Table of Contents

Overview

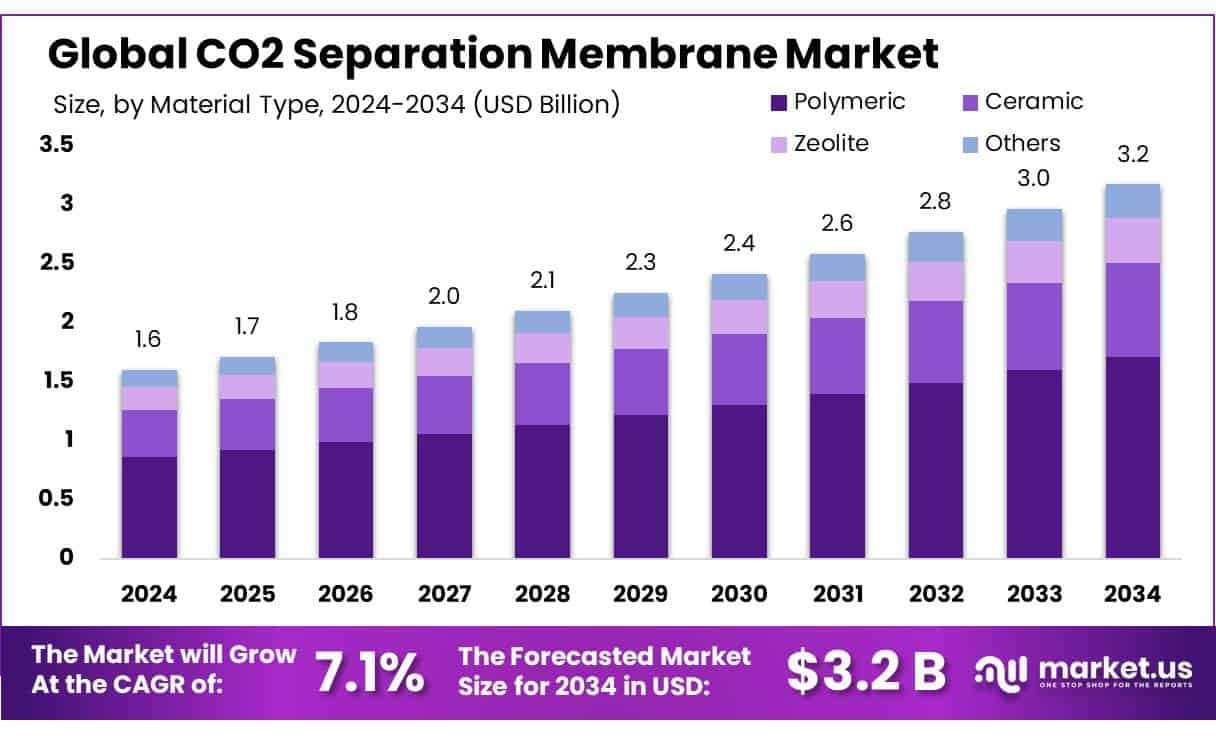

New York, NY – Oct 17, 2025 – The Global CO2 Separation Membrane Market is projected to grow from USD 1.6 billion in 2024 to approximately USD 3.2 billion by 2034, registering a compound annual growth rate (CAGR) of 7.1% between 2025 and 2034.

The CO₂ separation membrane market is experiencing rapid growth, fueled by the urgent need to combat climate change and the rising demand for sustainable industrial solutions. These membranes play a key role in capturing carbon dioxide from gas mixtures, making them essential for industries seeking to lower greenhouse gas emissions. Widely applied in power generation, oil and gas, and chemical manufacturing, they enhance the performance of carbon capture and storage (CCS) systems.

Over the past five years, the market has grown at an average annual rate of about 8%, reaching an estimated value of USD 1.2 billion in 2025. This expansion reflects their increasing importance in environmental management and compliance with tightening regulations.

