Table of Contents

Overview

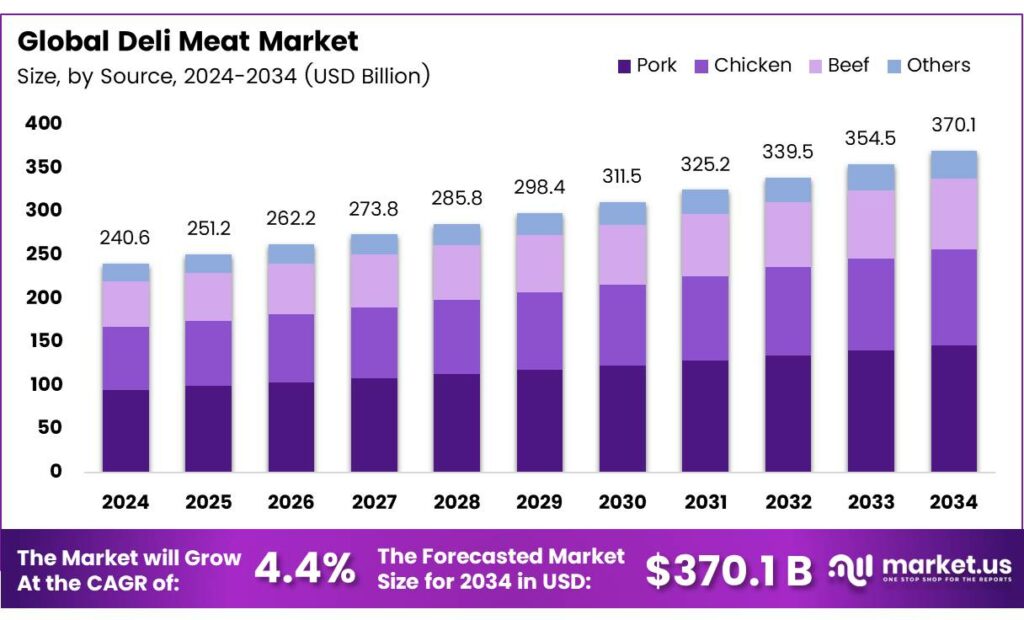

New York, NY – September 29, 2025 – The Global Deli Meat Market is projected to reach USD 370.1 billion by 2034, up from USD 240.6 billion in 2024, expanding at a CAGR of 4.4% between 2025 and 2034. Deli meats have become an integral segment of the processed food industry, supported by shifting consumer habits, rapid urbanization, and the growing need for convenient protein choices.

Products such as ham, turkey, salami, roast beef, and chicken slices are widely consumed across households, foodservice chains, and institutional catering. Their adaptability makes them suitable for sandwiches, salads, pasta dishes, and quick-serve meals, offering both convenience and taste in everyday diets.

The origins of deli meats date back to the Paleolithic era, when meat was preserved by sun-drying. However, the cold cuts familiar today trace their roots to around 500 BC, gaining popularity among Roman and Etruscan populations. Essentially, deli meats refer to cured or pre-cooked cuts served cold, prized for their ease of preparation and suitability for social gatherings, family meals, and casual occasions.

Among the product range, luncheon meat is considered one of the most economical options. Typically, it is made from an emulsion containing 30–35% lean meat, 20–24% fat, 30–35% water, and 5–10% powdered additives. The mixture is packed into waterproof casings and cooked until the core temperature reaches 70°C. In countries like Australia, luncheon meat is a staple in sandwiches, offering an affordable protein source.

To improve the texture and quality of these products, milk-based ingredients such as caseinates and whey protein concentrates (WPCs) are often incorporated. These proteins enhance water retention and fat-binding capacity, addressing the fact that over 70% of water in lean meat exists as free water, which impacts tenderness and juiciness. When combined with salts and milk proteins, moisture retention improves, ensuring a better final product.

Key Takeaways

- The Global Deli Meat Market is projected to grow from USD 240.6 billion in 2024 to USD 370.1 billion by 2034, at a CAGR of 4.4%.

