Table of Contents

Overview

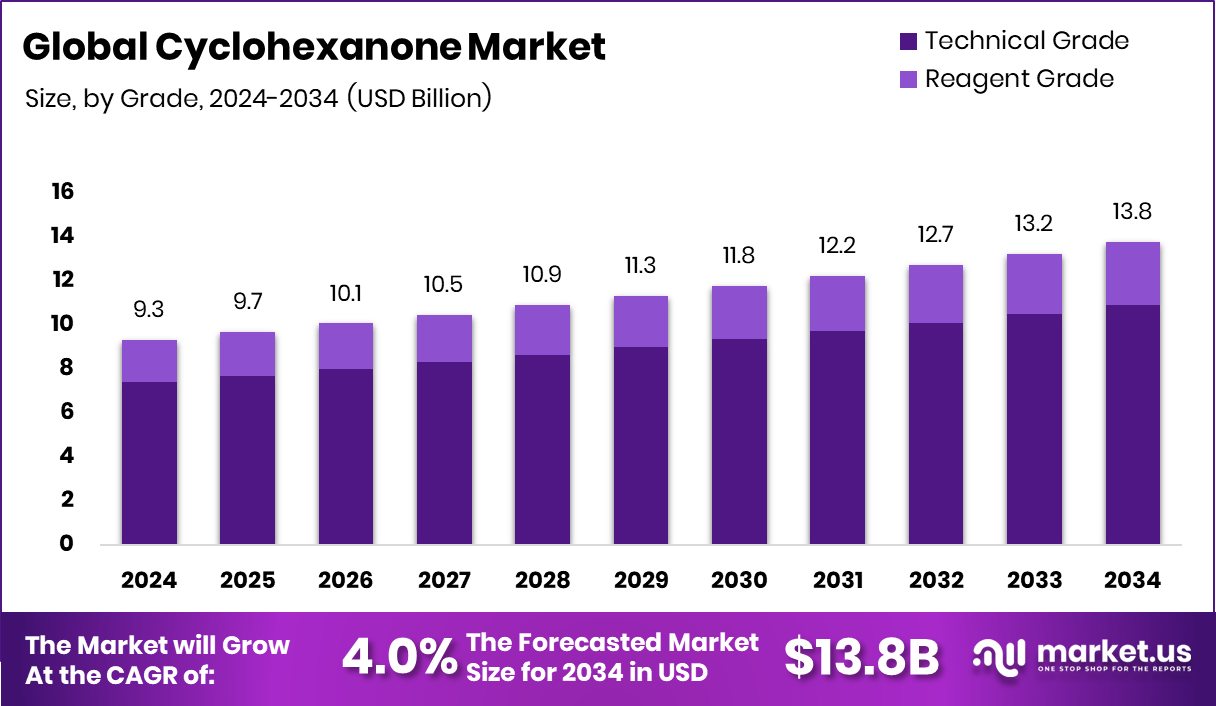

New York, NY – Nov 19, 2025 – The global cyclohexanone market is moving steadily upward, expected to reach USD 13.8 billion by 2034, rising from USD 9.3 billion in 2024 at a 4.0% CAGR. Much of this momentum comes from the Asia Pacific, which continues to expand rapidly, supported by strong nylon and polymer production and holding 45.9% of the market’s growth.

Cyclohexanone remains a core industrial chemical, valued for its role as a precursor in producing caprolactam, adipic acid, and ultimately nylon. Its use as a solvent in paints, coatings, resins, and adhesives further supports its importance across manufacturing. Because it sits at the center of the polymer and chemical supply chain, its demand rises alongside growth in textiles, automotive parts, engineered plastics, and construction materials.

A key driver is the increasing preference for lightweight, durable nylon materials in automotive interiors, industrial equipment, and modern packaging. As industries look for stronger and more efficient materials, cyclohexanone consumption naturally expands.