Growth is driven by stricter emission policies such as the EU Green Deal’s net-zero goal by 2050 and advancements in membrane materials offering greater selectivity and durability. Government support is also pivotal, with initiatives like the U.S. DOE’s USD 24 million investment in next-gen carbon capture technologies and CCS adoption strategies in countries such as Japan and South Korea accelerating market adoption.

Key Takeaways

- The CO₂ separation membrane market is projected to grow from USD 1.6 billion in 2024 to around USD 3.2 billion by 2034, at a CAGR of 7.1%.

- Polymeric membranes led the market in 2024, accounting for over 54.30% of the share.

- Hollow fiber modules held the top position among module types, with more than a 47.20% share.

- Post-combustion capture dominated the application segment, representing over 44.40% of the market.

- The oil & gas industry was the largest end-use sector, holding more than 37.50% of the market share.

- North America led regionally, securing a 46.44% share valued at about USD 0.7 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/co2-separation-membrane-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.6 Bn |

| Forecast Revenue (2034) | USD 3.2 Bn |

| CAGR (2025-2034) | 7.1% |

| Segments Covered | By Material Type (Polymeric, Ceramic, Zeolite, Others), By Module (Hollow Fiber, Spiral Wound, Others), By Application (Pre-combustion Capture, Post-combustion Capture, Industrial Separation), By End-use (Oil and Gas, Chemicals, Power Generation, Food and Beverage, Others) |

| Competitive Landscape | UBE Corporation, BORSIG GmbH, Toray Industries, Inc., NGK INSULATORS, LTD., Pall Corporation, Fujifilm Holdings Corporation, SLB, Air Liquide Advanced Separations, GENERON, JGC HOLDINGS CORPORATION, Evonik Industries AG, Membrane Technology and Research, Inc., Grasys, Other Key Players |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=145003

Key Market Segments

By Material Type

- Polymeric Membranes Hold Over 54% Share in CO₂ Separation Market

In 2024, polymeric membranes dominated the CO₂ separation membrane market with a 54.30% share. Their strong position is driven by excellent gas separation efficiency, durability, and adaptability for large-scale industrial use. Continuous advancements have enhanced their performance under varying pressures and temperatures. Looking to 2025, innovations in polymeric material science are expected to boost separation efficiency and extend operational lifespan, reinforcing their market leadership.

By Module

- Hollow Fiber Modules Lead with 47.20% Market Share

Hollow fiber modules accounted for over 47.20% of the market in 2024, thanks to their high surface-area-to-volume ratio, which improves gas separation efficiency. Their structure of fine fibers ensures maximum CO₂ contact, making them ideal for high-throughput and selective separation needs. With ongoing fabrication improvements expected in 2025, their adoption will likely expand further across emission-reduction industries.

By Application

- Post-combustion Capture Dominates with 44.40% Share

Post-combustion capture led the market in 2024 with a 44.40% share, enabling CO₂ capture from emissions after combustion in power plants and industrial operations. Rising regulatory pressure to reduce greenhouse gases and proven effectiveness have made it the preferred approach. Continued technological advancements in 2025 are expected to enhance efficiency and cost-effectiveness, strengthening its role in meeting global climate goals.

By End-use

- Oil & Gas Sector Commands 37.50% Share in CO₂ Separation Membranes

The oil & gas sector held a 37.50% market share in 2024, driven by regulatory compliance needs and carbon footprint reduction efforts. CO₂ separation membranes are extensively used in natural gas purification and enhanced oil recovery. As the industry pushes for cleaner technologies, demand for efficient CO₂ separation solutions is projected to remain strong into 2025.

Regional Analysis

In 2024, North America dominated the CO₂ separation membrane market, securing a 46.44% share valued at approximately USD 0.7 billion. This leadership is driven by the region’s advanced technological capabilities and strict environmental regulations, which have encouraged substantial investments in carbon capture and storage (CCS) solutions.

