Table of Contents

Overview

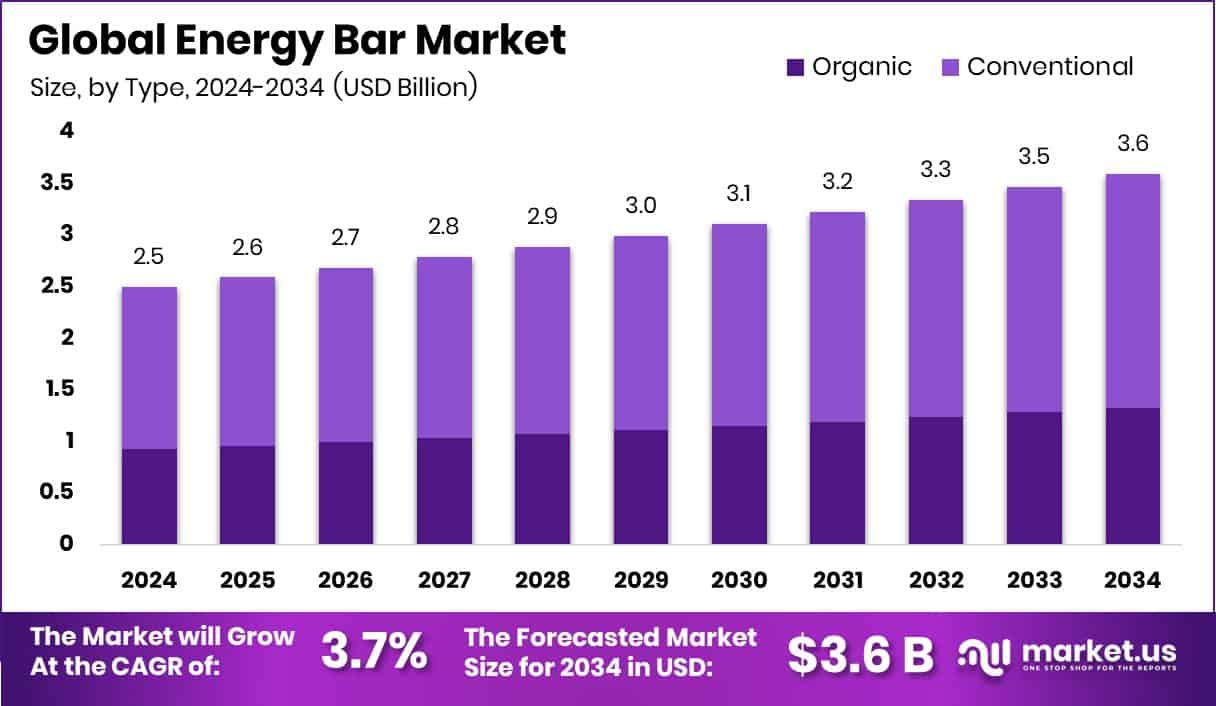

New York, NY – August 22, 2025 – The global energy bar market is projected to reach approximately USD 3.6 billion by 2034, growing from USD 2.5 billion in 2024 at a compound annual growth rate (CAGR) of 3.7% between 2025 and 2034. North America currently leads the market, contributing around USD 1.08 billion, which accounts for about 43.3% of the global share. Energy bars are convenient, ready to eat snacks formulated with a mix of carbohydrates, proteins, fiber, and healthy fats, designed to offer quick energy for active individuals or serve as a meal replacement.

Growing health awareness and the increasing popularity of active lifestyles are key factors driving market growth. Energy bars are especially favored by fitness enthusiasts, athletes, and busy professionals due to their portability and nutritional value. As urban living and hectic schedules rise, so does the demand for quick, functional foods. Governments are also supporting agricultural innovation and market expansion, such as Canada’s $7.3 million investment in cereal research through programs like AgriMarketing and AgriScience, indirectly contributing to energy bar supply chains.

Shifting dietary preferences are further boosting demand, with consumers increasingly seeking high-protein, low-carb, and plant-based options. Energy bars align well with these trends, offering convenient and tasty solutions for various nutritional needs. The addition of superfoods and a focus on clean-label ingredients have helped build trust among health-conscious consumers. Global cereal production, a core component of many energy bars, reached 2,842 million tons in 2024, with wheat production expected to rise by nearly 1% to 796 million tons in 2025, ensuring continued availability of key ingredients.

Key Takeaways

- The global energy bar market is projected to reach approximately USD 3.6 billion by 2034, rising from USD 2.5 billion in 2024, with a steady CAGR of 3.7% from 2025 to 2034.

