Table of Contents

Overview

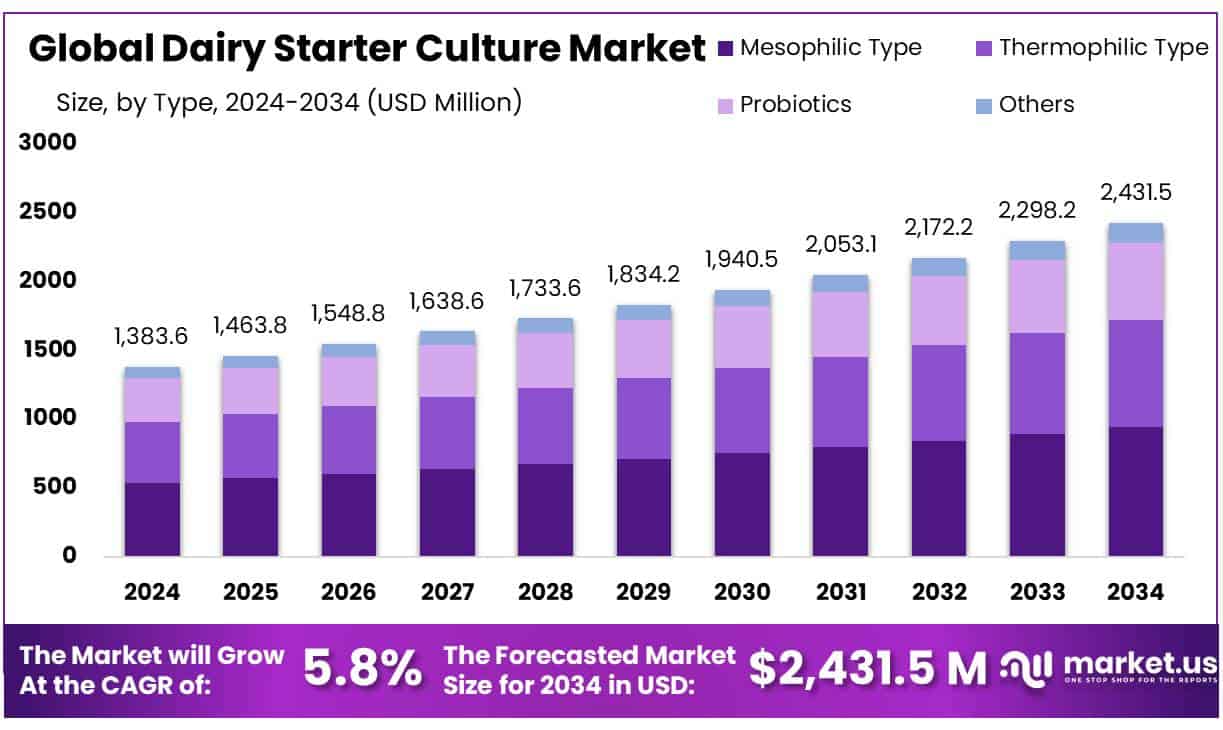

New York, NY – July 31, 2025 – The global dairy starter culture market is projected to reach approximately USD 2,431.5 million by 2034, up from USD 1,383.6 million in 2024, registering a compound annual growth rate (CAGR) of 5.8% from 2025 to 2034. In 2024, North America emerged as the leading regional market, accounting for over 48.2% of the total market share and generating revenues of around USD 666.8 million.

Dairy starter culture concentrates comprising mesophilic, thermophilic, and probiotic strains play a vital role in converting raw milk into products like cheese, yogurt, fermented butter, and other cultured dairy items. These cultures, typically offered in frozen, freeze-dried, or liquid forms, are activated upon mixing with milk, triggering fermentation that delivers the desired flavor, texture, and quality. Their use ensures product uniformity, longer shelf life, and adherence to food safety standards.

Government initiatives focused on health and dairy sector development are driving market growth. In India, programs like the National Animal Disease Control Programme and the Dairy Entrepreneurship Development Scheme offer vaccination and financial support to dairy farms, boosting herd size and production capabilities. The ₹15,000 crore Animal Husbandry Infrastructure Development Fund further strengthens dairy infrastructure, indirectly benefiting the starter culture market.

National efforts, such as the National Dairy Plan and Operation Flood led by the National Dairy Development Board, have significantly increased milk production reaching around 187.7 million tonnes in 2018-19 and daily per capita availability to 394 grams. These developments support rising demand for starter cultures in dairy processing.

Looking ahead, growth potential exists in both functional product innovation and geographic expansion. The popularity of probiotic-rich dairy products is increasing, with studies from FAO/WHO highlighting their gastrointestinal health benefits. Additionally, fast-growing dairy sectors in Asia Pacific, particularly in India and China, are presenting new opportunities for market expansion.

Key Takeaways

- The global dairy starter culture market is projected to grow from USD 1,383.6 million in 2024 to approximately USD 2,431.5 million by 2034, expanding at a CAGR of 5.8%.

