Table of Contents

Overview

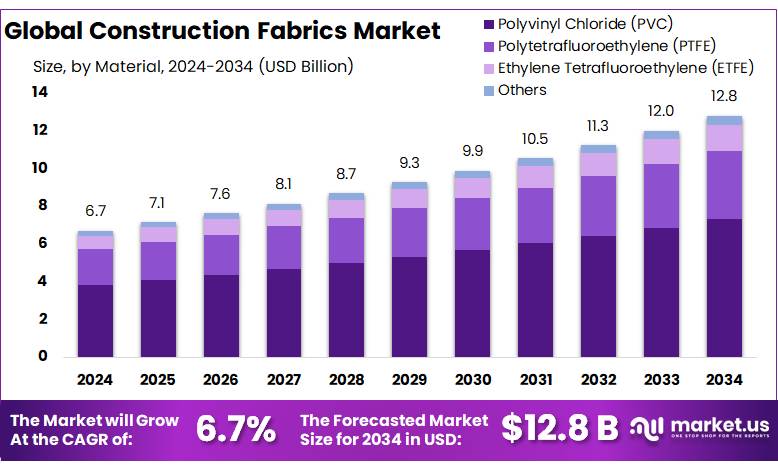

New York, NY – August 11, 2025 – The Global Construction Fabrics Market is projected to reach approximately USD 12.8 billion by 2034, rising from USD 6.7 billion in 2024, with a compound annual growth rate (CAGR) of 6.7% over the forecast period (2025–2034). In 2024, the Asia Pacific (APAC) region led the market, accounting for over 45.8% of global revenue, valued at USD 3.0 billion, highlighting the region’s strong demand and infrastructural growth.

Within India’s technical textiles industry, the construction fabrics segment has emerged as a key growth driver, spurred by increasing infrastructure demands and strategic government support. As noted in the Ministry of Textiles’ Baseline Survey on Technical Textiles, this sector spans several vital applications, including geotextiles, protective textiles, and specialized construction fabrics, all essential to the nation’s infrastructure projects.

India ranks as the world’s second-largest producer of man-made fibres (MMF) after China and the third-largest textile exporter. In FY2022, textile and apparel exports from India totaled around USD 44.4 billion, with the construction fabrics segment contributing notably to this figure, reflecting its expanding global footprint.

Government initiatives have played a significant role in accelerating growth in this sector. One such initiative is the PM Mega Integrated Textile Region and Apparel (MITRA) scheme, launched in 2021. With an allocated investment of INR 4,445 crore, this scheme aims to establish seven mega textile parks across the country.

These parks are designed to bring together the entire textile value chain from fibre production to garment manufacturing, enhancing operational efficiency and global competitiveness. The integrated infrastructure offered by these parks is expected to significantly strengthen the construction fabrics sector by supporting advanced manufacturing and fostering innovation.

Key Takeaways

- The Construction Fabrics Market is projected to grow from USD 6.7 billion in 2024 to around USD 12.8 billion by 2034, registering a CAGR of 6.7% over the forecast period.

- Polyvinyl Chloride (PVC) dominated the market, accounting for more than 57.2% of the global share.

- Tensile Architecture held a leading position, contributing over 44.9% of the total market share.

- The Non-residential segment captured a commanding share of more than 71.4% in the global market.

- The Asia Pacific (APAC) region led the market, holding 45.8% of the global share, with an estimated value of approximately USD 3.0 billion in 2024.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-construction-fabrics-market/request-sample/

Report Scope

| Market Value (2024) | USD 6.7 Billion |

| Forecast Revenue (2034) | USD 12.8 Billion |

| CAGR (2025-2034) | 6.7% |

| Segments Covered | By Material (Polyvinyl Chloride (PVC), Polytetrafluoroethylene (PTFE), Ethylene Tetrafluoroethylene (ETFE), Others), By Application (Tensile Architecture, Awnings and Canopies, Facades, Others), By End Use (Non-residential, Residential) |

| Competitive Landscape | Dongwon Industry Co., ENDUTEX COATED TECHNICAL TEXTILES, Erez thermoplastic Products, Hightex Maintenance GmbH, HIRAOKA & Co., Ltd., IASO, Novum Membranes GmbH, Saint-Gobain, Sattler AG, Seaman Corporation, Seele, Sefar AG, Serge Ferrari, Sioen Industries Nv, Structurflex, Taiyo Kogyo Corporation, Tensaform, Verseidag-Indutex GmbH |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153902

Key Market Segments

Material Analysis

Polyvinyl Chloride (PVC) commands a leading 57.2% share in the construction fabrics market in 2024, driven by its durability, affordability, and versatility. Its flexibility, weather resistance, and ease of fabrication make it ideal for architectural applications like canopies, awnings, tensile roofs, and stadium covers.

PVC’s weldability and compatibility with coatings enhance its use in large-scale projects. In 2025, demand for PVC-based fabrics continues to rise with growing infrastructure projects in urban and commercial sectors, supported by its recyclability and advancements in UV-resistant and fire-retardant coatings, promoting sustainable construction.

Application Analysis

Tensile Architecture holds a dominant 44.9% share of the global construction fabrics market in 2024, reflecting its appeal for lightweight, flexible, and aesthetically pleasing structures. Widely used in stadiums, airport terminals, exhibition halls, and walkways, tensile structures leverage high-performance fabrics to cover large spans efficiently.

