Table of Contents

Overview

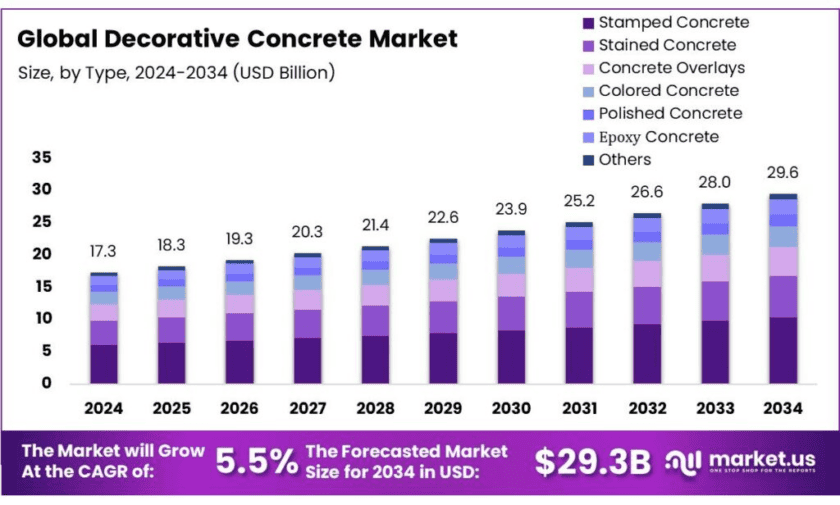

New York, NY – Nov 06, 2025 – The global decorative concrete market is projected to reach USD 29.6 billion by 2034, rising from USD 17.3 billion in 2024, reflecting a CAGR of 5.5% from 2025 to 2034. In 2024, North America dominated the market, capturing 37.80% share, equivalent to around USD 6.5 billion in revenue. Decorative concrete refers to concrete designed or treated for aesthetic enhancement—including integral coloring, staining, polishing, stamping, overlays, and exposed aggregates—while maintaining its structural function. The American Concrete Institute (ACI 310R-19) provides guidelines for these methods, defining standards for mix design, curing, sealing, and protection used across both pedestrian and vehicular environments.

Industry growth is underpinned by global cement production and construction activity. According to the U.S. Geological Survey, the United States produced approximately 92 million metric tons of portland cement across 96 plants in 2022, providing the raw base for decorative and architectural concrete applications such as plazas, retail spaces, streetscapes, and hospitality interiors. Meanwhile, sustainability remains a key trend: the International Energy Agency (IEA) reported that the cement sector’s direct CO₂ intensity increased ~1% in 2022, though a 4% annual reduction through 2030 is needed to align with net-zero goals.

Government infrastructure programs further support decorative concrete demand. In the United States, the Bipartisan Infrastructure Law allocates about USD 1.2 trillion, including USD 550 billion in new funding, directed toward roads, sidewalks, and civic spaces that frequently specify stamped, colored, and exposed-aggregate concrete for durability and visual appeal. Similarly, within the European Union, the Renovation Wave initiative targets the modernization of 35 million buildings by 2030, promoting the use of polished, terrazzo-style, and low-maintenance concrete finishes for both interior and exterior public spaces—further reinforcing the material’s global growth trajectory.

Key Takeaways

- Decorative Concrete Market size is expected to be worth around USD 29.6 Billion by 2034, from USD 17.3 Billion in 2024, growing at a CAGR of 5.5%.

- Stamped Concrete held a dominant market position, capturing more than a 34.9% share of the decorative concrete market.

- Floors held a dominant market position, capturing more than a 32.2% share of the decorative concrete market.

- Residential held a dominant market position, capturing more than a 57.3% share of the decorative concrete market.

