Table of Contents

Introduction

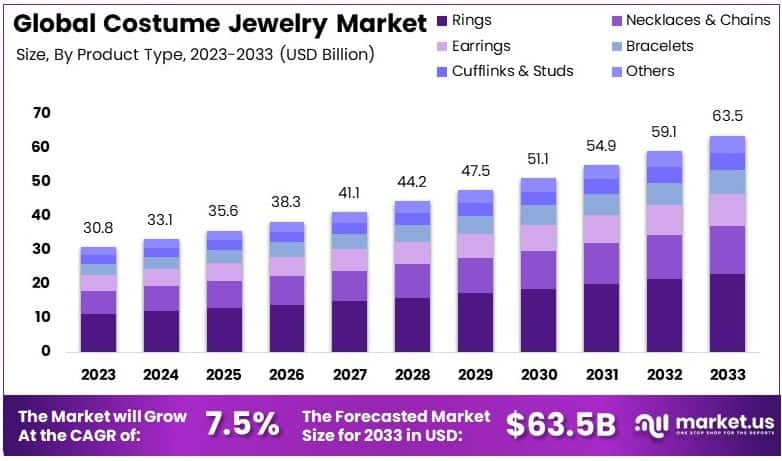

New York, NY – April 10, 2025 – The Global Costume Jewelry Market is projected to reach approximately USD 63.5 billion by 2033, rising from an estimated USD 30.8 billion in 2023. This growth reflects a compound annual growth rate (CAGR) of 7.5% during the forecast period spanning 2024 to 2033.

Costume jewelry, also referred to as fashion jewelry, encompasses decorative accessories that are made using inexpensive materials such as base metals, glass, plastic, and synthetic stones rather than precious metals or gemstones. Designed to complement current fashion trends, costume jewelry offers consumers an affordable way to accessorize, making it especially appealing in price-sensitive markets. The global costume jewelry market refers to the industry involved in the design, manufacturing, distribution, and sale of such non-precious jewelry items across various end-use segments including retail, online, and specialty stores.

The growth of the costume jewelry market can be attributed to a combination of rising disposable incomes, growing fashion consciousness among consumers, and the influence of social media platforms and celebrity endorsements. In particular, the demand is being driven by millennials and Gen Z consumers who are inclined toward trend-oriented and seasonal jewelry collections rather than traditional and high-investment pieces. Furthermore, the increasing penetration of e-commerce has expanded the accessibility of costume jewelry to a broader demographic, thereby boosting market volume.

An additional growth factor includes the growing acceptance of gender-neutral and unisex jewelry lines, which has opened new customer segments and diversified product offerings. From an opportunity standpoint, manufacturers are capitalizing on sustainability trends by introducing eco-friendly and recyclable materials in fashion jewelry, aligning with environmentally conscious consumer preferences. Moreover, the fusion of technology and fashion such as digitally customizable jewelry and augmented reality try-on features is expected to enhance consumer engagement and further stimulate demand, positioning the market for robust growth in the forecast period.

Key Takeaways

- The Costume Jewelry Market was valued at USD 30.8 billion in 2023 and is projected to reach USD 63.5 billion by 2033, expanding at a robust CAGR of 7.5% over the forecast period.

- Rings emerged as the leading product type in 2023, accounting for 36.2% of the market share, primarily due to their widespread popularity and versatility across various consumer demographics.

- Metal dominated the material type segment in 2023, attributed to its durability and aesthetic appeal, which make it a favored choice in costume jewelry manufacturing.

- Female consumers represented the majority in 2023, comprising 60.7% of the market, underscoring their stronger preference and higher purchasing power in the costume jewelry segment.

- Offline stores accounted for 74.4% of the total market share in 2023, reaffirming the critical role of physical retail experiences in jewelry purchases.

- Asia Pacific led the global market in 2023 with a 33.8% share, supported by a rising middle-class population, increasing urbanization, and growing disposable incomes across emerging economies.

