Table of Contents

Overview

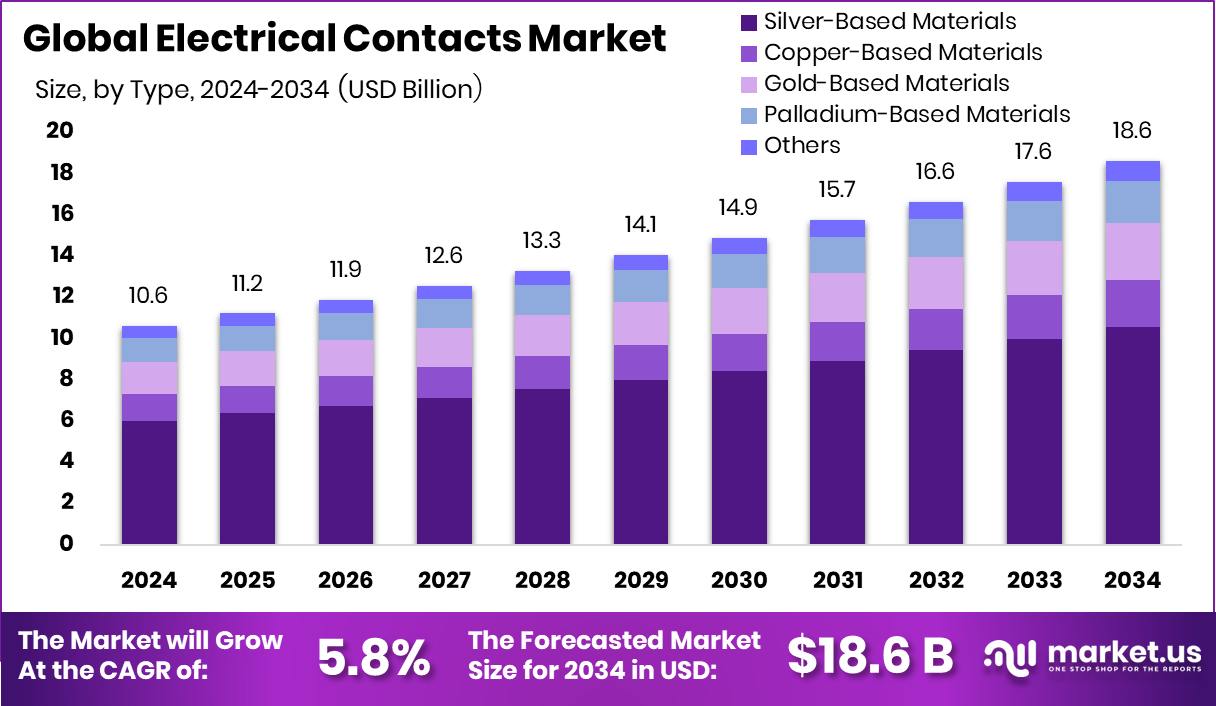

New York, NY – August 12, 2025 – The Global Electrical Contacts Market is projected to reach approximately USD 18.6 billion by 2034, rising from USD 10.6 billion in 2024, with an expected CAGR of 5.8% between 2025 and 2034.

Electrical contacts are conductive components designed to open or close an electrical circuit, enabling current flow between two points. Typically manufactured from copper, silver, or durable alloys, they are valued for their high conductivity and longevity. These components are integral to switches, relays, circuit breakers, and connectors, operating under both mechanical and electrical control.

The market encompasses the design, manufacture, and supply of contact components used across diverse sectors, including power generation, industrial automation, automotive, consumer electronics, and telecommunications. Expansion is being fueled by rising electricity consumption, rapid industrial automation, and the growing integration of electronics into everyday devices.

Modernization of power infrastructure, renewable energy adoption, and smart grid development are further driving demand for reliable contact materials in switching equipment. For instance, the Energy Market Authority (EMA) has conditionally approved the import of 1.75 GW of electricity from Australia, underscoring the scale of cross-border power initiatives.

