Table of Contents

Introduction

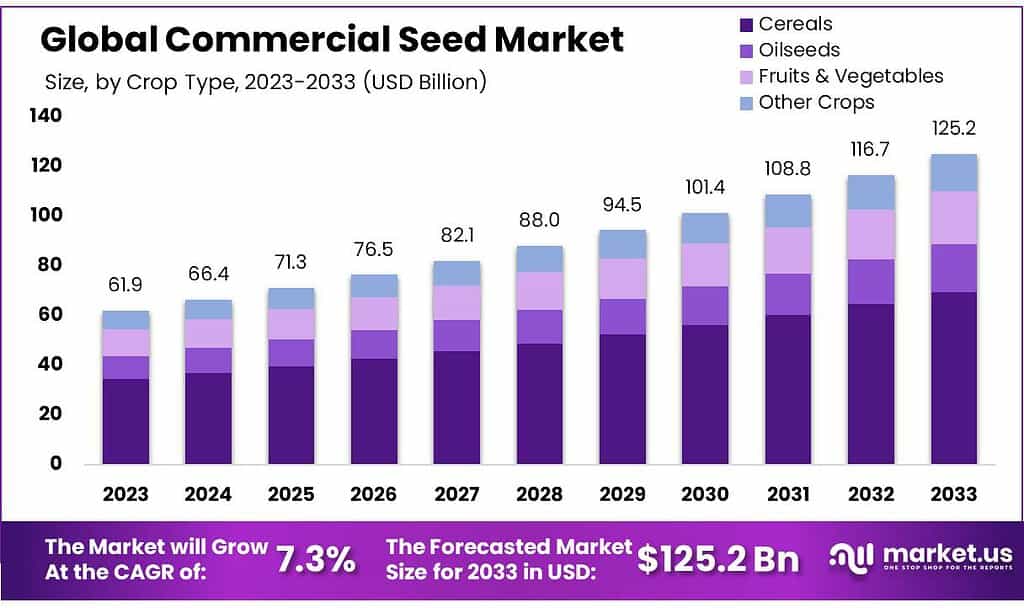

The global commercial seed market is projected to grow significantly, with its size expected to increase from USD 61.9 billion in 2023 to approximately USD 125.2 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.3%. The demand for commercial seeds is driven by several key factors, including the increasing global population, the need for higher crop yields, and the decreasing availability of arable land.

As the world population is anticipated to surpass 10 billion by 2050, the demand for food is set to increase substantially, pushing agricultural producers to adopt advanced seed technologies. Commercial seeds, including genetically modified (GM) varieties, offer enhanced crop yields and improved resistance to pests, diseases, and adverse environmental conditions, making them an attractive option for farmers globally. Biotechnology advancements, particularly in molecular biology, have also contributed to the growth of this market by enabling the development of seeds with desirable traits like herbicide tolerance and insect resistance.

However, the commercial seed market faces challenges such as high costs associated with research and development (R&D), stringent regulatory requirements, and concerns over the environmental impact of GM seeds. These factors may slow the pace of market expansion, particularly in regions with restrictive policies on genetically modified organisms (GMOs). Despite these challenges, opportunities exist, particularly in emerging markets where the adoption of high-yielding seed technologies is increasing.

Recent developments in the market include mergers and acquisitions aimed at consolidating market positions. For example, Syngenta’s acquisition of Nidera Seeds in 2018 strengthened its presence in South America, while companies like Bayer, Monsanto, and DowDuPont continue to dominate the industry. The adoption of GM seeds, especially in countries like the U.S., Brazil, and Argentina, is expected to drive the fastest growth, with GM crops occupying more than 10% of global arable land.

American Takii Inc.: American Takii continues to focus on expanding its product range, especially in vegetable and flower seeds. Recent catalogs for 2024-2026 feature new varieties of onions, Asian vegetables, and sunflowers, aimed at enhancing yield and adaptability to different climates.

BASF SE: BASF made a significant acquisition of businesses and assets from Bayer, a transaction valued at €7.6 billion. This strategic move, completed in 2018, included Bayer’s global seeds business, traits, research and breeding capabilities, and a vegetable seeds platform. This acquisition has strengthened BASF’s presence in the seed market and added expertise in non-selective herbicides and nematicide seed treatments. Furthermore, in 2023, BASF launched the xarvio Agro Experts program in Brazil, aimed at improving access to digital farming solutions.

Bayer AG: Bayer has been actively involved in collaborative projects, such as a multi-million-dollar, five-year partnership with Pairwise, launched in August 2023, to advance the development of short-stature corn. This initiative focuses on improving crop efficiency and resilience.

