Table of Contents

Overview

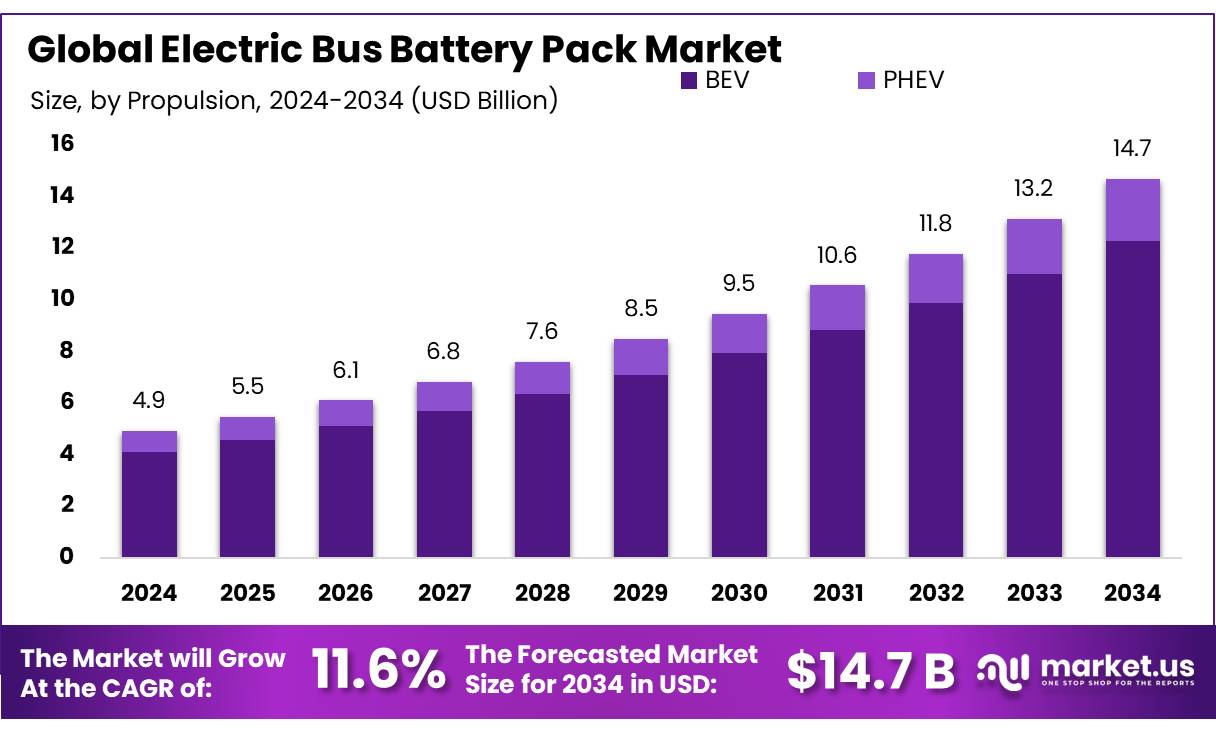

New York, NY – August 21, 2025 – The Global Electric Bus Battery Pack Market is projected to reach USD 14.7 billion by 2034, up from USD 4.9 billion in 2024, with a CAGR of 11.6% during the forecast period (2025–2034). In 2024, the Asia-Pacific (APAC) region led the market, holding a 42.8% share and generating USD 2 billion in revenue.

In India, the electric bus battery pack industry is witnessing robust growth, fueled by government policies, technological advancements, and rising environmental awareness. Key initiatives include the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) and the PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) schemes, which aim to lower the cost of electric vehicles (EVs) and promote their adoption, particularly electric buses.

Under FAME Phase II, launched in 2019 with a ₹11,500 crore budget, the government sanctioned 2,636 charging stations across 62 cities in 24 states and union territories and supported the deployment of 5,595 electric buses in 64 cities. The scheme allocates ₹10,000 crore to incentivize EVs, offering subsidies of up to ₹20 lakh per electric bus. Additionally, the Production Linked Incentive (PLI) Scheme for Advanced Chemistry Cells (ACC) promotes domestic battery manufacturing with subsidies of up to ₹2,000 per kWh, subject to production and value-addition targets.

