Table of Contents

Overview

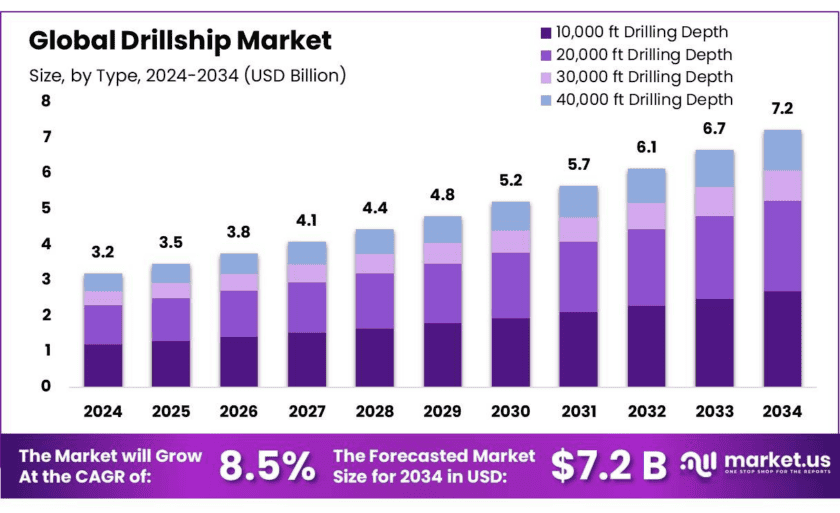

New York, NY – Oct 27, 2025 – The global drillship market is projected to grow significantly, reaching approximately USD 7.0 billion by 2034, up from USD 3.2 billion in 2024, with a compound annual growth rate (CAGR) of 8.5% between 2025 and 2034. Drillships are advanced, specialized vessels designed for offshore drilling operations, particularly in deep-water and remote locations such as the Arctic. Equipped with sophisticated dynamic positioning systems and satellite-based navigation, they are essential for accurate and efficient drilling of oil and gas wells in challenging environments.

According to the International Energy Agency (IEA), global oil demand is expected to rise significantly, reaching 103.9 million barrels per day (mb/d) by 2025, a notable jump from the estimated 830,000 barrels per day in earlier forecasts. This surge reflects the increasing global reliance on oil, particularly in the transportation and industrial sectors.

The IEA’s Global Energy Review highlights that in 2024, the power sector led energy demand growth, with global electricity consumption increasing by 1,100 terawatt-hours, or 4.3% year-on-year. This surge underlines the growing role of electricity in supporting industrial development and modern infrastructure.

From 2000 to 2025, the transportation sector has been a key driver of oil consumption, accounting for nearly 60% of the rise in global demand, according to the Organization of Petroleum Exporting Countries (OPEC). This reflects the steady increase in vehicle usage, aviation, and freight movement worldwide.

The demand for natural gas also saw a major uptick in 2024, according to IEA reports. Consumption increased by 115 billion cubic meters (bcm), or 2.7%, significantly higher than the average annual increase of 75 bcm over the past decade. By 2050, LNG trade is projected to meet around 20% of global natural gas needs, primarily driven by rising consumption across the Asia Pacific region.

In offshore drilling, ultra-deepwater activity in regions like Brazil, Guyana, Suriname, and the U.S. Gulf of Mexico has spurred a sharp rise in demand for modern drillships. Day rates for these vessels surpassed USD 500,000 in 2024, with projections suggesting they could exceed USD 600,000 by 2026, based on fleet status reports. This trend underscores the increasing importance of drillships in accessing difficult deepwater and Arctic reserves.

According to the Oil 2023 report, global oil demand is forecasted to grow by 6% by 2028, reaching approximately 105.7 million barrels per day. This rise is largely driven by expanding demand from the petrochemical and aviation sectors, which in turn boosts investment in drillships and advanced offshore technologies.

The IEA also notes a rise in global upstream investments—covering exploration, extraction, and production—reaching USD 528 billion in 2023. This represents an 11% increase over the previous year and the highest level of investment since 2015, indicating strong confidence in future oil and gas output.

On the global oil trade front, India imported 22 million barrels of Venezuelan crude in 2024, accounting for around 1.5% of its total oil imports. Meanwhile, China imported about 500,000 barrels per day, and the United States brought in approximately 240,000 barrels daily, highlighting the ongoing global reliance on Venezuela’s oil supply.

