Table of Contents

Overview

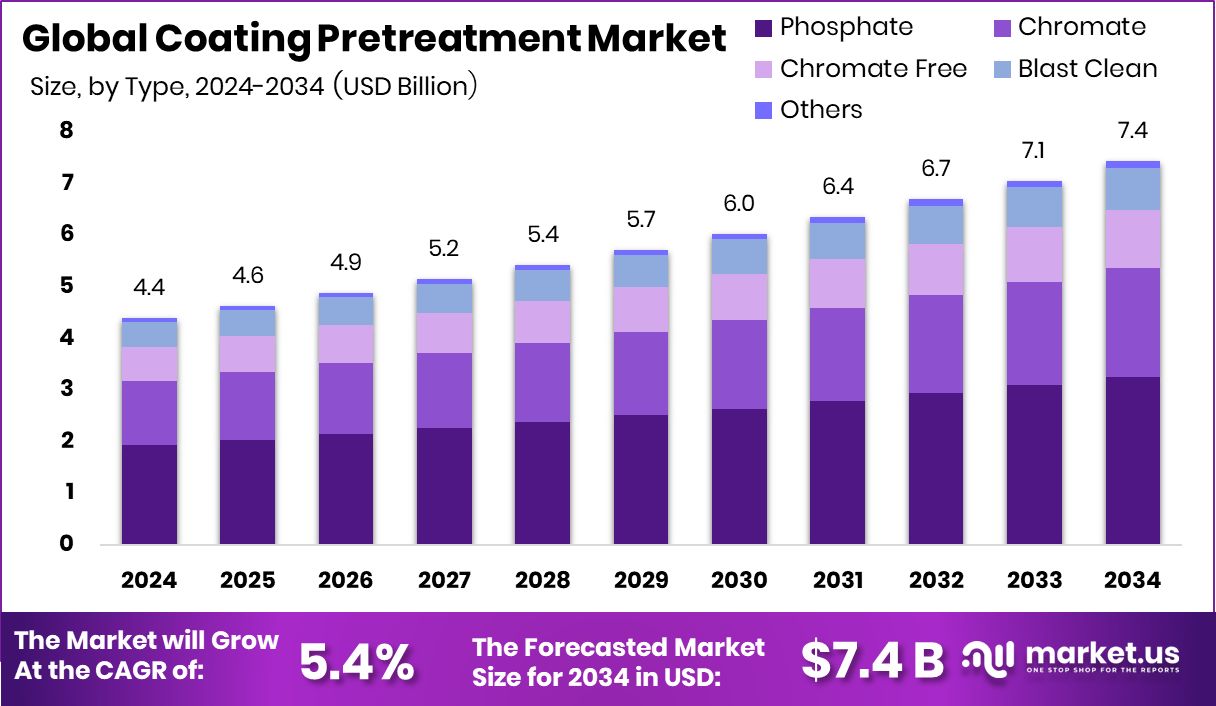

New York, NY – August 08, 2025 –The Global Coating Pretreatment Market is projected to reach USD 7.4 billion by 2034, growing from USD 4.4 billion in 2024, with a CAGR of 5.4% from 2025 to 2034. In 2024, North America led the market, generating USD 2.0 billion in revenue.

Coating pretreatment is a vital surface preparation process performed before applying coatings like paint, powder, or plating on metal or non-metal surfaces. Its primary goal is to clean the substrate, eliminate contaminants such as oils, rust, and dirt, and create a chemically active surface to enhance coating adhesion. Common techniques include chemical cleaning, phosphating, chromating, and anodizing, tailored to the substrate and application.

The coating pretreatment market encompasses the global production, distribution, and application of chemicals, equipment, and technologies for surface preparation. It serves industries such as automotive, construction, appliances, aerospace, and general manufacturing. The demand is driven by the need for durable, high-performance coatings that provide both protective and aesthetic benefits under challenging conditions.

