Table of Contents

Report Overview

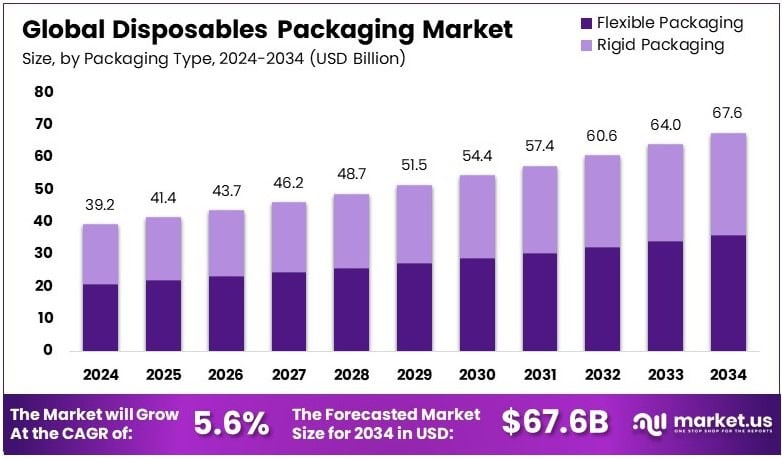

The Global Disposables Packaging Market size is expected to be worth around USD 67.6 Billion by 2034, from USD 39.2 Billion in 2024, growing at a CAGR of 5.6% during the forecast period from 2025 to 2034.

Disposables packaging, known for its single-use convenience, continues to find widespread application across sectors such as food and beverage, healthcare, personal care, and retail. With shifting consumer preferences, regulatory pressures, and sustainability demands, the industry is undergoing a transformative phase.Disposables packaging refers to single use materials like plastic, paper, and aluminum used primarily in the food, healthcare, and retail industries for wrapping or containing products. Designed for convenience and hygiene, this packaging type is disposed of after one use, reducing the need for cleaning and reuse.

The market is growing rapidly due to the rise of e-commerce, food delivery, and increasing hygiene concerns. As global retail e-commerce sales are projected to surpass $8 trillion by 2027, the demand for safe, lightweight, and protective disposable packaging continues to climb. Additionally, rising product returns due to damage are pushing businesses to adopt more durable and sustainable packaging solutions.

However, the market faces intense competition and saturation, leading companies to differentiate through eco-friendly materials and customized designs. At the same time, evolving environmental regulations, like the U.S. Extended Producer Responsibility (EPR) laws, are reshaping packaging practices. Brands that balance strength, sustainability, and cost-effectiveness are better positioned to succeed in this shifting landscape.

Key Takeaways

- The Disposables Packaging Market was valued at USD 39.2 billion in 2024 and is projected to reach USD 67.6 billion by 2034, growing at a CAGR of 5.6%.

- Plastic held the largest share in the material segment in 2024, accounting for 41.8% due to its cost-effectiveness and widespread use.

- Flexible Packaging led the packaging type segment in 2024 with a share of 52.7%, attributed to its lightweight and durable nature.

- Containers represented the top product type in 2024, making up 38.9% of the segment, owing to their versatility in food and beverage applications.

- The Food & Beverage industry dominated end-use in 2024, capturing 60.1% of the market, driven by rising demand for packaged and ready-to-eat foods.

- North America led the global market in 2024, contributing 35.6% or USD 13.96 billion, boosted by high demand from foodservice and healthcare sectors.

Key Market Segments

Material Type Analysis

Plastic leads the disposables packaging market with a 41.8% share due to its affordability, lightweight nature, and flexibility. It is widely used in food, healthcare, and retail for items like trays, containers, and wraps that help keep products fresh and protected. Although there is growing interest in eco-friendly materials like recyclable plastic, paper, and biodegradable options, plastic continues to dominate due to its cost-effectiveness and practicality in mass production.

Packaging Type Analysis

Flexible packaging holds the largest share at 52.7% because it uses less material, reduces shipping costs, and saves storage space. Common formats like pouches, sachets, and films are popular for snacks, condiments, and frozen foods. This type of packaging also offers convenience and extended shelf life, making it ideal for single-use products. While rigid packaging still plays a role for heavy or fragile items, flexible options are growing faster due to their versatility and lower costs.

Product Type Analysis

Containers are the top product type, capturing 38.9% of the market. Their popularity comes from widespread use in restaurants, takeout services, and food delivery platforms. These containers offer various sizes, help maintain food temperature, and protect against spills. They can be made of plastic, paper, or aluminum, and some are microwave-safe or compostable. Other products like trays, bottles, and wraps also contribute, but containers lead due to their multi-purpose use and high demand.

End-Use Industry Analysis

The food and beverage industry dominates the use of disposable packaging with a 60.1% share. This is driven by everyday food consumption, strong retail presence, and the rise of food delivery services. Items like coffee cups, meal trays, and takeaway boxes are widely used in restaurants, cafes, and convenience stores. Other sectors like healthcare, personal care, and industrial also rely on disposables for hygiene, product safety, and convenience, but food and beverage remains the core driver of market growth.

Drivers

Food Delivery and Safety Innovations Drive Market Growth

The disposables packaging market is witnessing significant growth, primarily fueled by the expanding food and beverage sector. The increasing popularity of fast food, takeaway services, and ready-to-eat meals has created strong demand for single-use packaging solutions. These formats offer unmatched convenience for both consumers and service providers. Urbanization, coupled with hectic lifestyles, has led to widespread reliance on delivery platforms such as DoorDash, Uber Eats, and Zomato, further boosting the usage of disposable trays, cups, wraps, and containers.