Key Takeaways

- The global drillship market was valued at USD 3.2 billion in 2024.

- The global drillship market is projected to grow at a CAGR of 8.5% and is estimated to reach USD 7 billion by 2034.

- Among by type (drilling depth), 20,000 ft. drilling depth accounted for the largest market share of 37.2 %, due to their extensive use in deep regions.

- By application, deep water accounted for the largest market share of 49.3%, driven by ongoing advancements in drilling technologies and subsea systems.

- By end-use, oil and gas exploration accounted for the majority of the market share at 58.2%, driven by high demand and untapped reserves in deep and ultra-deepwater regions.

- North America is estimated as the largest market for drillship with a share of 37.9% of the market share, driven by region robust untapped resources in deep regions with government incentives for energy exploration.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/drillship-market/free-sample/

Report Scope

| Market Value (2024) | USD 3.2 Bn |

| Forecast Revenue (2034) | USD 7.0 Bn |

| CAGR (2025-2034) | 8.5% |

| Segments Covered | By Type (10,000 ft. Drilling Depth,20,000 ft. Drilling Depth,30,000 ft. Drilling Depth,40,000 ft. Drilling Depth), By Application (Shallow Water, Deep Water, Ultra-deepwater), By End-use (Oil & Gas Exploration, Oil & Gas Production, Deep-sea Mining), |

| Competitive Landscape | A.P. Møller – Maersk A/S, Bureau Veritas Marine & Offshore, CBO Holding S.A., China Shipbuilding Group, Cosco Shipping Lines Co., Ltd., Daewoo Shipbuilding & Marine Engineering, Diamond Offshore Drilling, Finctierani-Cantieri Navali Italiani, Hanjin Heavy Industries and Construction, Hyundai Heavy Industries, Hyundai Mipo Dockyard, JSC Kherson Shipyard, Kawasaki Kisen Kaisha, Ltd., Maersk Drilling, Mitsubishi Heavy Industries, Ocean Rig, Samsung Heavy Industries Co., Ltd., Seadrill Limited, Sembcorp Marine Ltd., Siem Offshore Inc., Stena Drilling, STX Shipbuilding, Transocean Ltd, Valaris Limited, Wärtsilä Corporation. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145239

Key Market Segments

Type Analysis: In 2024, drillships with a 20,000 ft drilling depth held the largest share of the market, accounting for 37.2% of total revenue. These vessels are widely used due to their capability to reach deep-water reserves located at significant ocean depths. Their robust design and advanced systems enable them to operate efficiently in challenging offshore environments, such as the Gulf of Mexico and offshore Brazil. As exploration activities increasingly shift toward deeper and less accessible reserves, the demand for 20,000 ft drillships continues to grow, making them essential for safe and efficient offshore drilling operations.

Application Analysis: The deepwater drilling segment led the market in 2024, securing a dominant 49.3% market share. This growth is driven by increasing exploration and production activities in deepwater fields, as onshore reserves become more limited. Deepwater drillships are vital for accessing untapped oil and gas resources located in offshore regions beyond the reach of conventional drilling methods. Continued technological advancements in subsea systems and deepwater drilling techniques are further boosting this segment’s expansion. As a result, deepwater applications are expected to remain the leading force in the drillship market for the foreseeable future.

End-Use Analysis: In terms of end-use, the oil and gas exploration segment dominated the global drillship market in 2024, holding a significant 58.2% share. This is largely due to the increasing global need to discover new oil and gas reserves in deepwater and ultra-deepwater environments. With traditional fields declining, exploration has moved to more complex offshore areas, where drillships are uniquely suited for the task. Their ability to perform in extreme and remote ocean conditions, combined with advancements in exploration technologies, continues to make this segment a key driver of market growth.

List of Segments

By Type

- 10,000 ft Drilling Depth

- 20,000 ft Drilling Depth

- 30,000 ft Drilling Depth

- 40,000 ft Drilling Depth

By Application

- Shallow Water

- Deep Water

- Ultra-deepwater

By End-use

- Oil & Gas Exploration

- Oil & Gas Production

- Deep-sea Mining

Regional Analysis

In 2024, North America emerged as the largest regional market in the global drillship industry, capturing 37.9% of the total market share. This dominance is fueled by the region’s significant role in the global oil and gas sector, supported by vast natural resources, strong regulatory frameworks, and a continuous rise in energy demand. Offshore exploration, particularly in deepwater regions like the Gulf of Mexico, is accelerating—further driving the need for advanced drillships equipped for complex and high-depth operations.

