Table of Contents

Introduction

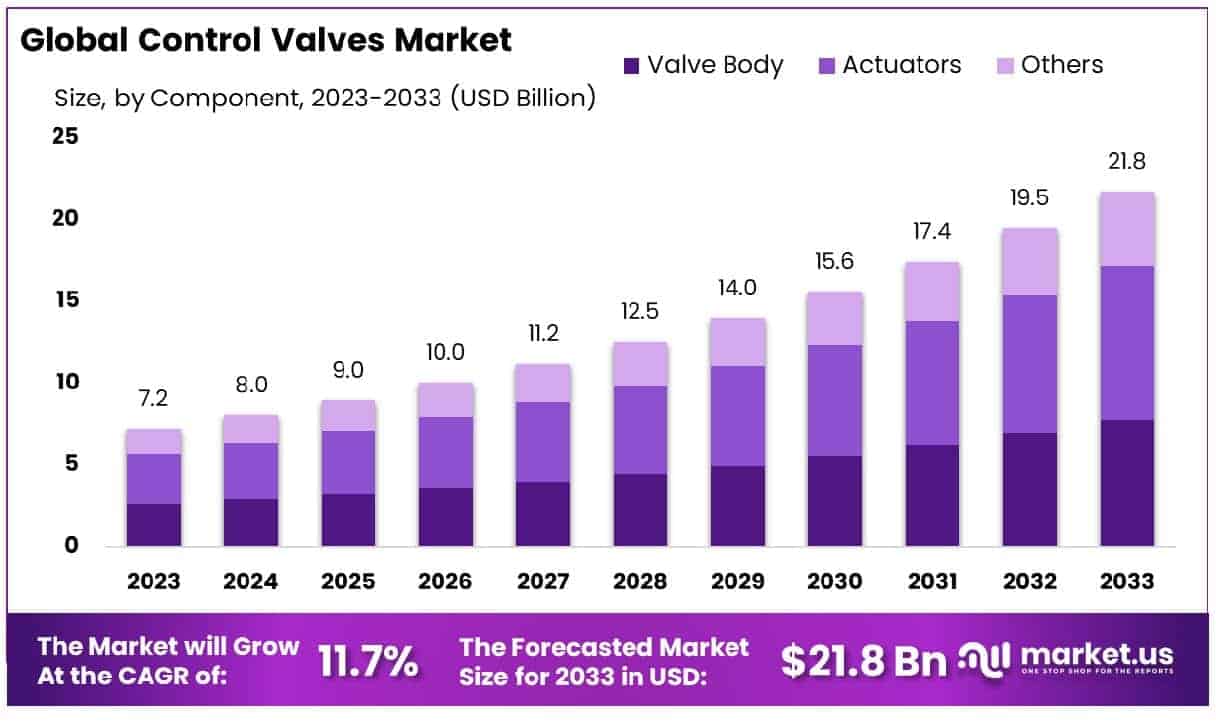

The Global Control Valves Market is projected to expand significantly, growing from USD 7.2 billion in 2023 to an estimated USD 21.8 billion by 2033. This represents a compound annual growth rate (CAGR) of 11.70% over the forecast period from 2024 to 2033.

A control valve is a vital component in various industries, designed to regulate the flow and pressure within a system by modifying the size of the flow passage as directed by a signal from a controller. This adjustment maintains the desired set point in a process value, such as temperature, pressure, or flow rate.

The control valve market, therefore, caters to sectors that require precise control over environmental conditions, including but not limited to oil and gas, water management, chemicals, and pharmaceuticals. Growth in the control valve market is primarily driven by the increasing need for automation across industries and the push for more efficient process control to enhance safety, reduce waste, and increase production efficiency.

Rising industrialization in emerging economies and enhancements in technology such as the integration of IoT and smart controls are boosting demand. This market presents numerous opportunities for innovation, particularly in developing smart, energy-efficient valve solutions that comply with stringent environmental regulations and cope with varying pressures and temperatures. This is crucial for expanding market outreach and catering to a broader range of industrial applications, positioning the control valve market for significant expansion and transformation.

Key Takeaways

- The control valves market is projected to grow significantly, reaching an estimated value of USD 21.8 billion by 2033, up from USD 7.2 billion in 2023, with a compound annual growth rate (CAGR) of 11.70% from 2024 to 2033.

- Actuators are crucial components in the control valves market, representing 43.4% of the overall market share. Their significant proportion highlights their essential function in the operation of control valves, facilitating movement and control mechanisms that are integral to various industrial processes.

- Valves ranging in size from 1 to 6 inches make up 32.4% of the market share. This size range is particularly favored in various applications due to its versatility and efficiency in handling moderate flow rates, making it suitable for a wide range of industrial uses.

