Table of Contents

Overview

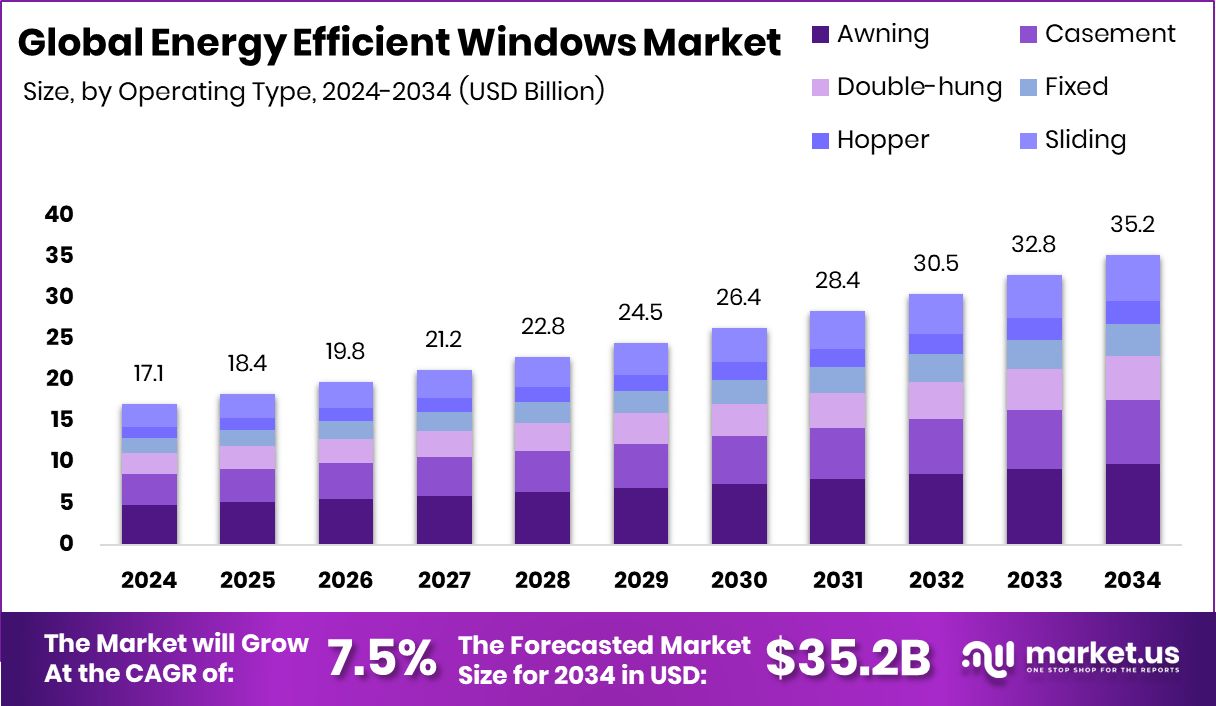

New York, NY – Nov 05, 2025 – The Global Energy Efficient Windows Market is projected to reach USD 35.2 billion by 2034, up from USD 17.1 billion in 2024, expanding at a 7.5% CAGR. North America dominated with a 43.3% share, generating about USD 7.4 billion in 2024.

Energy-efficient windows minimize heat loss in winter and reduce cooling needs in summer using insulated frames and reflective coatings, supporting sustainability and lower energy costs.

Growth is driven by construction and renovation activities encouraged by government funding. Programs like the UK’s £302 million allocation to modernize education buildings and training efforts to build 1.5 million homes underscore strong infrastructure momentum. In the U.S., the Commerce Department’s $18 million investment to expand homeownership and Sacramento’s $2.1 million housing initiative are also spurring demand.

Further opportunities come from large-scale housing investments aimed at greener buildings—such as the UK’s £2 billion plan for social and affordable housing, alongside a £600 million program for construction-skills development. Localized initiatives like the $1 million Launchpad program in North Lake Tahoe to support workforce housing are similarly boosting demand for sustainable materials, including energy-efficient windows. These combined actions reflect a clear policy-driven shift toward eco-friendly, energy-saving infrastructure worldwide.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-energy-efficient-windows-market/request-sample/

Key Takeaways

- The Global Energy Efficient Windows Market is expected to be worth around USD 35.2 billion by 2034, up from USD 17.1 billion in 2024, and is projected to grow at a CAGR of 7.5% from 2025 to 2034.

