Table of Contents

Introduction

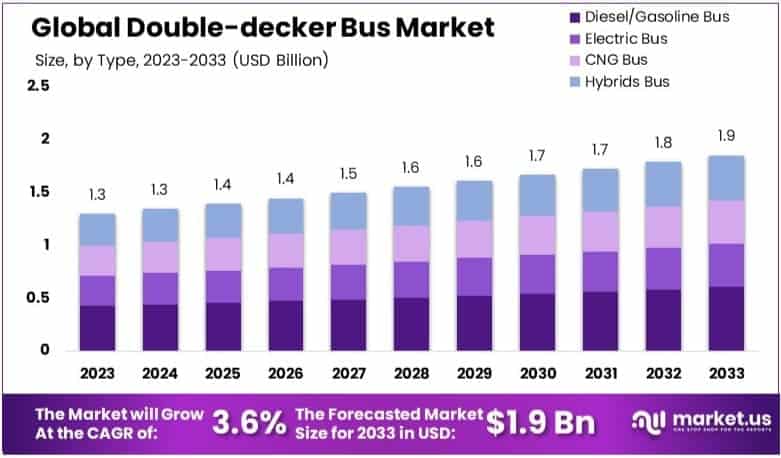

The Global Double-decker Bus Market is projected to reach approximately USD 1.9 billion by 2033, up from USD 1.3 billion in 2023, exhibiting a compound annual growth rate (CAGR) of 3.6% during the forecast period from 2024 to 2033.

The double-decker bus is a type of public transportation vehicle characterized by two passenger decks, offering higher seating capacity within the same road footprint. These buses are widely used in urban transit systems, sightseeing tours, and intercity travel, particularly in densely populated cities where optimizing space efficiency is crucial. The double-decker bus market encompasses the production, distribution, and adoption of these buses globally, driven by increasing urbanization, rising public transport investments, and the demand for sustainable mass mobility solutions.

The market is witnessing steady growth due to government initiatives promoting eco-friendly public transportation, advancements in electric and hybrid bus technologies, and increasing tourism activities. Additionally, the shift toward reducing carbon emissions and congestion in major metropolitan areas has accelerated the adoption of double-decker buses, particularly electric variants, as cities prioritize cleaner and more efficient transit options.

Growing investments in smart city projects, coupled with the expansion of bus rapid transit (BRT) networks, further propel market demand. The rising need for high-capacity, cost-effective public transport solutions, particularly in Asia-Pacific and Europe, presents significant growth opportunities for manufacturers.

Moreover, technological advancements, such as autonomous double-decker buses and improved battery efficiency in electric models, are expected to create new opportunities for market expansion. However, challenges such as high initial costs, maintenance complexities, and regulatory constraints in certain regions may restrain market growth to some extent. Despite these challenges, the double-decker bus market is poised for steady expansion, driven by increasing infrastructure development, sustainable mobility initiatives, and growing urban populations worldwide.

Key Takeaways

- The global double-decker bus market is projected to reach USD 1.9 billion by 2033, expanding at a CAGR of 3.6% from USD 1.3 billion in 2023.

- Diesel/Gasoline buses account for the largest share 32.6% due to their widespread infrastructure and established technology.

- Public transport leads the market with 52.2% share, driven by high passenger demand and urban congestion solutions.

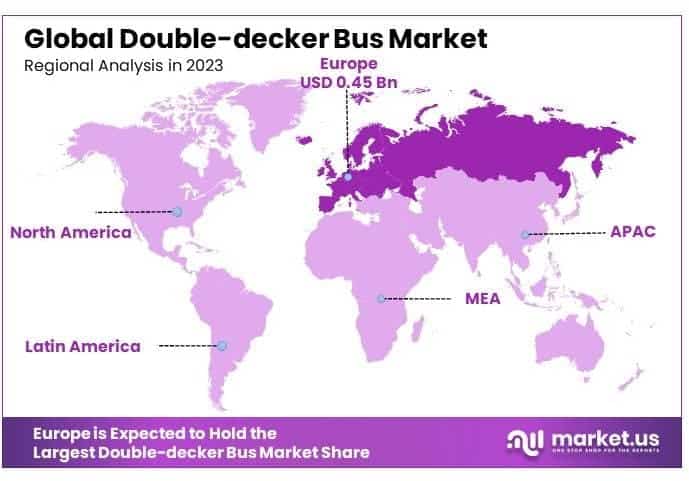

- Europe holds the largest market share 34.5%, supported by extensive adoption in public transport, intercity travel, and favorable regulatory policies.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 1.3 Billion |

