Table of Contents

Overview

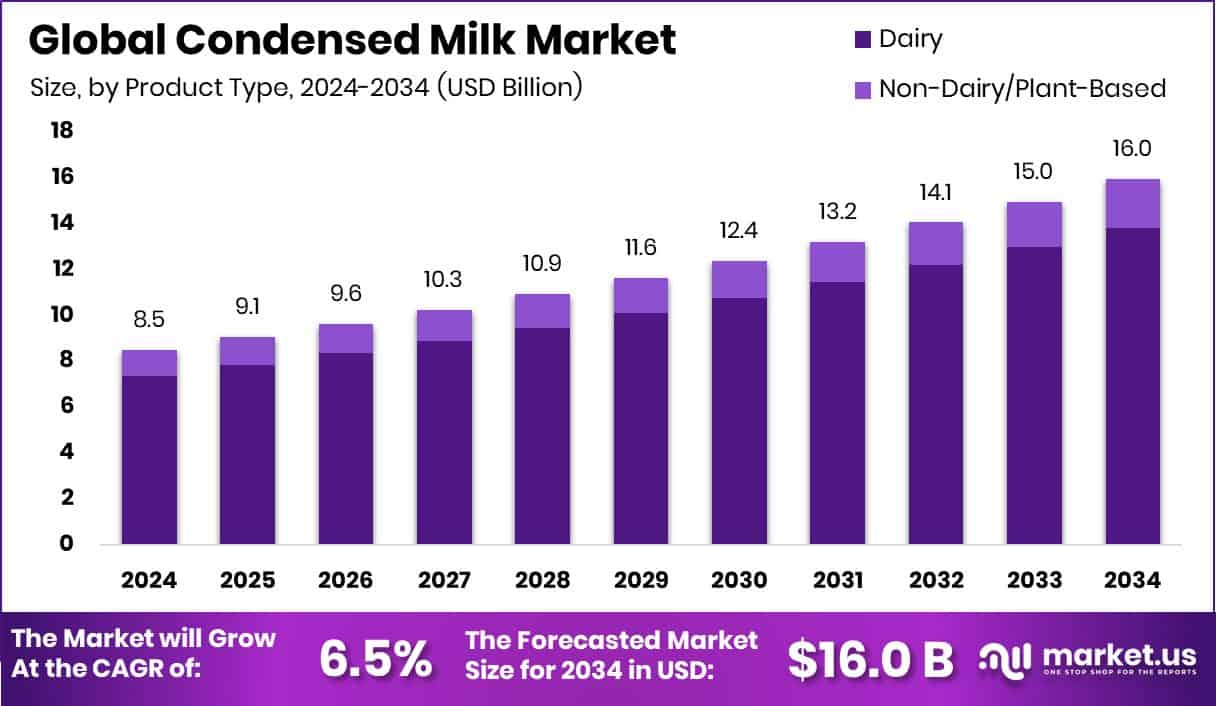

New York, NY – July 25, 2025 – The global condensed milk market is projected to reach a value of USD 16.0 billion by 2034, rising from USD 8.5 billion in 2024, with an expected CAGR of 6.5% between 2025 and 2034. North America currently leads the market, accounting for 45.9% of the global share, primarily driven by strong demand for desserts and beverages. Condensed milk, a thick and sweetened version of cow’s milk with reduced water content, is widely used in baked goods, confectionery, and beverages due to its creamy texture and extended shelf life, making it especially useful in regions with limited refrigeration facilities.

Market growth is significantly influenced by the rising demand from the bakery, confectionery, and beverage industries. The product enhances the flavor and texture of various recipes, ranging from cakes and cookies to puddings and sweet drinks. This has led to its extensive use across both household kitchens and commercial food processing. Increasing urbanization, shifting dietary habits, and the growing preference for convenient cooking ingredients have further boosted the market. Notable developments include Stellapps securing USD 26 million for nationwide dairy expansion and Doodhvale Farms raising USD 3 million in funding, signaling investor interest in value added dairy segments.

In addition to industrial demand, evolving consumer preferences are playing a key role in expanding the market. A growing appetite for indulgent and premium desserts, especially in emerging economies with rising incomes, has spurred demand for high quality sweeteners like condensed milk. The popularity of home baking especially post-pandemic and increased demand for long-shelf-life dairy products in rural areas are creating new growth avenues. Supporting this trend, Milk Mantra Dairy recently raised USD 10 million to scale its operations, highlighting further opportunities in the condensed milk sector.