According to the International Energy Agency (IEA), the United States alone accounted for 46% of global crude oil output, 20% of natural gas production, and 51% of rig count activity in 2024, reinforcing North America’s central position in global energy markets. Alongside these production strengths, the region has also made notable progress in drilling technology and environmental safety. Energy companies are increasingly adopting innovative solutions to enhance operational efficiency, reduce costs, and minimize environmental impact—all while adhering to strict standards set by regulatory bodies like the Bureau of Safety and Environmental Enforcement (BSEE). These combined factors are expected to continue supporting North America’s leadership in the drillship market in the years ahead.

Top Use Cases

Deepwater & Ultra-Deepwater Oil & Gas Exploration: Drillships are central to extracting oil and gas in deepwater and ultra-deepwater offshore zones thanks to their dynamic positioning and satellite-guided capabilities. They are increasingly used in high-interest areas such as the Gulf of Mexico, Guyana, Brazil, and the Arctic. Key stat: Seventh-generation drillships have day rates exceeding USD 500,000, with some reaching USD 600,000 per day, driven by tight supply and expanding deepwater project demand.

Well Maintenance, Completion & Subsea Installations: Beyond exploration, drillships serve vital support roles in completing wells, installing subsea equipment, and performing maintenance like casing or tubing placement and subsea tree setup Drilling Contractor. Their mobility and deck capacity make them suited to remote and complex offshore operations.

Rapid and Mobile Responses: Drillships possess high transit speed and large load capacity, offering flexibility and swift redeployment compared to anchored rigs. Their ability to reposition under their own power is especially advantageous in moderate to benign offshore environments, enhancing operational efficiency.

Emergency & Salvage Interventions: A prime example of drillship versatility came with the Discoverer Enterprise, which mounted a critical response during the Deepwater Horizon spill by capping the well and collecting oil and gas under emergency conditions.

Infrastructure Support: Pipeline Laying: Some drillships are retrofitted to support subsea pipeline installations using J-Lay technology, particularly in deepwater settings where traditional S-Lay methods fail due to high mechanical stresses. Their deck load capacity and dynamic positioning make them ideal platforms for such infrastructure tasks.

Recent Developments

In 2024, A.P. Møller – Mærsk A/S reported a solid USD 55.5 billion in annual revenue, with USD 6.5 billion in operating income, positioning it as a global logistics giant that also maintains a strategic presence in offshore drilling through its subsidiary Maersk Drilling. Formerly integrated with the Maersk Group, Maersk Drilling emerged from a demerger in 2019 to focus on safe, efficient offshore operations supported by one of the most advanced fleets in the industry. From a market analyst’s perspective, Maersk blends maritime strength with cutting-edge, reliable drillship capabilities.

Bureau Veritas S.A.—a global classification society—generated USD 6.34 billion in revenue in 2024, with marine and offshore services contributing around 7% of that total, or roughly USD 444 million. Through its Marine & Offshore division, Bureau Veritas provides vital classification, certification, and advisory services for drilling units and offshore assets, helping operators meet strict safety, design, and environmental standards with its comprehensive rules like NR569 and NR570. As a market analyst, I see Bureau Veritas as an essential partner ensuring drillships meet regulatory demands while maintaining performance and safety.

CBO Holding S.A. (Grupo CBO) from Brazil plays a vital offshore support role—especially in deep-water oil and gas operations like those in the Pre-Salt region. In 2022, the company generated USD 354 million in service revenue, securing its place as one of Brazil’s top maritime support players with long-term contracts and strong technological capabilities. Their vessels handle everything from anchor handling and logistics to subsea maintenance. As a market research analyst, I’d note that CBO’s solid revenue base and operational breadth make it a dependable offshore services provider in emerging deep-water markets.

The merged China State Shipbuilding Corporation (CSSC) became the world’s largest shipbuilder following its consolidation in 2019. In 2023, CSSC reported a group revenue of USD 48.9 billion and a net income of around USD 2.4 billion, underscoring its strength across commercial and naval shipbuilding, including offshore vessels used in drillship platforms. From an analyst’s viewpoint, CSSC’s sheer scale, state support, and dual-use infrastructure position it as a powerful force shaping the global drillship supply and broader offshore industry landscape.

