Table of Contents

Overview

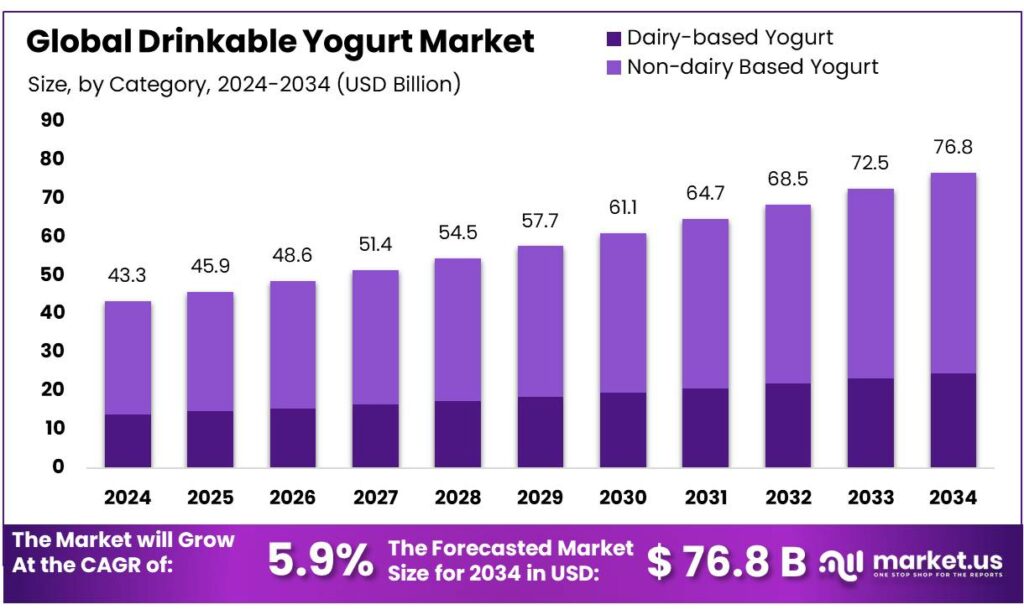

New York, NY – September 17, 2025 – The Global Drinkable Yogurt Market is projected to reach around USD 76.8 billion by 2034, rising from USD 43.3 billion in 2024, at a CAGR of 5.9% from 2025 to 2034. In 2024, Asia-Pacific led the market, securing a 38.9% share with USD 16.8 billion in revenue.

In India, the drinkable yogurt segment is gaining momentum, fueled by rising demand for healthy, convenient, and on-the-go food options. The category spans probiotic drinks, flavored yogurts, and traditional beverages like lassi and buttermilk. This growth is anchored in India’s powerful dairy sector, which is the largest globally, producing 24% of the world’s milk and supporting over 80 million farmers.

Government policies are also accelerating development. The National Dairy Plan (NDP) and the Dairy Processing and Infrastructure Development Fund (DIDF) strengthen infrastructure and value-added product production. For instance, under DIDF, Tamil Nadu is building a 10,000-liter-per-day yogurt and probiotic plant in Srivilliputhur. Similarly, the Dairy Entrepreneurship Development Scheme (DEDS) provides financial support for dairy ventures, while the Animal Husbandry Infrastructure Development Fund (AHIDF), with a ₹15,000 crore allocation, promotes investment in dairy processing and chilling facilities.

Key Takeaways

- Drinkable Yogurt Market size is expected to be worth around USD 76.8 Billion by 2034, from USD 43.3 Billion in 2024, growing at a CAGR of 5.9%

- Dairy-based Yogurt held a dominant market position, capturing more than an 82.9% share of the global drinkable yogurt market.

- Flavored held a dominant market position, capturing more than 78.3% share in the global drinkable yogurt market.

- Supermarkets & Hypermarkets held a dominant market position, capturing more than a 49.6% share in the global drinkable yogurt market.