Bejo Zaden B.V.: Bejo Zaden is committed to innovation in vegetable seeds, with a focus on breeding disease-resistant and climate-resilient varieties. Although specific recent mergers or acquisitions have not been highlighted, their continued investment in R&D positions them as a leader in providing high-quality seeds to meet global agricultural challenges.

Commercial Seed Statistics

- Diversity within the sector: over 300 seed species are marketed internationally-each one has its unique phytosanitary issues.

- By 1944, U.S. sales in the seed corn market had expanded to over $70 million, establishing corn seed as the core business of the U.S. seed industry

- India is a water-stressed country, and agriculture consumes more than 80 percent of the total available water.

- The use of these water-saving irrigation practices reduces the consumption of water by 25–85 percent, while also improving farm productivity and reducing the cost of labor and the incidences of weeds and diseases in crops

- When looking at farmers all over the world, 84% are smallholders. Although their land plots are small, they contribute substantially to global food chains.

- Germination tests were conducted in a growth chamber in light (40 μmol·m−2·s−1) or darkness at 25 °C for 20 days after soaking the seeds in water for 10 minutes.

- Except for two seed lots from wild populations, better germination was observed for commercially cultivated populations in light (90% mean among seed lots, ranging from 82% to 95%) and in darkness (88% mean among seed lots, ranging from 82% to 97%) than for wild populations in light (56% mean among seed lots, ranging from 9% to 92%) or in darkness (37% mean among seed lots, ranging from 4% to 78%).

- Echinacea purpurea is the most used and cultivated species, accounting for 80% of Echinacea production

- Higher germination percentages were observed in commercial seed lots (90% mean among seed lots in light, ranging from 82% to 95%; 88% mean among seed lots in darkness, ranging from 82% to 97%) than from the wild populations (56% mean among seed lots in light, ranging from 9% to 92%; 37% mean among seed lots in darkness, ranging from 4% to 78%).

- in February 2003 at the NCRPIS after using dormancy-breaking techniques involving ethephon and moist prechilling (modified from Sari et al., 2001), and all samples germinated within 21 d at levels between 70% and 95%.

- Though the informal seed supply is not formally framed, it covers the majority of seed-related activities in most of sub-Saharan Africa and contributes about 80-100% of seed supply to the farmers (Maredia et al. 1999; Wekundah, 2012).

- Genetic purity: The seeds have to be genetically pure, this means true-to-type of the specific seed lot. For example, breeder seeds must be 100%, foundation seed 99.5%, and certified seed varieties 98 % genetically pure

- According to FAO statistics, worldwide groundnut was grown in about 25.67 million hectares and its production was 42.31 million tons having productivity of 1648 kg/ha during the year 2014.

- China’s cultivated land per capita is less than 1.4 acres, which is 40% of the world average.

Emerging Trends

- Biotechnology and Genetically Modified (GM) Seeds: One of the biggest shifts in the commercial seed market is the increasing reliance on GM seeds, which offer improved resistance to pests, diseases, and environmental stresses. These seeds are enabling farmers to achieve higher yields, especially in regions with challenging growing conditions. For example, GM maize (corn) holds the largest market share, driven by demand for biofuels and animal feed.

- Precision Agriculture and Digital Farming: The rise of smart farming technologies, such as sensors, drones, and satellite monitoring, is revolutionizing seed planting and crop management. Digital platforms are helping farmers optimize seed use by providing data-driven insights on soil conditions, weather patterns, and crop health. Companies like Syngenta and Bayer are leading the way by investing in digital platforms that integrate seed technology with precision farming tools.

- Sustainability and Climate-Resilient Seeds: With increasing concerns over climate change, there is a growing demand for seeds that can withstand extreme weather conditions such as drought, floods, and heat. These climate-resilient seeds are crucial for ensuring food security in regions vulnerable to climate fluctuations. Companies are heavily investing in R&D to develop new seed varieties that can thrive in these conditions.

- Consolidation and Mergers in the Industry: The commercial seed market has seen significant consolidation in recent years. Large agricultural companies, including Bayer and BASF, have acquired smaller seed firms or merged with other major players to strengthen their market positions. This trend is driven by the need to scale up operations and leverage R&D resources to stay competitive.

- Non-GMO and Organic Seed Demand: While GM seeds dominate in many regions, there is also a growing segment of the market focused on non-GMO and organic seeds. This shift is driven by consumer preferences for organic and natural products, particularly in Europe and parts of North America. Seed companies are responding by expanding their portfolios to include non-GMO options, catering to the demand for sustainable and eco-friendly agricultural practices.

Use Cases

- High-Yield Crop Production: Farmers in regions with decreasing arable land are turning to commercial seeds, especially genetically modified (GM) seeds, to maximize crop yields. These seeds help increase food production efficiency by offering traits like pest resistance and herbicide tolerance. For instance, GM maize has been widely adopted in the U.S. and Brazil, where it accounts for over 90% of the total maize production.