Though best known for container shipping, Cosco Shipping Lines Co., Ltd. (a state-owned Chinese company with a fleet exceeding 1,417 vessels and 229 dedicated tankers as of the end of 2023) also supports offshore energy logistics by constructing and maintaining specialized vessels and platforms that indirectly benefit drillship operations and offshore fields. From a market analyst perspective, Cosco’s strong fleet, port infrastructure, and logistics backbone enhance global offshore drilling efficiency—making it a solid strategic partner in energy supply chains.

In 2024, Daewoo Shipbuilding & Marine Engineering—now operating as Hanwha Ocean—reported around USD 7.80 billion in revenue, up from USD 5.62 billion in 2023. As a top-tier Korean shipbuilder, the company develops advanced offshore vessels, including drillships, FPSOs, and floating platforms. Their global scale and technical know‑how place them at the forefront of supplying sophisticated offshore drilling infrastructure, essential for deepwater exploration and energy transition projects.

In 2023, Italian shipbuilding giant Fincantieri—through its Offshore & Specialized Vessels segment—achieved revenue of around €1.07 billion, up over 42% from the previous year, contributing significantly to the group’s total revenue of €7.65 billion. That same year, EBITDA climbed steeply to €397 million, nearly doubling its 2022 margin. As a market analyst, these figures indicate that Fincantieri’s offshore vessel portfolio, including drillship-related projects, is not just growing but also delivering stronger profitability amid expanding global demand for specialized marine assets.

In 2024, Hanjin Heavy Industries & Construction recorded revenue of approximately KRW 1.16 trillion, a decrease of around 6.3% compared to 2023, yet profit sharply improved to KRW 56.5 billion, up from KRW 7.6 billion the year before. While its core focus spans shipbuilding, infrastructure, and energy, HHIC also supports offshore drilling via construction of specialized marine platforms and support vessels. From a market research perspective, HHIC’s strong recovery in profitability—and its engineering breadth—positions it as a steady, capable contributor in the offshore and drillship supply chain.

HD Hyundai Heavy Industries, the world’s largest shipbuilder, generated USD 9.75 billion in revenue in 2024, up 6.1% from 2023’s USD 9.19 billion. It builds a broad array of offshore assets—including drillships, FPSOs, and rigs—which underpin global deepwater exploration efforts. As a market analyst, I see Hyundai’s steady revenue growth and massive industrial scale as a foundation for delivering technically sophisticated and reliable drillship platforms—embracing both volume and innovation in a challenging offshore environment.

Hyundai Mipo Dockyard (HMD) reported annual revenue of 4.63 trillion KRW in 2024, marking notable growth compared to the 4.04 trillion KRW recorded in 2023. As part of HD Hyundai Group, HMD designs and builds a range of offshore vessels—including drillships, FPSOs, and pipe-layers—supporting deep-sea exploration and offshore operations. From a market analyst’s standpoint, HMD’s strong financial recovery and its expertise in specialized marine assets position it as a dependable player in global offshore drilling infrastructure development.

Kherson Shipyard in Ukraine is well-established in maritime construction, specializing in merchant vessels such as dry cargo ships, tankers, icebreakers, and crucially, drilling vessels and floating dry docks. Though exact revenue figures for 2023–2024 are not published publicly, the shipyard’s historical production of large-scale vessels—ranging from Arctic-class carriers to multi-purpose cargo and offshore support ships—undercuts its strategic role in regional offshore infrastructure. As a market analyst, I see Kherson Shipyard’s versatile capability as a valuable asset for countries seeking tailor-made offshore and drilling support vessels.

Conclusion

In conclusion, drillships remain critical drivers of deepwater and ultra-deepwater exploration, backed by strong demand in regions like the U.S. Gulf of Mexico, Brazil, and Guyana. Utilization rates have surpassed 90%, underscoring the high activity level in the sector. Industry leaders, such as Transocean, report day rates as high as USD 635,000 for premium vessels like the Deepwater Atlas—highlighting the fierce competition for capable platforms. While we may see some market normalization in utilization, forecasts anticipate sustained demand for high-spec, high-pressure drillships, particularly those equipped for 20,000-psi operations. For energy companies, this translates to a focus on securing efficient, technologically advanced vessels that can navigate complex offshore environments safely, meeting both operational and environmental expectations as the industry moves forward.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)