Table of Contents

Overview

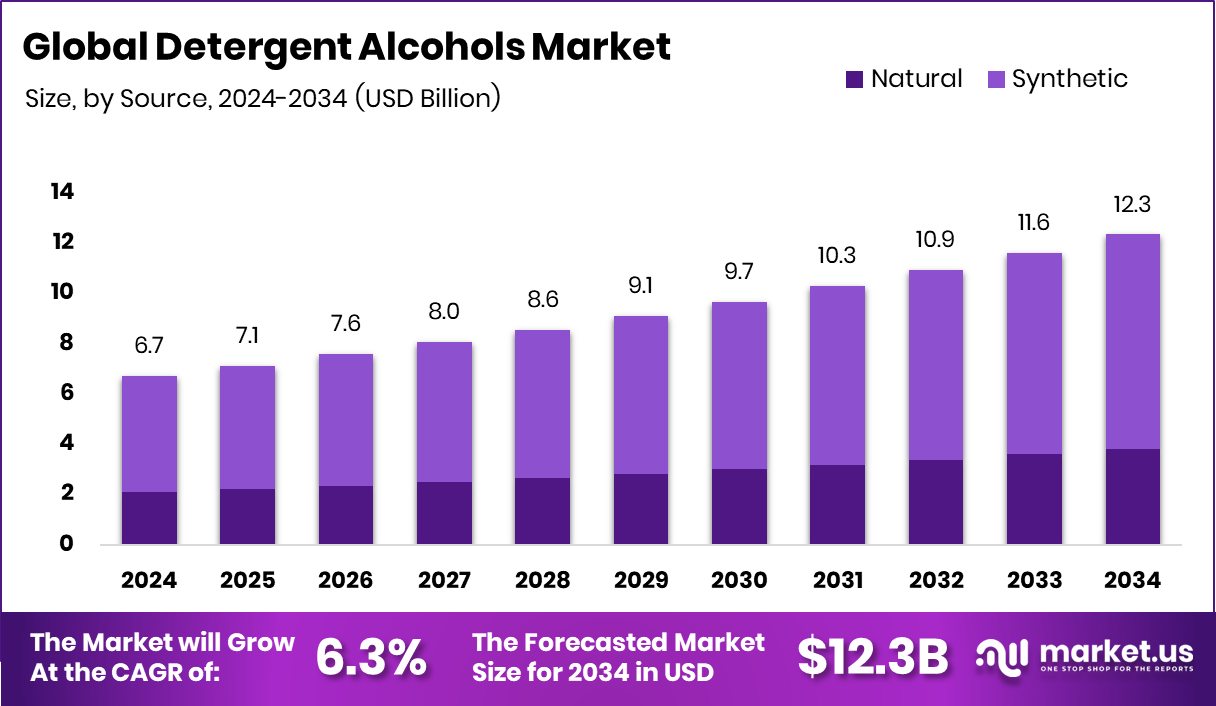

New York, NY – Nov 05, 2025 – The global detergent alcohols market is projected to grow from USD 6.7 billion in 2024 to about USD 12.3 billion by 2034, registering a CAGR of approximately 6.3% from 2025 to 2034. The Asia-Pacific region is leading this expansion, accounting for around 47.9% of global demand, driven by rapid urbanisation and rising detergent consumption.

Detergent alcohols—typically C12 to C18 long-chain primary alcohols—serve as key raw materials for surfactants used in detergents, cleaning agents, and personal-care products. Derived either from natural fats and oils or via petrochemical routes, these alcohols enhance foaming, wetting, and cleaning performance and are favored in eco-friendly formulations thanks to their biodegradability and surfactant compatibility.

The market spans production, supply, and end-use of these fatty alcohols and their conversion into ethoxylates and sulfates for cleaning applications across household, industrial, and personal care sectors. A major growth driver is the surging demand for sustainable cleaning and laundry solutions, prompted by heightened hygiene awareness and environmentally conscious consumer behavior. Innovation is proliferating—one example being the nearly USD 2 million from NOAA awarded to USC Sea Grant for turning marine debris into laundry detergent and sustainable dyes.

In the consumer space, eco-focused D2C brand Koparo raised Rs 14.5 crore to expand its green cleaning line. Meanwhile, novel product formats are emerging: dissolvable cleaning tablets and refillables backed by Everdrop’s USD 21.8 million Series A, the USD 100 million acquisition of The Laundress, and Dropps’s USD 10 million fundraising highlight the strong investment potential in sustainable laundry and surfactant systems.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-detergent-alcohols-market/request-sample/

Key Takeaways

- The Global Detergent Alcohols Market is expected to be worth around USD 12.3 billion by 2034, up from USD 6.7 billion in 2024, and is projected to grow at a CAGR of 6.3% from 2025 to 2034.

- In 2024, synthetic detergent alcohols held a 69.4% share, driving efficiency and scalability in production processes.

- Laundry detergents accounted for 44.8% of the detergent alcohols market, supported by strong global cleaning product demand.

