Table of Contents

Overview

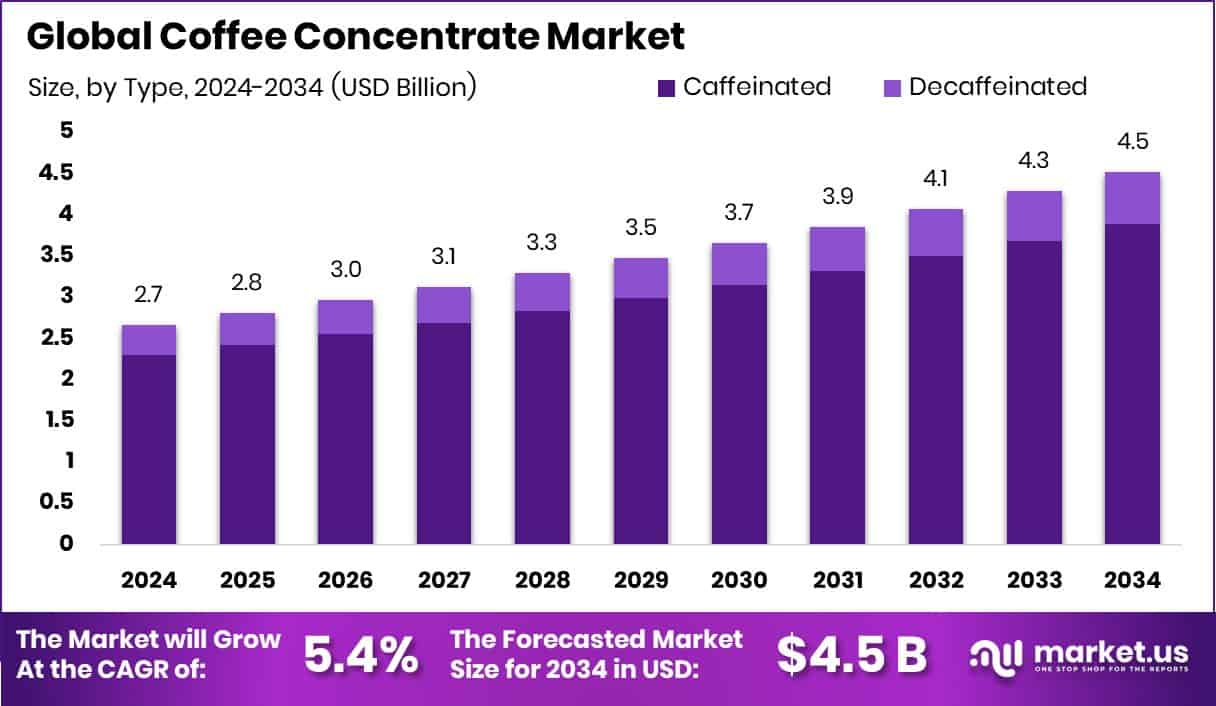

New York, NY – Sep 03, 2025 – The global coffee concentrate market is projected to reach approximately USD 4.5 billion by 2034, growing from USD 2.7 billion in 2024 at a CAGR of 5.4% between 2025 and 2034. North America leads the market with a 48.30% share, valued at USD 1.2 billion. Coffee concentrate is a highly concentrated liquid coffee made using a higher ratio of coffee to water, resulting in a bold flavor. It is commonly sold in bottles or syrups and can be easily mixed with hot or cold water, milk, or other liquids, offering convenience and customization to suit individual preferences.

The market has witnessed strong growth, fueled by rising demand for quick and easy coffee solutions. As consumer lifestyles become busier and preferences shift toward ready-to-drink (RTD) and premium-quality beverages, coffee concentrate serves as an ideal option for those looking to enjoy a flavorful coffee experience without the brewing time. Its ability to deliver consistent taste and ease of preparation has made it increasingly popular among both individual consumers and foodservice providers.

There is considerable opportunity in expanding coffee concentrate offerings to align with evolving consumer demands. With growing interest in health and wellness, manufacturers can introduce low-sugar, organic, or functional varieties. Additionally, as coffee culture continues to flourish globally, especially in urban and emerging markets, brands can innovate with new flavors and packaging formats that cater to the needs of on-the-go and environmentally conscious consumers.

Key Takeaways

- The global coffee concentrate market is projected to reach USD 4.5 billion by 2034, rising from USD 2.7 billion in 2024, with a steady CAGR of 5.4% between 2025 and 2034.

- Caffeinated variants lead the market, making up 86.40% of global sales.

- Arabica beans are the top choice for production, accounting for 63.30% of coffee concentrate sources.

- Bottled packaging remains the most common, representing 58.20% of the market due to its convenience and ease of storage.

- Cold brew coffee concentrate holds a 45.30% share, highlighting strong consumer interest in chilled coffee drinks.

- Orginal flavor continues to dominate consumer preference, making up 61.20% of the total demand.

- Medium roast is the favored roast level, contributing to 52.30% of total market sales.

- The HoReCa (Hotels, Restaurants, and Cafés) sector is the leading distribution channel, capturing 63.40% of sales driven by commercial consumption.

