Table of Contents

Overview

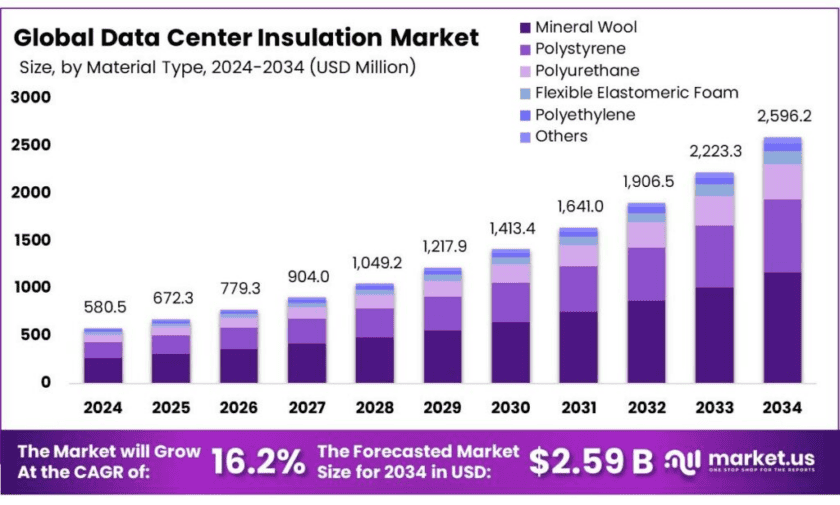

New York, NY – Oct 30, 2025 – The global Data Center Insulation Market is projected to reach USD 2,596.2 million by 2034, up from USD 580.48 million in 2024, expanding at a robust CAGR of 16.2% between 2025 and 2034. In 2024, North America dominated the market, accounting for 35.8% of the total share, with revenues of approximately USD 207.6 million.

Data center insulation forms an essential component of the data center infrastructure ecosystem, providing thermal and acoustic protection that enhances energy efficiency, operational reliability, and overall sustainability. As data centers continue to support global digitalization, cloud services, and enterprise networks, effective insulation solutions are becoming crucial to manage energy consumption and reduce heat load.

- Globally, data center power demand is projected to increase from 4 GW in 2019 to 53.1 GW by 2027, reflecting the exponential growth of cloud and AI-driven computing. This rapid expansion intensifies the need for energy-efficient designs and advanced insulation technologies to ensure stable internal environments and reduced cooling dependency.

Regulatory developments are further influencing market growth. The European Union’s Energy Efficiency Directive now mandates that data centers exceeding 500 kW disclose their energy usage and emissions, promoting greater transparency. Meanwhile, the UK government has rejected several large-scale data center projects due to energy supply constraints, underscoring the urgency for efficient thermal management.

Key Takeaways

- The global data center insulation market was valued at USD 580.48 million in 2024.

- The global data center insulation market is projected to grow at a CAGR of 16.2% and is estimated to reach USD 2596.2 Million by 2034.

- Between material types, mineral wool accounted for the largest market share of 46.0%.

- Among product types, sheets & rolls dominated the market with the largest share of 32.8%.

- Based on insulation type, thermal insulation held the majority of the share of 73.1%.

- New construction dominated the market of data center insulation with a market share of 76.0%.

- Among applications, walls & partitions accounted for the majority of the market share at 34.5%.

- IT & Telecom accounted for 41.2% owing to the exponential rise in data consumption.

- North America is estimated as the largest market for Data Center Insulation with a share of 35.8% of the market share.

- Asia-Pacific was estimated second largest growing market after Europe with a CAGR of 20.7%

➤ For a deeper understanding, click on the sample report link: https://market.us/report/data-center-insulation-market/free-sample/

Report Scope

| Market Value (2024) | USD 580.4 Mn |

| Forecast Revenue (2034) | USD 2596.2 Mn |

| CAGR (2025-2034) | 16.2% |

| Segments Covered | By Material Type (Mineral Wool, Polystyrene, Polyurethane, Flexible Elastomeric Foam, Polyethylene & Others), By Product Type (Sheets & Rolls, Panels, Pipe Section, Tiles, Boards & Slabs, Wired Mat & Others), By Insulation Type (Thermal Insulation & Acoustic Insulation), By Installation Method (New Construction, Retrofit / Renovation), By Application (Walls & Partitions, Roofs & Ceilings, Pipe, Air Duct, Equipment, Raised Floors, Others) By End-Use (IT & Telecom, BFSI, Healthcare, Retail & E-commerce, Entertainment & Media, Manufacturing, Energy & Utilities, Others) |

| Competitive Landscape | Saint–Gobain, Sika AG, Ventac, Johns Manville, Armacell International S.A., Owens Corning, IAC Acoustics UK Ltd, Huamei Energy-saving Technology Group Co., Ltd., InsulTech, LLC, Kingspan Group, Knauf Group, Rockwool A/S, Supreme Industries, L’ISOLANTE K-FLEX S.p.A., Thermaflex & Others |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=138658

