Table of Contents

Overview

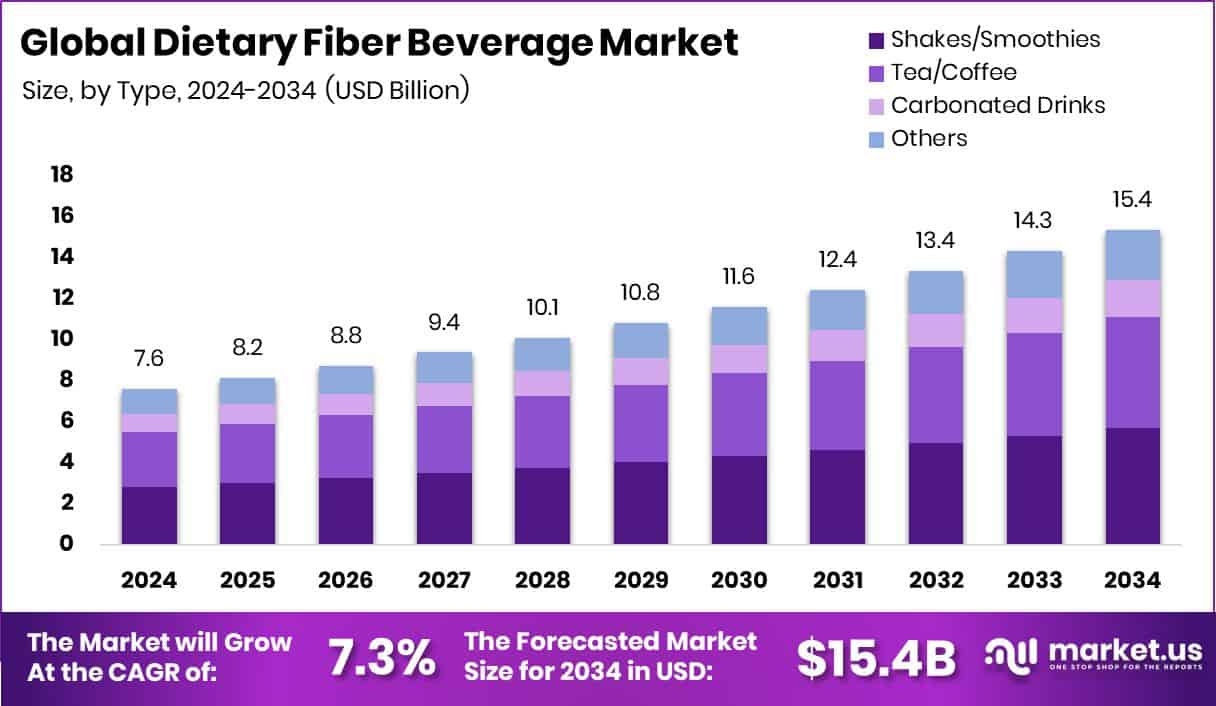

New York, NY – Nov 25, 2025 – The Global Dietary Fiber Beverage Market is set to reach USD 15.4 billion by 2034, rising from USD 7.6 billion in 2024, with a steady 7.3% CAGR, and North America holds a leading 41.90% share, generating USD 3.1 billion in demand. These beverages blend soluble or insoluble fibers from fruits, oats, and plant extracts, offering an accessible way to support digestion, gut health, fullness, and overall well-being. Their convenience makes them appealing to health-focused and everyday consumers who want nutrition without lifestyle changes.

Growing demand for functional drinks and clean-label choices continues to accelerate the category. The trend aligns with rising interest in digestive health, immune support, and weight balance. Market momentum is also reinforced by strong investment activity across the beverage and café ecosystem.

Funding milestones such as First Coffee’s USD 1.2 million, Chelvies Coffee’s USD 1 million, and Fore Coffee’s USD 8.5 million highlight investor confidence. Additional boosts include Blue Tokai’s USD 25 million bridge round, Third Wave Coffee’s USD 35 million Series C, abCoffee’s USD 3.4 million, and Flash Coffee’s USD 3 million.

Innovation continues as more brands explore fiber-fortified ready-to-drink options and café menu offerings. Investments like Preferred’s USD 4.2 million and repeat backing for First Coffee reflect growing belief in beverages that mix taste, convenience, and functional benefits.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-dietary-fiber-beverage-market/request-sample/

Key Takeaways

- The Global Dietary Fiber Beverage Market is expected to be worth around USD 15.4 billion by 2034, up from USD 7.6 billion in 2024, and is projected to grow at a CAGR of 7.3% from 2025 to 2034.

- The dietary fiber beverage market sees shakes and smoothies leading strongly with 37.2% share.

- The Dietary Fiber Beverage Market is driven by convenient RTD options, holding a 72.5% share.

- Inulin captures a 44.7% share, shaping innovation across the evolving dietary fiber beverage market globally.

- Hypermarkets and supermarkets hold a 33.1% share, guiding retail growth in the dietary fiber beverage market.