- Linear control valves hold a substantial 64.5% share of the product market. This prominence is indicative of their widespread application in industries where precise control of flow rate, pressure, or temperature is critical, such as in chemical processing and water management.

- The oil and gas sector remains a significant application area for control valves, holding a 24.2% share of the market. The critical role of control valves in oil and gas operations, where they regulate flow and pressure in pipelines and processing facilities, underscores their importance in this industry.

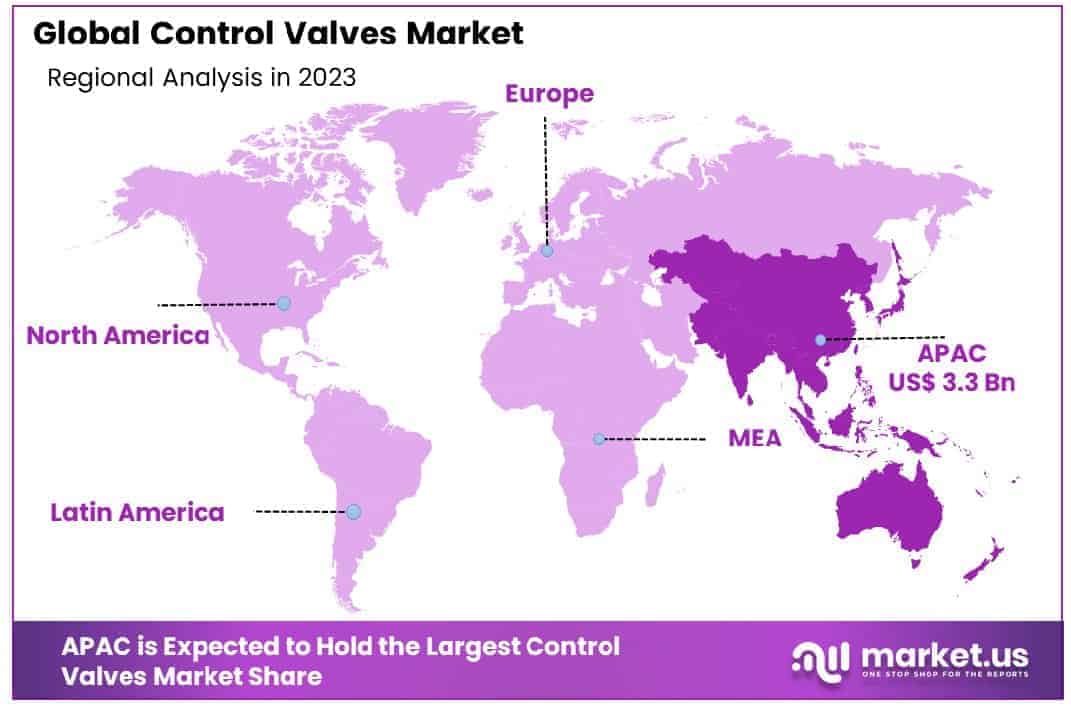

- The Asia-Pacific region holds a commanding lead in the global control valves market, with a substantial market share of 45.8%. This dominance underscores the region’s pivotal role in driving demand and innovation in the control valves sector, likely due to increasing industrial activities and infrastructure development across key Asian economies.

Key Segments Analysis

- In 2023, the control valves market was segmented into Valve Body, Actuators, and Others. Actuators dominated the market, holding a significant 43.4% share due to their crucial role in valve operation and control, spurred by increased automation in industries like water and wastewater, oil and gas, and power generation. The Valve Body and Others categories also contributed to the market, with Valve Body being substantial but less than Actuators, and Others encompassing essential accessories and components, reflecting the industry’s move towards more advanced and efficient control systems.

- In 2023, the control valves market was segmented by size into categories including Less than 1 inch, Between 1 to 6 inches, Between 6 to 25 inches, Between 25 to 50 inches, and More than 50 inches. Valves sized between 1 to 6 inches held the largest share at 32.4%, reflecting their broad utility and versatility across multiple industries such as water management, chemicals, and pharmaceuticals. These medium-sized valves are favored for their ideal balance of control precision and flow capacity, essential for most medium-scale applications, while the other size categories cater to more specific needs for different flow rates, underscoring the central role of medium-sized valves in enhancing operational efficiency and system optimization across diverse sectors.

