Table of Contents

Overview

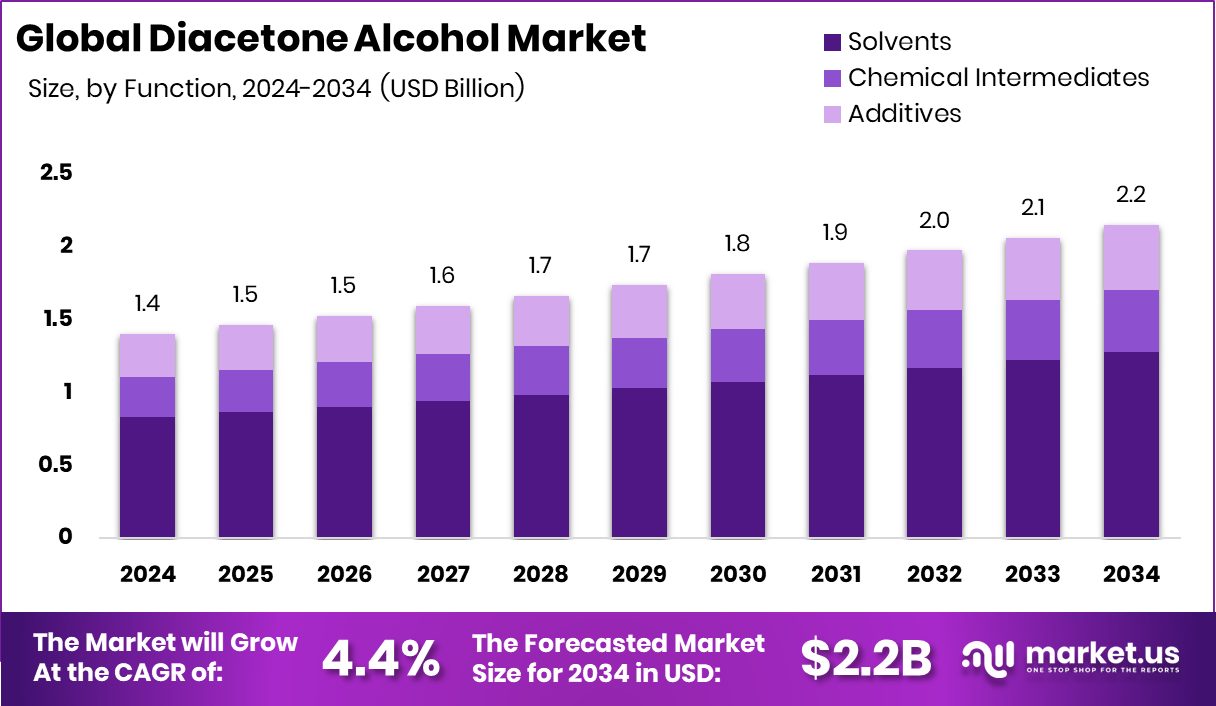

New York, NY – Nov 11, 2025 – The global market for diacetone alcohol is projected to rise from approximately USD 1.4 billion in 2024 to around USD 2.2 billion by 2034, growing at a CAGR of 4.4% between 2025 and 2034. North America commands a substantial share—about 47.30%—of global consumption, driven by increased adoption of sustainable solvents.

As a transparent, color- and odor-reduced solvent and chemical intermediate that mixes with water and many organics, diacetone alcohol finds major use in coatings, adhesives, inks, and textile treatments thanks to its reliable drying performance and strong solvency characteristics. Growth is largely propelled by surging demand for eco-friendly, high-performance solvent systems in paints and coatings, backed by rising infrastructure and industrial activity.

Key industry funding reflects this momentum: eco-coatings player Ecoat secured €21 million to reimagine sustainable paint technologies; meanwhile, major chemical firms are redeploying capital, as evidenced by Akzo Nobel’s ₹2,143 crore divestment and BASF’s €7.7 billion coatings sale.

Specialty chemical markets tied to this intermediate also saw investment: Arbuda Agrochemicals’ ₹120 crore IPO, Distil’s US$7.7 million Series A round, and Kotak’s US$45 million funding into an agro-chemical business all underscore growing investor interest. As formulation trends continue shifting toward low-VOC, water-based systems, diacetone alcohol remains positioned as a versatile bridge between performance and sustainability.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-diacetone-alcohol-market/request-sample/

Key Takeaways

- The Global Diacetone Alcohol Market is expected to be worth around USD 2.2 billion by 2034, up from USD 1.4 billion in 2024, and is projected to grow at a CAGR of 4.4% from 2025 to 2034.

- In 2024, the Diacetone Alcohol Market dominated by solvents, capturing 59.3% share due to rising coating applications.

- The Diacetone Alcohol Market witnessed strong demand from paints and coatings, accounting for 38.2% share globally.

