Table of Contents

Overview

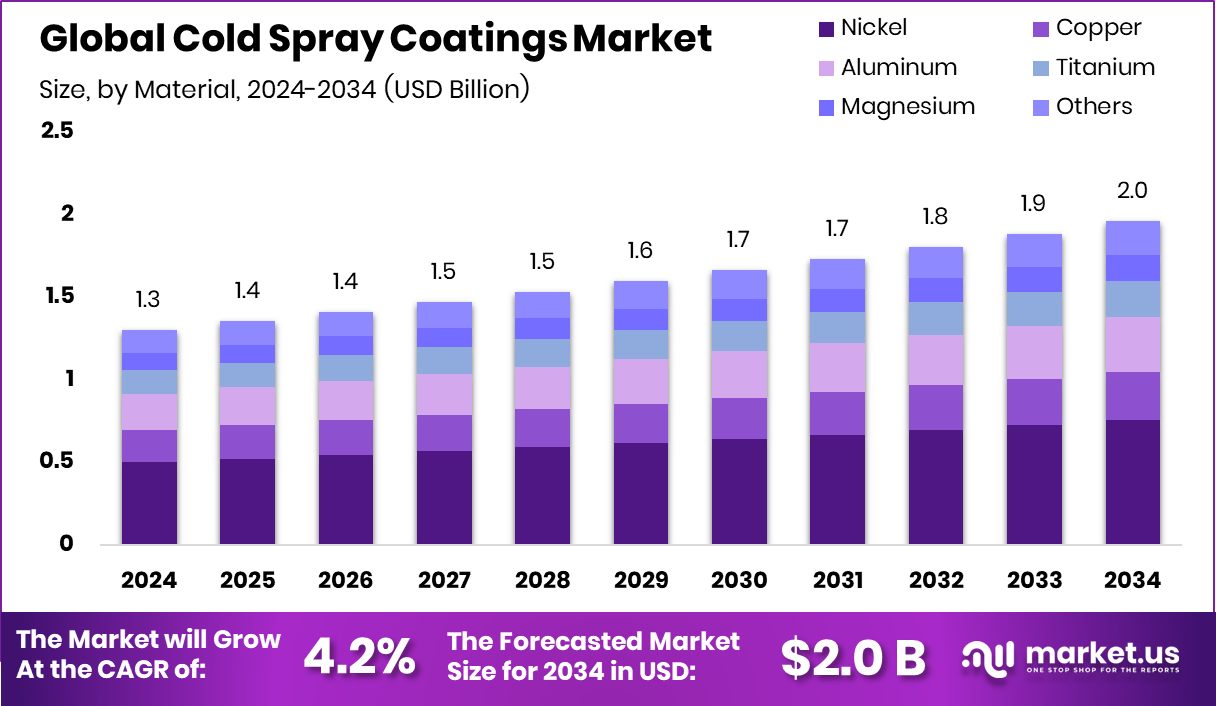

New York, NY – August 05, 2025 – The Global Cold Spray Coatings Market is projected to reach approximately USD 2.0 billion by 2034, growing from USD 1.3 billion in 2024, with an anticipated compound annual growth rate (CAGR) of 4.2% from 2025 to 2034. North America holds a dominant 47.9% market share, driven by increasing demand for surface restoration in the aerospace and defense industries.

Cold spray coating is a solid-state deposition process where metal powders are propelled at high speeds using compressed gas and applied to a surface without melting. Unlike traditional thermal spray techniques, cold spray operates at lower temperatures, preserving the original properties of both the substrate and the powder. This makes it ideal for heat-sensitive materials, enabling the creation of thick, dense coatings with excellent adhesion, minimal oxidation, and reduced thermal degradation.

The cold spray coatings market encompasses global demand, production, and application of cold spray technologies across industries such as aerospace, automotive, defense, energy, and electronics. Market growth is fueled by advancements in material science and the need for durable, corrosion-resistant, and eco-friendly surface treatments. Cold spray is increasingly adopted for repair, restoration, and extending the lifespan of components.

