Table of Contents

Overview

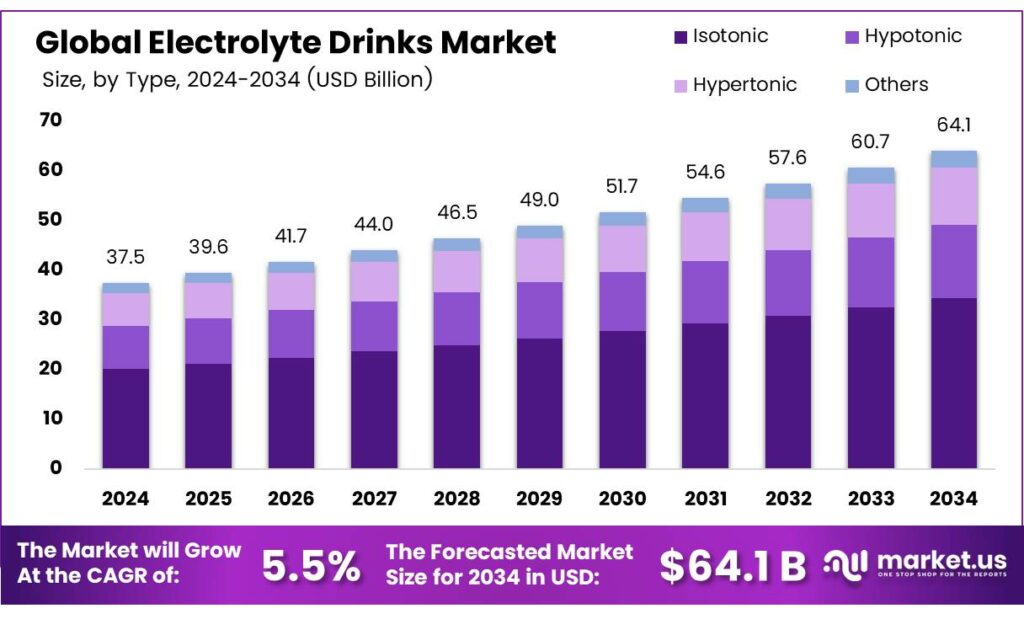

New York, NY – September 18, 2025 – The Global Electrolyte Drinks Market is projected to reach USD 64.1 billion by 2034, up from USD 37.5 billion in 2024, expanding at a CAGR of 5.5% from 2025 to 2034. Electrolytes such as sodium, potassium, magnesium, calcium, phosphorus, chloride, and bicarbonate are vital minerals that help regulate nerve signaling, muscle contraction, pH balance, and hydration.

In adults, water turnover averages about 4% of body weight daily, while in infants it can be as high as 15%, largely due to insensible water loss through the skin and lungs. These losses rise under heat, altitude, or dry conditions, making electrolyte balance even more critical. Kidney function also affects hydration, as adults can concentrate urine up to 1,400 mosmol/L, compared to 700 mosmol/L in infants, meaning water requirements differ across age groups.

Diet is another major contributor to fluid and electrolyte intake. Historically, adults consumed around 2.8 cups of beverages daily, including 1.3 cups of milk, 1.5 cups of tea/coffee, and 1.75 cups of soft drinks, while fruits and vegetables (85–95% water content) further supported hydration. For adults, fluid needs are generally set at 1–1.5 mL per kcal of energy, increasing during pregnancy (+30 mL/day) and especially during lactation (+1,000 mL/day).

Sodium intake remains an important factor in electrolyte balance. Community water supplies contribute little (<20 mg/L), while processed foods are the main source. Surveys show that 32% of sodium intake comes from baked goods and cereals, 21% from meats, and 14% from dairy products. Daily sodium consumption ranges between 1.8–5 g, with men in some studies adding as much as 5.5 g of table salt per day. This highlights why electrolyte drink demand is growing not only for athletes and active consumers but also for broader populations seeking hydration and mineral balance in changing lifestyles.