- Conventional energy bars lead the market, holding a 63.3% share, driven by their affordability and widespread accessibility.

- Cereals and grains serve as the main ingredients in energy bars, accounting for 37.2% of the market share.

- Hypermarkets and supermarkets are the primary sales channels, contributing 38.3% to the global distribution of energy bars.

- North America remains the largest regional market, generating USD 1.08 billion and representing 43.3% of the global market share.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/energy-bar-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.5 Billion |

| Forecast Revenue (2034) | USD 3.6 Billion |

| CAGR (2025-2034) | 3.7% |

| Segments Covered | By Type (Organic, Conventional), By Ingredient (Cereals and Grains, Nuts and Seeds, Fruits, Protein, Chocolate Coated, Others), By Distribution Channel (Hypermarkets and Supermarkets, Traditional Grocery Store, Pharmacy and Drug Store, Convenience Stores, Online, Others) |

| Competitive Landscape | BellRing Brands, Inc, General Mills Inc., Glanbia plc, Kellanova, Kellogg Company, Mars, Incorporated., McKee Foods Corporation, Mondelez International, Inc., Nestlé S.A., NuGo Nutrition, Inc., Post Holdings Inc., PROBAR LLC, The Simple Good Foods Company, THG plc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144880

Key Market Segments

1. By Type Analysis

- Conventional energy bars lead the market with a 63.3% revenue share, primarily due to their affordability, accessibility, and mass consumer appeal. In 2024, this segment held a strong 49.2% position in the type category, benefiting from established supply chains, consistent formulations, and wide retail availability. Consumers often choose conventional bars for quick energy during workouts or as convenient meal replacements, given their presence in gyms, supermarkets, and convenience stores. Strong brand recognition, marketing efforts, and variety in flavors and nutritional content further reinforce the segment’s dominance. While organic options are growing in popularity, higher prices and limited availability continue to restrict their market share.

2. By Ingredient Analysis

- Cereals and grains account for 37.2% of the global ingredient use in energy bars, supported by their reputation as reliable, sustained energy sources. In 2024, this ingredient category led with a 49.2% market share, driven by consumer preference for familiar ingredients like oats, rice crisps, and wheat flakes. These components are rich in carbs and fiber, making them ideal for satiety and energy release. Their compatibility with other ingredients such as nuts and fruits allows manufacturers to offer appealing flavor combinations while ensuring shelf stability. Additionally, cereals and grains offer cost-efficiency, making them suitable for both budget and premium product lines.

3. By Distribution Channel Analysis

- Hypermarkets and supermarkets dominate the energy bar market’s distribution channels, holding a 38.3% share globally. In 2024, this segment also led with a 49.2% share due to its broad retail reach and consumer convenience. These outlets offer a wide selection of brands and product types, encouraging volume purchases through in-store promotions and discounts. Located in key urban and suburban areas, these stores provide visibility and accessibility, which help drive impulse buying, especially when products are placed near checkout counters. Their ability to support new product launches and consumer comparisons makes them the top choice for both manufacturers and shoppers.

Regional Analysis

- One of the key challenges facing the energy bar market is the relatively high price of products, which restricts access for a wider range of consumers. While urban, health-conscious buyers may be willing to spend more on these convenient snacks, energy bars remain less appealing to price-sensitive segments, particularly in middle-income and rural populations. Traditional snack alternatives often cost significantly less, making energy bars a less practical choice for many.

- This pricing disparity becomes even more evident in developing countries, where affordability heavily influences purchasing decisions. In such regions, energy bars are often viewed as premium or niche products, limiting their mass-market reach. The higher cost discourages frequent purchases and reduces the likelihood of energy bars becoming a staple in everyday diets.

- Moreover, specialty variants such as organic, vegan, or high-protein bars typically come with an added price tag, further narrowing the target audience. Although nutritional awareness is on the rise, the lack of affordable alternatives remains a major hurdle. To achieve broader market penetration, manufacturers need to prioritize value-based pricing, introduce smaller or economical pack sizes, and explore localized production to reduce overall costs.

Top Use Cases

- Sports and Athletic Performance: Athletes such as runners, cyclists, and fitness enthusiasts regularly use energy bars before or after workouts for quick energy and muscle recovery. High-protein and low‑sugar variants are preferred to support endurance and reduce fatigue during training or competition. These snacks are easy to carry and eat on-the-go, making them ideal for active lifestyles in sports contexts.

