Table of Contents

Overview

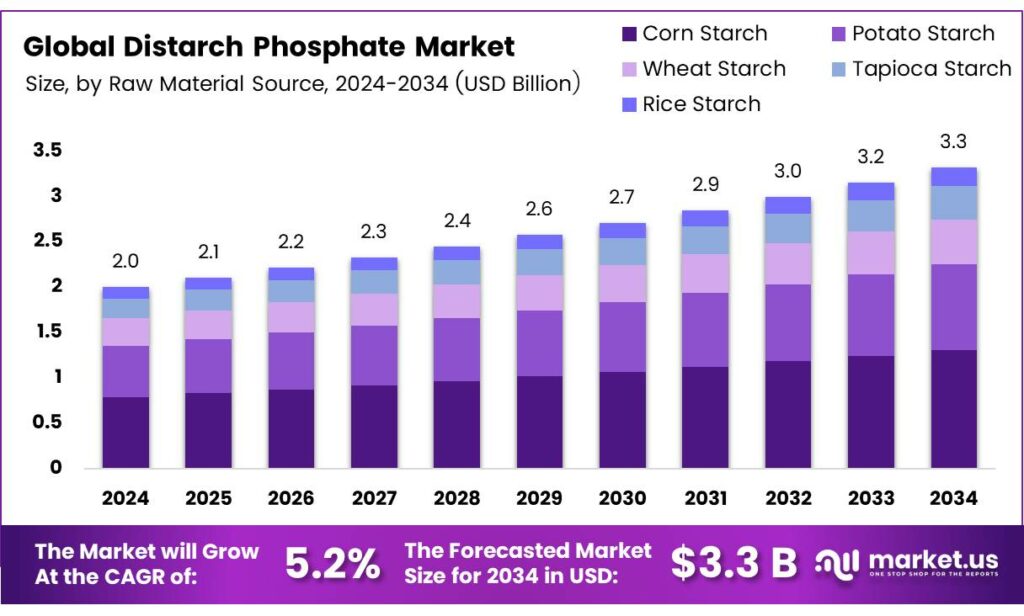

New York, NY – September 19, 2025 – The Global Distarch Phosphate (DSP) Market is projected to reach approximately USD 3.3 billion by 2034, growing from USD 2.0 billion in 2024 at a CAGR of 5.2% between 2025 and 2034.

Distarch Phosphate, a modified food starch, is classified as Generally Recognized as Safe (GRAS) when used as a dietary fiber source and for its functional properties such as thickening, binding, and texturizing. It is widely incorporated in everyday food applications, including bread, ready-to-eat cereals, cereal bars, and various processed products. The ingredient is derived from food-grade starches such as potato, corn, tapioca, and wheat, ensuring compatibility with multiple food formulations.

DSP is approved for use across seventeen food categories, with intake levels ranging from 3.5–7.0 grams per serving and an average of 5 grams per serving. In the U.S., estimated per capita consumption ranges between 16.8–34.5 grams per day, with high-level consumers reaching 33.6–69.0 grams per day. Modified food starches produced using phosphorus oxychloride (POCh) are already recognized as approved food additives by the FDA.

The safety of DSP has been reviewed by qualified scientific experts, supported by analytical data and published research, and made available for FDA evaluation through Keller and Heckman LLP, Washington, D.C. Manufacturing involves esterification of starch with POCh at levels up to 0.1%, as defined in the Food Chemicals Codex (FCC) monograph. However, recent proposals suggest production using higher POCh levels (up to 4.5%, with evaluations confirming that residual phosphorus remains low under 0.4% in potato starch and below 0.5% in wheat starch, making it suitable for food-grade applications.

Key Takeaways

- The Global Distarch Phosphate Market is expected to grow from USD 2.0 billion in 2024 to USD 3.3 billion by 2034, at a CAGR of 5.2%.

- Corn starch held a 39.4% share in 2024 due to its cost-effectiveness and versatile applications.

- Thickeners captured a 29.7% market share in 2024, driven by demand in food and beverage products.