- Pork dominates with a 39.5% share in 2024, driven by popular products like ham, bacon, salami, and sausages.

- Cured deli meats lead with a 33.7% share in 2024, favored for long shelf life and versatile applications.

- Supermarkets and Hypermarkets hold a 43.1% share in 2024, offering wide product availability and promotions.

- North America leads with 32.9% market share, USD 78.9 billion in 2024, supported by robust retail and consumer demand.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-deli-meat-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 240.6 Billion |

| Forecast Revenue (2034) | USD 370.1 Billion |

| CAGR (2025-2034) | 4.4% |

| Segments Covered | By Source (Pork, Chicken, Beef, Others), By Product (Cured, Uncured, Smoked, Roasted, Cooked), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Store, Specialty Store, Online Retailers, Others) |

| Competitive Landscape | Hormel Foods Corporation, Cargill Incorporated, Tyson Foods, Inc., JBS, Maple Leaf Foods, Conagra Foodservice, Carl Buddig and Company, West Liberty Foods LLC, Dietz and Watson, Sysco Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157435

Key Market Segments

By Meat Source

Pork remains the dominant force in the global deli meat market, securing a 39.5% share in 2024. Its popularity stems from a diverse range of products, including ham, bacon, salami, and sausages, which are staples in both retail and foodservice settings. Pork’s versatility in sandwiches, ready-to-eat meals, and catering, combined with its appealing taste, widespread availability, and cost-effectiveness, drives its strong market position.

As demand for processed and convenience foods rises, pork is poised to maintain its lead, bolstered by the growth of quick-service restaurants and packaged meal solutions. Innovations like healthier, low-sodium pork deli products are also expected to attract health-conscious consumers while retaining broad appeal.

By Product Type

Cured deli meats, such as salami, pepperoni, prosciutto, and ham, command a 33.7% share of the global deli meat market in 2024. Their rich flavors, long shelf life, and versatility in applications like sandwiches, pizzas, and snack platters make them a consumer favorite.

Modern packaging innovations and strong demand from retail and foodservice channels sustain the segment’s dominance. The rise of premium artisanal cured meats, particularly among urban consumers seeking authentic flavors, further strengthens this category. Cured meats are expected to maintain their market leadership, driven by convenience-focused households and quick-service restaurant demand.

By Distribution Channel

Supermarkets and hypermarkets dominate deli meat sales, capturing a 43.1% market share in 2024. These retail giants offer extensive product selections, diverse brands, and competitive promotions, making them the go-to choice for households seeking fresh and packaged deli meats.

Their role in one-stop shopping aligns with the needs of busy families and professionals, who often purchase deli meats alongside other grocery items. Investments in cold-chain logistics and appealing in-store displays enhance product freshness and consumer interest. With urbanization and evolving lifestyles, supermarkets and hypermarkets are expected to maintain their dominance through 2025.

Regional Analysis

North America leads the global deli meat market, holding a 32.9% share valued at USD 78.9 billion in 2024. This dominance is driven by robust retail networks, including supermarkets and hypermarkets, and a strong cultural preference for convenient, ready-to-eat meats. Europe follows closely, fueled by its deep-rooted tradition of charcuterie and premium meats, particularly in countries like Germany, Italy, and France, where gourmet and PDO products thrive.

The Asia-Pacific region is the fastest-growing market, propelled by urbanization, rising incomes, and increasing adoption of Western-style convenience foods in countries like China, India, and Southeast Asia. Latin America and the Middle East & Africa show steady growth, driven by urban retail expansion and growing interest in deli meats among younger and middle-income consumers.

Top Use Cases

- Sandwiches and Wraps: Deli meat shines as a quick protein boost for everyday lunches, turning simple bread into tasty sandwiches or wraps. Busy folks layer slices of turkey or ham with veggies and cheese for a no-fuss meal that’s portable and filling. This everyday favorite fits right into packed schedules, offering endless flavor combos without much prep time.