- In 2023, the control valves market featured a diverse range of products including Linear, Gate, Diaphragm, Rotary, Ball, Butterfly, and Plug valves, with Linear products leading significantly by holding a commanding 64.5% market share. This substantial lead underscores their versatility and precision in regulating flow, making them particularly suitable for critical applications in water treatment, chemical manufacturing, and oil and gas production. Linear valves’ design allows for straight-line movement which facilitates precise control, cementing their preference over other types for ensuring operational efficiency and accuracy across various industrial processes

- In 2023, the control valves market was segmented by applications including Oil & Gas, Chemicals, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Pharmaceuticals, and Others, with Oil & Gas leading at a 24.2% share. This prominent share highlights the essential role of control valves in the oil and gas industry’s operational processes such as exploration, extraction, refining, and transportation. The sector’s reliance on precise and robust flow control solutions exemplifies its significant influence on market trends and technological advancements in control valve applications, despite the strong presence of other sectors.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 7.2 Billion |

| Forecast Revenue (2033) | USD 21.8 Billion |

| CAGR (2024-2033) | 11.70% |

| Segments Covered | By Component(Valve Body, Actuators, Others), By Size(Less than 1, Between 1 to 6, Between 6 to 25, Between 25 to 50, More than 50), By Product(Linear, Gate, Diaphragm, Others, Rotary, Ball, Butterfly, Plug), By Application(Oil & Gas, Chemicals, Energy & Power, Water & Wastewater Treatment, Food & Beverages, Pharmaceuticals, Others) |

| Competitive Landscape | Emerson Electric Co., Flowserve Corporation, Schlumberger Limited, General Electric Company, Honeywell International Inc., Metso Corporation, IMI plc, Spirax-Sarco Engineering plc, Crane Co., Velan Inc., Samson AG, Rotork plc. |

Emerging Trends

- Digital and IoT Integration: The integration of the Industrial Internet of Things (IIoT) with control valves is transforming their operation. With connected devices, valves can now communicate seamlessly with other systems, allowing for predictive maintenance and improved process control.

- Advancements in Materials: There’s a growing trend towards using non-metallic materials like ceramics and advanced polymers in valve manufacturing. These materials offer superior corrosion resistance and can reduce the overall weight of the valves, making them suitable for a wider range of applications.

- 3D Printing: Additive manufacturing is revolutionizing the production of control valves by allowing for the creation of complex designs that were previously impossible or too expensive to manufacture. This technology also supports rapid prototyping and customization of valves to specific requirements.

- Environmental Sustainability: Valve manufacturers are increasingly focusing on reducing environmental impact by developing energy-efficient designs and incorporating sustainable materials and manufacturing processes. This shift is driven by global environmental concerns and the need for more sustainable industrial practices

Top Use Cases

- Water Management: Control valves play a critical role in managing water distribution in municipal and industrial settings, helping to regulate flow and pressure within water treatment and distribution systems.

- Energy Production: In power plants, control valves are essential for regulating steam and water flow, ensuring efficient and safe energy production.

- Oil and Gas Industries: Control valves are used extensively in the oil and gas industry to manage the flow of oil and gas through pipelines and into processing equipment.

- Chemical Processing: The chemical industry relies on control valves to control the flow of various chemicals through reactors, filters, and other processing equipment.

- Food and Beverage Production: In the food and beverage industry, control valves help maintain the flow and mix of ingredients, manage steam for sterilization, and control cooling systems.

Major Challenges

- Wear and Tear: Regular use subjects control valves to wear and tear, which can lead to leaks and operational inefficiencies, requiring frequent maintenance and replacement.

- Complex Installation and Maintenance: The installation and maintenance of control valves can be complex due to their sophisticated designs and the critical nature of their function, requiring specialized skills and training.

- Adapting to New Materials and Technologies: As new materials and technologies become prevalent, there’s a challenge in adapting existing systems and training personnel to handle these innovations effectively.

- Regulatory Compliance: Control valves must meet various international standards and regulations, which can vary widely by region and application, posing a significant challenge in design and implementation.

- Environmental Impact: Reducing the environmental impact of control valves, including issues related to emissions and energy usage, remains a persistent challenge.

Top Opportunities

- Expansion in Emerging Markets: Increasing industrialization in developing countries presents significant opportunities for the expansion of control valve applications, particularly in water and wastewater treatment, energy, and manufacturing sectors.

- Innovation in Valve Technologies: There is an opportunity for manufacturers to lead in innovation, developing smarter, more efficient control valves that integrate seamlessly with automated systems and IoT.

- Healthcare and Pharmaceuticals: As these sectors continue to grow, there’s an increasing demand for precise and reliable control valves to manage fluids and gases in various medical and pharmaceutical applications.

- Renewable Energy Projects: The global shift towards renewable energy sources like wind, solar, and bioenergy creates new opportunities for control valves in managing flow rates and operational efficiencies in these technologies.

- Aftermarket Services: Providing comprehensive service and maintenance options can offer a steady revenue stream for manufacturers while ensuring optimal performance and longevity of installed control valves in various industries.

