Table of Contents

Overview

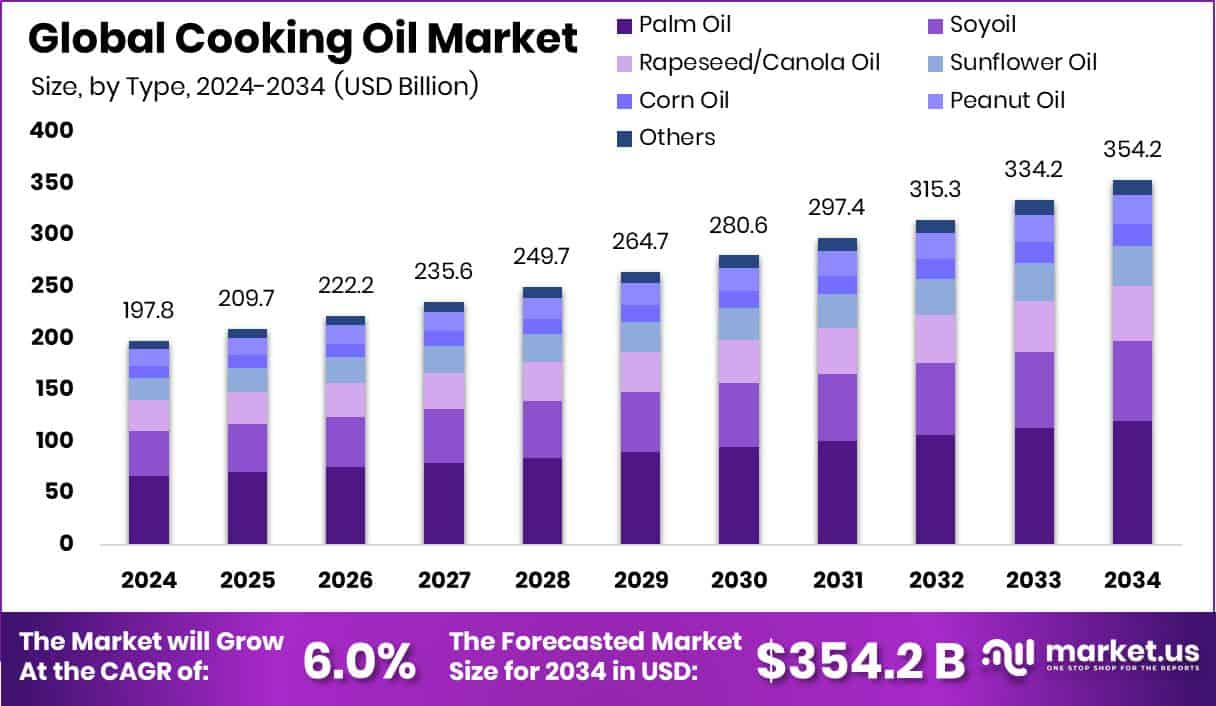

New York, NY – Aug 05, 2025 – The global cooking oil market is projected to reach approximately USD 354.2 billion by 2034, rising from USD 197.8 billion in 2024, with a compound annual growth rate (CAGR) of 6.0% between 2025 and 2034. In North America, strong demand from both households and food service establishments has driven the market to a value of USD 73.7 billion.

The cooking oil market encompasses the global production, trade, and consumption of various edible oils for household and commercial use. It includes refined, unrefined, blended, and fortified oils supplied through retail packages, industrial bulk formats, and specialty dietary options. For instance, India’s edible oil import bill is set to rise by $2 billion, underscoring the growing focus on domestic and alternative oil sources.

Health and wellness trends are reshaping the industry, with consumers seeking oils low in saturated fats and rich in nutrients like omega-3 and vitamin E. Companies are responding by developing healthier, functional oils. For example, No Palm Ingredients recently raised €5 million to scale up its palm oil alternative operations, signaling industry momentum toward sustainable, health-conscious solutions.

Innovation and eco-conscious production are also key growth areas. As sustainability becomes a priority, producers are turning to environmentally friendly practices and developing nutrient-rich oil blends. Notably, GrainCorp’s venture capital arm invested $1.2 million in a synthetic palm oil startup, reflecting the industry’s increasing support for green alternatives and product innovation.

Key Takeaways

- The global cooking oil market is projected to reach USD 354.2 billion by 2034, rising from USD 197.8 billion in 2024, with a CAGR of 6.0% from 2025 to 2034.

- Palm oil leads the product segment with a 33.8% share, driven by its affordability and wide usage.