Key Takeaways

- The global condensed milk market is projected to reach approximately USD 16.0 billion by 2034, growing from USD 8.5 billion in 2024 at a CAGR of 6.5% between 2025 and 2034.

- Dairy based variants lead the market, accounting for a dominant 86.7% share of global condensed milk sales in 2024.

- Sweetened condensed milk holds the largest segment share, making up 72.3% of overall market demand across various applications.

- The confectionery industry remains the top end-user, contributing 28.4% of demand due to its extensive use in sweets and desserts.

- Supermarkets and hypermarkets serve as the main retail outlets, representing 45.9% of global condensed milk distribution.

- North America generated USD 3.9 billion in market revenue in 2024, maintaining its position as a key regional market.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-condensed-milk-market/free-sample/

Report Scope

| Market Value (2024) | USD 8.5 Billion |

| Forecast Revenue (2034) | USD 16.0 Billion |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Product Type (Dairy, Non-Dairy/Plant-Based), By Category (Sweetened Condensed Milk, Unsweetened Evaporated Milk), By End User (Confectionery, Infant Food, Dairy Products, Bakeries, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Retail, Others) |

| Competitive Landscape | Nestlé S.A., FrieslandCampina N.V., Eagle Family Foods Group LLC, Arla Foods amba, Vinamilk, PT Indofood CBP (Indolakto), Hochwald Foods GmbH, Dana Dairy Group Ltd., Gujarat Co-operative Milk Marketing Fed. (Amul), Morinaga Milk Industry Co., Ltd., Santini Foods, Inc., Nature’s Charm Co. Ltd., Alaska Milk Corp., Fraser & Neave Holdings Bhd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153056

Key Market Segments

By Product Type Analysis

- In 2024, dairy-based condensed milk accounted for a commanding 86.7% of the global market, driven by its widespread use in both household and commercial kitchens. Its rich flavor, creamy texture, and nutritional benefits make it a preferred ingredient in desserts, beverages, and baked goods. Cultural familiarity with dairy based recipes, particularly in traditional sweets, further enhances its market dominance. Additionally, its versatility and extended shelf life make it especially popular in regions lacking refrigeration, supporting its continued leadership in the product type segment.

By Category Analysis

- Sweetened condensed milk led the category segment in 2024, capturing a 72.3% market share. Its high demand stems from its dual functionality acting as both a milk base and a sweetener which simplifies cooking and enhances flavor. Its thick, sweet consistency makes it ideal for desserts and confections, while its long shelf life adds convenience for both households and food manufacturers. The product’s versatility in baked goods and traditional sweet dishes continues to support its strong presence across global markets.

By End User Analysis

- The confectionery industry was the largest end-user segment in 2024, accounting for 28.4% of condensed milk usage. This dominance is fueled by the product’s essential role in sweets like fudge, caramel, toffee, and filled chocolates. Its rich sweetness, moisture retention properties, and smooth texture make it invaluable for enhancing product quality and simplifying production processes. As demand grows for indulgent, creamy confectionery products, condensed milk remains a staple ingredient for manufacturers aiming for consistent taste and texture.

By Distribution Channel Analysis

- Supermarkets and hypermarkets led the distribution channel segment in 2024, with a 45.9% market share. Their dominance is due to broad product availability, brand variety, and attractive in-store promotions that boost visibility and consumer choice. These retail outlets offer a convenient shopping experience with well stocked dairy sections that encourage impulse buying. As organized retail continues to expand in urban areas, supermarkets and hypermarkets are expected to remain the top sales channels for condensed milk products.

Regional Analysis

- In 2024, North America led the global condensed milk market, holding a dominant 45.9% share valued at USD 3.9 billion. This leadership is primarily attributed to robust demand from the food and beverage sector, especially in desserts and ready to eat products. The region’s widespread and well developed retail infrastructure, including supermarkets and hypermarkets, further strengthens its market position.

- Europe follows closely behind, with steady consumption driven by the popularity of sweetened condensed milk in bakery and confectionery products. The region’s ongoing interest in indulgent and traditional foods continues to support demand, although its overall market size remains smaller than North America’s.

- The Asia Pacific region is experiencing the fastest growth, fueled by rising disposable incomes and increasing demand for dairy based and convenience foods in countries like India and China. These trends are encouraging greater use of condensed milk in both household cooking and commercial applications.