Meanwhile, sustainability is opening new avenues. Global funding flows—such as Bioweg’s USD 19 million Series A, Epoch Biodesign’s USD 18.3 million, and Samsara Eco’s USD 100+ million and USD 65 million rounds—highlight accelerating interest in green chemistry and recycling technologies. These investments signal rising potential for bio-based or circular alternatives, setting the stage for future innovations linked to cyclohexanone’s value chain.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-cyclohexanone-market/request-sample/

Key Takeaways

- The Global Cyclohexanone Market is expected to be worth around USD 13.8 billion by 2034, up from USD 9.3 billion in 2024, and is projected to grow at a CAGR of 4.0% from 2025 to 2034.

- The Cyclohexanone Market’s Technical Grade segment dominates with a strong 79.3% share in 2024.

- Liquid form holds a major position in the Cyclohexanone Market, accounting for 89.8% overall share.

- Nylon 6 type leads the Cyclohexanone Market, contributing to nearly 50.0% of total consumption.

- Caprolactam application remains the largest in the Cyclohexanone Market, securing around 59.1% market share.

- The Asia Pacific market value reached around USD 4.2 billion, driven by industrial expansion.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165207

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.3 Billion |

| Forecast Revenue (2034) | USD 13.8 Billion |

| CAGR (2025-2034) | 4.0% |

| Segments Covered | By Grade (Technical Grade, Reagent Grade), By Form (Solid, Liquid), By Type (Nylon 6, Nylon 66, Polyester Polyol, Others), By Application (Caprolactam, Adipic Acid, Solvents, Others) |

| Competitive Landscape | Gujarat State Fertilizers & Chemicals Limited (GSFC), Asahi Kasei Corporation, BASF, Domo Chemicals, Ostchem, Fibrant, JIGCHEM UNIVERSAL, ARIHANT SOLVENTS AND CHEMICALS, Qingdao Hisea Chem Co., Ltd., LUXI GROUP, Chang Chun Group |

Key Market Segments

By Grade Analysis

In 2024, Technical Grade cyclohexanone clearly led the By Grade segment with a strong 79.3% share, reflecting its essential role in large-scale industrial applications. Its dominance mainly stems from its widespread use in producing nylon intermediates, coatings, resins, and various solvent systems, where consistency and reliability are critical.

Manufacturers favor this grade because it offers high purity at a cost-effective level, making it suitable for continuous chemical processing and bulk polymer synthesis. Its stable performance profile allows chemical, textile, and polymer industries to maintain efficient operations without compromising formulation quality.

The persistent requirement for nylon and resin production continues to reinforce this segment’s leadership, ensuring that Technical Grade remains the preferred choice across global markets.

By Form Analysis

In 2024, the Liquid form dominated the By Form segment of the Cyclohexanone Market, securing an impressive 89.8% share. This strong lead comes from its ease of use in industrial settings, where liquid cyclohexanone offers superior solubility and smooth handling during manufacturing operations.

As a key solvent and intermediate for nylon, coatings, and various chemical formulations, its liquid state supports efficient mixing, quicker reaction times, and better process control—qualities essential for high-volume production lines. This performance advantage makes it the preferred format across major chemical and polymer applications.

Its flexibility, stability, and compatibility with diverse chemical processes have further strengthened its adoption, helping the liquid form maintain its clear leadership in the Cyclohexanone market throughout 2024.

By Type Analysis

In 2024, Nylon 6 led the By Type segment of the Cyclohexanone Market with a solid 50.0% share, underscoring its central role in global polymer production. This leadership stems from cyclohexanone’s essential function as a precursor for both nylon-6 and nylon-66, materials heavily relied upon in automotive components, industrial machinery, and textile manufacturing.

Nylon’s strong performance characteristics—such as durability, flexibility, and lightweight structure—continue to align with industry demands for efficient, high-strength materials. As sectors like automotive and textiles accelerate their shift toward advanced engineered polymers, nylon output has risen steadily, directly increasing the need for cyclohexanone.

