Table of Contents

Overview

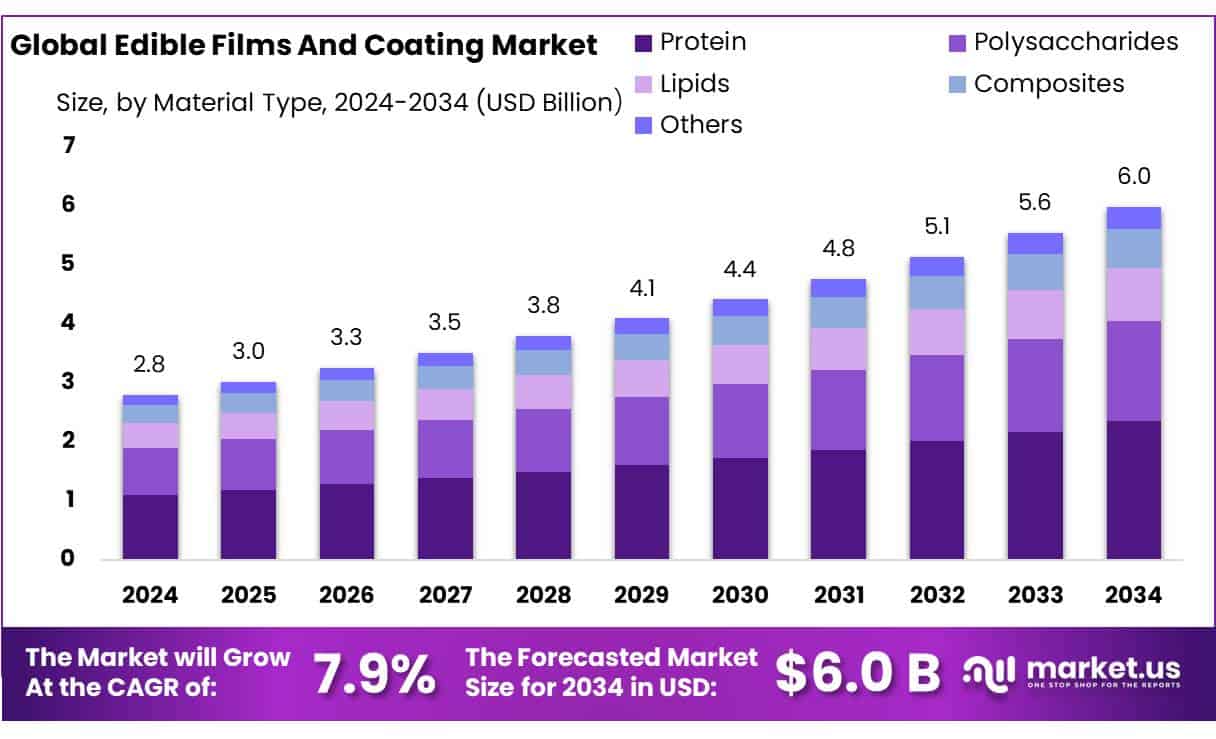

New York, NY – July 28, 2025 – The Global Edible Films and Coating Market is projected to soar from USD 2.8 billion in 2024 to USD 6.0 billion by 2034, achieving a robust CAGR of 7.9% during the 2025–2034 forecast period.

The Edible Films and Coatings Industry has become a vital component of the sustainable food packaging sector, offering biodegradable and consumable alternatives to conventional plastic materials. According to the Food and Agriculture Organization and various peer-reviewed sources, approximately 141 million tonnes of plastic packaging are generated each year, with food packaging accounting for nearly 33% of this total.

The growth of the edible films and coatings market is primarily driven by increasing regulatory pressure to reduce plastic waste, growing consumer preference for natural and clean-label products, and the demand to enhance the shelf life of perishable items. Notably, plant-based edible coatings have shown tangible benefits; for example, solutions developed by companies such as Apeel Sciences have successfully doubled the shelf life of products like avocados.

Scientific research has also played a key role in advancing the market. Between 1998 and 2023, more than 428 academic studies have focused on improving the functional properties of biopolymer-based films—such as chitosan, alginate, and nanocomposite variants—with enhancements in moisture barriers and antimicrobial activity.

Government support remains instrumental. In the United States, the Organic Trade Association reported that organic food sales exceeded USD 60 billion in 2022, including USD 22 billion from organic produce alone—representing 15% of total fruit and vegetable sales. This shift in consumer behavior toward organic products underscores the need for packaging solutions like edible films that align with organic certification standards.

Key Takeaways

- Edible Films And Coating Market size is expected to be worth around USD 6.0 billion by 2034, from USD 2.8 billion in 2024, growing at a CAGR of 7.9%.

- Protein held a dominant market position, capturing more than a 39.2% share of the global edible films and coatings market.

- Fruits and vegetables held a dominant market position, capturing more than a 32.9% share of the global edible films and coating market.

- North America dominated the edible films and coatings market, securing a commanding 42.9% share and reaching a total market value of approximately USD 1.2 billion.

How Growth is Impacting the Economy

The Edible Films and Coatings Market’s growth significantly impacts the global economy by fostering sustainable practices and reducing food waste, which accounts for global food production. By extending shelf life, these solutions minimize economic losses, saving billions annually, as seen in initiatives like Apeel Sciences, which has prevented spoilage of over 166 million produce items.