- Conventional oils dominate the market with a 91.2% share, indicating strong consumer preference for standard cooking options.

- Refined oils account for 86.3% of the market, valued for their clarity, longer shelf life, and consistent performance in cooking.

- Food service outlets contribute to 41.4% of total demand, fueled by the rising popularity of commercial and quick-service food establishments.

- Hypermarkets and supermarkets hold a 38.1% share, supported by broad product availability and competitive pricing.

- North America recorded a market value of USD 73.7 billion, reflecting robust and steady regional consumption.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-cooking-oil-market/free-sample/

Report Scope

| Market Value (2024) | USD 197.8 Billion |

| Forecast Revenue (2034) | USD 354.2 Billion |

| CAGR (2025-2034) | 6.0% |

| Segments Covered | By Type (Palm Oil, Soyoil, Rapeseed/Canola Oil, Sunflower Oil, Corn Oil, Peanut Oil, Others), By Nature (Organic, Conventional), By Category (Refined, Unrefined), By Application (Food Service Outlets, Household, Food Processing), By Sales Channel (Hypermarkets and Supermarkets, Departmental Stores, Discount Stores, Online Stores, Convenience Stores, Others) |

| Competitive Landscape | Archer Daniels Midland Company, Associated British Foods Plc, Bunge Limited, Cargill, Incorporated, CJ Cheiljedang Corporation, ConAgra Brands, Inc., Fuji Oil Company, Ltd., George Weston Foods Limited, IFFCO Group, Nutiva, Olam International Limited, Ottogi Co. Ltd., Sime Darby Plantation, Wilmar International Limited |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153193

Key Market Segments

By Type Analysis

Palm oil dominates the market with a 33.8% share.

As of 2024, palm oil leads the cooking oil market with a 33.8% share, thanks to its wide availability, affordability, and versatility in cooking. Its neutral flavor and high oxidative stability make it ideal for frying, baking, and food processing. The oil’s long shelf life and cost efficiency also make it popular in price-sensitive regions and large-scale food industries.

By Nature Analysis

Conventional oils command 91.2% of the market.

In 2024, conventional cooking oils held a commanding 91.2% share, supported by mass production, lower cost, and familiarity. Produced using traditional methods, these oils are widely available and preferred for everyday cooking in households and commercial kitchens alike. Their ease of access and affordability continue to drive market dominance globally.

By Category Analysis

Refined oils lead with 86.3% of global consumption.

Refined oils made up 86.3% of the market in 2024. Their popularity stems from being clear, odor-free, and suitable for high-heat cooking. The refining process enhances shelf life and removes impurities, making these oils a staple for consumers, restaurants, and food manufacturers who prioritize consistency, hygiene, and quality.

By Application Analysis

Food service outlets account for 41.4% of demand.

Food service establishments, including restaurants and catering businesses, drove 41.4% of market demand in 2024. These businesses rely on durable, high-performing oils for frying and frequent cooking. The need for bulk, stable supply in commercial kitchens continues to position this sector as a leading application area in the cooking oil market.

By Sales Channel Analysis

Hypermarkets and supermarkets hold a 38.1% market share.

Hypermarkets and supermarkets remained the top retail channels in 2024, capturing 38.1% of cooking oil sales. These stores offer a wide selection, competitive pricing, and convenient access, making them popular with consumers. Their reach across urban and semi-urban areas, along with frequent promotional offers, drives consistent market engagement.

Regional Analysis

North America led the global cooking oil market in 2024 with a 37.3% share.

In 2024, North America held the largest share of the global cooking oil market at 37.3%, translating to a market value of USD 73.7 billion. This dominance is driven by high usage across households and commercial foodservice operations, where refined and processed oils are commonly used in everyday cooking and large-scale food production.

Other key regions include Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe maintains stable demand due to its established food processing sector. Asia Pacific offers strong growth potential due to its large population and changing dietary habits. In Latin America and the Middle East & Africa, increasing urbanization and income levels are gradually boosting consumption, signaling long-term market opportunities in these emerging regions.

Top Use Cases

1. Health‑focused and Functional Oils: With rising health awareness, over 40% of households now prefer heart‑healthy oils enriched with omega‑3 and omega‑6 fatty acids. Demand for organic, cold‑pressed, virgin oils is up, pushing brands to launch functional blends and fortified products that support cardiovascular health.

2. Commercial Foodservice & Processing Demand: The food processing, restaurant, and hotel sectors drive cooking oil use. These institutional buyers consume bulk volumes, particularly conventional oils and palm oil, benefiting from low cost and high thermal stability in frying and baking operations worldwide.