Key Takeaways

- The Global Electrolyte Drinks Market is projected to grow from USD 37.5 billion in 2024 to USD 64.1 billion by 2034, at a CAGR of 5.5%.

- Isotonic drinks led the market in 2024, holding a 53.7% share due to their effective rehydration properties.

- Liquid format dominated in 2024 with a 49.5% share, favored for its convenience and immediate hydration benefits.

- Flavored electrolyte drinks captured an 89.4% share in 2024, driven by consumer preference for enjoyable taste profiles.

- Supermarkets and Hypermarkets accounted for a 39.9% share in 2024, offering wide product availability and competitive pricing.

- North America held a 44.6% market share in 2024, generating USD 16.7 billion, fueled by health awareness and a strong sports culture.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-electrolyte-drinks-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 37.5 Billion |

| Forecast Revenue (2034) | USD 64.1 Billion |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Isotonic, Hypotonic, Hypertonic, Others), By Form (Liquid, Powder, Ready to Drink, Others), By Flavor (Flavored, Unflavored), By Distribution Channels (Supermarkets and Hypermarket, Online Stores, Convenience Store, Others) |

| Competitive Landscape | The Coca-Cola Company, PepsiCo, Abbott, PURE Sports Nutrition, The Vita Coco Company, SOS Hydration, DRINKWEL, NORMA Group, The Kraft Heinz Company, Kent Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156598

Key Market Segments

By Type

Isotonic Drinks Dominate with 53.7% Share

In 2024, isotonic drinks led the global electrolyte drinks market, securing a 53.7% share. Their balanced salt and sugar composition, mimicking the body’s natural fluids, makes them ideal for rehydration during sports, exercise, and daily activities. Popular among athletes, fitness enthusiasts, and younger consumers, isotonic drinks are poised for further growth in 2025, driven by rising health awareness and demand for functional beverages. The convenience of ready-to-drink formats and widespread availability in retail and online channels will continue to solidify their position as the leading choice in the electrolyte drinks category.

By Form

Liquid Formats Lead with 49.5% Share

Liquid electrolyte drinks held a 49.5% market share in 2024, favored for their ready-to-drink convenience and rapid hydration benefits. Athletes, gym-goers, and those with active lifestyles particularly value their immediate energy and electrolyte replenishment. A diverse range of flavors and packaging options has broadened their appeal across age groups. In 2025, liquid formats are expected to see sustained growth, fueled by the shift toward healthier, on-the-go nutrition and their accessibility in supermarkets, gyms, convenience stores, and online platforms.

By Flavor

Flavored Drinks Command 89.4% Share

Flavored electrolyte drinks dominated in 2024 with an 89.4% market share, driven by their enjoyable taste and functional benefits. Popular flavors like citrus, berry, and tropical blends appeal to both casual consumers and athletes, particularly younger demographics. In 2025, flavored drinks are expected to maintain their lead as brands innovate with sugar-free, natural, and exotic flavor profiles. The combination of taste and hydration benefits ensures flavored electrolyte drinks remain a key growth driver in the market.

By Distribution Channel

Supermarkets and Hypermarkets Lead with 39.9% Share

In 2024, supermarkets and hypermarkets accounted for a 39.9% share of the electrolyte drinks market, offering extensive product variety, competitive pricing, and promotions that attract a wide consumer base. The convenience of one-stop shopping encourages bulk and impulse purchases. As urbanization and modern retail expand, these channels are expected to maintain their dominance in 2025, with increased shelf space for functional beverages further boosting sales of flavored and liquid electrolyte drinks.

Regional Analysis

North America commands a leading 44.6% share of the global market, valued at USD 16.7 billion. This dominance is supported by high health awareness, a strong sports culture, and the presence of established players such as Gatorade and Powerade. Growth momentum continues as consumers increasingly prefer clean-label and low-sugar alternatives, with additional demand coming from key European markets like the UK, Germany, and France.