- Party Platters and Catering: For gatherings big or small, deli meat builds eye-catching platters that wow guests with variety. Arrange salami, prosciutto, and roast beef alongside cheeses and fruits for easy sharing at events. It’s a hassle-free way to cater parties, keeping everyone happy with bite-sized options that feel fancy yet simple to assemble.

- Quick Snacks and Charcuterie Boards: Deli meat makes snacking smart and satisfying, perfect for after-school bites or movie nights. Roll up slices with cream cheese or pair on boards with crackers and olives for a fun, shareable treat. Its ready-to-eat nature suits impulse cravings, blending bold tastes with minimal effort for casual munching moments.

- Ready-to-Eat Meals and Salads: Toss deli meat into salads or grain bowls for a protein-packed dinner that comes together fast. Shredded chicken or beef adds heartiness to greens and dressings, ideal for meal preppers juggling weeknights. This versatile add-in elevates simple recipes into balanced, flavorful dishes without firing up the stove.

- Fast Food and Restaurant Menus: In quick-service spots, deli meat stars in subs and paninis, drawing crowds with its speedy assembly and crowd-pleasing flavors. Chefs slice fresh portions for custom orders, boosting menu appeal in bustling eateries. It keeps operations smooth while delivering that comforting, savory hit diners crave on the go.

Recent Developments

1. Hormel Foods Corporation

Hormel is aggressively expanding its premium and natural deli offerings. A key development is the national rollout of its “Natural Choice” line, now featuring 100% natural turkey and ham with no preservatives. This directly targets health-conscious consumers. The company is also leveraging its Planters snack brand with new NUT-rition protein packs that include deli meat, creating cross-category synergy to drive growth in the convenient snacking segment.

2. Cargill Incorporated

Through its joint venture, Premier Meat Packers, Cargill is focusing on sustainable packaging and animal welfare in its deli operations. Recent developments include a commitment to transition consumer-facing plastic packaging to recyclable or reusable materials. They are also expanding their “Raised Rooted” brand, which offers transparently sourced beef and turkey deli meats, catering to consumers seeking traceability and simpler ingredients in the service deli counter.

3. Tyson Foods, Inc.

Tyson is heavily investing in automation and new product innovation for the deli. A major recent move is the launch of its “Tyson Tastemakers” line, featuring gourmet, chef-inspired flavors like Applewood Bacon Chicken Breast. The company is also implementing advanced slicing and packaging automation to improve efficiency and product consistency. This dual focus aims to capture market share with both unique flavors and improved operational margins in the competitive deli aisle.

4. JBS

JBS’s primary recent development in prepared foods is the strategic acquisition of most of Pilgrim’s Pride’s European operations, significantly expanding its European deli presence. This strengthens its global footprint. Domestically, its Swift Prepared Foods arm is innovating with pre-cooked bacon and premium carved deli meats, emphasizing convenience and quality. The company is also focusing on supply chain resilience to navigate market volatility and meet consistent demand for its branded deli products.

5. Maple Leaf Foods

Maple Leaf continues to lead with its sustainability and plant-based integration strategy. A key development is the expansion of its “Greenfield Natural Meat Co.” brand, emphasizing antibiotic-free and raised-without-animal-by-products claims. Simultaneously, the company is exploring hybrid products, though it remains committed to its core meat portfolio. Their focus is deeply rooted in their “Raised Better” promise, using sustainability as a key brand differentiator in the retail deli case.

Conclusion

Deli Meat evolves from a humble lunch staple into a versatile powerhouse for modern eating habits. With lifestyles speeding up and tastes leaning toward bold, convenient flavors, this category keeps winning hearts by fitting seamlessly into quick meals, social bites, and creative dishes. Looking ahead, expect even more buzz around fresh twists like cleaner ingredients and global-inspired varieties, ensuring deli meat stays a go-to for flavor lovers everywhere while adapting to wellness vibes and on-the-fly demands.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)