Table of Contents

Overview

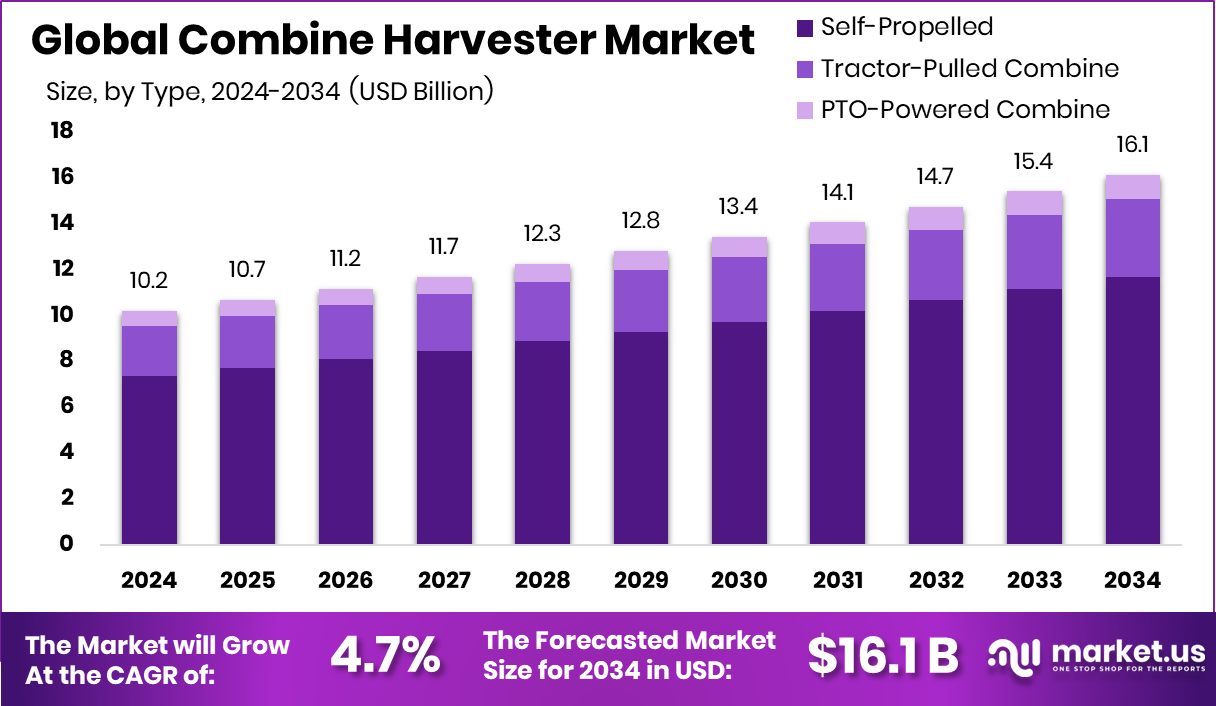

New York, NY – October 07, 2025 – The Global Combine Harvester Market is projected to reach USD 16.1 billion by 2034, rising from USD 10.2 billion in 2024, at a CAGR of 4.7% from 2025 to 2034. In North America, government subsidies and technological advancements strengthened the market, giving it a 43.9% share worth USD 4.4 billion.

A combine harvester integrates reaping, threshing, and winnowing into one efficient operation, enabling farmers to harvest key crops such as wheat, rice, maize, and barley—more quickly and with less manual labor. This technology minimizes post-harvest losses and enhances productivity, particularly in large-scale farming where timely harvesting is critical.

The market includes production, sales, adoption, and government-backed programs that support mechanization. Under India’s Sub-Mission on Agricultural Mechanization (SMAM), the government has released ₹656.56 crores to Uttar Pradesh for farm machinery distribution and the creation of hi-tech hubs. Such initiatives make modern harvesting more accessible to small and medium farmers.

Rising labor shortages, higher wages, and food security concerns are key demand drivers. Mechanized harvesting also prevents crop spoilage during unpredictable weather, ensuring higher efficiency. Furthermore, subsidies and custom hiring models allow small farmers to benefit from advanced machinery.