- The Asia-Pacific market value reached approximately USD 3.2 billion, driven by strong industrial demand.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=163504

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 6.7 Billion |

| Forecast Revenue (2034) | USD 12.3 Billion |

| CAGR (2025-2034) | 6.3% |

| Segments Covered | By Source (Natural, Synthetic), By Application (Laundry Detergents, Dishwashing Detergents, Personal Care and Cosmetics, Industrial Cleaners, Others) |

| Competitive Landscape | Sasol Ltd., BASF SE, KLK OLEO, Wilmar International, Godrej Industries, Procter & Gamble Chemicals, Emery Oleochemicals, Ecogreen Oleochemicals, Kao Corporation, VVF Ltd |

Key Market Segments

By Source Analysis

In 2024, synthetic detergent alcohols dominated the By Source segment of the global market, capturing a 69.4% share. Their leadership stems from consistent quality, large-scale production, and cost efficiency in surfactant manufacturing. Synthetic alcohols are extensively utilized in both household and industrial cleaning products due to their chemical uniformity and dependable performance. The synthetic production process allows precise control over carbon chain lengths and purity, improving formulation stability and effectiveness.

Their versatility across diverse detergent types and applications requiring high-performance, cost-stable raw materials further strengthens their market position. Supported by large industrial demand and continuous production advancements, synthetic detergent alcohols remain the preferred choice among major manufacturers, sustaining their dominance in the global detergent alcohols landscape.

By Application Analysis

In 2024, Laundry Detergents led the By Application segment of the global detergent alcohols market, holding a 44.8% share. This leadership is attributed to the extensive use of detergent alcohols as core surfactant ingredients in both liquid and powder formulations. Their superior emulsifying, foaming, and cleaning capabilities make them indispensable in creating effective, biodegradable laundry products. Rising consumer demand for high-efficiency and eco-friendly washing solutions has reinforced this dominance.

Moreover, the steady expansion of the household care sector and continuous innovations in concentrated detergent technologies have amplified detergent alcohol consumption in laundry applications. These factors collectively sustain laundry detergents as the leading segment, emphasizing their crucial role in driving overall market growth and advancing sustainable cleaning formulations globally.

Regional Analysis

In 2024, the Asia-Pacific region dominated the global Detergent Alcohols Market, capturing a 47.9% share valued at approximately USD 3.2 billion. This leadership stems from rapid industrialization, expanding urban populations, and growing consumption of cleaning and personal care products in China, India, and Japan. The region benefits from abundant and cost-effective raw materials, particularly natural fatty alcohols, which enhance production efficiency and regional supply strength.

North America ranks next, supported by its mature household cleaning industry and advancements in surfactant technologies. Europe maintains a strong presence driven by sustainable formulation initiatives and strict environmental standards promoting bio-based products.

Emerging economies in Latin America and the Middle East & Africa are also recording consistent growth, fueled by urbanization, rising hygiene awareness, and improving consumer lifestyles. Collectively, these factors ensure Asia-Pacific’s continued dominance while global demand for detergent alcohols grows steadily across all key regions.

Top Use Cases

- Laundry & household detergents: These alcohols act as raw materials for surfactants that help clean clothes and fabrics by breaking up oils, providing good wetting-and-foaming properties, and enabling efficient cleaning. They are widely used in both powders and liquids for home laundry.

- Industrial cleaning and equipment washing: In factory and institutional settings, detergent alcohol-derived surfactants are used in large-scale cleaning formulations for floors, machinery, metal parts, and heavy-duty degreasing because of their stable performance and capability to handle oils and industrial soils

- Textile processing & finishing: Detergent alcohols serve as intermediates or surfactants in textile manufacturing: for scouring (removing impurities), wetting & leveling (ensuring dyes spread evenly), and as antistatic or finishing agents on fabrics.

- Agricultural formulations (pesticide/herbicide emulsification): These alcohol-based surfactants help form stable emulsions of active chemicals in agro-products, improving the wetting and spreading of sprays on plant surfaces, thereby increasing the efficacy of crop protection.

- Personal care & cleaning products: While their main role in detergents is surfactant formation, these alcohols (or their derivatives) also contribute in shampoos, body washes, and cleaning wipes—improving foam, texture, wetting, and environmentally friendly biodegradability.

- Surface and material finishing / antistatic agents: Outside cleaning, detergent alcohols are used in finishing agents for plastics, papers, resins, and as antistatic coatings on materials. Their surfactant nature helps dispersions, emulsions, and surface treatments.

Recent Developments

- In October 2025, Sasol International Chemicals (a business unit of Sasol) announced the commercial launch of LIVINEX IO 7, a novel insect-oil-based nonionic surfactant feedstock for fabric, home-care, industrial & institutional cleaning markets. It uses oil from black soldier fly larvae, rich in fatty acids usable in detergent-grade alcohols, and is described as a “drop-in replacement” for C12–C14 chemistry without needing major reformulation. Initial rollout is in Europe with plans to expand into personal care.

- In November 2024, BASF’s Care Chemicals division entered into a partnership with Acies Bio to develop a fermentation-based production route for fatty alcohols from renewable methanol (derived from captured CO₂). The aim is to produce fatty alcohols – key building blocks for surfactants used in home-care and personal-care products – in a more sustainable manner.

Conclusion

The detergent alcohols market continues to evolve through innovation, sustainability, and consumer awareness. Growing interest in biodegradable and eco-friendly cleaning solutions has driven producers to shift toward renewable feedstocks and greener technologies.

Companies are expanding capacities and investing in bio-based alcohols to meet rising hygiene and environmental demands. This sector’s progress is supported by strong applications across household, industrial, and personal care formulations.

Emerging product formats—like concentrated detergents and refill systems—illustrate the market’s adaptability and innovation-focused approach. The increasing alignment of technology, sustainability, and efficiency ensures detergent alcohols remain a vital ingredient in the global cleaning and care industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)