- The mesophilic segment led the market by type, holding over 38.9% of the total share.

- Freeze-dried cultures dominated the form segment, accounting for more than 48.3% of the market.

- By application, lactic acid production held the largest share, contributing over 67.2%.

- Cheese manufacturing was the top application area, representing more than 55.5% of the market.

- Dairy and dairy-based products constituted the leading end-use segment, commanding over 81.4% of the market share.

- North America remained the dominant regional market, with a share of 48.2%, equating to approximately USD 666.8 million in revenue.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/dairy-starter-culture-market/free-sample/

Report Scope

| Market Value (2024) | USD 1383.6 Mn |

| Forecast Revenue (2034) | USD 2431.5 Mn |

| CAGR (2025-2034) | 5.8% |

| Segments Covered | By Type (Mesophilic Type, Thermophilic Type, Probiotics, Others), By Form (Liquid, Powder, Freeze-Dried), By Fermentation Type (Yeast-Lactic Acid, Fungus-Lactic Acid, Lactic Acid), By Application (Cheese, Yogurt, Kefir), By End-use (Dairy and Dairy-Based Products, Meat and Seafood, Others) |

| Competitive Landscape | Agropur, Almarai, Arla Foods, Clover S.A. Proprietary Limited, Fonterra Co-operative Group Limited, foremost farms usa, FrieslandCampina, Kerry Group, Nestlé, Saputo Fonterra, Synergy Flavors |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=152861

Key Market Segments

By Type Analysis

Mesophilic Cultures Lead with 38.9% Market Share Due to Versatility in Cheese and Fermented Dairy

As of 2024, mesophilic cultures dominate the dairy starter culture market with a 38.9% share. Their popularity stems from their widespread use in making soft and semi-hard cheeses like cream cheese, cottage cheese, and traditional fermented milk products. Operating effectively at moderate temperatures (20°C-30°C), these cultures are particularly suited to regions where ambient conditions align with their growth range, reducing the need for specialized temperature control and making them a cost-efficient option.

Their ability to enhance flavor, stabilize shelf life, and provide consistent acidification makes them ideal for both artisanal and industrial dairy processors. As consumer demand grows for clean-label and traditional dairy items, mesophilic cultures remain a preferred solution for manufacturers aiming for high-quality results with minimal additives.

By Form Analysis

Freeze-Dried Cultures Hold 48.3% Share Owing to Shelf Stability and Ease of Use

In 2024, freeze-dried cultures held the largest market share by form, accounting for 48.3%. This dominance is largely due to their long shelf life, ease of transport, and lack of cold chain requirements. Unlike frozen or liquid alternatives, freeze-dried cultures can be stored at room temperature, making them especially advantageous in areas with limited refrigeration.

Their compact format allows for precise dosing, improved hygiene, and consistent results in dairy production. These benefits are particularly critical in making yogurt, cheese, and other fermented products. The format’s reliability and user-friendliness have also increased adoption among small and mid-sized dairy producers with limited infrastructure.

By Fermentation Type Analysis

Lactic Acid Fermentation Commands 67.2% Share Due to Its Core Role in Flavor and Preservation

Lactic acid fermentation led the market in 2024, with a commanding 67.2% share. This method is central to producing staple dairy items like yogurt, sour cream, and various cheeses. Lactic acid bacteria convert lactose into lactic acid, enhancing product flavor and texture while naturally extending shelf life by reducing pH and limiting harmful microbial growth.

This fermentation method is favored for its reliability, safety, and alignment with the growing demand for natural, clean-label foods. Whether in traditional recipes or industrial processing, lactic acid fermentation remains the gold standard across the dairy sector.

By Application Analysis

Cheese Segment Tops with 55.5% Market Share Amid Rising Global Demand

Cheese was the leading application segment in 2024, accounting for over 55.5% of the dairy starter culture market. The essential role of starter cultures in cheese production from flavor development to textural consistency drives this strong presence. Both fresh varieties like mozzarella and aged cheeses such as cheddar and gouda rely on specific bacterial strains to achieve optimal quality.

Increasing global consumption of cheese, particularly in North America, Europe, and rapidly growing Asia-Pacific markets, continues to propel demand. The rise of artisanal and specialty cheese options, especially among health-conscious and gourmet consumers, has further boosted this segment’s momentum.

By End-use Analysis

Dairy and Dairy-Based Products Dominate with 81.4% Market Share

In 2024, dairy and dairy-based products represented over 81.4% of total market demand for starter cultures. These cultures are integral to everyday dairy foods such as yogurt, buttermilk, sour cream, cheese, and fermented milk drinks, helping define their flavor, texture, and safety.

Rising awareness of probiotic and digestive health benefits has increased global consumption of fermented dairy products. Additionally, these products hold cultural significance in many regions, ensuring consistent year-round demand. With expanding urban populations and rising disposable incomes, especially in developing countries, the consumption of value-added and functional dairy products continues to drive strong growth in this end-use category.