- In North America, the decorative concrete market held a commanding position in 2024, representing approximately 37.80% of the global market, with market value close to USD 6.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-decorative-concrete-market/free-sample/

Report Scope

| Market Value (2024) | USD 17.3 Bn |

| Forecast Revenue (2034) | USD 29.6 Bn |

| CAGR (2025-2034) | 5.5% |

| Segments Covered | By Type (Stamped Concrete, Stained Concrete, Concrete Overlays, Colored Concrete, Polished Concrete, Ероху Concrete, Others), By Application (Floors, Walls, Driveways And sidewalks, Patios, Pool decks, Others), By End-Use (Residential, Non-residential) |

| Competitive Landscape | Sika AG, HeidelbergCement AG, LafargeHolcim Ltd, Boral Limited, Bomanite India, BASF SE, Mcknight Custom Concrete, Inc., Deco-Crete, LLC, Seacoast Concrete, ARDEX |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159781

Key Market Segments

By Type Analysis – Stamped Concrete Leads with 34.9% Share in 2024

In 2024, stamped concrete emerged as the dominant decorative concrete type, accounting for 34.9% of the global market share. Its popularity stems from its ability to replicate high-end materials such as brick, stone, and tile at a fraction of the cost, making it ideal for both new builds and renovation projects. Widely used in driveways, patios, walkways, and pool decks, stamped concrete offers a blend of affordability and aesthetics. Looking ahead, the segment is expected to maintain its mid-30% share, supported by sustained demand in residential landscaping, urban beautification, and public infrastructure.

By Application Analysis – Floors Dominate with 32.2% Share in 2024

The floors segment led the decorative concrete market in 2024, capturing over 32.2% share. This strong position is attributed to the growing use of polished, stained, and stamped concrete flooring in residential, commercial, and industrial spaces. These surfaces combine durability, low maintenance, and design versatility, making them popular for shopping malls, offices, schools, and modern homes. The ability to achieve premium finishes at lower cost has driven global adoption.

By End-Use Analysis – Residential Segment Holds 57.3% Share in 2024

In 2024, the residential sector dominated the decorative concrete market, securing more than 57.3% of total share. Growth is driven by widespread use of decorative concrete in home construction and renovation, including stamped driveways, polished interior floors, colored patios, and textured pool decks. Homeowners increasingly prefer decorative concrete for its durability, affordability, and design flexibility compared to natural stone, tile, or wood. With rising urbanization, housing development, and remodeling activity, the residential segment will continue to lead.

List of Segments

By Type

- Stamped Concrete

- Stained Concrete

- Concrete Overlays

- Colored Concrete

- Polished Concrete

- Ероху Concrete

- Others

By Application

- Floors

- Walls

- Driveways & sidewalks

- Patios

- Pool decks

- Others

By End-Use

- Residential

- Non-residential

Regional Analysis

In 2024, North America led the global decorative concrete market, commanding a 37.80% share, valued at approximately USD 6.5 billion. This regional dominance is supported by the well-established construction industries in the United States and Canada, along with high disposable incomes, a strong home improvement culture, and strict quality and durability standards across residential and commercial projects.

Top Use Cases

Streetscapes, sidewalks & plazas in public works: Decorative concrete (stamped, colored, exposed-aggregate) is widely specified in streets, plazas, station forecourts, and waterfronts for durability and wayfinding. The U.S. Bipartisan Infrastructure Law provides USD 1.2 trillion in infrastructure funding, including USD 550 billion in new federal investments—fueling thousands of local projects that frequently adopt decorative finishes. The FHWA notes since IIJA enactment it has launched 3,700+ bridge projects and begun repair of 69,000+ miles of roadways, expanding opportunities for decorative flatwork in pedestrian areas.

Building renovations: polished & stained interiors: In energy retrofits and interior upgrades, polished/stained decorative concrete delivers long life with low maintenance in offices, schools, retail, and housing. The EU’s Renovation Wave aims to renovate 35 million buildings by 2030, with an estimated €275 billion per year of additional investment needed—creating a large pipeline where polished, terrazzo-like concrete floors are common due to durability and aesthetics.

Heat-island mitigation & “cool” pavements: Light-colored or reflective decorative concrete supports urban-heat reduction strategies. The U.S. EPA highlights cool pavements for lowering surface temperatures and improving storm-water quality; research finds reflective treatments can cut road surface temperatures by ~6 °C at midday in field trials, and evaporative/porous designs can reduce pavement temperatures by up to ~20 °C versus conventional surfaces—useful for plazas and high-footfall areas seeking thermal comfort.