- North America holds the largest regional share, valued at USD 1.2 billion and accounting for 48.30% of the global market.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-coffee-concentrate-market/free-sample/

Report Scope

| Market Value (2024) | USD 2.7 Billion |

| Forecast Revenue (2034) | USD 4.5 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Type (Caffeinated, Decaffeinated), By Source (Arabica, Robusta, Excelsa, Liberica), By Packaging (Bottles, Pouches, Others), By Brew Type (Cold, Drip, Espresso, Pour Over, Others), By Flavor (Original, Flavored (Vanilla, Mocha, Caramel, Chocolate, Coconut, Others)), By Roast Type (Dark, Medium, Light), By Distribution Channel (HoReCa, Retail (Supermarkets/Hypermarkets, Specialty Stores, Convenience Store, Online Retail, Others)) |

| Competitive Landscape | All American Coffee LLC, Blue Bottle Coffee, Inc., Califia Farms, LLC, Climpson & Sons, Grady’s Cold Brew, Javo Beverage Company, Inc., Javy Coffee Company, Kohana Coffee LLC., Monin, Nestle S.A., Starbucks Corporation, The J.M. Smucker Company, Wandering Bear Coffee |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145058

Key Market Segments

1. By Type Analysis

- In 2024, caffeinated coffee concentrates held a dominant position in the market, capturing 86.40% of the total share. This reflects the strong consumer preference for caffeine-based beverages, particularly among urban populations seeking convenient and energizing coffee options. The wide availability of caffeinated variants through retail and specialty channels has contributed to their popularity. As consumers continue to value bold flavors and customizable experiences, this segment is expected to maintain its leadership.

2. By Source Analysis

- Arabica beans remained the top choice for coffee concentrate production in 2024, making up 63.30% of the market. Known for their smooth and mild flavor profile, Arabica beans are widely preferred in premium and specialty coffee products. Their consistent quality and ability to meet evolving consumer expectations have made them a staple for manufacturers aiming to deliver superior taste. The rise of specialty coffee culture globally continues to support Arabica’s dominance in the market.

3. By Packaging Analysis

- Bottled coffee concentrate accounted for 58.20% of the market in 2024, making it the leading packaging format. Consumers favor bottled packaging due to its convenience, durability, and ability to preserve the product’s freshness. Glass and plastic bottles are especially popular for on-the-go use and home storage. The appeal of bottles is further enhanced by their branding potential and compatibility with eco-friendly innovations, keeping them a preferred choice in the segment.

4. By Brew Type Analysis

- Cold brew coffee concentrate captured 45.30% of the market in 2024, driven by increasing demand for smooth, low-acidity beverages. This brew type is especially popular in warmer regions and among consumers seeking refreshing, ready-to-drink options. Its compatibility with a variety of milk and water-based drinks, combined with a premium flavor profile, has made cold brew a go-to product for both casual and enthusiast coffee drinkers.

5. By Flavor Analysis

- Original flavor led the coffee concentrate market in 2024, accounting for 61.20% of global sales. The traditional, robust flavor of original coffee appeals to a wide range of consumers who prefer a classic coffee experience without added flavors. Its simplicity, versatility, and authenticity make it a preferred base for both standalone drinks and customized beverages, ensuring its continued market dominance.

6. By Roast Type Analysis

- Medium roast coffee concentrate held the top spot in 2024, with 52.30% of the market share. Its balanced profile offering a harmonious mix of sweetness, acidity, and richness—makes it the ideal choice for a broad consumer base. The ability to preserve the bean’s natural characteristics while delivering full-bodied flavor aligns well with the growing interest in premium, specialty coffee products.

7. By Distribution Channel Analysis

- The HoReCa sector (Hotels, Restaurants, and Cafés) dominated distribution in 2024, contributing 63.40% to coffee concentrate sales. These establishments rely heavily on coffee concentrates for quick, consistent service and cost efficiency. The trend toward offering high-quality coffee experiences in commercial settings has further fueled demand. With the hospitality industry continuing to grow, this channel is expected to remain a key driver of market expansion.

Regional Analysis

- North America leads the global coffee concentrate market, holding a dominant 48.30% share valued at . This strong position is fueled by rising consumer demand for convenient, ready-to-drink coffee options that do not compromise on quality or flavor. The region’s fast-paced lifestyle and mature coffee culture contribute significantly to its market leadership.

- In Europe, the coffee concentrate market is steadily gaining momentum, driven by increasing interest in premium and specialty coffee products. Consumers in this region are showing a preference for innovative, high quality coffee solutions that align with their evolving tastes and busy routines.

- The Asia Pacific region is emerging as a major growth hub for coffee concentrate, thanks to rapid urbanization, rising disposable incomes, and shifting consumer habits. As coffee becomes a more integral part of everyday life, demand for convenient formats like concentrates is expected to surge across this region.

- Meanwhile, the Middle East & Africa and Latin America hold smaller shares of the market but show promising growth potential. Traditional coffee consumption remains strong in these areas, and younger, urban populations are gradually embracing coffee concentrate products as part of a modern, fast-paced lifestyle.