| Forecast Revenue (2033) | USD 1.9 Billion |

| CAGR (2024-2033) | 3.6% |

| Segments Covered | By Type (Diesel/Gasoline Bus, Electric Bus, CNG Bus, Hybrids Bus), By Application (Public Transport, Intercity/Coaches, Others) |

| Competitive Landscape | Daimler AG, Volkswagen AG, Hinduja Group , AB Volvo , BYD Co Ltd. , VDL Groep BV, Zhengzhou Yutong Bus Co. Ltd., NFI Group Inc. , Marcopolo S.A., Van Hool NV, Adi Putro, Bustech Pty Ltd., others |

Emerging Trends

- Electrification of Fleets: There is a notable shift towards battery-electric double-decker buses. For instance, by March 2022, London had over 700 electric buses in service, with plans to increase this number to 2,500 by the end of 2025.

- Adoption of Hydrogen Fuel Cells: Cities are exploring hydrogen fuel cell technology for double-decker buses. In June 2021, London introduced 20 hydrogen-powered double-decker buses to its fleet.

- Integration of Wireless Charging: Innovations such as inductive wireless charging are being implemented. In February 2024, Seattle introduced 48 electric buses, including 33 double-decker models, equipped with InductEV’s wireless charging technology.

- Retrofitting Existing Buses: Operators are retrofitting older diesel double-decker buses with electric drivetrains to extend their service life and reduce emissions. In November 2023, Tootbus London announced plans to retrofit their buses with electric drivetrains from Magtec, making them zero-emission.

- Focus on Passenger Experience: Modern double-decker buses are being equipped with amenities such as Wi-Fi, USB charging ports, and improved seating to enhance passenger comfort.

Top Use Cases

- Urban Public Transit: Double-decker buses are utilized in densely populated cities to transport a large number of passengers efficiently, thereby reducing traffic congestion.

- Tourism and Sightseeing: These buses provide elevated views of cityscapes, making them popular for city tours and sightseeing purposes.

- Intercity Travel: Double-decker buses are employed for intercity routes, offering increased passenger capacity and amenities for longer journeys.

- School Transportation: In some regions, double-decker buses are used to transport students, maximizing capacity and reducing the number of vehicles required.

- Special Events and Charters: They are rented for events, providing group transportation with higher capacity than standard buses.

Major Challenges

- High Initial Costs: The acquisition cost of double-decker buses is higher compared to single-decker buses, posing budget constraints for operators.

- Infrastructure Limitations: The height of double-decker buses requires infrastructure modifications, such as taller bridges and terminals, limiting their deployment in certain areas.

- Maintenance Complexity: Double-decker buses have more complex mechanical systems, leading to higher maintenance requirements and costs.

- Regulatory Compliance: Navigating varying safety and operational regulations across different regions can be challenging for operators.

- Operational Challenges in Extreme Weather: Electric double-decker buses may experience reduced battery performance in cold weather conditions, affecting reliability.

Top Opportunities

- Government Initiatives for Sustainable Transport: Policies promoting zero-emission public transportation present opportunities for the adoption of electric and hydrogen-powered double-decker buses.

- Technological Advancements: Developments in battery technology and charging infrastructure can enhance the efficiency and appeal of electric double-decker buses.

- Urbanization and Population Growth: Increasing urban populations drive the need for high-capacity public transportation solutions, positioning double-decker buses as a viable option.

- Tourism Industry Expansion: Growth in tourism creates demand for sightseeing services, where double-decker buses offer unique vantage points for tourists.

- Public-Private Partnerships: Collaborations between governments and private companies can facilitate investments in double-decker bus fleets, infrastructure, and technology upgrades.

