Table of Contents

Overview

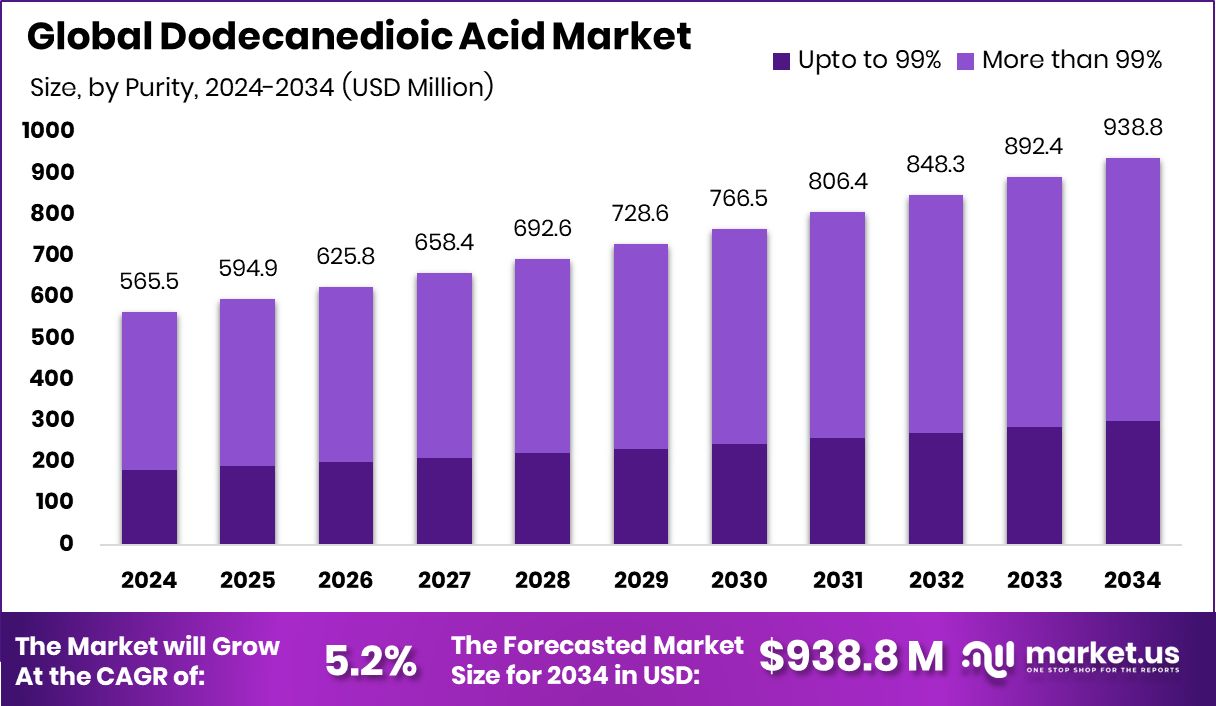

New York, NY – August 05, 2025 – The Global Dodecanedioic Acid (DDDA) market is projected to grow from USD 565.5 million in 2024 to approximately USD 938.8 million by 2034, achieving a CAGR of 5.2% from 2025 to 2034. The Asia-Pacific region holds a leading 36.7% market share, driven by robust industrial demand.

Dodecanedioic Acid (DDDA) is a 12-carbon, long-chain dicarboxylic acid, typically produced via petrochemical processes or biological fermentation using renewable feedstocks. This white crystalline powder is valued for its high stability and corrosion resistance, making it a key ingredient in high-performance polymers like nylon 612, as well as adhesives, resins, lubricants, and powder coatings.

The DDDA market encompasses the global production and trade network supplying DDDA to industries such as automotive, electronics, construction, and consumer goods. It is driven by demand for durable polymers suited for high-temperature and chemically harsh environments. The market includes both synthetic and bio-based production, with a growing focus on sustainable methods shaping its trajectory.

The market is propelled by rising demand for high-performance nylons and polymers in automotive components, electrical insulation, and industrial machinery. Nylon 612, synthesized using DDDA, is favored for its superior strength, flexibility, and heat resistance. The push for lightweight, fuel-efficient vehicles has increased the use of engineering plastics, further boosting DDDA demand. Additionally, rapid growth in electronics and powder coating applications supports consistent DDDA consumption in resin formulations.

Key Takeaways

- The Global Dodecanedioic Acid Market is expected to be worth around USD 938.8 million by 2034, up from USD 565.5 million in 2024, and is projected to grow at a CAGR of 5.2% from 2025 to 2034.

- In 2024, the more than 99% purity grade dominated, with 68.3% due to superior polymer compatibility.

- Synthetic process accounted for 87.4% and was favored for its scalability, consistency, and established industrial infrastructure.

- Nylon led with 48.5%, driven by rising demand for durable, lightweight polymers in automotive and electronics.