The rise of online food delivery and e-commerce has added a new layer of demand for robust, functional packaging. Companies are investing in packaging designs that are leak-proof, heat-resistant, and easy to stack to improve product safety during transportation. These enhancements not only protect the product but also elevate customer satisfaction by ensuring that food arrives fresh and intact.

Furthermore, tamper-evident and child-resistant packaging solutions are gaining traction across several industries. These technologies are increasingly utilized in sectors like pharmaceuticals, personal care, and food to ensure regulatory compliance and user safety. Products such as packaged beverages, infant foods, and cleaning agents often require such advanced packaging features..

Major Challenges

Despite its growth, the market faces several challenges. Increasing environmental scrutiny has led to regulatory restrictions on single-use plastics in various countries. The cost volatility of raw materials like plastic resin and paper pulp further strains profit margins. Additionally, insufficient recycling infrastructure in many regions contributes to environmental pollution and limits sustainable waste management. Growing consumer awareness is also pushing brands to transition from traditional disposables to refillable or reusable packaging, forcing a reevaluation of long-term strategies.

Business Opportunities

Innovation in sustainable and smart packaging presents significant opportunities. Companies investing in biodegradable alternativessuch as cornstarch-based plastics, bamboo, or sugarcane fibers are gaining traction with environmentally conscious consumers. Advances in barrier coatings that enhance the durability and moisture resistance of eco-materials are also expanding market reach. Smart packaging solutions incorporating QR codes and freshness indicators are increasingly popular in premium segments, offering both functional and branding advantages.

Restraining Factors

Despite the growing demand for disposable packaging across various industries, several critical factors are restraining the market’s long-term growth trajectory. Chief among these are mounting environmental concerns and rising regulatory scrutiny. Governments worldwide are implementing stricter bans and limitations on single-use plastics to combat pollution and reduce the environmental burden of non-biodegradable waste. These regulations force manufacturers to invest heavily in the development of sustainable packaging materials, increasing both time-to-market and production costs.

In addition, raw material price volatility remains a persistent challenge. Materials such as plastic resins, aluminum, and paper pulp often experience unpredictable price fluctuations due to changes in global oil markets, supply chain disruptions, and geopolitical tensions. These cost swings can significantly erode manufacturer profit margins, making disposable packaging less economically viable.

Consumer behavior is also shifting rapidly. With rising environmental awareness, a growing segment of consumers are rejecting single-use products in favor of eco-friendly, reusable, or refillable packaging solutions. This trend is particularly strong among younger demographics and in urban markets, where sustainability is increasingly tied to brand loyalty and purchase decisions.

Regional Analysis

North America

North America holds the largest share of the Disposables Packaging Market, accounting for 35.6% (USD 13.96 billion). This dominance is driven by high demand from food delivery services, fast food outlets, and a busy lifestyle that favors convenience. Both the U.S. and Canada use disposable packaging widely across industries like healthcare, retail, and food. While there’s increasing awareness of environmental concerns, many companies are shifting to recyclable and eco-friendly options without reducing their dependence on single-use packaging.

Europe

Europe is steadily growing in the disposables packaging market, with a strong focus on sustainability. Countries such as Germany and France are leading the charge by encouraging the use of recyclable and biodegradable materials. The region’s strict environmental regulations are pushing companies to adopt greener alternatives like paper and plant-based packaging, especially in food and retail sectors.

Asia Pacific

Asia Pacific is experiencing rapid growth in disposable packaging due to urbanization, growing e-commerce, and increasing demand for ready-to-eat food. Major countries like China, India, and Japan are at the forefront of both production and consumption. The popularity of street food, combined with digital food delivery platforms, continues to fuel the need for affordable and practical packaging solutions.

Recent Developments

- In March 2025, Vytal Global secured €14.2 million in funding to expand its technology-driven reusable packaging solutions across Europe, focusing on digital tracking and return logistics.

The investment supports Vytal’s mission to replace single-use packaging with scalable, sustainable systems. - In July 2024, the Future of Disposable Products report highlighted major trends such as compostable materials, smart labeling, and refillable formats driving innovation in the disposable sector.

These innovations are a response to consumer demand and stricter regulations on single-use plastics. - In April 2024, Novolex announced a strategic investment in OZZI, a reusable packaging company known for its closed-loop container systems used in institutional foodservice.

This partnership aims to enhance Novolex’s sustainable product offerings and reduce landfill waste. - In October 2025, Karat Packaging’s management planned to sell 1.5 million shares in a public offering, indicating a strategy to capitalize on market momentum and support company growth.

The offering is part of broader financial planning amid rising demand for foodservice packaging solutions. - In April 2025, the Multilayer Flexible Packaging Market was projected to reach USD 283.55 billion by 2034, driven by rising use in food, pharma, and personal care industries.

Technological advancements in barrier protection and shelf-life extension continue to fuel market growth.

Conclusion

The global disposables packaging market is evolving rapidly in response to shifting consumer behavior, environmental mandates, and technological innovation. While the market remains challenged by cost pressures and sustainability concerns, opportunities abound in eco-friendly materials, smart packaging technologies, and niche applications. With strong contributions from major players and continued investment in green solutions, the market is well-positioned for robust growth through 2034. Businesses that balance cost-efficiency with sustainability will be best placed to lead the next wave of innovation in disposable packaging.