- Low Substitution (DS 1-3) led with a 45.6% share in 2024 for balanced stability in food applications.

- The Food and Beverage sector held a 58.9% share in 2024, fueled by demand for processed foods.

- North America dominated with a 42.6% share, valued at USD 0.8 billion, due to its advanced food processing industry.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-distarch-phosphate-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.0 Billion |

| Forecast Revenue (2034) | USD 3.3 Billion |

| CAGR (2025-2034) | 5.2% |

| Segments Covered | By Raw Material Source (Corn Starch, Potato Starch, Wheat Starch, Tapioca Starch, Rice Starch), By Functional Properties (Thickeners, Stabilizers, Gelling Agents, Emulsifiers, Moisture Retention Agents), By Degree of Substitution (Low Substitution, Medium Substitution, High Substitution), By Application, Food and Beverage (Textile, Pharmaceutical, Others) |

| Competitive Landscape | Biochem Technology Group Company Limited, Cargill, Incorporated, Tate Lyle PLC, Emsland Group, Henan Haishengyuan Food Ingredients Co., Ltd., Ingredion Incorporated, Avebe U.A., Roquette Frères S.A. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=156760

Key Market Segments

By Raw Material Source

Corn Starch Commands 39.4% Share in 2024

In 2024, corn starch led the global distarch phosphate market with a 39.4% share, driven by its abundant supply, affordability, and versatility across food, pharmaceutical, and industrial applications. Its consistent quality, stability, and binding properties make it ideal for bakery products, sauces, dairy, and convenience foods, particularly in health-focused categories where it serves as a thickener and texturizer. Supported by robust production in North America and Asia-Pacific, corn starch maintains a competitive edge over alternatives like potato, tapioca, and wheat, ensuring supply stability and cost efficiency.

By Functional Properties

Thickeners Hold 29.7% Share in 2024

Thickeners dominated the distarch phosphate market in 2024, capturing a 29.7% share due to their widespread use in food and beverage products. Distarch phosphate’s ability to enhance texture, stabilize viscosity, and maintain consistency under various processing conditions makes it essential for soups, sauces, bakery fillings, and dairy products. The rising demand for convenience foods and ready-to-eat meals further boosts its use. Beyond food, its thickening properties benefit pharmaceuticals (e.g., tablet and liquid formulations) and cosmetics (e.g., creams and lotions), reinforcing its market strength.

By Degree of Substitution

Low Substitution (DS 1-3) Leads with 45.6% Share in 2024

In 2024, low substitution (DS 1-3) distarch phosphate held a 45.6% market share, driven by its widespread use in food applications like baked goods, cereals, sauces, and confectionery. Offering a balance of stability and functionality with minimal starch modification, low DS starches align with clean-label trends, meeting consumer demand for minimally processed ingredients. Their cost-effectiveness and performance make them a top choice for manufacturers in both developed and emerging markets, particularly in the growing processed food sector fueled by urbanization.

By Application

Food and Beverage Dominates with 58.9% Share in 2024

The food and beverage sector led the distarch phosphate market in 2024, holding a 58.9% share. Its prominence is driven by the growing demand for processed and convenience foods, where distarch phosphate acts as a thickener, stabilizer, and texturizer in bakery, dairy, sauces, soups, confectionery, and frozen meals. The shift toward convenient, shelf-stable, and health-oriented food options, combined with global urbanization, continues to drive its adoption. The ingredient’s role in enhancing product consistency and shelf life solidifies its importance in this segment.

Regional Analysis

North America Leads with 42.6% Share, USD 0.8 Billion Market

In 2024, North America dominated the global distarch phosphate market with a 42.6% share, valued at USD 0.8 billion. This leadership is driven by a sophisticated food processing industry that heavily utilizes distarch phosphate as a texturizer, stabilizer, and thickener in convenience foods, dairy, bakery, and meat products.

