Table of Contents

Overview

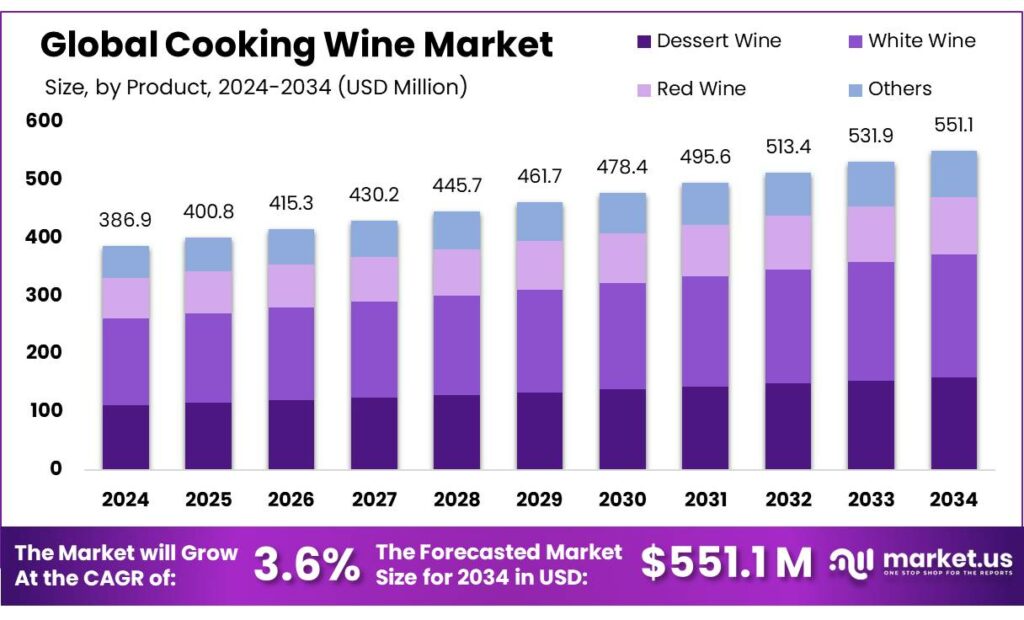

New York, NY – October 01, 2025 – The Global Cooking Wine Market is projected to reach USD 551.1 million by 2034, up from USD 386.9 million in 2024, registering a CAGR of 3.6% between 2025 and 2034. In 2024, North America dominated the market with a revenue share of 42.9%, valued at USD 45.7 million.

India’s cooking wine industry is undergoing a significant shift, fueled by changing consumer habits, government support, and a more diverse culinary culture. Historically, wine consumption in India has been low, with per capita intake averaging only 9 milliliters, a stark contrast to wine-centric countries like France. However, this trend is gradually evolving as urban millennials and the expanding middle class increasingly incorporate wine into their cooking and dining practices.

The state of Maharashtra, particularly the Nashik region, remains the hub of Indian wine production, contributing nearly 90% of the nation’s total output. Government schemes like the Wine Industry Promotion Scheme (WIPS), reintroduced in 2023, offer tax refunds to wineries, boosting competitiveness and encouraging sustainable growth. Similarly, the creation of Agri Export Zones in Nashik, Pune, Sangli, and Solapur has expanded the export opportunities for Indian wines.

Policy support has been central to this transformation. The Ministry of Food Processing Industries (MOFPI) has recognized wineries as part of both the horticulture and food processing sectors, easing licensing procedures and providing capital investment subsidies. These initiatives not only strengthen domestic production but also position India as an emerging player in the global cooking wine market.

Key Takeaways

- The Global Cooking Wine Market size is expected to be worth around USD 551.1 Million by 2034, from USD 386.9 Million in 2024, growing at a CAGR of 3.6%.

- White Wine held a dominant market position, capturing more than a 38.5% share of the cooking wine market.

