Table of Contents

Overview

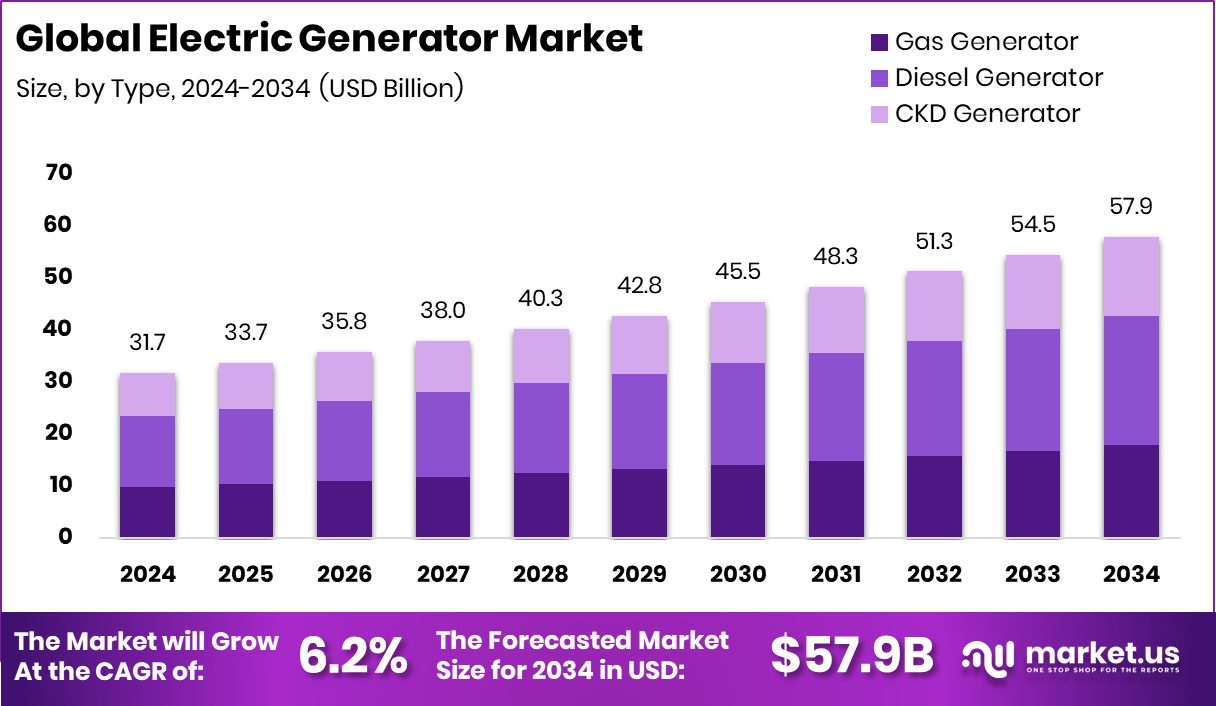

New York, NY – Nov 21, 2025 – The global electric generator market is expanding quickly as industries, communities, and modern energy systems demand reliable power. The market is projected to reach USD 57.9 billion by 2034, rising from USD 31.7 billion in 2024, supported by steady growth in regions such as North America, which holds a USD 14.5 billion market.

Generators remain essential because they convert mechanical motion into electrical energy, supplying power where grids are weak, overloaded, or unavailable. Their use now spans homes, industries, data centers, telecom sites, and remote infrastructure.

Demand is accelerating as countries face unstable grids and rising energy loads. New investment trends also shape the market. A clean-energy startup securing USD 165 million to develop portable nuclear units shows how alternatives to diesel are emerging. A company securing USD 23 million in Series C funding for cleaner generator technology highlights momentum toward low-emission solutions. Government actions are equally impactful, such as a national commitment of USD 16 million to help Pacific Island nations transition away from diesel dependence.

Major opportunities lie in hybrid and renewable-linked systems, modular mobile generators, digital monitoring, and low-carbon fuels. When a U.S. state approves USD 1.8 billion for microgrids powered by solar, batteries, and gas, it signals a transformative shift where generators evolve from emergency tools to active components of modern power architecture.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-electric-generator-market/request-sample/

Key Takeaways

- The Global Electric Generator Market is expected to be worth around USD 57.9 billion by 2034, up from USD 31.7 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- The electric generator market sees diesel generators dominating with a 42.9% share due to reliability.

- Standby generators hold a 56.2% share in the electric generator market, ensuring uninterrupted electricity during outages.

- Industrial users dominate the electric generator market with a 44.4% share, emphasizing manufacturing and energy-intensive sectors.

- The regional market in North America was valued at USD 14.5 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165365

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 31.7 Billion |

| Forecast Revenue (2034) | USD 57.9 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Type (Gas Generator, Diesel Generator, CKD Generator), By Application (Stand By, Peak Shaving, Continuous), By End-User (Industrial, Residential, Commercial) |

| Competitive Landscape | Aggreko, Atlas Copco., Caterpillar Inc., FG Wilson, Kirloskar Electric Co. Ltd., Cummins Inc., Rolls-Royce, Wärtsilä, Yanmar Co. Ltd., Briggs & Stratton |

Key Market Segments

By Type Analysis

In 2024, diesel generators dominated the electric generator market’s By Type segment with a 42.9% share, reflecting their strong role across industrial, commercial, and construction settings. Their popularity comes from dependable performance, high fuel efficiency, and the ability to deliver steady power in remote or off-grid regions where electricity access is limited.