Key Market Segments

Material Type Analysis – Mineral Wool Dominates with 46.0% Share in 2024

In 2024, mineral wool emerged as the leading material in the data center insulation market, accounting for 46.0% of the total share. Its dominance is attributed to exceptional thermal, acoustic, and fire-resistant properties, making it highly suitable for mission-critical environments like data centers. Mineral wool’s low thermal conductivity minimizes heat transfer and reduces cooling energy consumption, ensuring stable temperature control for server efficiency. Additionally, its non-combustible nature and sound absorption capabilities enhance both safety and noise reduction within facility operations.

Insulation Type Analysis – Thermal Insulation Leads with 73.1% Share in 2024

By insulation type, thermal insulation accounted for 73.1% of the global market in 2024. This dominance is driven by its essential role in improving energy efficiency and maintaining stable internal temperatures in energy-intensive data centers. Thermal insulation reduces the strain on HVAC systems, directly enhancing Power Usage Effectiveness (PUE) and lowering operational costs. With the rapid expansion of hyperscale and colocation centers, thermal insulation remains a top priority for improving sustainability and long-term equipment reliability.

Installation Method Analysis – New Construction Dominates with 76.0% Share in 2024

In 2024, new construction projects held a commanding 76.0% share of the data center insulation market. This trend reflects the global surge in new data center builds aimed at enhancing operational efficiency and meeting ESG compliance goals. Proper insulation in new facilities significantly minimizes heat transfer and cooling loads, reducing energy consumption. Compared to retrofit installations, new builds allow for full integration of thermal solutions across walls, ceilings, and raised floors—critical areas for maintaining consistent internal conditions.

Product Type Analysis – Sheets and Rolls Lead with 32.8% Share in 2024

Based on product type, sheets and rolls dominated the market in 2024 with a 32.8% share, owing to their versatility, cost-effectiveness, and ease of installation in large-scale projects. Widely used in walls, ceilings, ductwork, and equipment enclosures, these materials—often composed of mineral wool, fiberglass, or elastomeric foam—provide excellent thermal and acoustic insulation. Their lightweight and flexible design allows for adaptation to complex layouts, while their moisture resistance and fire-retardant properties safeguard critical IT infrastructure.

Application Analysis – Walls & Partitions Dominate with 34.5% Share in 2024

In 2024, walls and partitions accounted for 34.5% of total applications in the data center insulation market. These structures are vital for maintaining thermal stability and energy efficiency, acting as the first barrier against heat transfer from external environments. Insulated walls help reduce HVAC dependency and improve Power Usage Effectiveness (PUE) by ensuring optimal internal conditions for server operations. Their importance grows as data centers become denser and more power-intensive.

End-Use Analysis – IT & Telecom Leads with 41.2% Share in 2024

Among end-use industries, IT & Telecom dominated the data center insulation market in 2024, holding a 41.2% share. The rise in data consumption, driven by 5G deployment, cloud computing, and AI-driven workloads, has increased demand for energy-efficient data centers. Operators in this sector rely heavily on effective insulation to maintain thermal stability, reduce HVAC energy loads, and improve PUE metrics. The continuous expansion of hyperscale and colocation data centers further solidifies IT & Telecom’s leadership in this segment.