India’s broader EV strategy, as outlined by NITI Aayog, targets a 30% EV share in vehicle sales, aiming to unlock a USD 200 billion opportunity. State-level policies, such as Uttar Pradesh’s Electric Vehicle Manufacturing and Mobility Policy 2022, further support adoption by offering subsidies, a 100% waiver on road tax and registration fees, and ambitious targets, including 1 million EVs by December 2024 and 1,000 electric buses.

Key Takeaways

- The Electric Bus Battery Pack Market size is expected to be worth around USD 14.7 billion by 2034, from USD 4.9 billion in 2024, growing at a CAGR of 11.6%.

- BEV held a dominant market position, capturing more than 83.8% share in the global electric bus battery pack market.

- NCA battery chemistry held a dominant market position, capturing more than a 48.4% share.

- 40 kWh to 80 kWh held a dominant market position, capturing more than a 56.2% share in the electric bus battery pack market.

- Prismatic held a dominant market position, capturing more than a 59.2% share in the electric bus battery pack market.

- Lithium held a dominant market position, capturing more than a 36.6% share in the electric bus battery pack market.

- The Asia‑Pacific (APAC) region emerged as the clear leader of the electric bus battery pack market, accounting for a commanding 42.8% of the global market and generating approximately USD 2 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/electric-bus-battery-pack-market/request-sample/

Report Scope

| Market Value (2024) | USD 4.9 Billion |

| Forecast Revenue (2034) | USD 14.7 Billion |

| CAGR (2025-2034) | 11.6% |

| Segments Covered | By Propulsion (BEV, PHEV), By Battery Chemistry (LFP, NCA, NCM, MNC, Others), By Capacity (15 kWh to 40 kWh, 40 kWh to 80 kWh, Above 80 kWh), By Battery Form (Cylindrical, Pouch, Prismatic), By Material Type (Lithium, Cobalt, Manganese, Natural Graphite, Nickel, Others) |

| Competitive Landscape | BYD Company Ltd., CATL, China Aviation Battery Co. Ltd. (CALB), Farasis Energy (Ganzhou) Co. Ltd., Gotion High-Tech Co. Ltd., Hitachi, Leclanché SA, LG Energy Solution Ltd., NFI Group Inc., Panasonic Holdings Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=154835

Key Market Segments

By Propulsion Analysis

Battery Electric Vehicles (BEVs) dominated the Electric Bus Battery Pack market in 2024, holding an 83.8% share due to their zero-emission benefits and operational efficiency. BEVs are favored globally for their lack of tailpipe emissions, reduced maintenance costs, and enhanced energy efficiency, driven by advancements in lithium-ion battery technology and declining battery costs. Government initiatives in regions like Asia-Pacific and Europe further boost BEV adoption in public transit fleets.

By Battery Chemistry Analysis

Nickel Cobalt Aluminum (NCA) batteries led the market in 2024 with a 48.4% share, valued for their high energy density and extended range. NCA batteries are preferred for long-route urban and intercity electric buses due to their superior weight-to-capacity balance, reliability, and cycle life. Their dominance is expected to persist into 2025 as manufacturers optimize battery performance and cities prioritize efficient, long-range electric transit systems.

By Capacity Analysis

Battery packs with 40 kWh to 80 kWh capacity held a 56.2% market share in 2024, favored for their balance of range, weight, and cost in city buses. This capacity range suits urban transit with frequent stops and shorter routes, offering faster charging and improved operational efficiency. In 2025, this segment is projected to remain dominant as transit agencies focus on cost-effective, reliable electric buses for medium-range routes.

By Battery Form Analysis

Prismatic battery cells led the market in 2024 with a 59.2% share, valued for their compact design and thermal stability. Their rectangular shape enhances packing efficiency and structural integrity, making them ideal for electric buses. Prismatic cells are expected to maintain strong demand in 2025 as global bus production scales and operators prioritize reliable, space-efficient battery designs.

