Table of Contents

Overview

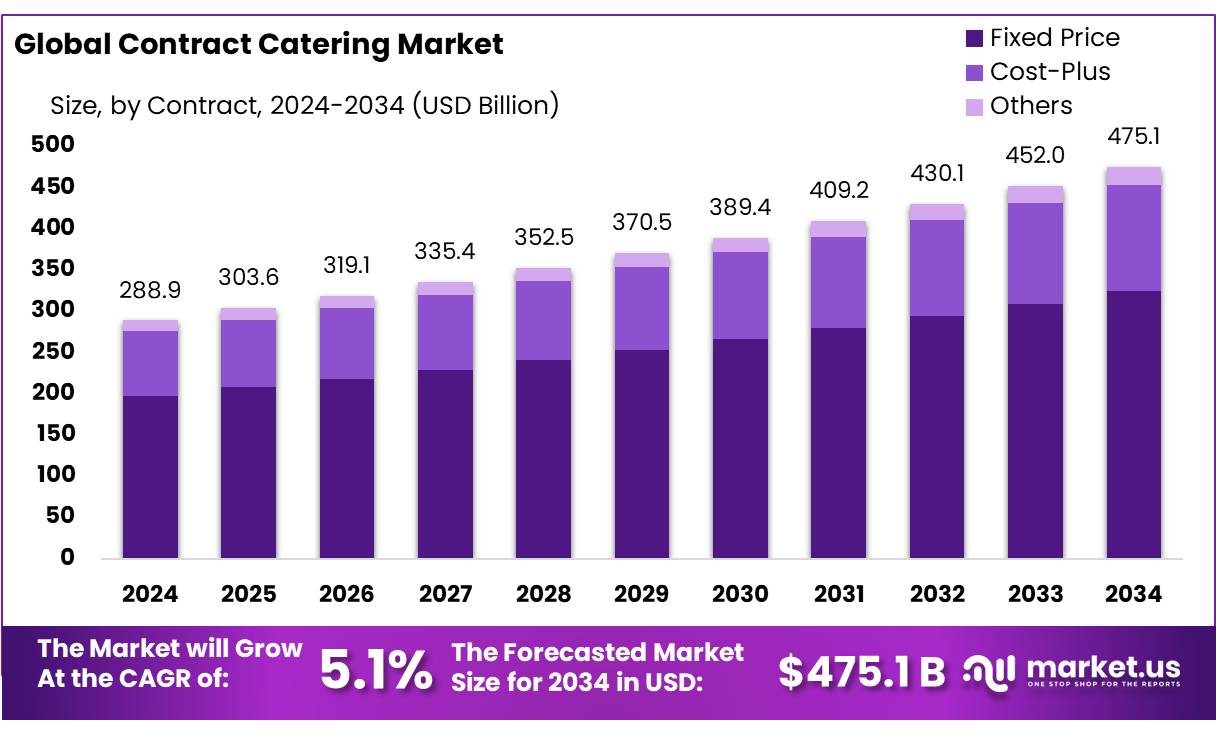

New York, NY – August 06, 2025 – The Global Contract Catering Market is projected to reach approximately USD 475.1 billion by 2034, growing from USD 288.9 billion in 2024, with a compound annual growth rate (CAGR) of 5.1% during the forecast period from 2025 to 2034. In 2024, the Asia-Pacific (APAC) region led the market, securing a 38.6% share and generating USD 4.6 billion in revenue.

Contract catering concentrates are compact, bulk food products, such as soups, sauces, and drink bases, designed for large-scale institutional or corporate kitchens. These concentrates enhance operational efficiency by minimizing preparation time, ensuring consistent quality, and maintaining food safety standards. They are widely used in institutional settings, including healthcare facilities, educational institutions, and corporate offices, as essential components of outsourced catering services.

Government programs, such as India’s Skill India campaign, have significantly contributed to the growth of the contract catering industry. Skill India aimed to train over 400 million individuals in industry-relevant skills, boosting workforce employability in sectors like hospitality and catering. Additionally, government efforts to enhance infrastructure and promote tourism in smaller cities have extended catering services beyond major metropolitan areas, creating new market opportunities.

