Table of Contents

Overview

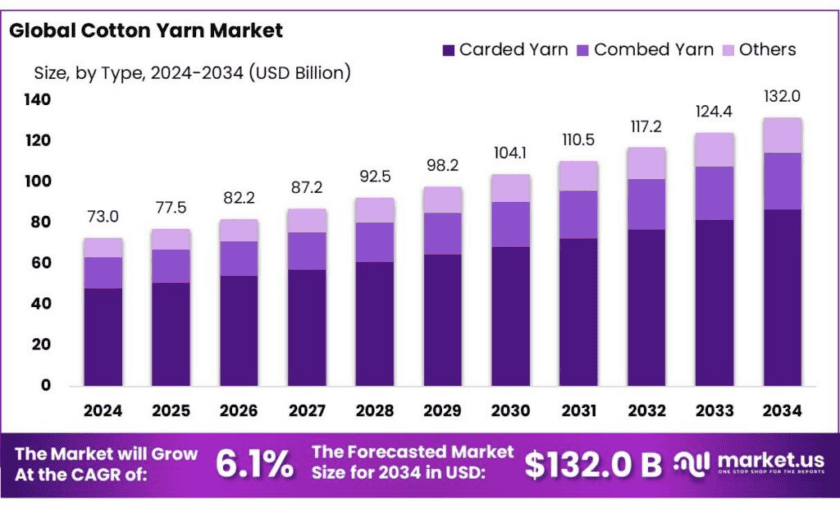

New York, NY – Oct 31, 2025 – The global cotton yarn market is projected to reach around USD 132.0 billion by 2034, rising from USD 73.0 billion in 2024, registering a CAGR of 6.1% between 2025 and 2034. In 2024, the Asia-Pacific (APAC) region led the market with a 52.8% share, generating approximately USD 38.5 billion in revenue. Cotton yarn serves as a key material in the textile sector, forming the foundation for producing fabrics used in apparel, home furnishings, and industrial applications.

It is produced by spinning cotton fibers into continuous strands through several stages, including ginning, carding, and spinning, resulting in fine threads that are woven or knitted into textiles. Valued for its soft texture, moisture absorption, and breathability, cotton yarn is especially suitable for garments in warm and humid climates.

For the Marketing Year (MY) 2025/26, domestic cotton production is forecast to reach 25 million 480-lb bales, cultivated across approximately 11.4 million hectares with an average yield of 477 kg per hectare. Government initiatives have further strengthened the industry’s growth. The Pradhan Mantri Mega Integrated Textile Region and Apparel Parks Scheme aims to create seven world-class textile parks equipped with modern infrastructure and integrated value chains.

Notably, the first park in Madhya Pradesh has already attracted INR 20,746 crore in investments, positioning it as India’s largest textile hub. Additionally, the temporary suspension of the 11% import duty on cotton, effective from August 19 to September 30, 2025, is expected to support domestic garment manufacturers amid export challenges, including rising tariffs in the U.S. market.

Key Takeaways

- Cotton Yarn Market size is expected to be worth around USD 132.0 Billion by 2034, from USD 73.0 Billion in 2024, growing at a CAGR of 6.1%.

- Carded Yarn held a dominant market position, capturing more than 65.8% of the cotton yarn market.

- Apparel held a dominant market position, capturing more than a 69.3% share of the cotton yarn market.

- Online held a dominant market position, capturing more than 87.4% of the cotton yarn market.

- Asia-Pacific (APAC) region holds a dominant share of 52.8% in the global cotton yarn market, valued at approximately USD 38.5 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-cotton-yarn-market/free-sample/

Report Scope

| Market Value (2024) | USD 73.0 Bn |

| Forecast Revenue (2034) | USD 132.0 Bn |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Type (Carded Yarn, Combed Yarn, Others), By Application (Apparel, Home Textiles, Industrial Textiles, Others), By Distribution Channel (Online, Offline) |

| Competitive Landscape | Texhong, Vardhman Group, BROS, Weiqiao Textile, Lutai Textile, Huafu, Alok, Huamao, Nahar Spinning, Nishat Mills, |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159039

Key Market Segments

By Type Analysis: Carded Yarn Leads the Market with 65.8% Share in 2024

In 2024, carded yarn held the largest share of the global cotton yarn market, accounting for 65.8% of total revenue. Its dominance is driven by its cost-effectiveness, durability, and broad applicability across textile categories. Carded yarn’s slightly rougher texture makes it suitable for fabrics that prioritize strength over smoothness, such as workwear, denim, and household textiles. Its lower production cost compared to combed or compact yarns enhances affordability for large-scale textile producers.

By Application Analysis: Apparel Segment Dominates with 69.3% Share in 2024

The apparel sector remained the largest application area for cotton yarn in 2024, capturing a 69.3% market share. Cotton yarn’s softness, breathability, and absorbent nature make it ideal for a variety of clothing applications—ranging from casual and sportswear to formal apparel. Global demand for natural fibers and the rising focus on sustainable fashion are key factors driving this segment. Moreover, cotton’s ability to blend with synthetic fibers expands its usage in flexible fabric designs..

By Distribution Channel Analysis: Online Sales Channel Accounts for 87.4% Share in 2024

In 2024, the online distribution channel led the cotton yarn market with an 87.4% share, reflecting the rapid expansion of e-commerce platforms across both developed and emerging markets. Digital marketplaces have revolutionized the yarn trade, offering manufacturers and consumers greater convenience, competitive pricing, and global reach. Rising internet penetration and widespread digital payment adoption have accelerated online sales, especially in regions like China, India, and Southeast Asia. Buyers now benefit from real-time price comparisons, faster delivery options, and bulk order flexibility, making online purchasing the preferred mode of trade.