3. Retail Expansion & Premium Shelf Space: Retail shelves for premium cooking oils have grown by 14% year-over-year, increasing visibility for gourmet oils like avocado and olive. Supermarkets and hypermarkets are expanding choices, attracting consumers seeking quality and variety in packaged oil offerings.

4. Geographical Trends & Coverage: Asia‑Pacific leads globally and is forecasted to remain dominant through 2033. This is propelled by population growth, urbanization, and changing dietary patterns, making the region the fastest-growing market for both classic and innovation-driven cooking oil types.

5. Sustainable & Alternative Oil Innovations: Sustainable oils such as microalgae‑based or synthetic oils are gaining traction in fine dining and eco‑conscious markets. Though production costs remain high, their lower carbon footprint and neutrality are attracting chefs and early adopters worldwide.

6. Used Cooking Oil & Circular Economy Applications: The used cooking oil market, projected to grow by around 5% CAGR, is increasingly used for biodiesel production, animal feed, and oleochemical applications. This reflects the expanding role of recycling and sustainability in the broader cooking oil ecosystem.

Recent Developments

Archer Daniels Midland Company (ADM): In mid‑2025, ADM announced the permanent closure of its soybean processing facility in Kershaw, South Carolina a move tied to its broader cost‑reduction strategy targeting USD 500-750 million savings over the next 3‑5 years. Earlier in July, ADM also shut its Brazil pet food plant as part of operations consolidation. These measures reflect ADM’s response to weakening crush margins, volatile commodity prices, and biofuel policy uncertainty, while shifting its focus toward core edible oil and vegetable processing operations.

Cargill, Incorporated: Cargill recently reached 50% completion on a new canola processing facility in Regina, Saskatchewan a plant capable of handling 1 million metric tons annually for food and biofuel markets, expected online in 2025. Additionally, as of January 2024, Cargill became the first global edible oil supplier to fully comply with WHO’s iTFA elimination standards, earning the top ranking on the 2025 Oil Supplier Index. These steps underline Cargill’s commitment to sustainable refining, clean‑label practices, and global edible oil innovation.

Bunge Limited: Bunge has invested over USD 300 million to expand its edible oil processing facility at the Port of Amsterdam, enhancing operational flexibility and sustainability. The upgraded plant enables Bunge to supply a broader portfolio of culinary oils including rapeseed and sunflower oils with a stronger commitment to traceability and eco-friendly sourcing across Europe. This facility is expected to support growing demand from both foodservice and packaged-food sectors.

Fuji Oil Company, Ltd.: Fuji Oil continues to invest in science-centered edible oil innovation. In 2025, the company expanded its product development ecosystem, with R&D units focused on cold-pressed and high-oleic oils, plant-based spreads, and specialty fats. It bolstered its position among the top 10 global cooking-oil manufacturers and plans to introduce new premium cooking oils to serve rapidly changing consumer tastes in Asia‑Pacific and beyond.

Wilmar International Limited: In mid‑2025, Wilmar International paid IDR 11.8 trillion (≈ US $725M) to Indonesian authorities amid a corruption investigation linked to the 2021 cooking oil export permit crisis. Although previously acquitted, the case is now under review by the Indonesian Supreme Court. Meanwhile, Wilmar acquired a 20% majority stake in AWL Agri Business Ltd (formerly Adani Wilmar) following Adani Group’s exit signifying deeper integration into India’s edible oil market. Wilmar also plans to scale its palm oil operations in Nigeria as economic conditions stabilize.

Olam International Limited: Olam has restructured its edible oil business into a focused arm, Olam Agri (Olam Agri Ltd), consolidating its edible oil refinery assets in Mozambique and sugar operations in India. In early 2025, it signed an agreement for SALIC to acquire its remaining 64.57% stake in Olam Agri for US $2.58 billion, valuing the unit at US $4.0 billion. Olam is also investing US $500 million in its food ingredients segment, which includes edible oils, as part of its long-term strategic shift toward high-margin products.

ConAgra Brands, Inc.: Although primarily known for its cooking sprays like PAM, ConAgra recently faced a high-profile lawsuit. In October 2023, a consumer was awarded US $7.1 million in damages after experiencing burns from an allegedly defective cooking oil can. While not directly tied to cooking oils in bulk, it underscores the reputational risk facing food brands associated with edible oil products. No new edible oil product launches were reported in 2024-2025.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)