The fastest-growing region, APAC, sees rising demand due to urbanization, warmer climates, and growing fitness trends in countries like China, India, and Japan. Gaining traction with increased awareness of hydration and fitness, showing potential for future growth. Emerging opportunities arise from growing health consciousness and active lifestyles, though the market remains smaller compared to other regions.

Top Use Cases

- Athletes During Intense Workouts: Active sportspeople often sweat a lot, losing key minerals like sodium and potassium. Electrolyte drinks help quickly replace these to keep energy high and muscles working smoothly. They prevent tiredness and cramps, making them a go-to choice for runners, cyclists, or team players pushing their limits in long sessions.

- Recovery After Heavy Exercise: After a tough gym session or game, the body needs to bounce back from fluid loss. These drinks speed up rehydration by balancing salts and fluids faster than plain water. Fitness fans sip them post-workout to cut down on soreness and feel refreshed sooner, supporting better daily routines.

- Illness and Dehydration Relief: When hit by stomach bugs, fever, or vomiting, people lose fluids and electrolytes fast, leading to weakness. Gentle electrolyte drinks restore balance without overwhelming the tummy. They’re a simple way for families or travelers to recover quicker and get back to normal without extra hassle.

- Outdoor Workers in Hot Weather: Folks like construction crews or gardeners face scorching sun and heavy sweat all day. Electrolyte drinks keep them sharp by fighting off heat fatigue and dizziness. Easy to grab on the job, they maintain focus and safety, turning a draining shift into a steady one.

- Daily Wellness for Busy Lifestyles: Health-aware urbanites mix electrolytes into water for all-day hydration, especially in dry or stressful times. They boost focus and mood by steadying body salts, fitting seamlessly into office breaks or commutes. It’s a smart swap for soda, promoting lasting energy without the crash.

Recent Developments

1. The Coca-Cola Company

Coca-Cola expanded its electrolyte portfolio by launching Powerade Ultra. This new line features five functional benefits, including enhanced hydration with zero sugar, and utilizes a high-performance ion4 electrolyte blend. It represents a significant innovation aimed directly at the growing functional beverage segment beyond their classic Powerade offerings.

2. PepsiCo

PepsiCo’s Gatorade launched the Gatorade Gx platform, a personalized hydration system. The core is the Gx bottle and smart cap that syncs with an app to recommend doses from concentrated Gatorade Gx Pods. This tech-driven approach moves beyond one-size-fits-all drinks to offer customized electrolyte replenishment based on individual athlete sweat loss and needs.

3. Abbott

Abbott continues to lead in medical hydration with recent innovations to its Pedialyte brand for adults. They expanded into new formats like Pedialyte Sport and Pedialyte Organic, directly competing with traditional sports drinks. This leverages their clinical hydration credibility to capture health-conscious consumers seeking effective electrolyte solutions for active lifestyles, not just illness.

4. PURE Sports Nutrition

UK-based PURE Sports Nutrition focuses on scientific formulations with no artificial ingredients. A key development is their Electrolyte Plus tablets, which are sugar-free and designed for efficient hydration. They have grown through direct-to-consumer and professional athlete endorsements, emphasizing research-backed efficacy over mass-market marketing, carving a niche in the premium performance segment.

5. The Vita Coco Company

The Vita Coco Company expanded beyond coconut water with the launch of Vita Coco Electrolytes. This line blends their signature coconut water with added electrolytes and vitamins, available in sparkling and still varieties. It positions them directly in the functional beverage space, leveraging their natural and better-for-you brand image to compete with sugary sports drinks.

Conclusion

Electrolyte Drinks evolving from sports sidelines to everyday essentials, fueled by a wave of wellness awareness and active living. Consumers crave natural, low-sugar options that fit seamlessly into hectic days, blending convenience with real health perks like better hydration and vitality. Brands innovating with plant-based flavors and eco-packaging will lead, tapping into a broader crowd beyond athletes, from office goers to families. This shift promises steady expansion, rewarding companies that listen to the call for simple, feel-good refreshment in a fast-paced world.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)