Looking ahead, opportunities lie in sustainable and precision farming. The U.S. Department of Agriculture’s US$1.5 billion allocation (FY 2024) for climate-smart agriculture encourages the use of eco-efficient harvesters with low emissions, fuel savings, and sensor-based technologies. This shift is expected to foster broader adoption of next-generation harvesting solutions worldwide.

Key Takeaways

- The Global Combine Harvester Market is expected to be worth around USD 16.1 billion by 2034, up from USD 10.2 billion in 2024, and is projected to grow at a CAGR of 4.7% from 2025 to 2034.

- Self-propelled machines dominate the Combine Harvester Market with 72.4%.

- Combine Harvester Market favors 301–450 HP power output at 48.2%.

- Hydraulic systems lead the Combine Harvester Market, holding 69.8% share.

- Grains and cereals drive the Combine Harvester Market with 43.7%.

- Strong mechanization adoption in North America drove the market to 43.9% share, totaling USD 4.4 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-combine-harvester-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 10.2 Billion |

| Forecast Revenue (2034) | USD 16.1 Billion |

| CAGR (2025-2034) | 4.7% |

| Segments Covered | By Type (Self-Propelled, Tractor-Pulled Combine, PTO-Powered Combine), By Power Output (HP)(Up to 300 HP, 301 to 450 HP, Above 450 HP), By Mechanism (Hydraulic, Hybrid), By Crop Type (Grains and Cereals, Fruits and Vegetables, Turf and Ornamentals, Others) |

| Competitive Landscape | Deere & Company, CNH Industrial N.V., AGCO Corporation, Claas KGaA mbH, Kubota Corporation, SDF Group, Yanmar Holdings Co., Ltd., Mahindra and Mahindra Ltd., Iseki and Co., Ltd., Rostselmash |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158344

Key Market Segments

By Type Analysis

Self-propelled combine harvesters led the market in 2024, commanding a 72.4% share in the By Type segment. Their dominance stems from superior efficiency, advanced technology, and the ability to cover large fields quickly without relying on external tractors. These machines offer farmers a streamlined, all-in-one harvesting solution. Government subsidies and funding have made self-propelled harvesters more accessible, even for medium-scale farmers. The push for mechanization, coupled with labor shortages and the need to minimize post-harvest losses, solidifies their position as the top choice in 2024.

By Power Output (HP) Analysis

In 2024, the 301 to 450 HP range dominated the By Power Output segment, capturing a 48.2% market share. These harvesters strike an optimal balance between power and fuel efficiency, making them ideal for large-scale commercial farming and challenging field conditions. Their ability to handle high-yield crops, reduce harvesting time, and minimize crop wastage drives their popularity. Supported by government subsidies and the growing demand for mechanized farming, the 301 to 450 HP category remains the preferred choice for modern agricultural operations.

By Mechanism Analysis

Hydraulic systems held a commanding 69.8% share in the By Mechanism segment in 2024. Their preference is driven by superior efficiency, reliability, and precise control in diverse field conditions. Hydraulic combines excel in handling varying crop densities, reducing downtime, and enhancing operational safety. Farmers favor these systems for their consistent performance across terrains. With increasing mechanization and robust government support for modern harvesting equipment, hydraulic systems remain the leading mechanism in the global combine harvester market.

By Crop Type Analysis

Grains and cereals dominated the By Crop Type segment in 2024, accounting for a 43.7% market share. This is driven by the widespread cultivation of staple crops like wheat, rice, maize, and barley, which demand efficient and timely harvesting. Combine harvesters help reduce post-harvest losses and improve yield quality, meeting the needs of high-production regions. Rising global food demand and government-backed initiatives to boost grain productivity through mechanization reinforce the dominance of grains and cereals in the market.

Regional Analysis

In 2024, North America led the global combine harvester market with a 43.9% share, valued at USD 4.4 billion. Large-scale commercial farming, high labor costs, and advanced mechanization practices drive this dominance, particularly in the U.S. and Canada, where federal funding supports modern equipment adoption.