In 2025, steady demand persists due to urban development and green building initiatives, with innovations in fabric technology enhancing strength, weather resistance, and UV protection, ensuring tensile architecture’s continued prominence.

End Use Analysis

The non-residential sector leads with a 71.4% share in 2024, fueled by its extensive use in commercial buildings, industrial sheds, transportation hubs, sports arenas, and public infrastructure. Construction fabrics meet the demand for durable, weather-resistant, and energy-efficient solutions in roofs, façades, and temporary structures.

In 2025, ongoing investments in urban infrastructure, smart city projects, and public facilities will drive the adoption of high-performance fabrics, valued for their lightweight nature, quick installation, and alignment with modern architectural and sustainability standards.

Regional Analysis

In 2024, the Asia Pacific (APAC) region dominates the global construction fabrics market with a 45.8% share, valued at approximately USD 3.0 billion. Rapid urbanization, infrastructure growth, and investments in countries like China, India, Japan, and South Korea fuel this leadership.

China’s large-scale projects, including the Belt and Road Initiative and urban redevelopment, are key drivers, while India’s growth is propelled by initiatives like the Smart Cities Mission and expansions in metro rail and airports. The region’s focus on cost-effective, sustainable building solutions boosts demand for advanced fabrics, particularly for tensile architecture, commercial roofing, and façade cladding, with an emphasis on energy efficiency and weather resistance.

Top Use Cases

Geotextiles for Soil Stabilization: Construction fabrics like geotextiles are used in road and building projects to stabilize soil, prevent erosion, and improve ground strength. They act as a barrier, separating soil layers and enhancing durability, making them ideal for infrastructure projects like highways and bridges, ensuring long-lasting and cost-effective construction solutions.

Tensile Architecture for Iconic Structures: Construction fabrics, such as PTFE and ETFE, are used in tensile architecture to create lightweight, durable roofs and facades for stadiums and airports. These fabrics offer flexibility, weather resistance, and aesthetic appeal, allowing architects to design innovative, curvilinear structures that are both functional and visually striking.

Awnings and Canopies for Shelter: Construction fabrics are widely used for awnings and canopies in commercial and residential spaces. Made from materials like PVC, they provide shade, UV protection, and weather resistance. These fabrics are easy to install, low-maintenance, and enhance outdoor spaces with customizable designs and energy-efficient properties.

Green Roofs for Sustainable Buildings: Construction fabrics are key in green roof systems, supporting vegetation while providing waterproofing and drainage. Non-woven fabrics ensure root protection and water management, promoting eco-friendly construction. They help reduce urban heat, improve insulation, and meet sustainability goals in modern residential and commercial projects.

Erosion Control in Civil Engineering: Construction fabrics, like woven geotextiles, are used in coastal and riverbank projects to control erosion. They stabilize soil, prevent sediment loss, and withstand harsh environmental conditions. These fabrics are cost-effective, easy to install, and vital for protecting infrastructure like shorelines and embankments from natural wear.

Recent Developments

1. Dongwon Industry Co.

Dongwon Industry Co. has recently expanded its portfolio of high-performance construction fabrics, focusing on UV-resistant and fire-retardant materials for large-scale infrastructure projects. The company introduced a new polyester-based membrane with enhanced durability for tensile structures. Dongwon is also investing in eco-friendly coatings to reduce environmental impact. Their fabrics are now being used in stadiums and solar shade structures across Asia.

2. ENDUTEX COATED TECHNICAL TEXTILES

ENDUTEX has launched innovative PVC-coated fabrics with self-cleaning and anti-microbial properties, ideal for temporary shelters and architectural membranes. The company has also developed lighter, more flexible fabrics for dynamic construction applications, improving energy efficiency in buildings. ENDUTEX is collaborating with European architects to integrate smart textiles with sensor-embedded capabilities for real-time structural monitoring.

3. Erez Thermoplastic Products

Erez has introduced thermoplastic-coated fabrics with high tensile strength and weather resistance, targeting modular construction and inflatable structures. Their latest TPU (Thermoplastic Polyurethane) membranes are being used in disaster relief shelters due to their rapid deployment features. The company is also researching recyclable materials to align with sustainable construction trends.

4. Hightex Maintenance GmbH

Hightex has developed PTFE-coated glass fiber fabrics for long-span roofing and facades, offering superior weather resistance and thermal insulation. They recently supplied materials for a major airport terminal project in Germany. Hightex is also advancing photocatalytic coatings that break down pollutants, contributing to cleaner urban environments.

5. HIRAOKA & Co., Ltd.

HIRAOKA has expanded its breathable construction fabrics line, which improves moisture control in building envelopes. Their new nanofiber-reinforced textiles enhance tear resistance while remaining lightweight. The company is also working on solar-reflective fabrics to reduce urban heat island effects in large-scale construction projects.

Conclusion

The Construction Fabrics Market is growing rapidly due to rising urbanization, infrastructure projects, and demand for sustainable materials. Innovations in eco-friendly fabrics, such as recyclable PTFE and ETFE, are driving adoption in tensile architecture, green roofs, and erosion control. With a focus on durability, energy efficiency, and aesthetics, construction fabrics are shaping modern construction, offering versatile solutions for global infrastructure needs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)