- The energy-efficient windows market sees strong growth, with the awning type capturing 31.8% of the market share.

- Double glazing dominates at 69.3%, reflecting demand for better insulation and reduced energy consumption.

- Glass accounts for 73.4%, showing its critical role in enhancing window efficiency and sustainability.

- Renovation and reconstruction lead with 59.9%, highlighting retrofitting trends in energy-efficient building solutions.

- The residential sector holds 68.2%, driven by rising homeownership and eco-friendly living preferences worldwide.

- The Energy Efficient Windows Market in North America reached USD 7.4 Bn, 43.30%.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159958

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 17.1 Billion |

| Forecast Revenue (2034) | USD 35.2 Billion |

| CAGR (2025-2034) | 7.5% |

| Segments Covered | By Operating Type (Awning, Casement, Double-hung, Fixed, Hopper, Sliding), By Glazing Type (Double Glazing, Triple Glazing, Others), By Component (Frame, Glass, Hardware), By Construction Type (New Construction, Renovation and Reconstruction), By End-User (Residential, Non-Residential) |

| Competitive Landscape | Andersen Corporation, Pella Corporation, Marvin Windows and Doors, JELD-WEN, Inc., Simonton Windows, Atrium Windows & Doors, Milgard Windows & Doors, Harvey Building Products, Kolbe Windows & Doors |

Key Market Segments

By Operating Type Analysis

In 2024, the Awning segment dominated the By Operating Type category of the Energy Efficient Windows Market, capturing a 31.8% share. This strong position stems from the growing adoption of awning windows in residential and commercial buildings, where improved ventilation and energy conservation are priorities. Their smart design allows partial opening during rainfall, ensuring consistent airflow while preserving insulation performance. This balance between practicality and efficiency has made awning windows a preferred option for energy-conscious users.

Supported by expanding government housing investments and sustained construction growth, the segment is set to maintain its leadership. As global building projects increasingly emphasize sustainability and thermal efficiency, the awning window’s adaptability and weather-resistant design continue to drive its market influence, reinforcing its role as a key contributor to the expanding energy-efficient windows sector worldwide.

By Glazing Type Analysis

In 2024, Double Glazing dominated the By Glazing Type segment of the Energy Efficient Windows Market, securing a substantial 69.3% share. Its strong market presence is driven by the ability to reduce heat transfer effectively, helping both households and businesses lower energy usage. Double glazing also provides superior insulation, reduces outdoor noise, and enhances indoor comfort, making it ideal for new constructions and renovation projects alike. This glazing type’s combination of high performance and cost efficiency has cemented its popularity among consumers and builders.

As global priorities shift toward energy conservation and sustainable construction, double glazing remains at the forefront, playing a crucial role in advancing the adoption of energy-efficient windows across residential, commercial, and institutional sectors. Its balance of durability, comfort, and environmental benefits continues to strengthen its leadership in the market.

By Component Analysis

In 2024, Glass dominated the By Component segment of the Energy Efficient Windows Market, capturing a commanding 73.4% share. This leadership underscores the vital role of advanced glazing technologies in boosting thermal insulation and optimizing overall window performance. As the main component influencing heat regulation, glare reduction, and natural light entry, glass remains central to energy-efficient design.

Its dominance reflects the growing adoption of innovative coatings and multi-layer glazing systems that enhance energy savings while maintaining visual clarity. With global building codes increasingly prioritizing sustainability and energy efficiency, the glass segment continues to anchor market growth.

Its ability to combine functionality with aesthetics has positioned it as an indispensable element in the development of next-generation energy-efficient windows, reinforcing its pivotal role in sustainable construction across residential, commercial, and institutional sectors worldwide.

By Construction Type Analysis

In 2024, the Renovation and Reconstruction segment led the By Construction Type category of the Energy Efficient Windows Market, accounting for a strong 59.9% share. This dominance stems from the growing emphasis on upgrading existing buildings to meet modern energy efficiency standards.

Both homeowners and commercial property owners are increasingly replacing outdated windows with advanced, energy-saving alternatives to lower utility expenses and enhance indoor comfort. The segment’s leadership reflects the extensive stock of aging infrastructure worldwide that requires modernization. Additionally, renovation and reconstruction efforts are strongly supported by government-backed sustainability programs that encourage energy-efficient retrofits.

These initiatives have made this segment a key driver in promoting greener, more efficient building practices. As global awareness of sustainable construction continues to rise, the renovation and reconstruction segment remains a cornerstone in advancing the adoption of energy-efficient windows across diverse property types.