This deep integration into polymer synthesis has firmly established Nylon 6 as the dominant type within the Cyclohexanone Market, highlighting its continued importance in the broader global chemicals and materials landscape in 2024.

By Application Analysis

In 2024, Caprolactam dominated the By Application segment of the Cyclohexanone Market with a notable 59.1% share, reflecting cyclohexanone’s essential role as the primary feedstock for caprolactam synthesis. Since caprolactam is the key building block for nylon-6, its demand remains closely tied to the expanding use of nylon in global industries.

Nylon-6 is widely used in textiles, engineering plastics, and industrial fibers, all of which depend on high-purity raw materials for consistent performance. This requirement keeps caprolactam production heavily reliant on cyclohexanone, ensuring stable consumption throughout polymer manufacturing.

Growth in textile production, along with rising adoption of lightweight engineered plastics in the automotive sector, strengthened the caprolactam segment’s leadership in 2024. These trends firmly established caprolactam as the primary application area for cyclohexanone in global industrial operations.

Regional Analysis

In 2024, the Asia Pacific dominated the global cyclohexanone market, accounting for a 45.9% share and a value of USD 4.2 billion. Its leadership is driven by rapid industrialization and strong growth in chemical manufacturing, textiles, and polymer production across China, India, and Japan. Rising demand for nylon in automotive and engineering applications further strengthens the region’s influence.

North America maintains a steady demand supported by mature chemical infrastructure and stable use of cyclohexanone in coatings, solvents, and industrial formulations. Europe shows consistent growth as advanced processing technologies and strict quality standards sustain the region’s chemical output.

Emerging markets in the Middle East & Africa, as well as Latin America, are gradually expanding, supported by growing manufacturing capabilities and increasing investments in industrial development. With its efficient production ecosystem and robust domestic consumption, the Asia Pacific region remains firmly positioned as the leading regional market for cyclohexanone in 2024.

Top Use Cases

- Nylon precursor: Cyclohexanone is a key building block to make both adipic acid and caprolactam, which go on to become nylon-6 and nylon-66 fibers.

- Solvent for paints & coatings: It acts as a solvent in the manufacture of paints, varnishes, lacquers, and coatings, helping dissolve resins and thin films in industrial processes.

- Intermediate in plastics & resins: It’s used as a starting material in the production of synthetic resins, polyvinyl chloride (PVC) copolymers, and methacrylate-ester polymers.

- Industrial solvent for rubbers & waxes: Cyclohexanone is used to dissolve crude rubber, cellulosic materials, waxes, and polymer films — useful in degreasing, spot-removing and cleaning operations.

- Adhesives and automotive uses: The chemical serves in adhesive formulations and automotive-industry applications where strong solvent action and blending are needed for coatings or plastic parts.

- Pharmaceutical and agrochemical synthesis: It also features as a chemical intermediate in medicines and herbicides: derivatives of cyclohexanone are used in the synthesis of active compounds and plant-protection chemicals.

Recent Developments

- In October 2025, AKC announced expansion of capacity to manufacture components for clean-hydrogen and chlor-alkali markets (including membranes and electrolysis systems), begun Dec 18 2024. Still, no direct mention of cyclohexanone.

- In August 2024, BASF announced the structural adjustment at its Ludwigshafen site, including closures of certain plants and a review of others. While this didn’t specify cyclohexanone explicitly, it formed part of the site-wide strategy that earlier included the cyclohexanone plant.

Conclusion

The Cyclohexanone Market continues to evolve as industries move toward advanced materials, efficient manufacturing, and cleaner chemical processes. Its role as a crucial intermediate for nylon and other polymer applications keeps demand steady across automotive, textiles, and industrial sectors. Growing interest in sustainable chemistry and improved production technologies is also shaping future opportunities.

As manufacturers optimize operations and explore greener pathways, cyclohexanone remains an important link in the global chemical value chain. The market’s direction will increasingly reflect innovation, regulatory progress, and the expanding need for high-performance materials across multiple end-use industries.