- The Food Processing Industry held a dominant market position, capturing more than a 45.8% share of the cooking wine market.

- B2B (Business-to-Business) held a dominant market position, capturing more than a 67.3% share of the cooking wine market.

- Europe held a dominant market position in the cooking wine sector, capturing more than a 38.5% share, valued at USD 148.9 million.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/cooking-wine-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 386.9 Million |

| Forecast Revenue (2034) | USD 551.1 Million |

| CAGR (2025-2034) | 3.6% |

| Segments Covered | By Product (Dessert Wine, White Wine, Red Wine, Others), By Application (Food Processing Industry, Food Service, Households), By Distribution Channel (B2B, B2C) |

| Competitive Landscape | AAK AB, Batory Foods, PALMETTO CANNING, ECOVINAL, S.L.U., Iberica Export, Marina Foods, Inc., Stratas Foods, The Kroger Co., Mizkan America Inc., Roland Foods, LLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157488

Key Market Segments

By Product Analysis

White Wine led the cooking wine market in 2024, holding a 38.5% share due to its versatility and widespread use. Its light, crisp, and slightly fruity flavor complements a variety of dishes, including seafood, chicken, pasta sauces, and risottos. The growing preference for healthier, lighter cooking options has boosted demand, as white wine enhances flavors without overpowering dishes. Its accessibility, affordability, and prominence in cuisines like Mediterranean and French solidify its role as a kitchen staple. As global culinary trends evolve, white wine remains a key ingredient in fine dining and gourmet preparations.

By Application Analysis

The Food Processing Industry dominated the cooking wine market in 2024, capturing a 45.8% share. This growth is fueled by the rising use of cooking wines in ready-to-eat meals, sauces, and other processed foods. Mild-flavored wines, such as white wine, are favored for their ability to enhance taste while ensuring consistency in large-scale production. The long shelf life of cooking wines makes them ideal for processed and packaged foods. As demand for convenient, flavorful food grows, particularly in emerging markets, the industry’s reliance on cooking wines to add depth without excess fat or calories ensures continued market strength.

By Distribution Channel Analysis

In 2024, B2B transactions dominated the cooking wine market with a 67.3% share, driven by strong demand from the foodservice and wholesale sectors. Restaurants, catering companies, and food manufacturers rely on bulk purchases of cooking wine to meet operational needs at competitive prices. The rise in consumer demand for restaurant-quality flavors has spurred B2B sales, as businesses incorporate cooking wines to elevate menus. The convenience and cost-effectiveness of B2B channels ensure their continued dominance as the foodservice industry seeks to deliver sophisticated, high-quality dishes.

Regional Analysis

Europe led the global cooking wine market, securing a 38.5% share with a valuation of USD 148.9 million. This dominance stems from the region’s deep-rooted culinary traditions, where cooking wines are essential in both traditional and contemporary cuisines. Countries like France, Italy, and Spain, known for their extensive wine production, naturally drive significant consumption of cooking wine in households and professional kitchens alike.

The region’s thriving foodservice industry, encompassing upscale restaurants, catering services, and food processing, fuels substantial demand for cooking wine. The growing trend of gourmet cooking and fine dining further solidifies wine’s role as a key culinary ingredient. Additionally, Europe’s focus on healthy and natural cooking practices boosts the preference for wines that enhance flavors without relying on excess fats or artificial additives.

Top Use Cases

- Enhancing Meat Dishes: Cooking wine tenderizes tough cuts of meat while adding depth of flavor through slow braising or marinating. In classic recipes like chicken with mushrooms or beef stews, a splash of red wine breaks down proteins, creating juicy results that soak up savory notes. Home cooks love how it turns simple meals into restaurant-quality favorites, making weeknight dinners feel special without much effort.

- Building Flavorful Sauces: A key ingredient in reductions and pan sauces, cooking wine deglazes skillets to lift browned bits for rich gravies. White varieties brighten cream-based options for seafood, while reds deepen tomato or mushroom blends. This quick technique elevates everyday proteins, helping busy families craft glossy finishes that impress guests effortlessly.