- The Asia-Pacific market size reached USD 207.5 million during the same year.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-dodecanedioic-acid-market/request-sample/

Report Scope

| Market Value (2024) | USD 565.5 Million |

| Forecast Revenue (2034) | USD 938.8 Million |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Purity (Up to 99%, More than 99%), By Manufacturing Process (Synthetic Process, Biological Process), By Application (Nylon, Corrosion Inhibitor, Engine Coolant, Epoxy Resin, Powder Coating, Tooth Brush Bristles, Others) |

| Competitive Landscape | BASF SE, Cathay Industrial Biotech, UBE Industries, Santa Cruz Biotechnology, Catha, Evonik, Chemceed |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153605

Key Market Segments

Purity Analysis

High-purity Dodecanedioic Acid (>99%) commands a 68.3% share of the global market in 2024. This grade is favored for its chemical consistency and superior quality, making it essential for high-performance polymers, specialty coatings, and advanced adhesives. Industries like automotive, electronics, and manufacturing prioritize this high-purity DDDA for its enhanced mechanical strength, corrosion resistance, and thermal stability. Stringent quality standards and growing awareness of its long-term benefits over lower-purity alternatives drive its dominance. Advances in purification technologies and process control further enable scalable, consistent production, ensuring sustained demand for high-purity DDDA.

Manufacturing Process Analysis

Synthetic processes dominate the Dodecanedioic Acid Market with an 87.4% share in 2024. Preferred for their cost efficiency, consistency, and scalability, synthetic methods leverage established petrochemical routes to produce high-purity DDDA. These processes meet the strict requirements of industries such as polymers, coatings, and adhesives.

Supported by robust infrastructure and reliable raw material supply, synthetic production ensures predictable outcomes and compatibility with large-scale operations. Despite rising sustainability concerns, the synthetic route’s technical reliability, low variability, and alignment with downstream applications solidify its market leadership.

Application Analysis

Nylon applications lead the Dodecanedioic Acid Market with a 48.5% share in 2024, driven by demand for specialty nylons like nylon 612. Valued for its mechanical strength, heat resistance, and chemical stability, DDDA is a critical monomer in nylon production, enhancing flexibility and wear resistance. This makes it ideal for high-stress applications in industries requiring durable engineering plastics. Nylon’s dominance is fueled by its design versatility, ease of molding, and long service life, meeting the needs of industrial and technical applications.

Regional Analysis

In 2024, Asia-Pacific holds a leading 36.7% share of the Dodecanedioic Acid Market, valued at USD 207.5 million. This is driven by the region’s growing industrial base, high demand for performance polymers, and strong chemical manufacturing infrastructure.

China, India, and South Korea are key players, supported by increased production and favorable industrial policies. North America and Europe follow, driven by steady demand in automotive and engineering sectors, while the Middle East & Africa and Latin America hold smaller shares, with growth tied to emerging industrial and construction activities.

Top Use Cases

- Nylon Production: Dodecanedioic acid is a key ingredient in making nylon 612, a strong and heat-resistant material. It’s used in automotive parts, cables, and textiles due to its durability and low moisture absorption, ensuring products last longer and perform well in tough conditions.

- Powder Coatings: DDDA acts as a crosslinker in powder coatings, improving durability and corrosion resistance. It’s widely used in appliances, automotive parts, and industrial equipment, providing a tough, attractive finish that withstands harsh environments.

- Adhesives and Sealants: DDDA enhances the strength and flexibility of adhesives and sealants. It’s used in construction, automotive, and packaging industries, where strong bonding and resistance to environmental factors are critical for reliable performance.

- Corrosion Inhibitors: DDDA forms a protective layer on metal surfaces, preventing rust in industries like oil and gas, metalworking, and water treatment. It ensures equipment longevity and reduces maintenance costs in harsh conditions.

- Personal Care Products: DDDA and its derivatives are used in shampoos, conditioners, and skin creams as emollients and humectants. They provide moisturizing and softening effects, improving product texture and user experience in cosmetics.

Recent Developments

1. BASF SE

BASF continues to expand its bio-based chemicals portfolio, including DDDA, used in high-performance polymers and coatings. The company focuses on sustainable production methods, integrating renewable feedstocks. BASF’s DDDA is key to producing engineering plastics like PA 6,12. Recent investments in R&D aim to enhance efficiency and reduce carbon footprint. BASF collaborates with partners to advance bio-based solutions.

2. Cathay Industrial Biotech

Cathay Industrial Biotech, a leader in bio-based DDDA, has scaled up production using fermentation technology. The company supplies DDDA for nylon (PA 6,12 and PA 12,12) and polyesters. Recent expansions in China strengthen its global market position. Cathay emphasizes sustainable production with non-petroleum feedstocks, aligning with green chemistry trends.

3. UBE Industries

UBE Industries produces DDDA for high-performance polyamides and resins. The company has optimized its manufacturing process to improve yield and sustainability. UBE’s DDDA is used in automotive and electronics applications. Recent developments include partnerships to enhance supply chain efficiency and expand market reach in Asia and Europe.

4. Santa Cruz Biotechnology

Santa Cruz Biotechnology supplies DDDA for research and industrial applications. The company provides high-purity DDDA for pharmaceutical and specialty chemical uses. Recent efforts focus on expanding catalog offerings and ensuring supply chain reliability for niche markets.

5. Catha

Limited recent updates are available on Catha’s DDDA production. The company may be involved in specialty chemicals, but detailed developments are not publicly reported. For current information, checking industry databases or direct inquiries is recommended.

Conclusion

Dodecanedioic acid is a versatile compound driving innovation across industries like automotive, cosmetics, and healthcare. Its role in high-performance materials, sustainable solutions, and metabolic supplements highlights its growing demand. As industries prioritize durability, eco-friendly options, and health benefits, DDDA’s market is set to expand, fueled by advancements in production and diverse applications.