Request A Sample Copy Of This Report at https://market.us/report/costume-jewelry-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 30.8 Billion |

| Forecast Revenue (2033) | USD 63.5 Billion |

| CAGR (2024-2033) | 7.5% |

| Segments Covered | By Product Type (Necklaces and Chains, Rings, Earrings, Bracelets, Cufflinks and Studs, Others), By Material Type (Metal, Plastic, Stones, Glass, Others), By Gender (Male, Female, Unisex), By Distribution Channel (Online, Offline) |

| Competitive Landscape | Pandora, Swarovski, Claire’s, H&M Accessories, Zara Accessories, BaubleBar, Charming Charlie, Forever 21 Accessories, Topshop Jewelry, Aldo Accessories, Accessorize, Icing, Lovisa, Bijou Brigitte, Mango Accessories |

Emerging Trends

- Maximalist Designs: There is a resurgence of bold, chunky jewelry pieces, including oversized necklaces and statement earrings, marking a shift from minimalist styles.

- Personalized Accessories: Consumers are increasingly favoring customizable jewelry, such as charm necklaces, allowing for individual expression through unique combinations.

- Sustainable Materials: The use of eco-friendly materials like recycled metals and lab-grown gemstones is on the rise, reflecting a commitment to environmental responsibility.

- E-commerce Expansion: The proliferation of online platforms has made costume jewelry more accessible, with digital marketing and influencer collaborations enhancing brand visibility.

- Fashion Collaborations: Partnerships between jewelry brands and fashion designers are leading to exclusive, limited-edition collections that attract fashion-conscious consumers.

Top Use Cases

- Everyday Fashion: Costume jewelry serves as an affordable means for individuals to accessorize daily outfits, allowing for frequent style changes without significant financial investment.

- Special Occasions: These pieces offer budget-friendly options for accessorizing during events like weddings and parties, providing elegant looks without the expense of fine jewelry.

- Gift Giving: Due to its affordability and variety, costume jewelry is a popular choice for gifts across various occasions.

- Fashion Experimentation: Consumers utilize costume jewelry to trial new trends and styles, enabling them to stay fashionable without long-term commitments.

- Theatrical and Performance Wear: The entertainment industry often employs costume jewelry to achieve desired aesthetics in productions, benefiting from its versatility and cost-effectiveness.

Major Challenges

- Quality Perception: The association of costume jewelry with lower quality can deter consumers seeking durability, impacting purchasing decisions.

- Market Saturation: An abundance of designs and brands leads to intense competition, making it challenging for companies to differentiate their offerings.

- Allergic Reactions: The use of certain materials may cause skin allergies in some individuals, limiting the potential customer base.

- Environmental Concerns: Non-sustainable production practices can harm the environment, prompting eco-conscious consumers to seek alternatives.

- Counterfeit Products: The prevalence of imitation goods can undermine brand reputation and consumer trust in the market.

Top Opportunities

- Sustainable Practices: Adopting eco-friendly materials and ethical production methods can attract environmentally conscious consumers and enhance brand loyalty.

- Technological Integration: Utilizing augmented reality for virtual try-ons can enhance the online shopping experience, reducing hesitation associated with purchasing jewelry online.

- Emerging Markets: Expanding into developing regions with growing middle classes presents opportunities for market growth.

- Men’s Jewelry Segment: Designing and marketing jewelry specifically for men can tap into an underexplored demographic, diversifying the consumer base.

- Artisanal and Handcrafted Pieces: Offering unique, handcrafted jewelry appeals to consumers seeking individuality and supports local artisans.

Key Player Analysis

The global costume jewelry market in 2024 continues to be shaped by a dynamic mix of established brands and fast-fashion retailers, each leveraging unique strategies to maintain competitive positioning. Pandora and Swarovski remain key leaders, with Pandora focusing on modular and customizable jewelry that appeals to mid-to-premium consumers, while Swarovski emphasizes heritage craftsmanship and crystal embellishments that cater to aspirational buyers.