- The North America 41.90% share reflects strong consumer interest worth USD 3.1 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165772

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 7.6 Billion |

| Forecast Revenue (2034) | USD 15.4 Billion |

| CAGR (2025-2034) | 7.3% |

| Segments Covered | By Type (Shakes/Smoothies, Tea/Coffee, Carbonated Drinks, Others), By Form (Ready to Drink (RTD), Ready to Mix (RTM)), By Fiber Type (Inulin, FOS, GOS, Others), By Distribution Channel (Hypermarkets/Supermarkets, Convenience Stores, Online Retails, Specialty Stores, Pharmacies, Others) |

| Competitive Landscape | The Coca-Cola Company, PepsiCo, Inc., Abbott Laboratories, Meiji Holdings Co., Ltd., Califia Farms, LLC., Nestlé S.A., Danone S.A |

Key Market Segments

By Type Analysis

In 2024, Shakes/Smoothies led the By Type segment with a 37.2% share, driven by their familiar format and strong alignment with health-focused consumption habits. Their ability to combine fruits, plant fibers, and natural ingredients makes them an easy nutritional choice, especially for consumers seeking digestive benefits and fullness without changing daily routines.

The thicker, satisfying texture also contributes to their appeal among buyers focused on balanced energy and gut health. As functional beverages gain traction, demand continues shifting toward drinks that deliver both taste and nutritional value. Convenience, trusted formulations, and growing preference for fiber-rich wellness drinks help Shakes/Smoothies retain their dominant market role.

By Form Analysis

In 2024, Ready to Drink (RTD) formats dominated the By Form segment with a 72.5% share, reflecting the strong shift toward convenient, no-prep nutrition. Consumers gravitate toward RTD fiber beverages because they offer instant consumption, consistent taste, and portability, making them ideal for busy routines and mobile lifestyles. Their role in digestive support and overall wellness further boosts adoption as more people seek functional drinks with added value beyond hydration.

Widespread placement across cafés, supermarkets, and quick-service outlets also strengthens visibility and accessibility. With growing interest in health-focused beverages and easy-to-use formats, RTD fiber drinks continue to firmly hold their leadership position in the market.

By Fiber Type Analysis

In 2024, Inulin led the By Fiber Type segment with a 44.7% share, reflecting its strong suitability for beverage formulations. Its mild taste, natural solubility, and prebiotic benefits make it highly attractive for brands designing fiber-enriched drinks without compromising flavor or mouthfeel. Inulin also enhances texture and supports gut-health claims, helping it gain preference among both manufacturers and health-conscious consumers.

As demand rises for plant-derived, easily digestible ingredients, inulin stands out as a reliable option that supports smooth beverage consistency and digestive wellness. These advantages continue to reinforce its leading role in the Dietary Fiber Beverage Market.

By Distribution Channel Analysis

In 2024, Hypermarkets/Supermarkets led the By Distribution Channel segment with a 33.1% share, driven by high visibility and steady consumer traffic. These retail formats provide large shelf space, making it easy for shoppers to compare brands, flavors, and fiber types in a single visit. Their role in routine household purchasing reinforces their importance as a primary buying point for dietary fiber beverages.

Promotional displays, clear product labeling, and frequent discounts also help encourage trial and repeat purchases. With convenience and variety under one roof, hypermarkets and supermarkets remain the most trusted and accessible channels, helping them maintain their dominant position in the market.

Regional Analysis

In 2024, North America led the Dietary Fiber Beverage Market with a 41.90% share worth USD 3.1 billion, driven by strong interest in gut-health products and convenient functional drinks. A well-developed retail ecosystem and high awareness of nutrition trends continue to support its dominance.

Europe remains a key contributor, with consumers steadily shifting toward fiber-enriched beverages as part of healthier daily routines. Asia Pacific shows fast-growing potential due to rising health consciousness and a younger population open to ready-to-drink formulations.

Meanwhile, the Middle East & Africa is gradually expanding as fortified beverages gain attention among urban buyers, and Latin America is strengthening its presence through broader retail access and increasing demand for health-focused drinks.

Top Use Cases

- Gut-microbiome support: Beverages enriched with dietary fiber help feed gut bacteria that produce short-chain fatty acids (SCFAs), which play a major role in digestive health and metabolism.

- Digestive regularity & bowel comfort: Adding soluble fiber (e.g., inulin) into drinks can improve bowel movement frequency, stool consistency and overall bowel-related quality of life in healthy adults.

- Blood sugar/metabolism support: Fiber-rich drinks can slow carbohydrate absorption, reduce blood-glucose and insulin spikes, and favour better metabolic responses when used regularly.

- Satiety & weight-management assistance: Because fiber draws in water and adds bulk, fiber-fortified beverages help with feeling fuller between meals, which can support healthier snacking or energy balance.

- Immune & intestinal barrier function: Specific fibers, like inulin in beverages, are shown to help maintain the intestinal barrier and regulate immune cells, thereby contributing to gut-immune system interactions.

- Clean label & texture enhancement in beverages: Fiber ingredients (e.g., inulin) bring functional benefits beyond health—improving mouth-feel, stabilising texture and enabling beverages to carry additional health claims while keeping flavour mild.

Recent Developments

- In March 2025, Califia Farms launched its “Creamy Refreshers” line—plant-based drinks combining coconut cream with real juice in four flavors (Strawberry Crème, Key Lime Colada, Piña Colada, Orange Crème). They’re dairy-free, soy-free, gluten-free, and lower in sugar.

Conclusion

The Dietary Fiber Beverage Market continues to evolve with growing interest in digestive wellness, balanced nutrition, and convenient functional drinks. Consumers are becoming more aware of gut health and are seeking products that support daily wellness without requiring major lifestyle changes. Brands are responding with cleaner labels, plant-based fibers, and ready-to-drink options that offer both taste and benefits.

Rising investments, café expansion, and new product innovations are helping the category move from niche to mainstream. As demand strengthens across retail and food-service channels, fiber-enriched beverages are set to become a regular part of everyday nutrition for a wide range of consumers.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)