By Material Type Analysis

Lithium-based materials dominated the market in 2024 with a 36.6% share, driven by their high energy efficiency, fast charging, and long cycle life. These batteries support longer travel distances and are critical to fleet electrification. In 2025, lithium’s dominance is expected to continue as technological advancements improve performance, safety, and cost-effectiveness.

Regional Analysis

The Asia-Pacific (APAC) region led the electric bus battery pack market in 2024 with a 42.8% share, generating USD 2 billion in revenue. China’s leadership, driven by the “New Energy Vehicle” program and widespread electric bus deployment, anchors the region’s dominance. Supported by robust supply chains, established manufacturers, and public procurement, APAC’s position is expected to strengthen in 2025 as electrification policies and infrastructure investments expand.

Top Use Cases

- Urban Public Transit: Electric bus battery packs power city buses, offering zero-emission transport. Their 40–80 kWh capacity suits frequent stops and shorter routes, reducing air pollution and noise. Fast-charging capabilities ensure minimal downtime, making them ideal for high-frequency urban routes, supporting cleaner and quieter cities.

- Intercity Transport: Battery packs with over 80 kWh capacity enable electric buses to cover longer intercity routes. High-energy-density NCA batteries provide extended range, ensuring reliable travel between cities. Improved charging infrastructure supports quick top-ups, making electric buses a sustainable option for regional travel.

- School Bus Fleets: Electric bus battery packs, especially 15–40 kWh, power school buses, offering safe, eco-friendly transport. Lithium-based batteries ensure efficient, quiet rides, reducing emissions around children. Government subsidies make them cost-effective, supporting widespread adoption in school districts for healthier communities.

- Tourist Shuttle Services: Prismatic battery cells power electric shuttle buses for tourist routes, offering compact design and thermal stability. Their 40–80 kWh capacity supports moderate ranges, ideal for scenic tours. Low maintenance and zero emissions enhance the eco-friendly appeal for tourism operators.

- Airport Ground Operations: Electric bus battery packs with lithium materials drive airport shuttles, providing quiet, emission-free transport. Their 40–80 kWh capacity suits short, repetitive routes between terminals. Fast charging ensures continuous operation, aligning with airports’ sustainability goals and reducing operational costs.

Recent Developments

1. BYD Company Ltd.

BYD continues to leverage its vertical integration, producing both buses and its Blade Batteries. Their recent focus is on enhancing safety and energy density through cell-to-pack (CTP) technology, which improves volumetric utilization. This design is integral to their global electric bus offerings, providing longer range and improved durability.

2. Contemporary Amperex Technology Co. Limited (CATL)

CATL is pushing the boundaries with its latest Qilin (Kirining) 3rd-generation battery system, achieving a record-high integration efficiency than previous CTP designs. This innovation offers up to energy density, directly benefiting electric buses by enabling significantly longer ranges on a single charge.

3. China Aviation Lithium Battery (CALB)

CALB is aggressively expanding its market share with its high-performance, safe, and durable battery systems. Their key development is the “One-Stop” Betl Platform product, ideal for the demanding cycles of electric buses. They are focusing on improving cycle life and calendar life to reduce the total cost of ownership for fleet operators.

4. Farasis Energy (Ganzhou) Co., Ltd.

Farasis Energy is focusing on next-generation silicon anode technology to boost the energy density of its bus battery packs. Their SPS (Super Pouch Solution) is a holistic approach integrating large-format pouch cells, manufacturing, and software to deliver an increase in range and faster charging compared to previous models.

5. Gotion High-Tech Co. Ltd.

Gotion High-Tech is making significant strides with its L600 Astroinno LMFP (lithium manganese iron phosphate) cell and pack technology. This new chemistry offers better performance than traditional LFP, with a volumetric cell energy density, enhances bus range. A major recent development is their partnership with Freyr Battery to produce these cells in Europe, aligning with local content goals.

Conclusion

The Electric Bus Battery Pack Market is booming, driven by the need for sustainable transport. With growing government support, advancements in battery technology like NCA and lithium, and expanding charging infrastructure, these packs are transforming urban transit, school fleets, and tourism. Their high energy efficiency and zero emissions make them a key player in achieving global decarbonization goals.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)