Supportive policies promoting energy efficiency and clean energy indirectly bolster the contract catering sector. For example, India’s National Mission for Enhanced Energy Efficiency (NMEEE) targets a capacity addition of 19,598 MW across industries, achieving annual fuel savings of approximately 23 million tonnes and reducing emissions by 98.55 million tCO2 per year.

The Bureau of Energy Efficiency’s Perform, Achieve, Trade scheme encourages energy-saving practices, which are readily adopted by centralized concentrate producers. Similarly, the Maharashtra Energy Development Agency (MEDA), under India’s Energy Conservation Act (2001), has implemented energy-efficient programs, such as street lighting and building retrofits, fostering a regulatory environment that supports efficiency investments in food processing facilities.

Key Takeaways

- Contract Catering Market size is expected to be worth around USD 475.1 Billion by 2034, from USD 288.9 Billion in 2024, growing at a CAGR of 5.1%.

- Fixed Price held a dominant market position, capturing more than 68.4% share of the global contract catering market.

- Standard Menu held a dominant market position, capturing more than a 42.9% share in the contract catering market.

- Corporate/Office Catering held a dominant market position, capturing more than a 34.8% share of the global contract catering market.

- The North American contract catering market is a pivotal segment within the global food service industry, commanding a substantial share of approximately 47.2%, valued at USD 136.3 billion.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/contract-catering-market/request-sample/

Report Scope

| Market Value (2024) | USD 288.9 Billion |

| Forecast Revenue (2034) | USD 475.1 Billion |

| CAGR (2025-2034) | 5.1% |

| Segments Covered | By Contract (Fixed Price, Cost-Plus, Others), By Menu Type (Standard Menu, Customized/Bespoke Menu, Buffet/Cafeteria Style, Others), By End-User (Corporate/Office Catering, Education Catering, Healthcare Catering, Defense and Offshore Catering, Sports and Leisure Catering, Travel Catering, Others) |

| Competitive Landscape | United Enterprises Co. Ltd., Elior Group SA, Aramark Corporation, CH&Co Catering Group Limited, Mitie Group plc, Sodexo S.A., Rhubarb Food Design Limited., AVI Foodsystems, Inc., Culinary Service Types Group, Hospital Housekeeping Systems (HHS), Maxx Hospitalities & Catering Service Type, Metz Culinary Management, Prince Food Systems, Red bean Hospitality |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153515

Key Market Segments

Contract Type Analysis

In 2024, Fixed Price contracts commanded a 68.4% share of the global contract catering market, making them the preferred choice for organizations seeking stable budgeting. This model locks in service costs upfront, shielding clients from fluctuations in ingredient prices, labor costs, or operational expenses.

Its reliability has made it a top pick for government agencies, schools, and corporate offices, where predictable financial planning is essential. Post-pandemic, businesses have increasingly favored Fixed Price contracts to ensure cost certainty and operational continuity. This structure also allows caterers to optimize operations, forecast revenue accurately, and secure long-term supplier deals. priorities.

Menu Type Analysis

In 2024, Standard Menu captured a 42.9% share of the contract catering market, dominating in workplaces, hospitals, and schools where nutrition, simplicity, and portion control are critical. With predefined meal options, this format enables caterers to streamline inventory, ensure food safety, and maintain consistent quality in large-scale operations.

Clients benefit from predictable costs, making it ideal for budget-constrained institutions. Its popularity in 2024 was boosted by compatibility with centralized production, which minimizes waste and enhances kitchen efficiency.

End-User Analysis

In 2024, Corporate/Office Catering accounted for a 34.8% share of the global contract catering market, fueled by a focus on employee wellness, productivity, and workplace satisfaction. Companies are increasingly investing in on-site dining to offer convenient, nutritious meals, aligning with health and safety standards.

The 2024 return-to-office trend, particularly in tech hubs and corporate campuses, further boosted demand for professional catering services. Fixed contracts ensure consistent food quality and compliance with regulations. Corporate catering is set to remain a key segment as firms leverage meal services to enhance employee engagement and reduce absenteeism.