Key Player Analysis

The Global Double-decker Bus Market in 2024 is driven by key players leveraging technological advancements, sustainability initiatives, and strategic expansions. Daimler AG and Volkswagen AG remain at the forefront, capitalizing on their engineering expertise and expanding electric bus portfolios. Hinduja Group and AB Volvo strengthen their market presence with fuel-efficient and hybrid models catering to urban transit demands. BYD Co Ltd. leads in electric double-decker adoption, benefiting from strong government support.

VDL Groep BV and Zhengzhou Yutong Bus Co. Ltd. focus on lightweight, energy-efficient designs. NFI Group Inc. and Marcopolo S.A. expand in North America and Latin America. Van Hool NV, Adi Putro, and Bustech Pty Ltd. emphasize regional market penetration with innovative models. Collectively, these players shape market dynamics through product differentiation, regional expansions, and investments in zero-emission technology.

Market Key Players

- Daimler AG

- Volkswagen AG

- Hinduja Group

- AB Volvo

- BYD Co Ltd.

- VDL Groep BV

- Zhengzhou Yutong Bus Co. Ltd.

- NFI Group Inc.

- Marcopolo S.A.

- Van Hool NV

- Adi Putro

- Bustech Pty Ltd.

- Others

Regional Analysis

Europe Leads the Double-Decker Bus Market with the Largest Market Share of 34.5% in 2024

Europe dominates the global double-decker bus market, holding the largest market share of 34.5% in 2024, driven by extensive public transportation networks, stringent emission regulations, and increasing investments in sustainable urban mobility. The market in Europe is valued at approximately USD 0.45 million, reflecting steady demand across key countries such as the United Kingdom, Germany, and France.

The rising adoption of electric double-decker buses, particularly in the UK, is a significant growth driver, supported by government incentives and environmental policies. Moreover, the presence of leading manufacturers and strong regional investments in smart and eco-friendly transportation infrastructure further propel market expansion. Europe’s commitment to reducing carbon emissions through the electrification of public transport positions it as a key contributor to the double-decker bus market’s overall growth.

Recent Developments

- In 2024, National Express owner Mobico began the sale of its North American school bus division, aiming to cut its £1.2bn debt. The move led to a sharp rise in the company’s shares. Alongside this, Mobico reported a 24% increase in half-year profits, reaching £71.2m, as it worked towards financial stability.

- In 2024, First Bus received the Yutong U11DD battery-electric double-decker in the UK. This vehicle is the first of 126 set to arrive under a larger 169-bus order, partly funded by the Zero Emission Bus Regional Areas scheme. The model includes several upgrades based on feedback from previous trials, ensuring improved efficiency and performance for operators.

- In 2023, Volvo introduced its first-ever BZL Electric double-decker buses in Cambridge, adding 30 new zero-emission vehicles to the city’s transport system. The initiative represents the largest investment in the region’s bus network in a decade, supporting cleaner air and encouraging public transport use.

- In 2025, Go North West will expand its electric fleet with 19 Wrightbus Streetdeck Electroliners entering service on 5 January. These buses will operate on routes 472 and 474, replacing smaller vehicles to reduce overcrowding. With this addition, Go North West’s battery-electric fleet will grow to 69 buses, strengthening the Bee Network’s sustainable transport strategy.

- In 2024, Wrightbus launched a large fleet of zero-emission buses in Oxford, marking a major step in the city’s green transport transition. The £82.5m initiative will deploy 159 battery-electric buses, with Oxford Bus Company operating 104 of them. Manufactured in Ballymena, the fleet includes 99 StreetDeck Electroliners and five GB Kite Electroliner single decks, alongside new charging infrastructure at bus depots.

- In 2024, Go-Ahead announced a £500m investment in electric buses to accelerate fleet decarbonisation. The initiative is expected to support up to 500 UK manufacturing jobs, with Wrightbus establishing a dedicated production line to meet demand. This investment signals a significant commitment to sustainable public transport and green economic growth.

Conclusion

The global double-decker bus market is anticipated to experience steady growth, driven by increasing urbanization and the need for efficient public transportation solutions. The adoption of electric and hybrid propulsion technologies is expected to rise, reflecting a global shift towards sustainable mobility. Europe is projected to maintain a significant market share, supported by extensive public transport networks and favorable regulatory policies. Despite challenges such as high initial costs and infrastructure limitations, ongoing technological advancements and supportive government initiatives are likely to create new opportunities for market expansion.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)