Key Player Analysis

- Emerson Electric Co.: Emerson stands out in the control valve market with a significant focus on innovation and customer-centric solutions, particularly for industries such as oil & gas and power generation. They are a key player with a strong emphasis on technological advancements, which help them maintain a substantial market presence. Emerson’s market strategies often involve the release of new, advanced products, like the Fisher FIELDVUE DVC7K digital valve controller, enhancing their competitive edge.

- Flowserve Corporation: Known for its resilience and strategic expansions, Flowserve has been proactive in diversifying its product offerings and extending its geographical reach. This adaptability has solidified its status as a trusted name in control valve solutions across multiple sectors globally. The company’s efforts are geared towards enhancing operational efficiencies and leveraging technological innovations.

- Schlumberger Limited: Schlumberger, primarily recognized for its expertise in oilfield services, plays a pivotal role in the control valves sector with solutions tailored for high-performance and reliability in oil and gas applications. Their approach combines robust technology with extensive industry knowledge, positioning them as a preferred provider for specialized control valve needs.

- Honeywell International Inc.: Honeywell is pivotal in the development and implementation of control systems and technologies. With a broad portfolio that includes actuators and valve bodies, Honeywell focuses on sectors like aerospace, building technologies, and performance materials, thereby enhancing their offerings in the control valves market.

- General Electric Company: GE leverages its vast technological expertise to offer innovative control valve solutions, particularly emphasizing energy efficiency and reduced environmental impact. Their products are designed to meet the demands of a variety of industries, including power generation and water treatment, which are critical areas of focus for the company

Regional Analysis

Asia-Pacific Leads the Control Valve Market with the Largest Market Share of 45.8%

The control valve market in the Asia-Pacific region has demonstrated robust growth, reflecting a commanding market share of 45.8% in 2023. Valued at USD 3.3 billion, the region’s market is fueled by rapid industrialization and increasing investments in infrastructure and energy sectors. Asia-Pacific stands out as the dominant region, driven by significant advancements in manufacturing capabilities and technological innovation.

Countries like China, Japan, and India are spearheading the regional demand, supported by their expanding oil and gas industries, which necessitate sophisticated control valve solutions for operational efficiency and safety. The strategic push towards modernizing process industries and the adoption of automation technologies across various sectors further amplify the regional market’s expansion, positioning Asia-Pacific at the forefront of the global control valve landscape.

Recent Developments

- 2023 – HMS Networks AB (publ), an international leader in industrial ICT, has officially agreed to acquire Red Lion Controls from Spectris Group Holdings Limited. This purchase includes all shares of Red Lion Controls Inc. and Red Lion Europe GmbH, along with certain assets in other regions, marking a significant expansion for HMS in the North American market and enhancing its product lineup.

- July 6, 2023 – Mami, a pioneer in multi-sensing platforms for the IoT sector, has successfully completed a Series A funding round, securing $10.5 million. Key investors include Verizon Ventures, Amavi Capital, INSPiRE, and Aconterra, bolstering nami’s position in the IoT ecosystem.

- October 31, 2024 – AMETEK, Inc. has announced its acquisition of Virtek Vision International, a top producer of laser-based projection and inspection systems. Virtek’s offerings, which include 3D laser projectors and AI-enhanced smart cameras, help streamline complex manufacturing processes in aerospace, defense, and other industries.

- October 29, 2024 – StoneTree Investment Partners has invested in Viking Engineering & Development, a premier provider of automated assembly systems based in Blaine, MN. Since 1975, Viking has led the market in creating equipment for the wood pallet and bed frame sectors, offering comprehensive services from installation to remote machine monitoring.

- November 5, 2024 – Integrated Water Services, Inc. (IWS) has acquired Hi-Line Industries, known for its bespoke water and wastewater treatment equipment. This move supports IWS’s strategy to provide complete solutions in North America, backed by Sciens Water.

- 2024 – Siemens has reached an agreement to purchase Altair Engineering Inc. for USD 113 per share, totaling around USD 10 billion. This acquisition enables Siemens to further solidify its role as a powerhouse in industrial software, offering a premium of 19% over Altair’s last unaffected stock price.

Conclusion

The control valve market is poised for substantial growth over the next decade, fueled by rapid industrialization in emerging markets and significant advancements in technology. As industries increasingly adopt automation to improve process efficiencies and ensure environmental compliance, the demand for innovative control valve solutions is expected to rise. This sector’s expansion is further supported by the integration of smart technologies and IoT, which enhance operational functionality and efficiency. Moreover, the move towards using non-traditional materials such as ceramics and advanced polymers in valve manufacturing addresses the need for more durable and lightweight components. Overall, the control valve market is set to transform significantly, offering numerous opportunities for development and innovation across various applications, from water management to energy production and beyond.