Regional Analysis

North America holds a 47.2% share of the global contract catering market, valued at USD 136.3 billion in 2023.

North America’s dominance in the contract catering industry, with a 47.2% market share, stems from its advanced infrastructure, high consumer spending, and technological innovation. The U.S. leads due to significant R&D investments, a mature foodservice ecosystem, and supportive regulations fostering scalability.

Canada’s growth is driven by government-backed sustainability and digital initiatives, while Mexico contributes through its expanding consumer base and competitive manufacturing. Key growth factors include rising demand for tailored meal solutions, digital tools like mobile ordering and AI analytics, and a focus on employee wellness.

About 61% of U.S. companies outsource food services, with 59% prioritizing wellness-focused, customizable options. The education sector also plays a major role, with 48% of institutions adopting contract-based food programs emphasizing nutrition, convenience, and efficiency.

Top Use Cases

- Corporate Offices: Companies hire contract caterers to provide daily meals for employees, boosting productivity and wellness. Fixed-price contracts ensure budget-friendly, consistent food quality. Nutritious, customizable menus cater to diverse dietary needs, while on-site dining saves time, enhancing workplace satisfaction and engagement.

- Educational Institutions: Schools and universities use contract catering to serve healthy, standardized meals to students and staff. Fixed menus simplify operations, reduce costs, and ensure nutritional compliance. Pre-packaged or delivered meals support hybrid learning, making it easier to manage large-scale dining needs efficiently.

- Healthcare Facilities: Hospitals and care homes rely on contract catering for tailored, nutritious meals for patients and staff. Specialized diets, like low-sodium or gluten-free, meet medical needs. Consistent service ensures hygiene and cost control, supporting patient recovery and staff well-being in high-demand settings.

- Sports and Leisure Venues: Stadiums and event venues use contract caterers to serve large crowds during games or concerts. Flexible menus with quick-serve options enhance fan experiences. Catering services streamline logistics, ensuring fast delivery and quality food, boosting revenue and customer satisfaction at events.

- Government and Defense: Government offices and military bases use contract catering for reliable, cost-effective meal solutions. Fixed-price agreements ensure budget stability, while standardized menus meet nutritional standards. Catering supports large groups, maintaining morale and efficiency in high-pressure environments with consistent service.

Recent Developments

1. United Enterprises Co. Ltd.

- United Enterprises Co. Ltd. has expanded its contract catering services in the Middle East, focusing on corporate and healthcare sectors. The company has introduced AI-driven meal planning to enhance efficiency and sustainability. They recently secured a major contract with a leading Saudi Arabian hospital group, emphasizing nutritious and customized meal solutions.

2. Elior Group SA

- Elior Group has strengthened its sustainability initiatives by committing to carbon-neutral catering. The company partnered with WWF France to reduce food waste and promote plant-based menus. Recently, Elior won a contract to provide catering services for several European universities, integrating digital ordering systems for convenience.

3. Aramark Corporation

- Aramark launched its “Healthy for Life 2030” initiative, aiming to improve nutrition and reduce environmental impact. The company acquired Good Eating Company, expanding its premium corporate catering portfolio. Aramark also introduced AI-powered kitchen automation to streamline operations in North America.

4. CH&Co Catering Group Limited

- CH&Co Catering Group rebranded its education catering division as “Bespoke by CH&Co”, focusing on tailored school meal programs. The company also partnered with Fooditude to expand sustainable workplace catering in the UK. Their recent “Plastic-Free Pledge” aims to eliminate single-use plastics.

5. Mitie Group plc

- Mitie expanded its catering division through a partnership with ISS UK, offering integrated facilities management and catering services. The company introduced “Fuel Hub”, a digital platform for employee meal benefits, and secured contracts with multiple UK government offices. Mitie also emphasizes net-zero catering with locally sourced ingredients.

Conclusion

The Contract Catering Market is thriving, driven by demand for cost-effective, reliable, and customized meal solutions across corporate, education, healthcare, and event sectors. With a focus on health, sustainability, and technology like AI and online platforms, caterers are meeting diverse needs efficiently. The market is set to grow steadily, fueled by outsourcing trends and innovative dining experiences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)