Even as renewable and cleaner technologies gain momentum, diesel generators remain essential for managing outages and supporting areas with weak or unstable grids. Their capacity to handle heavy loads, operate for longer hours, and maintain durability under demanding conditions continues to reinforce their leading position. This combination of reliability and proven operational strength ensures diesel generators stay deeply embedded in the global power supply ecosystem.

By Application Analysis

In 2024, the Standby category led the Electric Generator Market’s By Application segment with a 56.2% share, highlighting its essential role in ensuring uninterrupted power. Standby generators are increasingly deployed in hospitals, commercial facilities, data centers, and homes, where even short outages can disrupt operations or compromise safety.

Growing grid instability and more frequent extreme weather events have accelerated the need for dependable emergency power systems. Standby generators deliver immediate backup through automatic activation, allowing critical infrastructure to maintain continuity without interruption. Their expanding use is also supported by improvements in automatic transfer switches and remote monitoring, which boost reliability and simplify management. With global power resilience becoming a top priority, the standby segment continues to reinforce its market dominance.

By End-User Analysis

In 2024, the Industrial segment dominated the Electric Generator Market’s By End-User category with a 44.4% share, reflecting the sector’s strong dependence on uninterrupted power. Industries such as manufacturing, mining, and oil and gas rely heavily on generators to maintain continuous operations and avoid costly production downtime.

These facilities require equipment capable of managing high electrical loads while performing reliably in demanding and often harsh environments. As industrial automation expands and infrastructure projects grow worldwide, the need for stable and efficient backup systems has intensified. With energy security becoming a strategic priority for many enterprises, the industrial segment remains the core driver of generator usage across the global market.

Regional Analysis

In 2024, North America led the global Electric Generator Market with a 45.80% share, valued at USD 14.5 billion, driven by strong industrial activity, severe weather-related outages, and rising adoption of standby systems across data centers, manufacturing sites, and healthcare facilities. This solid infrastructure base keeps demand consistently high in the U.S. and Canada.

Europe continued to expand as countries upgraded aging grids and embraced more energy-efficient backup solutions. In the Asia Pacific, fast urban growth and industrial expansion boosted generator use across commercial, industrial, and residential settings.

The Middle East & Africa and Latin America showed steady progress supported by infrastructure upgrades and off-grid power requirements in remote regions. Overall, North America remains the central hub for technological advancement and large-scale generator deployment worldwide.

Top Use Cases

- Hybrid and off-grid power systems: In remote locations or micro-grid systems, generators are combined with solar, wind, and batteries—serving either as prime power when the grid is absent or as backup alongside renewables.

- Mobile or temporary power for events & emergency response: Generators are used for outdoor events (concerts, festivals), emergency response operations (after natural disasters), and temporary infrastructure (mobile clinics, field stations) to supply electricity in places with no fixed grid.

- Industrial operations & heavy manufacturing: Factories, water treatment plants, food and beverage processing, mining operations—all these sectors use large generators to run heavy loads, maintain operations during power disruptions, and support load peaks or off-grid sites.

- Critical facilities – hospitals & data centres: Hospitals, healthcare centres, and data centres cannot afford power outages—life-critical machines or vast data systems depend on continuous electricity. Generators step in instantly to take over when the main supply drops.

- Construction and remote site power: At building sites, mining projects, oil-and-gas fields or any location without a steady grid connection, generators provide the needed electricity for tools, lighting, pumps, and machinery.

- Backup power for homes & buildings: When the main electricity supply fails—due to storms, grid glitches, or maintenance—a generator keeps lights, refrigeration, heating/cooling, and essential appliances running until normal power returns.

Recent Developments

- In December 2024, Caterpillar unveiled its new G3500K series gas generator sets. These are designed to help customers lower their energy costs by making use of efficient gas power rather than purely diesel.

- In September 2025, Atlas Copco introduced its EPH series of modular hybrid power generators, designed for off-grid and remote-site use. These units combine a traditional diesel generator with a battery energy storage system (BESS) and can link to solar power. The purpose: to reduce fuel consumption by up to 90%, cut CO₂ emissions by up to 86%, lower engine hours (up to 95% less wear), and provide quieter operation.

Conclusion

The electric generator market is steadily evolving as power reliability becomes a global priority. Growing pressure from extreme weather, rising energy demand, and expanding industrial activity keeps generators essential across homes, businesses, and critical facilities.

At the same time, new technologies—such as hybrid systems, cleaner fuels, and digital monitoring—are reshaping how generators operate and integrate with modern energy networks.

Advances in microgrids, renewable pairing, and mobile power solutions are opening fresh opportunities, especially in regions with unstable grids or remote needs. Together, these shifts highlight a market moving toward smarter, cleaner, and more resilient power-generation solutions.

Discuss Your Needs With Our Analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)