Fast-fashion giants such as H&M Accessories, Zara Accessories, Forever 21 Accessories, and Mango Accessories offer cost-effective, trend-responsive collections, enabling them to rapidly meet shifting consumer preferences. Meanwhile, specialty retailers like Claire’s, Icing, and Charming Charlie concentrate on youthful demographics and impulse-buying behavior through vibrant in-store experiences. Brands such as BaubleBar and Lovisa are strengthening digital-first strategies and influencer-driven marketing to appeal to younger, socially connected consumers. Accessorize, Topshop Jewelry, Aldo Accessories, and Bijou Brigitte maintain a mid-tier market presence by offering style variety and affordability, emphasizing seasonal collections and fashion alignment.

Top Companies in the Market

- Pandora

- Swarovski

- Claire’s

- H&M Accessories

- Zara Accessories

- BaubleBar

- Charming Charlie

- Forever 21 Accessories

- Topshop Jewelry

- Aldo Accessories

- Accessorize

- Icing

- Lovisa

- Bijou Brigitte

- Mango Accessories

Purchase The Full Report Now at https://market.us/purchase-report/?report_id=135233

Regional Analysis

Asia Pacific Leads Costume Jewelry Market with Largest Market Share of 33.8% in 2024

In 2024, the Asia Pacific region emerged as the leading regional market in the global costume jewelry industry, commanding a dominant market share of 33.8%. The regional market was valued at approximately USD 10.41 billion, underscoring the substantial consumer base and evolving fashion trends across key economies such as China, India, Japan, and South Korea.

The growing influence of pop culture, increasing urbanization, and expanding middle-class population with rising disposable incomes have played a vital role in elevating the demand for affordable fashion accessories, including costume jewelry. Additionally, the proliferation of online retail platforms and aggressive marketing campaigns by regional and international brands have contributed to market expansion.

Recent Developments

- In 2024, Pandora introduced the PANDORA ESSENCE collection as part of its goal to grow into a complete jewellery brand. The new line brings a fresh and elegant style, inspired by soft, flowing shapes found in nature. The 50-piece collection includes a mix of rings, earrings, and necklaces designed for everyday wear. Crafted from sterling silver, 14K gold plating, and cultured pearls, each piece reflects Pandora’s focus on quality and timeless beauty.

- In 2024, Kendra Scott and LoveShackFancy partnered to launch a limited jewellery collection, available from April 17. The collection includes playful and romantic designs such as bow necklaces, heart-shaped lockets, and a charm bracelet. It also features a special edition of the Elisa necklace with a LoveShackFancy twist. Available online, this release is expected to attract strong demand due to its unique style and limited availability.

- In 2023, LVMH made a strategic move by acquiring a majority stake in Platinum Invest Group. The decision was aimed at strengthening Tiffany & Co.’s production capacity. By adding this French jewellery manufacturer to its portfolio, LVMH took steps to support better control over its supply chain and enhance the craftsmanship behind its luxury pieces. This acquisition reflects LVMH’s ongoing focus on quality and brand growth.

Conclusion

The global costume jewelry market is poised for significant growth, driven by rising fashion consciousness, increasing disposable incomes, and the widespread influence of social media and celebrity endorsements. Consumers’ preference for affordable, trend-driven accessories has expanded the market, with e-commerce platforms enhancing accessibility and offering diverse product selections. Notably, the resurgence of bold, maximalist designs, including oversized necklaces and statement earrings, reflects a shift from minimalist styles and aligns with current fashion trends. Additionally, the growing emphasis on sustainability has led manufacturers to adopt eco-friendly materials and ethical production methods, catering to environmentally conscious consumers. Despite challenges such as market saturation and concerns over product quality, the integration of technology, particularly augmented reality for virtual try-ons, presents opportunities to enhance consumer engagement and drive online sales. Overall, the market’s trajectory indicates a dynamic landscape, responsive to evolving consumer preferences and technological advancements.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)