List of Segments

By Material Type

- Mineral Wool

- Stone Wool

- Glass Wool

- Polystyrene

- Polyurethane

- Flexible Elastomeric Foam

- Polyethylene

- Others

By Product Type

- Sheets and Rolls

- Panels

- Pipe Section

- Tiles

- Boards & Slabs

- Wired Mat

- Others

By Insulation Type

- Thermal Insulation

- Acoustic Insulation

By Application

- Walls & Partitions

- Roofs & Ceilings

- Pipe

- Hot Pipe

- Cold Pipe

- Others

- Air Duct

- Equipment

- Chillers

- Cooling Tanks

- Air Handlers

- Others

- Raised Floors

- Others

By End-Use

- IT & Telecom

- BFSI

- Healthcare

- Retail & E-commerce

- Entertainment & Media

- Manufacturing

- Energy and Utilities

- Others

Regional Analysis

In 2024, North America emerged as the leading region in the global data center insulation market, capturing a 35.8% share. This dominance was driven by the region’s extensive digital infrastructure and the rapid growth of hyperscale and colocation facilities. The United States, which hosts more than 2,600 operational data centers and accounts for nearly 40% of global capacity, remains at the center of the world’s cloud and digital ecosystem. Meanwhile, Canada continues to strengthen its presence, particularly in colder provinces such as Quebec and Ontario, where low ambient temperatures provide natural cooling advantages.

Regulatory frameworks such as ASHRAE 90.1 and California’s Title 24 have also been instrumental in encouraging energy-efficient design and construction practices, further boosting insulation adoption. Moreover, the growing popularity of modular and prefabricated data centers has increased demand for materials with high R-values and fire-resistant properties. In urban centers, the use of acoustic insulation is becoming essential to meet stringent noise control standards, ensuring compliance with local building codes.

Top Use Cases

Reduce cooling energy and peak loads: High-quality thermal insulation reduces heat transfer through walls, roofs, floors and ducts, lowering the cooling demand of a data center. This is critical as global data-center electricity demand is set to rise rapidly — the IEA projects data-centre electricity could reach ~945 TWh by 2030 under the Base Case.

Improve Power Usage Effectiveness (PUE) and operating costs: By lowering HVAC runtime and chilled-water losses, insulation helps improve PUE and cut operating expense. Studies of building retrofits show insulation measures can reduce heating energy by >50% and cooling loads by double-digit percentages in appropriate climates; similar proportional gains are achievable in data-centre envelopes and ducts when properly specified.

Stabilize internal temperatures for equipment reliability: Insulation narrows internal temperature swings, protecting servers and power equipment. Reduced thermal variance extends component life and lowers failure rates — a key consideration given that hyperscale growth concentrates heat loads (many large facilities added in recent years). For context, the U.S. hosts ~2,600 data centres (2024–25 estimates), concentrating demand and the need for robust thermal control.

Reduce ductwork and pipe losses (preserve chilled-water efficiency): Insulating chilled-air ducts, refrigeration piping and economizer circuits prevents transport losses; this reduces cooling plant capacity requirements and improves distribution efficiency. Practical projects have demonstrated measurable chilled-water savings when pipe and duct insulation is applied and specified to appropriate R-value / thickness standards.

Improve fire safety and code compliance: Non-combustible insulation (e.g., mineral wool) enhances fire resistance and helps meet building codes and standards commonly applied to mission-critical sites (ASHRAE and local codes). Compliance with standards such as ASHRAE 90.1 supports both energy performance and safety requirements for commercial data-centre construction.

Acoustic control for urban / mixed-use deployments: Insulation with sound-absorptive properties reduces HVAC and equipment noise, which is important for urban colocation sites and buildings near residential zones. Acoustic insulation can support compliance with municipal noise limits while improving workplace comfort for on-site staff.

Recent Developments

Saint-Gobain has strengthened its insulation materials business, which includes offerings for data-centre infrastructure, through strategic acquisitions and capacity expansions. In 2023, the Group completed 36 acquisitions totaling nearly €0.9 billion in sales and furthered its insulation business by acquiring stone-wool producer Termica San Luis in Argentina. The company’s insulation segment spans glass-wool, stone-wool and foams, and it emphasizes energy-efficiency and sustainability across its product lines.

Sika supports data-centre construction through systems that enhance thermal and acoustic performance, as well as fire and moisture protection. In 2024, the company reported CHF 11.76 billion in sales and leveraged its solutions to help reduce 13,000 tons CO₂-eq over the life of a 25,000 m² facility. Sika’s global footprint—102 countries and over 400 factories—positions it to contribute high-performance insulation and building-envelope systems at scale in mission-critical digital-infrastructure projects.