Regional Analysis

North America Leads with 48.2% Market Share, Valued at USD 666.8 Million in 2024

In 2024, North America held the largest share of the global dairy starter culture market, capturing 48.2%, which translates to approximately USD 666.8 million in revenue. This dominant position is driven by the region’s well-established dairy industry, robust processing infrastructure, and consistent consumer demand for fermented dairy products. The United States led regional performance with a market valuation of USD 365.9 million, reflecting high production volumes and the widespread use of starter cultures across dairy segments.

Canada also contributed significantly, fueled by growing interest in artisanal cheese and premium yogurt. In Mexico, rising domestic consumption of value-added dairy and increased exports have further supported regional growth.

Government policies have played a key role in sustaining this momentum. In the U.S., oversight from the FDA and USDA ensures high product standards, particularly for cultured items labeled with “live and active cultures.” Meanwhile, federal subsidies in Canada have supported dairy cooperatives in modernizing fermentation facilities, encouraging broader adoption of advanced starter cultures. These ongoing initiatives are expected to reinforce North America’s leadership in the market through 2025 and beyond.

Top Use Cases

Probiotic Yogurt Production: Starter cultures are key in yogurt fermentation, using strains like Lactobacillus bulgaricus and Streptococcus thermophilus to convert lactose into lactic acid. This process yields creamy texture, tangy flavor, and natural shelf life extension. Probiotic-rich yogurts now dominate dairy trends, driven by consumer demand for digestive and immune health benefits.

Cheese Manufacturing: In cheese production, starter cultures initiate acidification and texture formation, especially for varieties like cheddar, mozzarella, and traditional soft cheeses. These cultures help develop characteristic flavors, control moisture release, and inhibit spoilage organisms, delivering consistent quality and enhancing shelf stability across artisanal and industrial cheese lines.

Fermented Milk Beverages (e.g. Buttermilk, Sour Cream): Cultures applied in fermented milk products convert sugars into lactic acid, lending a smooth, tangy profile while naturally preserving freshness. These beverages benefit from improved taste, texture, and microbial safety, making them a staple in many diets and increasingly relevant for clean-label, probiotic-driven product lines.

Shelf‑Life Extension via Biopreservation: Dairy starter cultures, particularly lactic acid bacteria, act as natural biopreservatives by lowering pH and producing antimicrobial compounds. This inhibits spoilage and pathogenic microbes in products like cheese and yogurt, reducing reliance on chemical additives and aligning with consumer preference for eco‑friendly, clean-label shelf-life solutions.

Emerging Use in Plant‑Based Fermented Products: As plant-based dairy alternatives gain traction, starter cultures originally developed for dairy are being adapted for fermentation of soy, oat, and almond milks. These cultures improve flavor, texture, and probiotic content, enabling producers to meet the rising demand for functional, non‑dairy fermented foods.

Recent Developments

Agropur: While Agropur has not announced any new dairy starter culture-specific innovations recently, the cooperative published its 2023 ESG Report in July 2024, highlighting sustainability in dairy processing and community engagement. In early 2025, Agropur cheeses won multiple awards at the 2025 U.S. Championship Cheese Contest, reflecting its product quality. These achievements support overall excellence in its dairy operations, including culture usage, albeit without explicit starter culture R&D announcements.

Kerry Group: Kerry Group, known for its Biofermentium® culture-enzyme systems, continues to expand its range of customized cultures for dairy and plant-based cheese, offering melt, stretch, and flavor properties. Its Accel® accelerated fermentation technology enables faster production cycles, and salt-reducing starter systems help manufacturers achieve lower-sodium formulations without compromising taste. Kerry’s developments reflect ongoing product innovation targeting core dairy and emerging vegan sectors.

DSM Food Specialties: DSM has introduced Delvo Fresh YS-042, a yogurt culture launched in mid‑2021, designed for stirred yogurt that stays creamy and thick throughout shelf life without added texturizers or proteins. This innovation offers cost-efficient formulation and cleaner ingredient lists, aligning with growing demand for minimalist dairy products. While not new to 2025, it remains a strategic signature culture in DSM’s portfolio.

Conclusion

Growth is driven by rising consumer demand for fermented dairy products rich in probiotics, alongside a shift toward clean-label and functional offerings. Technological advancements in strain development and fermentation processes are enabling more efficient, tailored culture solutions. With emerging markets in Asia-Pacific and Latin America growing rapidly and established markets like North America and Europe maintaining momentum, the outlook remains favorable for continued expansion and innovation through 2034.

Technological innovations like development of tailored strains and streamlined fermentation methods are enhancing culture performance and efficiency. North America remains dominant, but Asia‑Pacific and Latin America are emerging as the fastest‑growing regions, thanks to rising urbanization, expanding middle classes, and increasing dairy consumption in markets like India, China, and Brazil. This promising outlook positions the market for continued expansion and innovation through the decade.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)