This supports farmers, especially in regions like Asia-Pacific and Latin America, by enhancing food security and reducing post-harvest losses. Job creation in research, production, and distribution further stimulates economies. However, high production costs and fluctuating raw material prices pose challenges, particularly in developing markets, necessitating investment in cost-effective technologies to sustain economic benefits.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-edible-films-and-coating-market/request-sample/

Strategies for Businesses

Businesses should invest in R&D to develop cost-effective, plant-based edible coatings, aligning with consumer demand for clean-label products. Collaborations with food producers can enhance scalability, while adopting nanotechnology and antimicrobial coatings can improve product functionality. Expanding distribution channels and focusing on eco-friendly certifications will attract environmentally conscious consumers. Additionally, leveraging government initiatives, such as the EU’s Circular Economy Action Plan, can secure funding and regulatory support. Companies like DuPont and Cargill should prioritize mergers and acquisitions to strengthen market presence and innovate sustainable packaging solutions to remain competitive.

Report Scope

| Market Value (2024) | USD 2.8 Billion |

| Forecast Revenue (2034) | USD 6.0 Billion |

| CAGR (2025-2034) | 7.9% |

| Segments Covered | By Material Type (Protein, Polysaccharides, Lipids, Composites, Others), By Application (Fruits and Vegetables, Bakery and Confectionery, Dairy Products, Meat, Poultry, and Seafood, Nutritional Products, Others) |

| Competitive Landscape | AGC SEIMI CHEMICAL CO., LTD., BASF SE, Evonik Industries AG, Sumitomo Chemical Co., Ltd., Heliatek GmbH, Graphic Packaging International, LLC, WestRock Company, Smurfit Kappa, Krones AG, Amcor plc, Graham Packaging Company, Sonoco Products Company, Berry Global Inc |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=151993

Key Market Segments

Material Type Analysis

In 2024, protein-based materials led the global edible films and coatings market, commanding a 39.2% share. Proteins, such as whey, soy, gelatin, and casein, are favored for their superior film-forming capabilities, offering robust oxygen barriers and mechanical strength. These properties make them ideal for food packaging, bakery, and fresh produce applications, where moisture retention and biodegradability are critical.

The surge in demand for sustainable, clean-label packaging solutions, coupled with regulatory restrictions on synthetic materials, has bolstered the popularity of protein-based films. This trend is particularly strong in North America and Europe, where eco-friendly packaging solutions are in high demand.

Application Analysis

In 2024, the fruits and vegetables segment dominated the edible films and coatings market, holding a 32.9% share. This prominence is driven by the need to minimize post-harvest losses and preserve freshness during storage and transport. Edible coatings act as protective layers, reducing moisture loss and slowing respiration rates to extend shelf life while maintaining quality.

Growing consumer demand for chemical-free, clean-label preservation methods has spurred the use of plant- and protein-based coatings on produce like apples, mangoes, and avocados. Supportive government policies in regions like Asia-Pacific and Latin America, focused on reducing food waste, are expected to sustain this segment’s dominance.

Regional Analysis

North America led the edible films and coatings market in 2024, capturing a 42.9% share with a market value of approximately USD 1.2 billion. This leadership stems from a well-established food packaging sector and widespread adoption of sustainable technologies in the U.S. and Canada.

Government support, including funding from the U.S. Department of Agriculture (USDA) and National Science Foundation (NSF) for research into protein- and polysaccharide-based coatings, has driven innovation to reduce post-harvest waste and enhance food safety. In California, state-backed initiatives have promoted the use of whey- and plant-based coatings to extend shelf life without synthetic additives.

Recent Developments

1. AGC SEIMI CHEMICAL CO., LTD.

- AGC has developed a transparent, high-barrier edible film made from seaweed extracts, targeting fresh produce packaging. The film extends shelf life while being fully biodegradable. The company is collaborating with Japanese food manufacturers to commercialize the product.

2. BASF SE

- BASF launched innovative protein-based edible coatings for fruits and vegetables, enhancing moisture retention and reducing spoilage. Their new plant-derived formulations comply with EU food safety standards. BASF is also researching antimicrobial edible coatings for meat products.

3. Evonik Industries AG

- Evonik introduced a lipid-based edible coating that improves the shelf life of cheeses and baked goods. The company is expanding into nutraceutical coatings for fortified foods. Their latest R&D focuses on taste-neutral, flexible films for confectionery.

4. Sumitomo Chemical Co., Ltd.

- Sumitomo developed a starch-polysaccharide blend edible film for processed foods, reducing plastic waste. The company is testing heat-sealable edible packaging for ready-to-eat meals. Partnerships with Asian supermarkets are underway.

5. Heliatek GmbH

- Heliatek is pioneering organic photovoltaic-integrated edible coatings for smart food packaging, combining sustainability with freshness indicators. Their prototypes include UV-blocking edible films for perishables.

Conclusion

The Edible Films and Coatings Market is poised for significant growth, driven by sustainability and innovation. Its economic impact includes reduced food waste, job creation, and enhanced food security. Businesses must focus on cost-effective, eco-friendly solutions to capitalize on this trend. Continued investment in advanced technologies and strategic partnerships will ensure market leadership, aligning with global demands for sustainable packaging and contributing to a circular economy, ultimately benefiting both the environment and economic systems worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)