- Biofuel Production: Commercial seeds are increasingly used in biofuel crops, such as canola and soybean. These crops are genetically modified for higher oil content, making them more suitable for biodiesel production. In North America, canola seed production plays a significant role in supplying raw materials for biofuels.

- Animal Feed Industry: Commercial seeds like corn and soybean are critical for producing animal feed, particularly in regions with growing livestock industries. In 2021, over 40% of global corn production was directed toward animal feed, driven by rising meat consumption in regions like Asia and Latin America.

- Climate-Resilient Agriculture: In regions prone to extreme weather, such as Africa and parts of Southeast Asia, farmers are using climate-resilient seeds that can withstand droughts, floods, and heat. These seeds, often genetically modified, are designed to maintain productivity despite changing climate conditions. The adoption of these seeds is crucial for ensuring food security in regions vulnerable to climate change, enabling farmers to maintain stable crop production even in harsh conditions.

- Sustainable Agriculture Practices: Organic and non-GMO commercial seeds are increasingly popular among farmers practicing sustainable agriculture. These seeds are used to grow crops without synthetic fertilizers or pesticides, especially in Europe and North America, where consumer demand for organic products is rising. The use of non-GMO seeds in organic farming supports biodiversity, reduces soil degradation, and provides healthier food options for consumers, contributing to long-term agricultural sustainability.

- Vegetable and Fruit Farming: Commercial seeds are essential in vegetable and fruit production, offering farmers high-quality seeds with improved disease resistance and better yields. In countries like China and India, hybrid seeds are widely used for staple vegetables like tomatoes, peppers, and brassica. The availability of high-quality commercial seeds in the fruit and vegetable sectors helps meet the growing global demand for fresh produce, especially in urban areas where local sourcing is a priority.

Major Challenges

- High Research and Development (R&D) Costs: Developing new seed varieties, particularly genetically modified (GM) seeds, involves extensive research, requiring significant time and investment. The costs associated with R&D for biotechnology innovations, such as pest-resistant or climate-resilient seeds, are high. Companies often spend millions on ensuring the safety, effectiveness, and regulatory compliance of these seeds. This limits market entry for smaller firms, consolidating the market in the hands of a few large players.

- Regulatory Hurdles: Strict government regulations around the use of GM seeds in many regions pose another major challenge. While countries like the U.S. and Brazil have embraced GM seeds, other nations, including Russia and several European countries, have imposed restrictions or outright bans on their use due to environmental and health concerns. These regulations slow the adoption of advanced seed technologies and restrict the market’s expansion.

- Environmental and Ethical Concerns: The use of GM seeds has sparked debates about their long-term impact on biodiversity and ecosystems. Critics argue that widespread adoption of genetically modified crops could reduce genetic diversity and increase reliance on chemical herbicides, leading to environmental degradation. Ethical concerns about the ownership of seed patents by large corporations also contribute to resistance from farmers and consumers.

- Impact of Climate Change: As climate change affects weather patterns globally, farmers are facing more extreme and unpredictable conditions. While commercial seeds are often designed to improve yields, they may not be able to keep up with rapidly changing environmental challenges, leading to potential crop failures in vulnerable regions.

Market Growth Opportunities

- Rising Demand for Food Production: With the global population expected to exceed 10 billion by 2050, the need for higher agricultural output will drive demand for high-yielding and resilient seeds. Genetically modified (GM) seeds that improve crop yields and resist pests are seen as essential in meeting these demands, particularly in regions like Asia and Africa, where population growth is highest. This creates a significant opportunity for companies specializing in GM seeds and advanced crop technologies.

- Expansion of Precision Agriculture: The integration of digital technologies such as precision farming and smart agriculture tools offers new opportunities in the seed market. Precision farming enables farmers to use seeds more efficiently by providing data on optimal planting conditions, irrigation needs, and soil health. Companies investing in digital platforms that link seed performance with real-time data are likely to see strong growth, as this technology improves both yield and sustainability.

- Demand for Climate-Resilient Seeds: As climate change leads to more extreme weather events, there is a growing need for seeds that can thrive in harsh conditions like drought, floods, and heat. Developing and marketing climate-resilient seed varieties presents a major opportunity, especially in regions like Africa and Southeast Asia, where agriculture is highly vulnerable to changing weather patterns.

- Organic and Non-GMO Seeds: The increasing consumer preference for organic and non-GMO products, particularly in Europe and North America, offers growth potential for seed companies. This trend is driven by health-conscious consumers seeking sustainable and environmentally friendly farming practices. Expanding portfolios to include organic seeds can attract a growing market segment.