- In the Middle East and Africa, moderate market growth is being observed, largely influenced by cultural preferences for sweets and desserts that utilize condensed milk. Latin America, while a relatively smaller market, is showing steady consumption, particularly in dairy focused countries, indicating potential for gradual and consistent growth.

Top Use Cases

- Bakery & Confectionery: Condensed milk is widely used in the bakery and confectionery industry to make caramel fillings, toffees, chocolates, dessert sauces, and ice creams. Its creamy texture, sweetness, and thick consistency enhance the flavor and mouthfeel of baked goods and sweets, making it a vital ingredient for quality, taste, and consistency in finished products.

- Ready to Drink Beverages & Coffee Shops: In cafés and cafes, condensed milk is added to coffee, tea, smoothies, and flavored drinks to enrich creaminess and sweetness. Its use in popular beverages like Vietnamese iced coffee and milk teas reflects consumer appetite for indulgent, ready to drink options, boosting demand in the food service and beverage industry.

- Home Baking & Cooking: Condensed milk sees growing usage in home baking and cooking by consumers seeking convenience. It serves both as a sweetener and milk base in recipes like cakes, puddings, pies, and tres leches cake. The product’s long shelf life, ease of use, and consistent flavor make it popular among busy home bakers.

- Ethnic & Traditional Cuisine: In many cultures, condensed milk is essential for making traditional sweets like dulce de leche, brigadeiro, leche flan, and desserts in Southeast Asian cuisines. It brings richness and sweetness, and aligns with local familiar tastes, keeping it relevant in regional culinary practices around the world.

- Food Processing & Ready to Eat Products: Manufacturers of ready to eat meals, snack bars, and dessert products use condensed milk as a nutrient rich ingredient. It boosts taste, texture, and shelf stability in industrial food processing, supporting product development in snack, dairy, and meal segments globally.

- Packaging Innovation & Retail Formats: Condensed milk is packaged in cans, tubes, bottles, tetra packs, and pouches to meet consumer convenience needs such as portion control, resealability, and longer shelf life. These innovations enable wider retail distribution from hypermarkets to online stores and support market growth by addressing user habits and lifestyle trends.

Recent Developments

1. Nestlé S.A.

- In October 2024, Nestlé’s Carnation brand launched the “Carnation Makes Memories” campaign across the UK, promoted via TV, streaming, and cinema. The campaign tapped into childhood dessert nostalgia, positioning condensed milk as a key ingredient in beloved homemade treats like banoffee pie and cream desserts supporting consumer emotional connection and boosting brand visibility in the condensed milk segment.

2. Gujarat Co‑operative Milk Marketing Federation (Amul / GCMMF)

- In July 2025, GCMMF underwent leadership change with Ashok Chaudhary (Mehsana Dairy) elected chairman and Gordhan Dhameliya (Rajkot Dairy) vice‑chairman. This transition follows cooperative farmer unrest and may influence strategic decisions around product portfolio expansion and market positioning in dairy categories including condensed and evaporated milk.

3. FrieslandCampina N.V.

- Royal FrieslandCampina has announced it will cease production of sweetened condensed milk in the Netherlands by June 1, 2026, as part of production network optimization in the country’s dairy portfolio. The company continues its sustainability push with a commitment that 95% of its key raw materials must be fully traceable by 2025, strengthening consumer trust around origin transparency and supply chain responsibility.

4. Vinamilk

- Vinamilk secured Carbon Neutral certification for two factories and one farm in Vietnam, accelerating progress towards its Net Zero by 2050 emission goals. At the Global Dairy Congress 2025, Vinamilk showcased innovation in dairy science, launching its Green Farm high protein line and Vietnam’s first 6‑HMO infant formula, winning multiple awards including for packaging design underscoring its leadership in product and nutritional innovation

Conclusion

This growth is strongly driven by rising demand in bakery, confectionery, and beverage sectors, especially in North America and Asia Pacific. Companies like Nestlé, Vinamilk, Friesland Campina, and Amul are investing in innovation, sustainability, and market expansion to meet evolving consumer needs.

The increasing popularity of ready-to-use, long shelf life dairy products alongside a strong push for home baking and premium desserts is expected to keep fueling market demand globally. As consumer habits shift toward convenience and indulgence, condensed milk will remain a vital ingredient across both households and industrial food manufacturing.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)