- Asia‑Pacific region held a commanding 38.9% share—equating to around USD 16.8 billion—of the global drinkable yogurt market.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/drinkable-yogurt-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 43.3 Billion |

| Forecast Revenue (2034) | USD 76.8 Billion |

| CAGR (2025-2034) | 5.9% |

| Segments Covered | By Category (Dairy-based Yogurt, Non-dairy Based Yogurt), By Flavor (Flavored, Plain), By Sales Channel (Supermarkets/Hypermarkets, Departmental Stores, Convenience Stores, Others) |

| Competitive Landscape | Amy’s Kitchen, Inc., Bellisio Foods, Inc., Conagra Foods, Inc., Pillars Drinkable Yogurt, Goya Foods, Inc., Kraft Heinz, Iceland Foods Ltd, General Mills Inc, Nestle, Kellogg Co. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156536

Key Market Segments

By Category Analysis

Dairy-Based Yogurt Dominates with 82.9% Share in 2024

In 2024, dairy-based yogurt commanded 82.9% of the global drinkable yogurt market, firmly holding its leadership position. Its success stems from long-standing consumer trust, driven by rich taste, creamy texture, and strong nutritional credentials such as high protein, calcium, and probiotic benefits. Consumers across age groups—from children to seniors—continue to choose dairy-based yogurt as a reliable wellness option that balances taste with health.

The category also thrives on constant innovation. Probiotic-enhanced blends, vitamin fortification, and regional fruit-infused variants keep dairy-based drinkables modern and appealing. Looking ahead to 2025, the segment is expected to retain dominance as functional beverages gain popularity. Despite competition from plant-based alternatives, dairy-based yogurt maintains its edge due to affordability, wide availability, and a solid presence across both developed and emerging markets.

By Flavor Analysis

Flavored Drinkable Yogurt Leads with 78.3% Share in 2024

In 2024, flavored drinkable yogurt captured 78.3% of the market, making it the most popular choice worldwide. Consumers are drawn to diverse taste profiles—from strawberry and mango to blueberry and tropical blends—that make yogurt drinks feel indulgent while remaining nutritious. These flavor-rich options particularly resonate with children and young adults, who favor fun, taste-forward products for snacks and breakfasts.

Innovation continues to drive this segment. Seasonal launches, exotic fruit pairings, and reduced-sugar alternatives keep flavored yogurts exciting and relevant. Such variety not only satisfies evolving consumer palates but also fosters loyalty among health-conscious buyers who want both nutrition and taste in one convenient product.

By Sales Channel Analysis

Supermarkets & Hypermarkets Lead with 49.6% Share in 2024

In 2024, supermarkets and hypermarkets held 49.6% of global sales, cementing their role as the primary distribution channel for drinkable yogurt. Their dominance comes from extensive shelf space, diverse product displays, and the convenience of one-stop shopping. Consumers often discover new brands and flavors here, aided by in-store promotions, discounts, and free sampling that stimulate impulse purchases.

The visibility these outlets provide is unmatched. Brands strategically invest in eye-catching displays and promotional campaigns to attract health-focused consumers, who appreciate comparing nutrition labels and prices directly in-store. As functional beverages become mainstream, supermarkets and hypermarkets remain the central hub for driving product discovery and mass adoption.

Regional Analysis

Asia-Pacific Leads with 38.9% Share and USD 16.8 Billion Value in 2024

In 2024, Asia-Pacific commanded 38.9% of the global drinkable yogurt market, equivalent to USD 16.8 billion in revenue. The region’s dominance reflects both its scale and rising consumer appetite for nutritious, convenient beverages. Countries like China, India, and Japan are at the forefront, where busy urban lifestyles and growing health awareness fuel the demand for probiotic-rich drinkables.

APAC’s strength lies in the intersection of tradition and modern wellness trends. Yogurt drinks align with regional diets while meeting the demand for gut health and immunity support. In China, especially, probiotic dairy beverages—including drinkable yogurt—are rapidly gaining traction as everyday gut-health essentials, ensuring that Asia-Pacific remains the growth engine of this market.

