Table of Contents

Overview

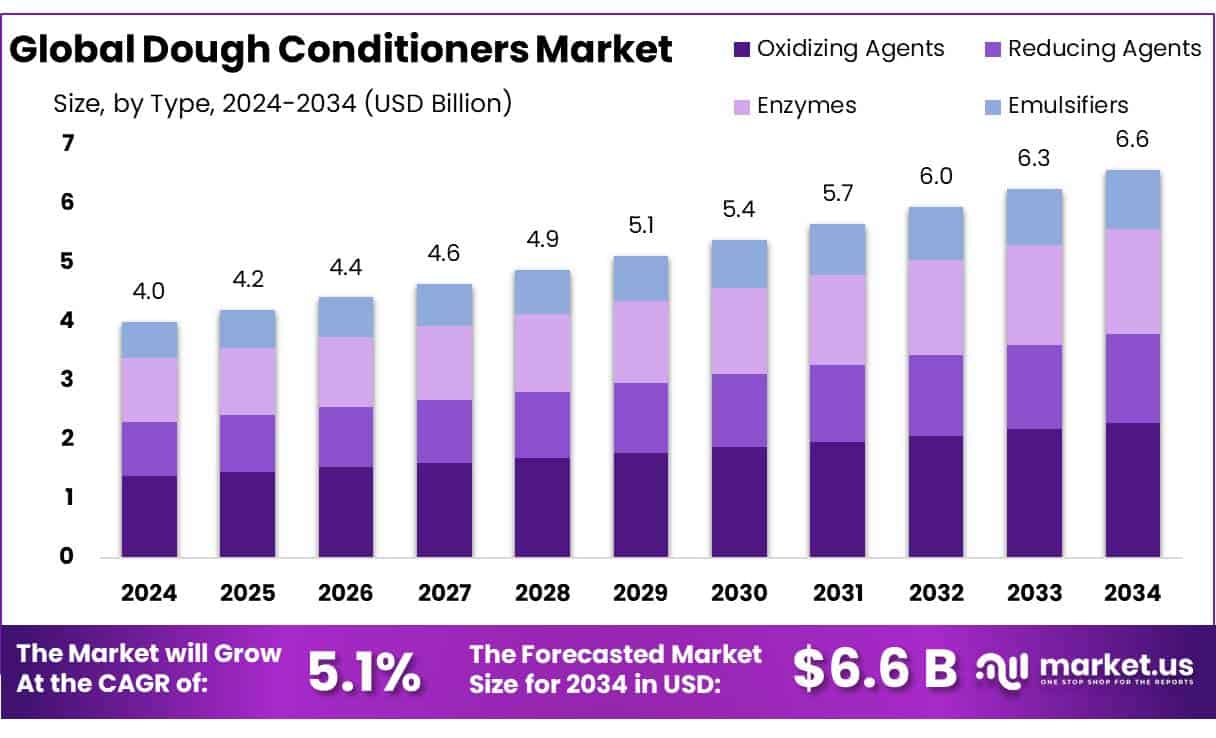

New York, NY – June 23, 2025 – The global dough conditioners market is poised for significant expansion, with its value projected to rise from around USD 4.0 billion in 2024 to approximately USD 6.6 billion by 2034, reflecting a steady compound annual growth rate (CAGR) of 5.1%. Demand is being driven by consumers’ increasing preference for freshly baked, ready-to-eat products, which require consistent texture, improved shelf life, and soft crumb characteristics. The popularity of clean-label, organic, and gluten-free bakery goods is further fueling demand for innovative, natural-form dough conditioners.

In 2024, the dough conditioners market was led by oxidizing agents, which held a dominant 34.8% share due to their essential role in improving dough strength, elasticity, and gas retention—key for consistent texture and volume in bakery products. By form, powdered dough conditioners accounted for 49.3% of the market, favored for their long shelf life, ease of handling, and compatibility with automated production systems.

In terms of application, bakery products remained the largest segment with a 54.2% share, driven by rising consumer demand for high-quality, consistent baked goods like bread, pastries, and cakes. The commercial end-use sector dominated the market with a substantial 78.3% share, as large-scale bakeries and food manufacturers increasingly adopted dough conditioners to ensure production efficiency, batch consistency, and uniform product standards across automated and industrial operations.

How Growth is Impacting the Economy

The upward trajectory of the dough conditioners market is catalyzing economic growth across the food and agriculture sectors. Investments in enzyme and emulsifier production are spurring job creation in ingredient manufacturing, research, and quality assurance. Automated bakery facilities are scaling operations, generating demand for specialized machinery and logistics services.

Cross-border export flows of conditioners and baked goods contribute to trade balances in emerging regions. Regulatory compliance for additive standards is prompting formal skill development and regulatory harmonization efforts, enhancing labor markets and technical expertise. Through multiplier effects, growth in conditioners fosters related industries such as packaging, transport, and retail. Overall, market expansion is contributing to GDP gains, employment, and innovation, particularly in regions integrating modern baking infrastructure.

Businesses should diversify product portfolios to include clean-label and enzyme-based conditioners that meet consumer demand for natural ingredients. Investing in R&D for specialty formulations—like gluten-free or plant-derived conditioners—can unlock niche markets. Strengthening partnerships with commercial bakeries and OEM equipment providers will improve market access. Streamlining supply chains to secure reliable, high-purity ingredient sources will reduce costs and enhance consistency.

