Table of Contents

Overview

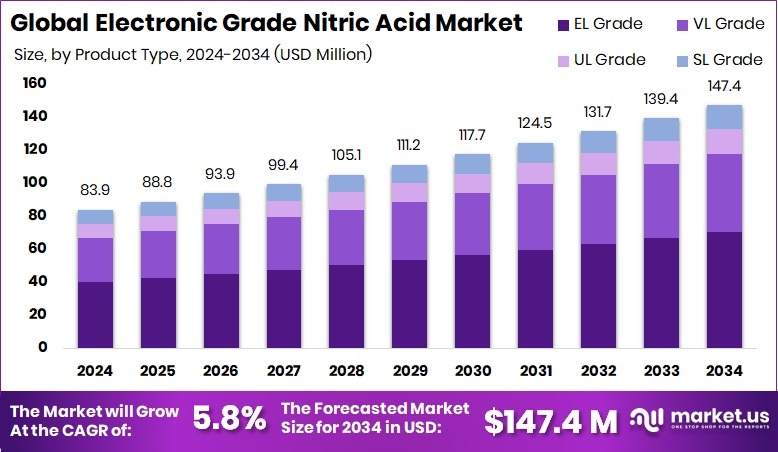

New York, NY – September 15, 2025 – The Global Electronic Grade Nitric Acid (EGNA) Market is projected to reach USD 147.4 million by 2034, rising from USD 83.9 million in 2024, with a steady CAGR of 5.8% between 2025 and 2034. Asia Pacific leads the market with a commanding 52.9% share, primarily fueled by the region’s strong semiconductor manufacturing base.

Electronic Grade Nitric Acid is a highly purified version of nitric acid, refined to eliminate metallic and organic impurities. This purity makes it indispensable in the production of semiconductors, photovoltaic cells, and other advanced electronics. It plays a critical role in wafer cleaning, surface preparation, and etching processes, where even the smallest contamination can affect device performance and yield.

Market demand is closely linked to the expansion of the semiconductor industry, driven by consumer needs for faster, smaller, and more powerful chips. The growing complexity of chip architectures requires ultra-clean processing chemicals, further boosting EGNA adoption. Similarly, the accelerating growth of the solar energy sector is adding momentum, as high-purity acids are essential in photovoltaic manufacturing.

In addition, the rapid uptake of 5G networks, artificial intelligence (AI), and Internet of Things (IoT) applications is pushing wafer production volumes higher. This creates consistent demand for EGNA in precision etching and cleaning steps, where reliability and device efficiency directly depend on chemical quality. Collectively, these factors position EGNA as a vital component of the global electronics supply chain over the coming decade.

Key Takeaways

- The Global Electronic Grade Nitric Acid Market is expected to be worth around USD 147.4 million by 2034, up from USD 83.9 million in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In 2024, EL Grade dominated the Electronic Grade Nitric Acid Market, holding a 47.9% share.

- Semiconductor applications led the Electronic Grade Nitric Acid Market in 2024, capturing a 51.2% share.

- The market value in the Asia Pacific reached USD 44.3 Mn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/electronic-grade-nitric-acid-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 83.9 Million |

| Forecast Revenue (2034) | USD 147.4 Million |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Product Type (EL Grade, VL Grade, UL Grade, SL Grade), By Application (Semiconductor, Solar Energy, LCD Panel, Others) |

| Competitive Landscape | BASF SE, Columbus Chemicals, UBE Corporation, T. N. C. Industrial, KMG Electronic Chemicals, EuroChem, Asia Union Electronic Chemicals |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=155346

Key Market Segments

By Product Type Analysis

EL Grade Holds 47.9% Share in 2024

In 2024, EL Grade secured a leading position in the By Product Type segment of the Electronic Grade Nitric Acid Market, accounting for 47.9% of the share. Known for its ultra-high purity and reliability, EL Grade is the preferred choice in advanced semiconductor and precision electronics manufacturing. Its extremely low metallic and particulate content minimizes contamination risks, which is vital in wafer cleaning, micro-pattern etching, and surface preparation for high-performance chips.

Demand for EL Grade is rising as integrated circuits become more complex and the industry shifts toward smaller nanometer-scale nodes, where even microscopic impurities can impact yield and device performance. Expanding applications in 5G networks, AI-driven computing, and automotive electronics have further accelerated adoption, highlighting its importance in achieving flawless device functionality.

The growing photovoltaic sector, particularly in the Asia-Pacific region, has also strengthened EL Grade’s dominance due to strict purity standards in solar cell production. With large-scale investments in semiconductor fabs and the increasing adoption of connected devices, EL Grade is expected to retain its strong market foothold in the coming years.

By Application Analysis

Semiconductors Lead with 51.2% Share in 2024

In 2024, the Semiconductor sector led the By Application segment of the Electronic Grade Nitric Acid Market, holding a 51.2% share. This dominance reflects the sector’s reliance on ultra-pure chemicals to ensure precision and defect-free chip fabrication. Electronic Grade Nitric Acid is a key material in semiconductor processing, particularly in wafer cleaning, oxidation removal, and surface preparation before advanced circuit layering.