Emerging growth opportunities include the adoption of environmentally friendly contact materials and the increasing shift toward high-voltage DC systems for energy and transportation projects. Investments in electric mobility, charging networks, and grid upgrades are set to boost demand for high-performance, durable contacts. In line with these trends, the UK’s National Grid has secured £1.5 million in funding from Ofgem to support innovative projects aimed at advancing net-zero goals, reflecting the industry’s commitment to sustainable and resilient electrical systems.

Key Takeaways

- The Global Electrical Contacts Market is expected to be worth around USD 18.6 billion by 2034, up from USD 10.6 billion in 2024, and is projected to grow at a CAGR of 5.8% from 2025 to 2034.

- In the electrical contacts market, silver-based materials dominate with 56.8% due to their high conductivity performance.

- Rivet-type contacts hold 53.1% market share, offering durability and stability in electrical switching applications.

- Low-voltage products account for 69.3%, reflecting widespread usage across home appliances and industrial automation equipment.

- The electronics and telecommunication sectors lead end-user adoption with a 37.4% share, driven by digital infrastructure growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/electrical-contacts-market/request-sample/

Report Scope

| Market Value (2024) | USD 10.6 Billion |

| Forecast Revenue (2034) | USD 18.6 Billion |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Type (Silver-Based Materials, Copper-Based Materials, Gold-Based Materials, Palladium-Based Materials, Others), By Electrical Contact (Rivet-Type, Plate-Type, Material-Wire), By Applications (Low-Voltage Products (Switches, Relays, Connectors, Others), Medium and High Voltage Products (Circuit Breakers, Transformers, Generators, Others)), By End-User (Electronics and Telecommunication, Power Distribution Center, Automotive, Aerospace, Others) |

| Competitive Landscape | METALOR Technologies SA, Modison Limited, Heraeus Group, Zhejiang Fuda Alloy Materials Technology Co., Ltd., Nippon Tungsten Co., Ltd., Materion Corporation, Umicore, Wenzhou Hongfeng Electrical Alloy Co., Ltd., Chugai Electric Industrial Co., Ltd., Taewon Precision Company, Electrical Contacts, Ltd., Longsun Group Co., Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154050

Key Market Segments

By Type Analysis

In 2024, silver-based materials dominated the electrical contacts market, securing a 56.8% share in the By Type segment. This leadership stems from silver’s exceptional electrical and thermal conductivity, making it the material of choice for high-performance applications where minimal contact resistance and maximum reliability are crucial.

Silver-based contacts are extensively applied in switches, relays, and circuit breakers, ensuring consistent current transfer and long operational life. With growing emphasis on energy efficiency and operational safety, demand for silver alloys engineered to balance performance and cost remains strong across both low-voltage and high-voltage systems.

By Electrical Contact Analysis

Rivet-type electrical contacts led the market in 2024, holding 53.1% of the By Electrical Contact segment. Known for their mechanical strength, durability, and ease of integration, these contacts are widely adopted in relays, switches, and contactors where stable pressure and conductivity are vital.

Rivet-type designs also bond effectively with base metals, ensuring longevity in high-use settings. With a proven track record for low maintenance and robust operation, they are expected to maintain their lead as demand for reliable contact solutions grows in control systems and protective devices.

By Applications Analysis

Low-voltage products accounted for a commanding 69.3% share of the market in 2024, reflecting their extensive use in circuit breakers, switches, contactors, and residential wiring devices. This segment’s dominance is driven by rising demand for safe and efficient low-voltage infrastructure across homes, commercial facilities, and industrial control systems.

Electrical contacts in these applications are critical for ensuring reliable current flow, preventing overloads, and enabling automation. The push toward smart homes, advanced control panels, and compact low-voltage networks is fueling the need for high-performance, arc-resistant, and long-lasting contact materials. With ongoing infrastructure upgrades worldwide, low-voltage products are expected to retain their leading position.

By End-User Analysis

In 2024, electronics and telecommunications emerged as the largest end-user segment, with a 37.4% market share. This dominance reflects the widespread use of electrical contacts in devices such as mobile phones, routers, network switches, and consumer electronics, where precision, minimal resistance, and consistent performance are critical.

The rapid expansion of digital connectivity, along with global 5G rollout and high-speed data network growth, has increased demand for miniaturized, corrosion-resistant contacts suitable for high-frequency operations. The proliferation of portable electronics continues to reinforce this segment’s market leadership.