The market’s growth is fueled by the global expansion of industrial manufacturing and infrastructure development. Investments in smart cities, renewable energy, and transportation projects increase the demand for long-lasting coated materials, necessitating effective pretreatment processes. The automotive, appliance, and construction sectors consistently require pretreatment to ensure corrosion resistance and maintain finish quality. Additionally, the rise of electric vehicles and lightweight materials like aluminum and alloys has heightened the need for specialized pretreatment solutions.

Key Takeaways

- The Global Coating Pretreatment Market is expected to be worth around USD 7.4 billion by 2034, up from USD 4.4 billion in 2024, and is projected to grow at a CAGR of 5.4% from 2025 to 2034.

- In 2024, phosphate type led the coating pretreatment market with a 43.8% dominant share globally.

- Steel substrates accounted for 57.1% of the coating pretreatment market due to their widespread industrial usage.

- The building and construction sector captured a 38.9% share in the coating pretreatment market, driven by infrastructure expansion projects.

- Coating pretreatment demand surged in North America, capturing 46.9% market share value.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/coating-pretreatment-market/request-sample/

Report Scope

| Market Value (2024) | USD 4.4 Billion |

| Forecast Revenue (2034) | USD 7.4 Billion |

| CAGR (2025-2034) | 5.4% |

| Segments Covered | By Type (Phosphate, Chromate, Chromate Free, Blast Clean, Others), By Metal Substrate (Steel, Aluminum, Others), By Application (Building and Construction, Automotive and Transportation, Appliances, Others) |

| Competitive Landscape | 3M Co., A.D.INTERNATIONAL INDIA, AkzoNobel N.V., Axalata Coating System LLC, BASF SE, Chemetall GmbH, DuBois Chemicals, Henkel AG & Co. KGaA, NEI Corporation., Nippon Paints Co. Ltd, Plastic Coatings Limited, PPG Industries, RPM International Inc., The Sherwin-Williams Company, Valspar, Vanchem Performance Chemicals |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153825

Key Market Segments

By Type Analysis

Phosphate leads the coating pretreatment market, commanding a 43.8% share in 2024. Its dominance stems from extensive use in metal surface treatments across industries like automotive, construction, and heavy machinery. Zinc and iron phosphating processes excel in enhancing paint adhesion and corrosion resistance, forming uniform, stable layers on both ferrous and non-ferrous substrates.

Cost-effective and reliable, phosphate coatings perform well in harsh conditions, maintaining strong demand in both developed and emerging markets. In 2024, the need for durable, high-performance coatings solidified phosphate’s role in new production and maintenance applications, reflecting industry trust in its proven effectiveness for coating integrity and longevity.

By Metal Substrate Analysis

Steel holds a commanding 57.1% share of the coating pretreatment market in 2024, driven by its widespread use in construction, automotive, infrastructure, and machinery. Pretreatment processes like phosphating and cleaning enhance steel’s durability and coating adhesion, ensuring long-term performance in diverse environments.

Steel’s strength, availability, and compatibility with various coatings make it a staple in large-scale manufacturing. The 57.1% share underscores steel’s critical role in industrial applications and the importance of pretreatment in boosting corrosion resistance and product lifespan, particularly in high-output emerging economies.

By Application Analysis

Building and construction dominate the coating pretreatment market with a 38.9% share in 2024, fueled by demand for corrosion-resistant, durable coated surfaces in infrastructure projects. Steel structures, metal roofing, and architectural components rely on pretreatment to ensure paint adhesion, longevity, and aesthetic quality under exposure to weather, moisture, and pollutants.

Global urban development, real estate growth, and smart city initiatives drive the use of pretreated metal components. This segment’s leading share highlights its high consumption of treated surfaces, valued for reducing maintenance costs and ensuring structural integrity in residential and commercial construction.