- Brightening Seafood and Poultry: Light white cooking wines cut through richness in poaching fish or simmering chicken, preventing dryness and infusing subtle acidity. They pair perfectly with herbs and citrus, as in lemony shrimp sautés or herb-roasted birds. Cooks appreciate the fresh lift it gives to lean proteins, turning basic recipes into vibrant, light meals.

- Creating Creamy Risottos and Pastas: Stirring cooking wine into rice or noodles early on evaporates alcohol while concentrating fruity undertones for creamy textures. It’s ideal for Italian-inspired sides, where it balances cheese and butter without overpowering. Aspiring chefs find it simplifies gourmet carbs, adding elegance to comfort foods in just one pot.

- Adding Zest to Asian Stir-Fries: In quick wok dishes, a dash of fortified cooking wine like Shaoxing tenderizes veggies and meats while mellowing garlic and ginger. It brings authentic umami to fried rice or vegetable medleys, helping fusion fans blend bold spices. This versatile boost makes home Asian cooking faster and more flavorful for all skill levels.

Recent Developments

1. AAK AB

AAK has recently focused on developing plant-based fat and oil solutions that enhance the flavor profile of ready meals and sauces, including those using cooking wine. Their recent initiatives highlight creating specialized oil systems that can carry and stabilize wine flavors during cooking, reducing bitterness and improving mouthfeel. This allows food manufacturers to achieve a more consistent and high-quality taste in their final products, catering to the growing demand for gourmet convenience foods.

2. Batory Foods

Batory Foods has expanded its capabilities in flavor delivery by integrating advanced liquid seasoning and wine-based marinades into its custom ingredient solutions. A key recent development is their work on reducing alcohol content in cooking wines while preserving the authentic flavor through proprietary dealcoholization techniques. This addresses the demand for nuanced flavors in retail and foodservice products without the associated alcohol, focusing on versatile, shelf-stable options for manufacturers.

3. PALMETTO CANNING

Palmetto Canning, known for its vinegar-based pepper sauces, has recently explored line extensions by incorporating cooking wines and sherries into its product development. Their focus is on creating small-batch, Southern-inspired marinades and braising liquids that use wine as a base. This development aims to leverage their brand reputation to offer all-natural, gluten-free cooking aids that provide authentic regional flavors for both home cooks and specialty food service providers.

4. ECOVINAL, S.L.U.

As a Spanish agri-food company, ECOVINAL has recently invested in sustainable production methods for its wine-derived food ingredients. Their developments include launching a new line of concentrated wine musts and alcohol-free wine reductions specifically for industrial food manufacturing. These products are designed to provide a consistent, sulfite-reduced, and intense flavor for sauces, dressings, and ready-to-eat dishes, aligning with the clean-label trend and the demand for authentic Spanish culinary ingredients.

5. Iberica Export

Iberica Export has recently strengthened its position by promoting authentic Spanish cooking wines, such as Sherry and Rioja, for gourmet applications. A key development is their new educational initiative targeting international chefs and distributors, focusing on the Denomination of Origin (D.O.) status of their products and their proper culinary use. They are also expanding their portfolio to include convenient, smaller-format bottles for the retail sector, making authentic Spanish cooking wines more accessible globally.

Conclusion

Cooking Wine is evolving from a basic pantry staple into a must-have for flavor explorers in modern kitchens. With home cooks embracing global recipes and healthier twists, its role in tenderizing, deglazing, and infusing dishes is more vital than ever. Trends toward organic options and easy pairings reflect a broader love for simple gourmet touches, promising steady appeal as lifestyles prioritize quick, tasty meals. This ingredient not only unlocks endless creativity but also bridges everyday eating with culinary adventure, solidifying its spot in vibrant food cultures worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)