The technology’s ability to deposit coatings without thermal stress or distortion is particularly valued for lightweight and complex components, as it maintains structural integrity. Key drivers include the demand for surface restoration, wear resistance, and cost-effective component repair.

Cold spray’s capacity to restore high-value parts to their original dimensions without heat-related damage makes it a preferred solution for maintenance-heavy industries. Recent advancements, such as Titomic Europe’s €800k funding to advance Cold Spray Additive Manufacturing, highlight the market’s focus on innovation and expanded applications.

Key Takeaways

- The Global Cold Spray Coatings Market is expected to be worth around USD 2.0 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 4.2% from 2025 to 2034.

- In the Cold Spray Coatings Market, nickel material leads with a 38.5% share in 2024.

- High-pressure technology dominates the Cold Spray Coatings Market, capturing 69.2% of total adoption globally.

- Corrosion protection remains the primary application, accounting for a 47.9% share in the Cold Spray Coatings Market.

- The aerospace end-use segment holds a dominant 49.6% share in the Cold Spray Coatings Market landscape.

- The North American market value reached approximately USD 0.6 billion, showing strong industrial adoption.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/cold-spray-coatings-market/request-sample/

Report Scope

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 2.0 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Material (Nickel, Copper, Aluminum, Titanium, Magnesium, Others), By Technology (High Pressure, Low Pressure), By Application (Corrosion Protection, Wear Resistance, Thermal Barrier Coatings, Others), By End-use (Aerospace, Automotive, Defense, Others) |

| Competitive Landscape | ASB Industries (Hannecard Roller Coatings, Inc), Bodycote plc, CenterLine (Windsor) Limited, Concurrent Technologies Corporation, Curtiss-Wright Surface Technologies, Flame Spray Technologies B.V., Fujimi Inc., Impact Innovations GmbH, Oerlikon Metco, Plasma Giken Co., Ltd., Praxair S.T. Technology, Inc., Titomic Limited, VRC Metal Systems, WWG Engineering Pte. Ltd. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153582

Key Market Segments

Material Analysis

Nickel leads the Cold Spray Coatings Market, commanding a 38.5% share in 2024. Its dominance stems from superior corrosion resistance, thermal stability, and excellent adhesion, making it ideal for demanding applications in aerospace, marine, and energy sectors. Nickel’s ability to form dense, uniform coatings without thermal distortion supports its use in extending the lifespan of costly components, particularly for repairs. Its oxidation resistance and compatibility with various substrates further solidify its preference for maintenance and restoration, ensuring sustained market demand.

Technology Analysis

High-pressure technology dominates with a 69.2% market share in 2024. Its ability to accelerate particles to supersonic speeds delivers exceptional deposition efficiency and bonding strength, crucial for durable, high-quality coatings. This technology excels in applying hard materials like nickel and titanium, enabling wear- and corrosion-resistant coatings for aerospace, defense, and heavy machinery. High-pressure systems offer precision and thick-layer formation without thermal distortion, reducing costs by restoring components to original specifications.

Application Analysis

Corrosion protection leads applications, holding a 47.9% share in 2024. The demand for safeguarding components from harsh environments—moisture, chemicals, and extreme conditions—drives its adoption in marine, energy, and infrastructure sectors. Cold spray’s oxide-free, dense coatings, using materials like nickel and aluminum, ensure long-term protection and asset integrity. Its suitability for in-situ repairs without altering substrate microstructure enhances cost-efficiency and performance, fueling its widespread use.

End-use Analysis

Aerospace dominates end-use with a 49.6% share in 2024, driven by the need for lightweight, corrosion-resistant, and reliable components. Cold spray is critical for maintenance, repair, and overhaul (MRO), restoring high-value parts like turbine blades and engine components without thermal stress. Its ability to enhance wear resistance and extend service life aligns with aerospace’s stringent safety and cost-efficiency requirements, reducing downtime and replacement costs while maintaining performance.