Commercial & institutional floors (malls, offices, schools): Polished/stained concrete floors are adopted for high traffic, low VOCs, and design flexibility (saw-cuts, dyes, embeds) following practices codified in ACI 310R-19 (decorative concrete guide). Underpinning supply, U.S. portland cement production totaled ~92 million metric tons in 2022 across 96 plants, indicating robust base materials for architectural and retail fit-outs that specify decorative finishes.

Airports & transit concourses: Terminals and concourses favor decorative concrete for abrasion resistance, quick cleaning, and integrated graphics. In the U.S., the FY 2025 budget shows the FAA at USD 26.8 billion, including IIJA/BIL advance appropriations—supporting modernization of facilities where hard-wearing, polished or exposed-aggregate concrete is frequently chosen for lifecycle and safety (slip-resistance and visibility).

Residential outdoor living (patios, driveways, pool decks): Decorative concrete (stamped, seeded, colored) mimics stone/brick at lower cost and supports custom patterns and borders. Technical practice for stamping, embossing, stenciling, and sealing is outlined in ACI 310R-19, enabling consistent finishes for large suburban deployments—driveways, sidewalks, and patios—where homeowners seek durable, low-maintenance surfaces that enhance curb appeal.

Recent Developments

In 2023, Sika AG achieved record sales of CHF 11,238.6 million (up 7.1% year-on-year) and set a new operating free-cash-flow high of CHF 1,372.7 million. While the company does not break out decorative-concrete numbers specifically, Sika’s core business in “Concrete” systems — including admixtures, flooring, and repair solutions — indicates strong involvement in decorative concrete applications worldwide. Their double-digit organic growth across regions signals rising demand for aesthetics-and-performance concrete finishes in building and renovation markets.

In its full-year 2023 report, Heidelberg Cement (now re-branded as Heidelberg Materials) reported an operating result well above market expectations and raised its full-year outlook. Although the report focuses broadly on cement, aggregates and new-construction solutions, the company’s portfolio of concrete and surface finishing systems positions it to benefit from the decorative concrete trend—especially in infrastructure and commercial construction where aesthetics and durability go hand-in-hand.

In 2023, LafargeHolcim (now Holcim Group) reported global net sales of CHF 16.2 billion. The company’s decorative-concrete offering under the “Artevia®” brand delivers polished, stamped and coloured mixes designed for both indoor and outdoor aesthetics—promoting design freedom while retaining concrete’s durability. As a market research analyst, I see LafargeHolcim leveraging this product line to capture premium flooring, landscaping and facade segments where durability and finish quality matter.

For FY 2024, Boral reported revenue of AUD 3.46 billion (approx. USD 2.29 billion). Its decorative concrete business in Australia offers several product ranges—including Expose, Boralstone and Colori—covering exposed aggregate, polished indoor/outdoor floors, and coloured concrete. As an analyst, I interpret Boral’s move as meeting strong-home-improvement demand and aligning with sustainability by using locally-sourced aggregates for regional authenticity and reduced transportation emissions.

In 2023-24, Bomanite India (via Bomacrete LLP in Chennai) secured the exclusive licence to manufacture decorative concrete systems in India—including stamped, topping and exposed-aggregate product lines—marking the brand’s first major push into the Indian market. Their entry corresponds with rising interest in outdoor living surfaces and premium finishing in residences and commercial projects, positioning the company as a key local supplier of aesthetic concrete solutions.

In 2024, BASF SE continued to support its construction-chemicals and architectural coatings segments by providing raw materials (resins, dispersions, additives) used in decorative concrete and surface finishes worldwide. While decorative concrete-specific revenue is not broken out, BASF’s materials for concrete coatings and surface treatments reinforce its indirect role in aesthetic concrete markets.

Conclusion

In conclusion, decorative concrete has firmly established itself as a multifaceted solution marrying aesthetics, durability, and cost-effectiveness in the built environment. Whether in high-end homes, commercial interiors, public plazas or infrastructure flatwork, decorative concrete enables designers and builders to replicate materials like stone or tile, apply colored/stamped finishes and deliver low-maintenance surfaces. As urbanisation accelerates, sustainability standards tighten and renovation activity expands, the demand for decorative concrete is set to rise further—driven by both aesthetics and functionality in equal measure.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)