High consumer demand for processed foods with improved texture and shelf life, coupled with innovation in clean-label and non-GMO products, fuels growth. A strong supply chain, major manufacturers, and clear FDA regulations ensure product quality and market stability, reinforcing North America’s position.

Top Use Cases

- Thickener in Soups and Sauces: Distarch phosphate acts as a reliable thickener in everyday soups and sauces, helping them stay smooth and consistent even after freezing and reheating. This makes it perfect for busy home cooks and food makers who want easy meals that don’t separate or get watery, keeping flavors locked in and textures appealing without much effort.

- Stabilizer in Dairy Products: In yogurts and ice creams, distarch phosphate works as a stabilizer to prevent separation and maintain a creamy feel during storage or transport. It ensures these treats stay fresh and enjoyable, appealing to families looking for hassle-free dairy options that hold up well in the fridge or freezer.

- Texturizer in Bakery Goods: Bakers use distarch phosphate to enhance the chew and softness in breads and pastries, making them more resilient to drying out. This simple addition helps create everyday favorites that feel fresh longer, ideal for stores and homes where quality baked items boost customer satisfaction without complex recipes.

- Absorbent in Cosmetics: In face powders and lotions, distarch phosphate absorbs extra oil for a matte, comfortable finish that lasts all day. It’s a gentle choice for daily skincare routines, helping users avoid shine and feel confident, while brands love how it blends smoothly into natural-looking formulas for everyday beauty needs.

- Binder in Pharmaceuticals: Drug makers rely on distarch phosphate as a binder in tablets to hold ingredients together firmly, ensuring even release and easy swallowing. This supports reliable health solutions for patients seeking simple, effective meds that work consistently, making it a go-to for creating trustworthy pills in everyday wellness routines.

Recent Developments

1. Biochem Technology Group Company Limited

Biochem Technology continues to expand its modified starch portfolio, with Distarch Phosphate being a key focus for the Asian market. Recent developments highlight its application in improving the texture and stability of instant noodles and dairy products. The company is investing in R&D to enhance the functional properties of its phosphated starches for cleaner-label solutions in response to consumer demand.

2. Cargill, Incorporated

Cargill is innovating with its Distarch Phosphate offerings, emphasizing sustainability and non-GMO verified options. Recent developments include expanding production capacity in Europe and Asia to meet growing demand for texturizers in plant-based meat and yogurt alternatives. Their focus is on providing starches that deliver superior freeze-thaw stability and creaminess, allowing for reduced fat and sugar content in final products.

3. Tate & Lyle PLC

Tate & Lyle has launched a new range of clean-label, functional, native, and modified starches, including Distarch Phosphate. Recent strategy focuses on providing solutions for sugar and fat reduction, with their phosphated starches improving moisture retention and shelf-life in baked goods and sauces. Their innovation pipeline is geared towards meeting E.U. clean-label demands while maintaining high performance.

4. Emsland Group

Emsland Group highlights its Distarch Phosphate as a crucial ingredient for texture modification in soups, sauces, and ready meals. Recent developments involve optimizing their production processes for greater consistency and functionality, particularly in cold swelling applications. The company emphasizes the non-GMO and allergen-free nature of its potato-based phosphated starches, catering to the European market’s preferences.

5. Henan Haishengyuan Food Ingredients Co., Ltd.

This Chinese manufacturer is actively expanding its export market for Distarch Phosphate, promoting its cost-effectiveness for canned foods, meat products, and pudding. Recent developments focus on increasing production capacity and ensuring compliance with international food safety standards, such as BRC. They are targeting growth in Southeast Asian and Middle Eastern markets with their competitively priced tapioca and potato-based starches.

Conclusion

Distarch Phosphate as a versatile star rising in the ingredient world, quietly powering better textures and stability across foods, beauty products, and health aids. Its natural roots and ability to fit clean-label trends make it a smart pick for brands chasing healthier, convenient options that delight everyday users. With growing love for simple, plant-based living, this modified starch promises steady demand and fresh innovations, helping companies meet consumer calls for quality without compromise.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)