- North America’s strong industrial base and coating demand supported its USD 0.6 Bn market value.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=164560

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.4 Billion |

| Forecast Revenue (2034) | USD 2.2 Billion |

| CAGR (2025-2034) | 4.4% |

| Segments Covered | By Function (Solvents, Chemical Intermediates, Additives), By End User (Paints Coating, Chemicals, Construction, Polymer Plastics, Textile, Leather, Agrochemicals, Automotive, Others) |

| Competitive Landscape | Arkema Group, Prasol Chemical Pvt. Ltd, Tianjin Daofu Chemical New Technology Development, Solventis Ltd., Monument Chemicals, Inc, Solvay S.A, Mitsubishi Chemical Corporation |

Key Market Segments

By Function Analysis

In 2024, the Solvents segment dominated the Diacetone Alcohol Market by Function, accounting for a 59.3% share. This leadership stems from its widespread use in coatings, adhesives, inks, and cleaning products, where diacetone alcohol offers exceptional solvency, stability, and low volatility.

Its compatibility with both water and organic compounds makes it ideal for industrial and decorative coating formulations. The compound enhances drying efficiency while reducing odor, aligning with the growing demand for low-VOC and eco-friendly solvent systems.

Continuous investment in sustainable specialty chemicals and innovation within coating technologies further strengthens its position. As industries shift toward greener and high-performance solutions, the solvent function of diacetone alcohol remains central to supporting cleaner manufacturing and long-lasting product performance across diverse applications.

By End User Analysis

In 2024, the Paints & Coatings segment dominated the Diacetone Alcohol Market by End User, holding a 38.2% share. This strong position is attributed to the compound’s vital role as a solvent and coalescing agent in paints, varnishes, and industrial coatings. Diacetone alcohol improves gloss, flow, and film formation while offering low odor and balanced evaporation—key traits for both water-based and solvent-based formulations.

Its high compatibility with diverse resins supports superior coating performance and stability. Rising investments in sustainable coating technologies, along with expanding infrastructure and industrial projects, continue to fuel demand.

Furthermore, its alignment with environmental standards and reduced VOC emissions strengthens its preference among manufacturers, ensuring that paints and coatings remain the largest and most consistent consumer segment for diacetone alcohol across global industries.

Regional Analysis

In 2024, North America led the global Diacetone Alcohol Market with a 47.30% share, valued at USD 0.6 billion. This dominance stems from its strong industrial base, widespread use in coatings and adhesives, and increasing adoption of low-VOC and sustainable solvent technologies across the U.S. and Canada.

Europe followed closely, supported by its advanced coatings and printing ink industries that emphasize environmental compliance and high-performance formulations. The Asia Pacific region recorded steady expansion driven by rapid industrialization, rising infrastructure investment, and growing demand from the paints, packaging, and agrochemical sectors.

Latin America and the Middle East & Africa demonstrated gradual growth, supported by expanding construction and manufacturing activities. North America continues to hold its lead, benefiting from innovation in specialty chemicals, strict regulatory standards, and strong downstream demand in automotive and building materials, reinforcing its position as the most influential regional market for diacetone alcohol.

Top Use Cases

- Solvent in industrial coatings: DAA is widely used as a solvent in paints, wood varnishes, and architectural coatings because it dissolves many resins, offers good flow and low odor, and supports high-performance film formation.

- Adhesives and sealants formulation: In adhesives and sealants, DAA helps improve the mixture’s flow, wetting, and adhesion properties by dissolving polymers and aiding smooth application in industrial and consumer settings.

- Cleaning & degreasing agent: Its strong solvency and compatibility with water and organic materials make DAA effective in formulations for cleaning oils, greases, waxes, and other stubborn residues—used in industrial cleaning fluids.

- Chemical intermediate in synthesis: DAA also serves as a building block (intermediate) in chemical syntheses—for example, in producing Methyl Isobutyl Ketone (MIBK) and other specialty chemicals—leveraging its hydroxyl & ketone groups

- Printing inks & textile treatments: In the printing and textile industries, DAA is used in ink formulations and textile finishing because it offers good solvent power, controlled evaporation, and compatibility with dyes/resins to produce glossy, uniform coatings.

- Removable/intermediate protective coatings: DAA is used in specialized removable paints/coatings; formulation might include DAA at ~10-30 % by weight, allowing an applied coating to be removed later without damaging the underlying surface (e.g., for temporary signage or protective layers).

Recent Developments

- In October 2025, Prasol Chemicals filed its Draft Red Herring Prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) to raise up to ₹500 crore via an IPO. The company noted it manufactures acetone-based specialty chemicals (including Diacetone Alcohol) and phosphorus-based derivatives. The IPO proceeds will partly go towards repaying borrowings and partly towards general corporate purposes.

- In December 2024, Arkema won the “Circularity & Climate Neutrality” category at the 2024 Cefic Responsible Care Awards for its “Optim’O” program, which covers wide-ranging water, recycling, and emissions reductions across its sites.

Conclusion

The Diacetone Alcohol market continues to gain momentum as industries move toward sustainable and high-performance solvent systems. Its versatility, low volatility, and compatibility with various materials make it essential in coatings, adhesives, inks, and cleaning formulations. Growing environmental awareness and technological advancements are reshaping production methods, supporting greener chemistry initiatives.

With expanding industrial applications and ongoing investment in specialty chemicals, diacetone alcohol remains a key ingredient in achieving cleaner manufacturing and improved product efficiency. Its balance of performance and sustainability ensures it remains a valuable component for industries seeking safer and eco-friendly solutions in the evolving global chemical landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)