Ventac, headquartered in Ireland, serves the data centre sector with precision-engineered acoustic and thermal insulation solutions for cooling units, generators and HVAC systems. The company recounts a “quality performance record of 99.6%” in its turnkey data-centre noise-control / insulation projects. While no full-year revenue figures for 2023/2024 were published specific to this segment, Ventac reports expansion into major hyperscale and edge data-centre engagements in its 2025 strategic outlook, signalling strong growing alignment with-data-centre infrastructure needs.

Johns Manville (JM), a Berkshire Hathaway company, has developed insulation systems directly designed for data-centre infrastructure. In October 2024, JM launched its AP™ Foil25 polyiso foam board, offering a compressive strength of 25 psi and an R-value of 6.0 per inch, aimed at demanding commercial applications including data centres. JM also highlights that data-centre chilled-water pipework and ducting represents “tens of thousands of linear feet” of insulation need, underlining high demand.

Armacell specialises in high-performance insulation solutions tailored for demanding environments such as data centres. In 2023, the company reported net sales of EUR 836.1 million, up 3.7% from EUR 806.2 million in 2022, and achieved an adjusted EBITDA of EUR 154.6 million (margin 18.5%). Through its “Data Centre” product line, Armacell emphasises reducing Power Usage Effectiveness (PUE) and carbon footprint by offering closed-cell, fibre-free insulation systems that block heat, moisture and dust.

Owens Corning is a U.S. leader in insulation and building-materials, supplying thermal systems that are increasingly used in data-centre infrastructure. For full-year 2023, their Insulation segment achieved net sales of USD 3.7 billion, with an EBIT of USD 619 million (≈17% margin). Although the company’s reporting does not isolate data-centre-specific revenue, its technical insulation portfolio is aligned with the energy-efficiency and thermal-control demands of modern data halls and colocation facilities.

IAC Acoustics UK Ltd embeds its acoustic and insulation solutions into data-centre infrastructure, supporting noise control, HVAC attenuation and equipment enclosures. The firm lists “Data Centres” among its key verticals on its website, noting turnkey packages for mechanical, electrical and server-room noise mitigation. While publicly disclosed revenue for 2023/24 specific to data-centre insulation is not available, its presence across major markets and dedicated data-centre product lines suggest strategic alignment with hyperscale and colocation builds requiring certified acoustic and thermal control solutions.

Huamei Energy-Saving Technology Group Co., Ltd., based in China, manufactures high-capacity insulation materials—including rubber-foam insulation (1.7 million m³ annual capacity), glass-wool (400,000 tons annual capacity) and extrusion-polystyrene boards (500,000 m³ annual capacity). The company reports that its thermal and acoustic insulation solutions are applied in key projects such as data-centre infrastructure, HVAC systems and new-energy installations. Its product portfolio enables asset owners to improve energy efficiency and operational reliability in mission-critical facilities.

InsulTech provides custom thermal and acoustic insulation solutions tailored to large-scale data-centre infrastructure. In 2024, they delivered turnkey insulation blankets for power-generation exhaust systems at an AT&T data centre in northern California, showcasing their capability to execute design-build-install projects with high precision. The company’s manufacturing bases in Yuma, Arizona and San Luis Río Colorado, Mexico enable short lead times and strong support for mission-critical builds in the digital-infrastructure sector.

Kingspan has positioned itself to serve data-centre markets through its “Data + Flooring” and insulation divisions. For the full year 2024, the group recorded revenues of €8.6 billion (+6% year-on-year) and trading profit of €907 million. The company specifically identified that data-centre and battery-plant demand were meaningful drivers, with their “Data Solutions” segment recording a 36% increase in sales.

Conclusion

In conclusion, insulation plays a pivotal role in enhancing the efficiency, reliability, and sustainability of modern data centres. With global data-centre electricity consumption estimated at 300–380 TWh in 2023, the stakes for operational efficiency are significant. By minimizing heat ingress and transmission through walls, ceilings, floors, piping and ductwork, insulation allows cooling systems to operate under less strain and thus lowers overall energy demand and improves metrics such as Power Usage Effectiveness (PUE).

Moreover, by stabilising thermal conditions and reducing acoustic and fire-risk exposure, insulation supports the safe and continuous operation of mission-critical IT infrastructure. As digital traffic, AI workloads and hyperscale deployments continue to grow, the adoption of advanced insulation materials and methods is set to rise, making it a strategic investment rather than a mere building component. Well-selected insulation can thus yield measurable cost savings, support regulatory and ESG goals, and enable data centres to scale in a more energy-conscious manner.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)