Key Player Analysis

In 2023 and 2024, American Takii Inc., a key player in the commercial seed market, has continued its focus on producing and launching high-quality vegetable and flower seeds. Their ongoing work in the commercial seed sector emphasizes innovation in vegetable varieties, including onions, leafy crops, and Asian vegetables. For example, Takii has expanded its onion seed program to include varieties suitable for different climates, such as long-day onions for the Northeastern U.S. and short-day onions for regions like the Western U.S. and Canada. This diversification helps farmers increase yield while adapting to specific regional requirements.

In 2023 and 2024, BASF SE has made significant strides in the commercial seed market by expanding its product portfolio and introducing new seed varieties to meet farmers’ needs. In July 2024, BASF launched 19 new Xitavo soybean seed products for the 2025 growing season, aimed at enhancing yield and disease resistance in various regions. This move has brought new genetic diversity to the U.S. market, helping farmers tackle climate challenges and improve crop performance. BASF’s commitment to innovation is further evident in the 2023 introduction of advanced seed variety placement technology through xarvio® SeedSelect, which helps farmers optimize crop yields by selecting the best seed varieties for their specific fields.

In 2023 and 2024, Bayer AG has made notable advancements in the commercial seed market, focusing on innovative crop systems and sustainability. In October 2023, Bayer introduced its Direct-Seeded Rice (DSR) system at the International Rice Congress in Manila, which is designed to reduce water usage by up to 40% and greenhouse gas emissions by 45%, a major shift from traditional rice cultivation methods. This system is expected to be transformative, particularly in India, with Bayer aiming to implement it across 2.5 million acres by 2030. Additionally, Bayer’s Preceon Smart Corn System, launched in 2023, is designed to improve corn standability and yield in challenging weather conditions, with further developments in gene-edited versions expected by 2027.

In 2023 and 2024, Bejo Zaden B.V. has focused on enhancing its position in the commercial seed market through innovation and expansion. One of the key developments was the introduction of B-Mox® improved priming technology for onion seeds, launched at the start of the 2023-2024 onion season. This technology is designed to improve seed vigor and plant resilience, leading to stronger crops and higher yields, particularly in stressful growing conditions. This follows the successful application of B-Mox® in carrot seeds, which has been well-received by growers for improving crop uniformity and health.

In 2023 and 2024, East-West Seed Group has focused on expanding its reach and innovating in the commercial seed market. The company reported a 6% increase in overall sales in 2023, reaching US$192.2 million. Growth has been especially strong in emerging markets such as Africa and Latin America, with over 30% sales growth in these regions. East-West Seed also strengthened its R&D operations in countries like Guatemala, India, and Indonesia, advancing its research into seed technologies suitable for tropical climates.

In 2023 and 2024, Enza Zaden Beheer B.V. has been active in advancing its global presence in the commercial seed market, emphasizing its commitment to sustainability and innovation in vegetable breeding. This Dutch company, founded in 1938 and based in the heart of the Netherlands’ Seed Valley, has continued to expand its product line and global operations, focusing on both traditional hybrid varieties and organic seeds.

In 2023 and 2024, Namdhari Seeds Pvt. Ltd. (NSPL) has been actively enhancing its facilities and capabilities within the commercial seed market. The company, a leader in the hybrid seed industry in India, has achieved significant milestones in seed health and safety. In August 2023, NSPL’s laboratories in Bangalore were awarded NABL Accreditation under ISO/IEC 17025:2017, positioning them among the few seed health labs in India with such credentials. This accreditation underscores their technical competence in extensive pathogen testing and quality control across various crops

In 2023 and 2024, Rijk Zwaan Zaadteelt en Zaadhandel B.V., a prominent Dutch vegetable breeding company, has continued to expand its influence in the global commercial seed market. Celebrating its centennial in 2024, the company underscores a century of innovation and market presence. As one of the leading vegetable seed developers, Rijk Zwaan dedicates approximately 30% of its turnover to research and development, emphasizing its commitment to pioneering new vegetable varieties that are resilient and sustainable.

In 2023 and 2024, Sakata Seed Corporation has been actively expanding its global footprint and enhancing its research and development capabilities in the commercial seed market. The company made significant strides in diversifying its vegetable seed offerings, particularly focusing on F1 hybrid seeds that are renowned for their high yield and quality. A notable development was the acquisition of Sana Seeds in October 2023, a move that strategically bolstered Sakata’s cucumber breeding programs in Europe and enhanced its research facilities in Almeria, Spain.

Conclusion

The global commercial seed market is poised for substantial growth, driven by increasing agricultural production demands and advancements in seed technology. By 2024, the market is projected to grow significantly, with innovations in biotechnology seeds and high adoption rates in emerging markets fueling this expansion. Companies are investing heavily in research and development to introduce new varieties that are more resilient to climatic changes and diseases, which is critical for ensuring food security globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)