Top Use Cases

- On-the-Go Breakfast Option: Busy folks love drinkable yogurt for quick morning meals. It’s packed with protein and probiotics that keep you full and energized till lunch. With flavors like berry or vanilla, it beats sugary cereals, helping control weight and boost gut health. Sales of these portable packs are soaring as urban lifestyles demand easy, nutritious starts to the day.

- Healthy Snack for Kids: Parents pick drinkable yogurt as a fun, spill-proof treat for children. Low in sugar but high in calcium, it supports growing bones and teeth while adding playful fruit tastes. Brands add fun characters on packaging to make snack time exciting. This trend is growing fast in family households seeking better alternatives to chips.

- Post-Workout Recovery Drink: Fitness enthusiasts grab drinkable yogurt after gym sessions for its natural proteins that repair muscles. Probiotics aid the digestion of heavy meals, reducing bloating. Available in high-protein versions, it’s a tasty way to refuel without bars or shakes. With wellness trends rising, athletes are swapping sodas for this creamy boost.

- Gut Health Daily Booster: People focused on wellness use drinkable yogurt to maintain a happy tummy. Live cultures fight bad bacteria, easing issues like IBS. It’s a simple daily sip that strengthens immunity, too. As awareness of microbiome health spreads, more adults add it to their routines for better overall vitality and fewer sick days.

- Plant-Based Choice for Vegans: Non-dairy drinkable yogurt from almond or oat milk suits lactose-intolerant or vegan diets. It delivers a similar creamy texture and probiotic perks without animal products. With eco-friendly appeal, it’s gaining fans among green-living crowds. Market shifts show vegan options growing over 10% yearly as tastes evolve.

Recent Developments

1. Pillars Drinkable Yogurt

Pillars has focused on the high-protein, low-sugar segment of drinkable yogurt, emphasizing gut health with prebiotics and probiotics. A key recent development is their expansion into new retail channels, making their products more accessible in major grocery chains across the United States. They continue to promote their clean-label, keto-friendly formulation as a primary selling point against larger competitors.

2. Bellisio Foods, Inc. (Parent of Michelina’s)

While historically known for frozen meals, Bellisio Foods has been expanding its portfolio. Recent developments indicate a strategic interest in adjacent categories, including potentially acquiring or developing snack and breakfast items. While not a direct player, their corporate strategy could lead them into the drinkable yogurt space to compete with convenient, on-the-go breakfast and snack options from rivals like Conagra.

3. Conagra Foods, Inc.

Through its brand Odom’s Tennessee Pride, Conagra has recently leveraged the drinkable yogurt category for breakfast innovation. Their development focuses on combining drinkable yogurt with granola, creating a convenient all-in-one meal. This move represents a strategic effort to capitalize on the breakfast segment with portable products that blend protein from yogurt and texture from mix-ins, addressing the demand for satiating on-the-go options.

4. Goya Foods, Inc.

Goya has recently expanded its yogurt offerings, including drinkable formats, specifically targeting the Latino community with familiar flavors. Their developments focus on authenticity and cultural resonance, promoting products like Yogurt Griego Bebible (Drinkable Greek Yogurt). This strategy strengthens their position in the dairy aisle and caters to the growing demand for culturally relevant, healthy beverages within the Hispanic market and beyond.

5. Amy’s Kitchen, Inc.

Amy’s has recently been exploring expansion beyond its core frozen and canned goods into the refrigerated sector, including dairy. While a dedicated drinkable yogurt product has not yet been launched, this strategic shift is a significant development. Their entry would likely focus on organic ingredients, non-GMO verification, and plant-based alternatives, aligning with their brand identity and filling a gap in the market for organic, clean-label drinkable yogurts.

Conclusion

Drinkable Yogurt as a bright spot in the dairy world, blending convenience with real health perks like gut support and protein power. Asia-Pacific leads share, but vegan twists and fun flavors are pulling in younger crowds everywhere. Brands that innovate with clean labels and bold tastes will grab the biggest slice. It’s not just a drink, it’s a smart daily habit set to refresh the snack scene.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)