Key Takeaways

- Dough Conditioners Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 4.0 Billion in 2024, growing at a CAGR of 5.1%.

- Oxidizing Agents held a dominant market position, capturing more than a 34.8% share in the dough conditioners market.

- Powder held a dominant market position, capturing more than a 49.3% share in the dough conditioners market.

- Bakery Products held a dominant market position, capturing more than a 54.2% share in the dough conditioners market.

- Commercial held a dominant market position, capturing more than a 78.3% share in the dough conditioners market.

- North America stands as the dominant region in the global dough conditioners market, commanding a substantial share of approximately 47.9%, equating to a market value of USD 1.9 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-dough-conditioners-market/free-sample/

Experts Review

Current market indicators reflect robust growth in dough conditioners, underpinned by strong bakery product demand and rising automation in commercial bakeries. Adoption of oxidizing agents and powdered forms underscores efficiency priorities. Looking ahead, the market is expected to maintain momentum via continued expansion into clean-label, enzyme-driven, and eco-friendly solutions.

Technological innovation and formulation customization will enable manufacturers to meet evolving consumer preferences and industrial scalability. Synergies with plant-based protein trends and gluten-free bakery segments present new growth opportunities. Overall, market fundamentals remain strong, with increasing per-capita bakery consumption and rapid deployment of conditioners in emerging markets supporting a positive long-term outlook.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=150897

Key Market Segments

By Type

- Oxidizing Agents

- Reducing Agents

- Enzymes

- Emulsifiers

By Form

- Powder

- Liquid

- Granular

By Application

- Bakery Products

- Pasta Products

- Pizza Dough

- Biscuit and Crackers

- Others

By End Use

- Commercial

- Household

Regional Analysis

In 2024, North America dominated the global dough conditioners market with a significant 47.9% share, valued at approximately USD 1.9 billion. This strong position is driven by high consumption of bakery staples such as bread, pastries, cakes, and pizza, along with the widespread presence of quick-service restaurants and rising demand for ready-to-eat meals.

The region is also witnessing a notable shift toward healthier, clean-label baked goods, prompting manufacturers to adopt natural and specialized dough conditioners suitable for organic, gluten-free, and additive-free formulations. This evolving consumer preference continues to shape innovation and product reformulation across the North American baking industry.

Top Use Cases

Expedited Rising & Proofing: Dough conditioners speed up the fermentation process by promoting yeast activity and gas retention, reducing proofing time. This enables high-throughput production in commercial bakeries, ensuring consistent texture and high volume across batches—even under varying temperature or humidity conditions.

Improved Dough Handling: By strengthening gluten and enhancing elasticity, conditioners make dough more resilient to mechanical stress during mixing, sheeting, or shaping. This ensures smoother processing, less waste, and uniformity—especially critical in automated and industrial baking environments.

Enhanced Volume & Texture: The use of oxidizing agents, emulsifiers, and enzymes provides stronger gas retention and uniform crumb structure. The result is bakery products with better volume, soft texture, fine crumb, and attractive crust—meeting consumer expectations for premium texture.

Extended Freshness & Shelf Life: Staling is delayed through enzyme activity and controlled moisture retention. Pizza dough, buns, and frozen or par-baked products maintain softness and quality during transport and shelf storage, reducing waste and improving operational efficiency.

Flour Quality Compensation: Variations in flour protein levels and processing properties can impede consistency. Dough conditioners compensate for these fluctuations—stabilizing dough performance and ensuring reliable outcomes regardless of raw material variability.

Recent Developments

Agropur Ingredients has enhanced its dough conditioning portfolio through R&D and product expansion. Notably, its Reddi-Sponge dough developer—an elastic, extensible powder used in commercial buns—has gained traction for aiding fermentation and extending shelf life in industrial bakery settings. The company continues to collaborate with dairy and ingredient customers in regions such as Argentina, Brazil, and Mexico to develop tailored solutions under the Agropur Ingredients brand.

ADM has reinforced its bakery ingredient leadership by expanding its line of emulsifiers and dough conditioners. Its deoiled powder emulsifiers, including the “Ultralec” range in IP and non-GMO variants, improve dough performance, texture, and shelf life. These products support lubricity, viscosity, and handling—key attributes for modern baking and clean-label formulations.

Allied Bakeries business, which includes well-known brands like Kingsmill and Hovis, as part of broader efforts to optimize its bakery ingredients and dough conditioning footprint. ABF remains active in ingredient manufacture, including texturants and dough conditioners, per its 2024 strategic report.ABF continues strategic movement in bakery operations.

Caldic has expanded its dough-conditioning solutions under its Trusol brand. The portfolio includes specialized lines such as Trusol Promase (dough conditioners), Trusol Mold X (clean-label mold inhibitors), and Trusol Lift & Lite (baking powder systems). These offerings support improved dough functionality, texture, and shelf life in commercial bake applications.

Conclusion

In summary, the dough conditioners market is demonstrating sustained growth, driven by a surge in bakery consumption, automation, and demand for consistent, high-quality products. Market expansion is delivering economic benefits across manufacturing, logistics, and ingredient sectors.

For success, businesses must innovate around clean-label formulations, optimize supply chains, and adapt strategies to regional trends. The optimistic analyst outlook underscores continued demand, especially in emerging markets. Consequently, conditioners are poised to remain essential in the industrial baking ecosystem, reinforcing market resilience and openness to innovation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)