List of Segments

By Type

- Carded Yarn

- Combed Yarn

- Others

By Application

- Apparel

- Home Textiles

- Industrial Textiles

- Others

By Distribution Channel

- Online

- Offline

Regional Analysis

Asia-Pacific Dominates the Cotton Yarn Market with 52.8% Share in 2024

In 2024, the Asia-Pacific (APAC) region led the global cotton yarn market, capturing a 52.8% share and generating approximately USD 38.5 billion in revenue. The region’s dominance stems from its well-established textile manufacturing base, cost-efficient labor, and strong export networks. Major contributors such as China, India, and Bangladesh continue to drive production and consumption, with India ranking as the world’s largest cotton yarn producer, followed closely by China.

The market’s growth is further supported by the rising middle-class population, increasing demand for cotton-based fabrics, and a growing shift toward eco-friendly and sustainable textiles. As textile production and consumption continue to rise across emerging economies, APAC is expected to retain its leadership position through 2025, with consistent expansion in both yarn output and apparel manufacturing.

Top Use Cases

Apparel manufacturing (knits & wovens at global scale): Brands and OEMs spin cotton yarn into T-shirts, shirts, chinos, underwear and dresses for mass markets. Global cotton mill-use/consumption is ~118.8 million 480-lb bales in 2024/25 (≈ 25–26 million tonnes), showing the sheer apparel-grade throughput relying on yarn supply. Asia remains the main spinning/sewing base feeding export apparel.

Denim & casualwear (jeans, twills, fleece): Cotton yarn is core to denim (warp) and sturdy casual fabrics. Apparel trade data underline the scale: textiles & clothing were 3.7% of world merchandise exports in 2022, with China the top clothing exporter; in 2023 China shipped US$165 billion of garments (31.6% share), followed by Bangladesh and Viet Nam—markets that rely heavily on cotton yarn for denim and casualwear programs.

Home textiles (towels, bedsheets, upholstery bases): Ring-spun and open-end cotton yarns feed terry towels, bedlinen and basic sheeting. Large producing/consuming countries keep demand resilient; for example, India’s official note indicates a cotton:non-cotton fiber use ratio around 60:40 in its textile industry—supporting strong domestic yarn pull across home-textile mills (spinning → weaving/knitting → processing).

Export-oriented spinning hubs (yarn-to-fabric trade): Cotton yarn also moves as a tradable intermediate from spinners to fabric mills abroad (e.g., India/Viet Nam → Turkey/Middle East; Brazil/U.S./West Africa supply lint). USDA projects global cotton trade at ~43.7 million bales in the latest circular, reflecting active cross-border flows of lint and yarn-derived fabrics that anchor mill utilization and loom scheduling.

Preferred natural fiber in sustainability roadmaps: Cotton yarn features in many brands’ “preferred fiber” mixes. 27% of global cotton production in 2022 came via programs with sustainability elements (up from 25% in 2021), while fossil-based polyester still dominates total fiber output (~54% share in 2022). The push for certified cotton (BCI/organic/regenerative) keeps a structural role for cotton yarn in lower-impact fabric portfolios.

Recent Developments

Texhong International Group Limited: In the year ended 31 December 2024, Texhong reported revenue of RMB 23,029 million, up from RMB 22,725 million a year earlier, and turned a net profit of RMB 553.5 million after a prior loss. As one of the largest cotton-yarn manufacturers globally, Texhong focuses on core-spun and ring-spun cotton yarns for apparel and home-textile exports, emphasising sustainable cotton sourcing and integrated vertical operations.

Vardhman Textiles Ltd.: For the quarter ended 30 June 2024 (Q1 FY 2025), the company reported yarn production of 66,881 metric tons, up from 63,406 metric tons a year earlier. In its full-year 2023-24 report, Vardhman reported revenue of INR 9,299 crore and a profit after tax of INR 608 crore. The company is a leading integrated cotton-yarn manufacturer in India, supplying both domestic and export markets and increasingly focusing on value-added yarns and sustainable manufacturing practices.

BROS Eastern Co., Ltd. (formerly BROS): In their latest available financial disclosure for the year ending December 2023, BROS Eastern reported yarn-segment sales of ¥645.67 crore (approx. USD 90 million) after a reduction from the prior year’s ¥698.91 crore. The company specializes in top-dyed mélange and pure cotton yarns, focusing on color-blended yarns for apparel makers. Their shift toward sustainable fibers and limited volumes highlights a niche rather than mass-spun position in cotton yarn manufacturing.

Weiqiao Textile Company Limited: For the year 2022, Weiqiao Textile reported an output of approximately 389,000 tonnes of cotton yarn, alongside 697 million metres of grey fabric and 53 million metres of denim. The group emphasises large-scale integrated spinning and weaving operations with a strong focus on efficiency and value-added products. As a major Chinese yarn manufacturer, its output scale underpins both domestic textile value-chains and exports of cotton yarn.

Conclusion

In conclusion, the global cotton yarn market remains fundamentally solid, driven by the expanding apparel and home-textile industries and consumers’ growing preference for natural fibers. For market players, success will depend on streamlining spinning capacity, shifting to value-added yarns, leveraging e-commerce channels, and aligning with sustainability standards—enabling both upstream stability and downstream competitiveness across the cotton-yarn value chain.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)