Regional Analysis

In 2024, North America dominated the global coating pretreatment market, capturing a 46.9% share valued at USD 2.0 billion. This leadership is fueled by robust industrial activity in automotive, aerospace, and construction, where metal surface treatments ensure durability and performance. Europe saw steady growth, driven by strict environmental regulations and a shift toward sustainable, low-VOC pretreatment chemicals, maintaining demand through quality and compliance focus.

Asia Pacific thrived due to rapid industrialization and construction, particularly in emerging economies, with transportation and consumer goods sectors boosting pretreatment use. The Middle East & Africa grew steadily, supported by infrastructure projects requiring weather-resistant coatings. Latin America showed moderate expansion, driven by rising industrial output and metal processing advancements. North America’s established industrial base solidified its top position in 2024.

Top Use Cases

- Automotive Industry: Coating pretreatment ensures car parts like frames and engines resist corrosion and hold paint well. It extends vehicle life by protecting metal surfaces from rust and wear, improving durability and appearance. This is critical for high-performance and low-maintenance vehicles, especially in regions with harsh weather conditions.

- Construction Sector: Pretreatment is vital for steel structures, roofing, and panels in buildings. It enhances corrosion resistance and paint adhesion, ensuring long-lasting, weather-resistant surfaces. This reduces maintenance costs and improves aesthetic quality, meeting the demands of urban development and infrastructure projects globally.

- Aerospace Applications: Pretreatment coatings protect aircraft components from extreme conditions. They enhance adhesion and corrosion resistance for metals like aluminum, ensuring durability and safety. This is crucial for high-performance parts, reducing maintenance and extending the lifespan of planes in demanding environments.

- Consumer Electronics: Pretreatment is used on metal parts in devices like smartphones and laptops. It improves coating adhesion, prevents corrosion, and enhances durability. This ensures sleek finishes and longer product life, meeting consumer demand for reliable, high-quality electronics in competitive markets.

- Furniture Manufacturing: Pretreatment coatings are applied to metal furniture frames to prevent rust and improve paint adhesion. This ensures durable, attractive finishes that withstand daily use. It’s especially important for outdoor furniture exposed to moisture, supporting the growing demand for eco-friendly, long-lasting products.

Recent Developments

1. 3M Co.

3M has introduced advanced pretreatment solutions for automotive and aerospace coatings, focusing on eco-friendly options. Their Scotch-Weld Pretreatment enhances adhesion and corrosion resistance while reducing VOC emissions. 3M is also investing in water-based pretreatment technologies to comply with stricter environmental regulations.

2. A.D. INTERNATIONAL INDIA

A.D. International India has developed zinc phosphate-free pretreatment chemicals for metal coatings, improving sustainability. Their latest formulations reduce sludge generation and energy consumption. The company is expanding into automotive and industrial coatings, offering customized pretreatment solutions.

3. AkzoNobel N.V.

AkzoNobel launched Interpon D2015 Eco, a chromium-free pretreatment for powder coatings, enhancing durability. They also introduced digital tools for pretreatment optimization, reducing waste. AkzoNobel’s focus is on circular economy solutions in metal pretreatment.

4. Axalta Coating Systems LLC

Axalta’s Alesta Zero pretreatment system eliminates heavy metals, improving eco-efficiency. Their Energy Cure Pretreatment reduces curing time, saving energy. Axalta is collaborating with automakers to develop next-gen pretreatment technologies.

5. BASF SE

BASF’s Oxsilan pretreatment replaces phosphates, reducing environmental impact. Their CathoGuard 800 e-coat pretreatment enhances corrosion resistance. BASF is also advancing AI-driven pretreatment process optimization.

Conclusion

The Coating Pretreatment Market thrives due to its critical role in enhancing durability and performance across industries like automotive, construction, aerospace, and electronics. Growing demand for eco-friendly, corrosion-resistant coatings, driven by urbanization and technological advancements, fuels market expansion. Despite challenges like environmental regulations, innovations in sustainable pretreatments ensure steady growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)