTACT’s commitment to sustainability, by using machines with better productivity, lower fuel consumption and reduced maintenance. This helps ENTACT provide remediation and construction services more efficiently and with lower environmental impact.

Conclusion

The Environmental Remediation Market is steadily growing as nations prioritize cleaner ecosystems and sustainable industrial practices. Increasing awareness of pollution’s impact on public health and the environment is driving the adoption of advanced cleanup technologies. Governments and industries are working together to restore contaminated lands, safeguard water resources, and ensure compliance with strict environmental regulations.

Continuous innovation in bioremediation, soil treatment, and waste management is making cleanup efforts more efficient and eco-friendly. With global efforts toward sustainability intensifying, the market is poised to play a crucial role in shaping a cleaner, safer, and more resilient environmental future.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)