Regional Analysis

North America leads the global market with a 47.9% share in 2024, generating USD 0.6 billion. Strong demand in aerospace, defense, and manufacturing, coupled with heavy MRO investment, drives its dominance.

Europe follows, benefiting from industrial modernization and eco-friendly repair technology adoption. Asia Pacific sees steady growth in manufacturing and automotive, while the Middle East & Africa and Latin America show emerging potential as industrial infrastructure expands, though their contributions remain smaller. North America remains the primary hub for cold spray coating adoption.

Top Use Cases

- Aerospace Component Repair: Cold spray coatings fix worn or damaged aircraft parts like turbine blades and landing gear. The process restores parts to their original shape without high heat, ensuring durability and corrosion resistance. This reduces downtime and maintenance costs, making it a go-to solution for aerospace companies needing reliable, long-lasting repairs.

- Automotive Engine Enhancement: Cold spray coatings improve engine parts by adding wear-resistant and corrosion-resistant layers. This boosts performance and extends the lifespan of components like pistons and cylinders. The eco-friendly process uses no harmful chemicals, aligning with the automotive industry’s push for sustainable, lightweight solutions to enhance fuel efficiency.

- Oil and Gas Equipment Protection: Cold spray coatings shield pipelines, valves, and pumps from corrosion and wear in harsh environments. The dense, strong coatings ensure equipment lasts longer, reducing maintenance costs. This technology is ideal for the oil and gas industry, where reliable, durable components are critical for safe operations.

- Electronics Component Coating: Cold spray coatings protect delicate electronic parts like circuit boards and sensors. The low-temperature process prevents damage to sensitive components while adding corrosion resistance and conductivity. This is vital for the growing electronics industry, especially for devices in the Internet of Things requiring durable, high-performance coatings.

- Medical Implant Enhancement: Cold spray coatings improve the biocompatibility and durability of medical implants, such as joint replacements. The coatings add corrosion resistance and reduce wear, ensuring implants last longer in the body. This eco-friendly method supports the medical industry’s need for safe, reliable, and sustainable solutions for patient care.

Recent Developments

1. ASB Industries (Hannecard Roller Coatings, Inc)

ASB Industries, now part of Hannecard Roller Coatings, continues to advance cold spray technology for industrial applications, focusing on wear-resistant coatings and repair solutions. Recent developments include expanding their cold spray capabilities for aerospace and defense sectors, offering high-performance coatings for critical components. The company emphasizes sustainable repair solutions to extend part lifespans.

2. Bodycote plc

Bodycote has been enhancing its cold spray offerings, particularly for aerospace and energy industries, with a focus on additive manufacturing and component repair. Their recent work includes developing high-strength, corrosion-resistant coatings for turbine blades and structural components. Bodycote is also investing in automation to improve cold spray precision and efficiency.

3. CenterLine (Windsor) Limited

CenterLine has been innovating in cold spray deposition systems, offering turnkey solutions for industrial applications. Their recent advancements include robotic cold spray systems for automated coating applications in automotive and aerospace. The company is also working on hybrid cold spray + machining solutions for precision repairs.

4. Concurrent Technologies Corporation (CTC)

CTC has been actively involved in cold spray R&D for defense applications, including corrosion-resistant coatings for naval and military equipment. Recent projects include developing portable cold spray systems for in-field repairs, reducing downtime for critical machinery. CTC collaborates with the U.S. Department of Defense on advanced coating solutions.

5. Curtiss-Wright Surface Technologies

Curtiss-Wright has expanded its cold spray capabilities for high-performance coatings in aerospace, defense, and power generation. Recent developments include cold spray repairs for turbine components and advanced metallurgical bonding techniques. The company is also working on cold spray for additive manufacturing applications.

Conclusion

The Cold Spray Coatings Market is growing steadily due to its versatile applications across industries like aerospace, automotive, and electronics. Its eco-friendly, low-heat process delivers durable, corrosion-resistant coatings, meeting the demand for sustainable and cost-effective solutions. With ongoing advancements in materials and automation, the market is set to expand, offering innovative opportunities for manufacturers and end-users alike.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)