Top Use Cases

- Household Convenience: Coffee concentrates are perfect for busy households. Consumers can quickly prepare café-style beverages like iced coffees or lattes without any complex brewing. A simple dilution offers a rich cup of coffee at home, saving both time and effort while delivering consistent flavor in every pour.

- Foodservice Efficiency (Cafés & Hotels): In cafés, restaurants, and hotels, coffee concentrates boost operational efficiency. Staff can serve high-quality beverages faster and maintain uniform taste across batches. These products reduce prep time, simplify training, and streamline service especially valuable during peak hours or in high-volume settings.

- Industrial & Food Manufacturing: Coffee concentrates are used in producing coffee-flavored food products like ice creams, desserts, and baked goods. They offer predictable taste and long shelf life, helping manufacturers maintain product consistency, reduce waste, and easily scale up production without compromising on flavor intensity.

- Functional & Health Products (Pharma & Nutraceuticals): The antioxidant-rich nature of coffee concentrates has led to their inclusion in supplements and health-focused products. They are integrated into nutraceuticals and wellness beverages to impart perceived health benefits, aligning with the growing consumer interest in functional, ready-to-consume coffee-based formulations.

- Cosmetics & Personal Care: Coffee concentrates are finding innovative use in cosmetic items like skin creams and exfoliants. Thanks to their antioxidant and anti-inflammatory properties, they help promote skin health and natural glow, appealing to consumers who prefer clean, organic, and ingredient-forward beauty products.

- Culinary & Beverage Innovation: Beyond beverages, coffee concentrates add depth to culinary creations. They are used in sauces, breakfast foods like oatmeal or yogurt, unique cocktails (e.g., espresso martinis), or even DIY flavored syrups. This versatility lets chefs and home cooks explore imaginative flavor pairings.

- Single-Serve & On‑the‑Go Formats: The introduction of single-serve or ready-to-drink concentrate formats like pods or sachets caters to fast-paced consumers. Perfect for offices, travel, or convenience stores, these formats offer quick, mess-free preparation, tapping into modern, mobile coffee consumption habits.

- Institutional Settings (Offices & Healthcare): Institutions like offices, schools, or hospitals leverage coffee concentrates to provide consistent, easy-to-serve coffee for large groups. These products simplify logistics, reduce cleanup and equipment costs, and ensure everyone gets a reliable caffeine fix without relying on fully equipped coffee bars.

Recent Developments

1. All American Coffee LLC

- All American Coffee LLC continues its long-standing role as a producer of high‑quality, all‑natural, shelf‑stable liquid coffee concentrate, tailored for foodservice professionals. Their Liquid Coffee Concentrate 30+1 formula offers a consistent coffee experience without refrigeration or preservatives, priced at around $129 per gallon a staple for hotels, restaurants, and catering. Their website highlights over 30 years of expertise in coffee processing and global trade. Notably, they now offer a range of packaging from Bag-in-Box single pails to IBC totes facilitating scalable use in kitchens and beverage operations.

2. Blue Bottle Coffee, Inc.

- Blue Bottle recently made headlines as employees at four East Bay locations (Berkeley and three in Oakland) are seeking to unionize under the Blue Bottle Independent Union. Their campaign marks the company’s first unionization push in California and comes amid concerns over healthcare benefits and living costs. This follows earlier union efforts at six Greater Boston locations in 2024. This development highlights notable internal change rather than product news—but is highly relevant to company dynamics and future operations.

3. Califia Farms, LLC

- Califia Farms continues to expand its coffee concentrate offerings, especially its unsweetened Cold Brew Coffee Concentrate crafted from 100% Arabica beans, ideal for mixing with water or plant‑based milks. Recently, they partnered again with Farm Design to refresh packaging—including premium amber glass bottles for their concentrated line. Their concentrate, known for balancing notes of apple, caramel, and cocoa, received acclaim and was featured among top cold‑brew concentrates in Food & Wine’s “8 Best Cold Brew Coffee Concentrates.”

4. Climpson & Sons

- Climpson & Sons promote their unique coffee concentrate created via a “flash brew” pour‑over method, dripping hot coffee over ice to rapidly chill and preserve freshness and vibrancy. They highlight suitability for modern offices—providing consistency, convenience, and quality in workplace coffee environments. Additionally, their Instagram recently referenced flexible coffee concentrate subscriptions targeting office use, suggesting a push toward subscription services.

Conclusion

The coffee concentrate market is growing steadily due to changing consumer lifestyles and rising demand for convenience-based beverages. More people are now choosing ready-to-mix cold brew and concentrate formats that offer both time savings and rich coffee flavors. Companies like Califia Farms, Blue Bottle, and Grady’s Cold Brew are driving innovation through new flavors, improved packaging, and instant formats. Additionally, interest from workplaces, foodservice chains, and health-conscious consumers is expanding market reach. With strong developments from established and niche players alike, the market is set to experience further growth, driven by convenience, quality, and sustainability trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)