Europe benefits from the Common Agricultural Policy (CAP), with subsidies promoting mechanized harvesting. Asia Pacific sees steady growth due to extensive rice and wheat cultivation and government-backed mechanization in countries like India and China. The Middle East & Africa shows gradual adoption to address labor shortages and climate challenges, while Latin America, led by Brazil and Argentina, sees rising demand fueled by robust grain exports.

Top Use Cases

- Wheat Harvesting: Farmers use combine harvesters to cut and gather ripe wheat stalks from large fields quickly. The machine separates the grain from the chaff and straw, cleaning it for storage. This saves time and labor, allowing for faster processing during peak seasons and reducing crop losses from weather delays or manual errors.

- Rice Field Operations: In paddy areas, self-propelled combines efficiently reap rice crops while handling wet conditions. They thresh the grain on the go and winnow out impurities, making it ready for milling. This method boosts productivity for staple food production and helps meet high demand in rice-growing regions.

- Corn and Maize Collection: Combines with specialized headers that strip corn ears from stalks in row-planted fields. The process includes threshing to remove kernels and cleaning them for immediate use or sale. This application supports large-scale farming by minimizing waste and enabling quick turnaround for animal feed or food processing.

- Soybean Yielding: For soybean fields, combines cut plants and separates pods to extract beans efficiently. Advanced models adjust for varying crop densities, ensuring high-quality output with less damage. This use case aids in sustainable agriculture by reducing manual handling and supporting export needs for oil and protein sources.

- Barley and Oat Processing: Combines harvest barley and oats by reaping the grains and separating them from husks in one pass. They handle uneven terrain well, spreading residue back to the soil for natural fertilization. This helps farmers achieve better yields for brewing, animal feed, and cereals with minimal post-harvest effort.

Recent Developments

1. Deere & Company

Deere is advancing automation with its ExactShot system, which uses robotics and sensors to place starter fertilizer directly onto seeds, reducing waste. Their combined lineup also features increased integration with the John Deere Operations Center, enabling data-driven harvesting decisions and automated machine monitoring for improved efficiency and yield mapping across large-scale farms.

2. CNH Industrial N.V. (Case IH & New Holland)

CNH’s recent focus is on the New Holland CR11 Twin Rotor combine, hailed as the world’s most powerful. For Case IH, the Axial Flow 2150 series incorporates new Advanced Farming Systems (AFS) technology. Both brands emphasize the integration of the MyCNH Industrial Portal for real-time data access, remote diagnostics, and streamlined fleet management to maximize uptime during critical harvest seasons.

3. AGCO Corporation (Fendt & Massey Ferguson)

AGCO’s Fendt brand launched the IDEALcombine in North America, featuring the patented DynaCrack system for gentle, efficient grain threshing. Massey Ferguson continues to enhance its ACTIVA combines with new productivity packages and improved cab comfort. A key development across brands is the expansion of AGCO’s digital ecosystem, AGCOConnect, to optimize machine performance and data management for growers.

4. Claas KGaA mbH

Claas has heavily invested in the digital ecosystem with its CLAAS EASY systems. Recent developments include the new LEXION 8000 series with enhanced TERRA TRAC crawler tracks for improved flotation. A major innovation is the introduction of the CEMOS AUTOMATIC system, which uses AI and sensor data to autonomously and continuously optimize combine settings in real-time for peak performance and grain quality.

5. Kubota Corporation

Kubota is expanding its presence in the large combine market with models like the M7 Series, now equipped with more powerful, EPA Tier 4-final compliant engines. Recent developments focus on enhancing the standard features of their autoguidance and telematics systems (Kubota Farm Management). They are also improving operator comfort and serviceability to increase daily productivity and appeal to a broader customer base.

Conclusion

Combine Harvesters stand as vital tools in modern farming, transforming how crops are gathered and processed. They enhance efficiency, cut down on manual work, and promote sustainable practices amid rising food needs. With ongoing tech upgrades like precision tools, these machines continue to drive agricultural progress, ensuring reliable yields and supporting global food security for farmers everywhere.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)