The transition toward sub-5nm chip architectures has intensified purity requirements, making contamination control a critical factor. Growing demand for powerful chips powering 5G, AI, autonomous driving, and high-speed computing is boosting EGNA consumption. Additionally, semiconductor fabrication plant expansions across Asia-Pacific and North America, supported by strong government incentives, have reinforced the segment’s leadership. With digitalization and connected technologies continuing to surge, semiconductors will remain the primary driver of EGNA demand over the next decade.

Regional Analysis

Asia Pacific Dominates with 52.9% Share in 2024

In 2024, the Asia Pacific emerged as the leading region in the Electronic Grade Nitric Acid Market, holding a 52.9% share valued at USD 44.3 million. The region’s dominance stems from its role as the global hub for semiconductor manufacturing, with China, Japan, South Korea, and Taiwan hosting some of the world’s largest fabrication facilities.

Rapid advancements in electronics, 5G infrastructure, electric vehicles, and photovoltaic manufacturing have sharply increased demand for high-purity chemicals like EGNA in wafer cleaning and microfabrication. Government-backed investments in semiconductor capacity expansions further strengthen the region’s growth momentum.

While North America and Europe maintain steady consumption supported by innovation and localized production, and Latin America and the Middle East & Africa gradually build their high-tech bases, Asia Pacific continues to outpace all regions due to its integrated supply chains, skilled workforce, and proximity to major electronics markets. With sustained investment in advanced manufacturing, the Asia Pacific is expected to retain its leadership, driving the majority of global EGNA consumption in the coming years.

Top Use Cases

- Semiconductor Manufacturing: Electronic-grade nitric acid is used to clean and etch silicon wafers in semiconductor production. Its high purity ensures no contamination, which is critical for creating reliable microchips used in smartphones, computers, and other devices, meeting the growing demand for advanced electronics.

- Solar Panel Production: This acid is essential in the texturization process of silicon wafers for solar panels. It helps improve the efficiency of photovoltaic cells by creating a textured surface that captures more sunlight, supporting the rising global demand for renewable energy solutions.

- LCD Panel Fabrication: In LCD panel manufacturing, electronic-grade nitric acid cleans and etches glass substrates to ensure high-quality displays. Its ultra-pure nature prevents defects in screens used in TVs, monitors, and smartphones, driven by the expanding consumer electronics market.

- Printed Circuit Board (PCB) Etching: The acid is used to etch copper on PCBs, ensuring precise circuit patterns. Its high purity is vital for producing reliable and compact electronics, meeting the needs of industries like automotive and telecommunications, especially with the rise of 5G technology.

- Medical Device Manufacturing: Electronic-grade nitric acid is used to clean and prepare surfaces for medical devices, ensuring they meet strict hygiene standards. Its role in producing high-performance components supports the growing healthcare industry, particularly for advanced diagnostic and treatment equipment.

Recent Developments

1. BASF SE

BASF has focused on expanding its high-purity chemical capacities, including electronic-grade nitric acid, to support the semiconductor industry’s growth, particularly in Asia. Their recent developments involve enhancing production processes at integrated Verbund sites to ensure superior quality and supply chain reliability for critical etching and cleaning applications, meeting the stringent standards required for advanced node chip manufacturing.

2. Columbus Chemicals

Columbus Chemicals is a key US-based supplier specializing in high-purity chemicals. Their recent activity emphasizes securing the domestic supply chain for electronic-grade acids. They focus on maintaining an extensive, certified inventory of products like nitric acid to ensure immediate availability for the North American microelectronics market, addressing increased demand and highlighting their role as a reliable logistics and distribution partner for the industry.

3. UBE Corporation

UBE Corporation has significantly invested in expanding its electronic-grade nitric acid production in Japan. A key recent development is the construction of a new manufacturing plant in Thailand, operational. This strategic move aims to strengthen their global supply capacity and serve the growing semiconductor manufacturing base in Southeast Asia, ensuring a stable supply of high-purity chemicals for the region’s tech industry.

4. T. N. C. Industrial Co., Ltd.

This Taiwan-based company is actively expanding its product portfolio and capacity for high-purity chemicals to serve the dense semiconductor industry in Taiwan. Their recent developments focus on meeting the surging local demand from major foundries and chipmakers. They emphasize stringent quality control and reliable delivery of electronic-grade nitric acid for wafer etching and cleaning processes, supporting the island’s critical role in global chip supply.

5. KMG Electronic Chemicals, Inc.

KMG, a prominent US purifier and distributor, has focused on operational excellence and supply chain robustness. Their recent developments highlight investments in purification technology and quality assurance systems to meet the evolving purity requirements for advanced semiconductor nodes. They emphasize their capability to provide ultra-high-purity electronic-grade nitric acid with consistent quality and reliable delivery to fabs across North America and other key markets.

Conclusion

The Electronic Grade Nitric Acid Market is growing steadily due to its critical role in high-tech industries like semiconductors, solar energy, and consumer electronics. With increasing demand for advanced electronics, renewable energy, and medical devices, the need for ultra-pure nitric acid is rising. Technological advancements and expanding production capacities further drive this market, making it a key component in modern manufacturing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)