- Weight Management and Meal Replacement: Energy bars serve as convenient substitutes for a meal or snack, especially in weight loss plans. Formulations with fixed calories and nutrients help consumers control hunger and avoid overeating. Busy professionals and those following intermittent fasting find bars handy for regulated nutrition without cooking or meal prep, aiding effective calorie management throughout the day.

- Busy Professionals and On-the-Go Snacking: Urban workers and professionals with hectic routines choose energy bars to bridge gaps between meals. These bars offer portable nutrition when lunch breaks are tight or traditional meals are unavailable. With ingredients like oats, nuts, and seeds, they provide energy and satiety, making them ideal for commuting, office desks, or travel situations.

- Functional Wellness and Specialized Nutrition: Bars formulated with probiotics, adaptogens, fiber, or nootropics appeal to health-conscious consumers seeking extra wellness benefits. People focusing on immune support, digestion, mood, or stress management favor these functional energy bars. Brands targeting niche wellness needs such as women’s health or children’s immunity—leverage tailored ingredients to meet specific health goals.

- Plant‑Based and Clean‑Label Demand: The rise in vegan and clean‑label preferences has spurred demand for plant‑based energy bars made from pea, soy, or grain proteins. Consumers concerned about artificial additives, sustainability, or dietary restrictions opt for bars with short ingredient lists. This segment is growing rapidly among eco-aware millennials and anyone seeking minimally processed, naturally sourced snacks.

- Distribution via New Channels: Energy bars reach consumers through diverse channels: supermarkets, convenience stores, online retailers, health outlets, gyms, and vending machines. Online subscriptions and e‑commerce platforms deliver wide variety, often with bundle offers. Vending and gym access make bars instantly available to fitness center visitors, while smaller retail formats increase visibility and impulse purchase.

Recent Developments

1. BellRing Brands, Inc.

- BellRing Brands recently unveiled a collaboration between its Premier Protein brand and Milk Bar called the “Power Hour” Protein Menu, launching in late July 2025. This partnership introduces protein-enriched bakery items like cookies and truffles available at flagship Milk Bar stores and via delivery platforms with free protein shakes for customers between 3–4 PM during the promotional window. In its second quarter of fiscal year 2025, BellRing Brands reported Q2 revenue of USD 547.5 million, exceeding analyst expectations by about 6.2% year-on-year, highlighting strong demand for its nutrition products including energy and protein bars.

2. General Mills, Inc.

- General Mills has expanded its Nature Valley bar lineup with the PACKED Sustained Energy Bars, featuring a trio of textures creamy nut butter, crunchy nuts/seeds, and chewy fruit—to deliver longer-lasting energy. These are designed for convenience stores and marketed for on-the-go consumption. Additionally, in 2024 and early 2025 General Mills previewed and rolled out new snack bar innovations including protein-forward options under Nature Valley and Cocoa Puffs, such as Nature Valley Protein Smoothie Bars, appealing to health-conscious and indulgence-seeking consumers.

3. Glanbia plc

- Glanbia’s think! brand recently introduced think! Crispy Squares—protein-rich snack bars available in marshmallow crunch, chocolate crunch, and toffee pretzel flavors—each offering around 15 g of protein with 3–4 g sugar and 140–160 calories. Earlier, Glanbia also launched think! MINIS, bite-sized protein snack bars at just 100 calories and 6 g protein per bar, in dessert-inspired flavors—targeted for light, portable snacking occasions.

4. Kellanova (formerly part of Kellogg’s)

- Under Kellanova’s RXBAR brand, a new RXBAR High Protein line has been introduced in mid‑2025, offering 18 g protein with just six plant-based ingredients. These gluten‑free bars—available in Strawberry Peanut Butter and Vanilla Peanut Butter—are sweetened with organic agave nectar and emphasize clean, simple formulation. Distribution includes Target and broader rollouts planned later in 2025. Kellanova’s RXBAR also recently unveiled a Lemon Honey Cashew Butter flavor under its Nut Butter & Oat line, featuring 10 g protein and 18 g whole grains, catering to clean‑label and nutrient-conscious consumers.

Conclusion

The energy bar market is steadily growing as more people choose healthier and convenient snack options. With rising awareness about fitness, wellness, and balanced diets, energy bars have become a preferred choice for individuals with active lifestyles. Conventional energy bars continue to dominate due to their wide availability and lower cost. Cereals and grains remain key ingredients, reflecting a demand for familiar and wholesome nutrition. As companies introduce new flavors, clean-label options, and protein-rich formulas, the market is expanding to serve a wider range of dietary needs. Growth will also depend on improving affordability and increasing reach through both retail and online platforms.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)