By End-User Analysis

In 2024, the Residential segment dominated the By End-User category of the Energy Efficient Windows Market, accounting for a substantial 68.2% share. This leadership highlights the increasing preference among homeowners for energy-efficient solutions aimed at reducing electricity costs and enhancing indoor comfort.

Supported by strong government investments in sustainable and affordable housing projects, residential adoption has accelerated across both new constructions and renovation activities. Homeowners increasingly value windows that deliver superior insulation, natural lighting, and long-term energy savings. The segment’s commanding position reflects how household modernization and eco-friendly building practices are fueling overall market expansion.

As sustainability becomes central to urban housing policies, the residential segment continues to anchor the global demand for energy-efficient windows, establishing itself as the most influential end-use sector driving market growth and technological advancement in the years ahead.

Regional Analysis

The Energy Efficient Windows Market displays diverse regional growth patterns influenced by construction activity, regulatory frameworks, and sustainability goals. In 2024, North America led the market with a 43.3% share, valued at USD 7.4 billion, driven by robust adoption in residential and commercial buildings and government-backed sustainable construction programs.

Europe maintained steady progress under strict energy efficiency mandates aimed at cutting carbon emissions from buildings. The Asia Pacific region is witnessing rapid expansion fueled by urbanization, infrastructure growth, and rising middle-class housing demand. In the Middle East & Africa, adoption is gradually increasing as governments promote sustainable city initiatives to combat high energy consumption in warm climates.

Latin America is also evolving, with new housing projects integrating energy-efficient designs supported by affordability and infrastructure investments. While global efforts toward reducing building energy footprints are accelerating, North America remains the dominant leader, setting standards for innovation and energy performance.

Top Use Cases

- Reducing Home Heating & Cooling Bills: Energy-efficient windows help maintain more stable indoor temperatures by limiting heat escape in winter and heat entry in summer. This leads to lower energy bills for homeowners.

- Cutting Energy Use in Commercial Buildings: In offices and large buildings, advanced glazing like double or low-emissivity (Low-E) glass can significantly reduce the load on HVAC systems by minimizing unwanted heat gain or loss.

- Noise Reduction & Improved Comfort: Energy-efficient windows often include thicker glazing, better seals and insulation features — these not only save energy but also reduce outside noise and eliminate cold drafts, improving occupant comfort.

- Upgrading Older Buildings During Renovation: When older buildings undergo renovation or reconstruction, replacing single-pane or inefficient windows with modern energy-efficient models is an effective way to boost energy performance without full rebuild.

- Maximising Daylight While Minimising Heat Gain: With the right combination of glazing and coatings, windows can allow ample natural light but reduce solar heat gain — benefitting both visual comfort and energy savings in spaces like classrooms or hospitals.

- Supporting Sustainable & Low-Carbon Building Goals: Energy-efficient windows are a key element in achieving greener buildings and lowering carbon footprints, as they contribute to reduced energy consumption and better insulation — aligning with sustainability goals.

Recent Developments

- In October 2024, Andersen launched a triple-pane glass option for its 400 Series windows (available in the U.S. Northeast). This upgrade is designed to meet stricter energy-efficiency codes (e.g., Stretch Code, ENERGY STAR v7.0), helping reduce heat transfer and improve insulation.

- In March 2024, Pella introduced the Steady Set™ Interior Installation System, a new method allowing installers to set windows from the inside. The system is reported to be up to 3.15 times faster than traditional methods and reduces installer exposure to outdoor conditions by up to 72%.

- In March 2024, Marvin announced it would build a 400,000-square-foot manufacturing facility in Kansas City, Kansas, to produce its fiberglass window and door solutions; scheduled to open in 2025 with initial ~100 jobs and aiming for ~600 jobs by 2028.

Conclusion

The Energy Efficient Windows Market is steadily advancing as sustainability and smart design become central to modern construction. Growing environmental awareness, coupled with stricter building standards, is encouraging widespread adoption of energy-saving materials and technologies. Manufacturers are focusing on innovation, from advanced glazing to intelligent automation, to meet evolving consumer needs.

Governments and housing authorities worldwide continue to promote energy-efficient solutions through incentives and policies that support greener infrastructure. This collective effort is reshaping both residential and commercial construction landscapes, creating a future where energy conservation, comfort, and sustainability are at the heart of every architectural development.