Regional Analysis

Asia-Pacific led the global electrical contacts market in 2024, capturing 38.7% of the share and generating USD 4.1 billion in revenue. The region’s dominance is anchored in its robust industrial automation, consumer electronics production, and large-scale energy infrastructure projects, particularly across China, India, Japan, and Southeast Asia.

Accelerated electrification initiatives and infrastructure expansion continue to drive demand for contact components in residential, commercial, and industrial sectors. North America remains a key market due to advancements in smart grids and low-voltage systems, while Europe benefits from strong automotive and automation industries aligned with sustainability goals.

The Middle East & Africa and Latin America are experiencing gradual growth, supported by modernization projects and rising electricity access. Asia-Pacific’s leadership is expected to persist as manufacturing capabilities scale and electrification investments intensify.

Top Use Cases

Use in Consumer Electronics: Electrical contacts are essential in devices like smartphones and laptops, ensuring reliable power and signal transfer. Their low resistance and durability support the tiny, intricate connections required in high-frequency electronics. As demand for portable gadgets grows, these contacts remain pivotal for manufacturers delivering consistent performance and long battery life.

Application in Automotive Relays and Starters: In vehicles, electrical contacts are used in relays and starters to control electric currents. They must endure frequent switching and tolerate vibration and heat. With increasing electric vehicle adoption, the need for high-quality, long-lasting contacts rises, supporting both safety and efficiency in modern automotive systems.

Switchgear in Power/Energy Infrastructure: Switchgear equipment relies on robust electrical contacts to switch power circuits safely. These contacts must handle high currents and prevent arcing during opening or closing. As global power grids modernize and renewables expand, demand grows for durable contacts that maintain operational safety and reduce maintenance needs.

Use in Industrial Automation Controllers: Industrial automation systems use electrical contacts within control panels, motor starters, and contactors. These contacts endure repeated switching under load and harsh conditions. Their reliability is critical to minimizing downtime and ensuring smooth production lines—key drivers for manufacturers investing in high-performance contact materials.

Integration in Telecommunications Hardware: Network switches, routers, and data centers rely on electrical contacts to move signals with minimal loss. High-frequency signal integrity and consistent contact performance are essential. As telecom infrastructure expands, especially with 5G and cloud networks, demand for precision-engineered, corrosion-resistant contacts surges sharply.

Recent Developments

1. METALOR Technologies SA

METALOR has been focusing on sustainable precious metal solutions for electrical contacts, emphasizing recyclability and reduced environmental impact. They introduced new silver-based contact materials with enhanced durability for high-voltage applications. Their R&D efforts aim to improve contact resistance and arc erosion resistance.

2. Modison Limited

Modison has expanded its silver-nickel and silver-cadmium oxide (AgCdO) contact production, catering to automotive and industrial relays. They are investing in automation and Industry 4.0 to enhance manufacturing precision. A recent development includes eco-friendly alternatives to cadmium-based contacts.

3. Heraeus Group

Heraeus launched advanced silver-graphite (AgC) and silver-tin oxide (AgSnO₂) contacts for EV charging systems. Their innovations focus on reducing welding tendencies and improving switching performance. They also emphasize AI-driven material optimization for better contact longevity.

4. Zhejiang Fuda Alloy Materials Co., Ltd.

Fuda has developed high-performance silver-metal oxide (AgMeO) contacts for photovoltaic and smart grid applications. Their latest products feature superior arc resistance and low material transfer, targeting renewable energy sectors.

5. Nippon Tungsten Co., Ltd.

Nippon Tungsten has introduced tungsten-copper (W-Cu) and tungsten-silver (W-Ag) contacts for aerospace and high-frequency switches. Their research focuses on nanostructured tungsten composites to enhance thermal conductivity and wear resistance.

Conclusion

The Electrical Contacts Market is grounded in versatility and critical performance across diverse industries. From powering everyday consumer gadgets to safeguarding industrial automation and enabling telecommunications infrastructure, contacts serve as the silent backbone of electrical systems. Market growth is propelled by rising electronics demand, renewable energy adoption, and automotive electrification.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)