The United States and Canada, with their strong industrial bases, play a pivotal role in market growth by adopting innovative measures to reduce industrial carbon emissions. Government-backed initiatives and R&D funding continue to enhance the performance and cost-effectiveness of CO₂ capture technologies, further supporting adoption.

Moreover, the presence of leading industry players headquartered in the region strengthens its competitive edge. These companies actively pursue strategic partnerships, product innovations, and capacity expansions, ensuring North America remains at the forefront of technological advancements and market share in CO₂ separation membranes.

Top Use Cases

- Post-combustion Carbon Capture in Power Plants

Membranes enable efficient CO₂ removal from flue gases after fossil fuel combustion, often as a retrofit solution. They offer low energy use and compact design, providing a cost-effective, modular alternative to solvent-based methods helpful in lowering industrial emissions while minimizing infrastructure disruption.

2. Biogas Upgrading for Renewable Energy

CO₂ separation membranes purify biogas by removing carbon dioxide and impurities to produce high-quality biomethane. Faster, energy-efficient processing with low operating costs makes them ideal for transforming organic waste into cleaner fuel, supporting renewable energy and sustainability goals.

3. Natural Gas Processing and Sweetening

In gas processing, membranes remove CO₂ and other acids (e.g., H₂S) from natural gas. This “sweetening” ensures the fuel meets pipeline or liquefaction standards, often for enhanced oil recovery or clean energy use without the energy burden of cryogenic or chemical methods.

4. Modular Membrane Reactors for Chemical Synthesis

Membrane-equipped reactors remove products like CO₂ as they form during synthesis reactions. This shifts reaction equilibrium, improves yield, and cuts energy needs especially useful in high-pressure or high-temperature environments, promoting efficient, cleaner chemical production.

5. Hybrid Systems for Hydrogen & Biogas Markets

Membranes team up with technologies like pressure swing adsorption in hybrid systems to purify hydrogen or upgrade biogas. These combinations enhance selectivity, reduce energy consumption, and enable cleaner production pathways for hydrogen fuel and renewable gas markets.

Recent Developments

- UBE Corporation

- UBE is expanding its polyimide hollow-fiber production for CO₂ separation membranes, aiming to boost capacity by about 1.8× at its Ube Chemical and Sakai factories. These enhancements, set to go live in the first half of the 2025 fiscal year, will help meet growing demand especially in North America and Europe for biogas-to-biomethane upgrading. UBE’s membranes offer high H₂S resistance, durability, and low CAPEX/OPEX, already deployed in over 200 biogas upgrading plants globally.

2. Toray Industries, Inc.

- Toray is launching a pilot facility at its Shiga Plant starting fiscal 2025 to scale up mass production of its all-carbon CO₂ separation membranes. These advanced membranes feature hollow-fiber spinning and thin-layer coating techniques validated in biogas and exhaust gas testing at the Tokai Plant. Toray is collaborating with biogas and natural-gas developers to validate real-world application, targeting efficient commercial deployment.

3. NGK INSULATORS, LTD.

- NGK has developed a ceramic CO₂ separation membrane tailored for industrial exhaust gases, boasting approximately five times the separation factor of traditional DDR-type zeolite membranes. Leveraging its zirconia-based ceramic precision, NGK is advancing toward commercialization around 2030. NGK’s sub-nano ceramic membranes also support CO₂-EOR (enhanced oil recovery), effectively separating CO₂ from associated crude gas under high-pressure conditions.

Conclusion

The CO₂ separation membrane market is witnessing rapid technological progress, driven by the urgent need for efficient carbon capture and utilization solutions across industries. Companies such as UBE Corporation, Toray Industries, NGK Insulators, and Air Liquide Advanced Separations are leading advancements through capacity expansions, pilot facilities, and innovative material development. UBE’s scaling of polyimide hollow-fiber membrane production, Toray’s move toward mass production of all-carbon membranes, NGK’s breakthrough in ceramic membrane performance, and Air Liquide’s successful field tests of hybrid membrane liquefaction systems reflect a strong focus on enhancing efficiency, durability, and cost-effectiveness.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)