Table of Contents

Overview

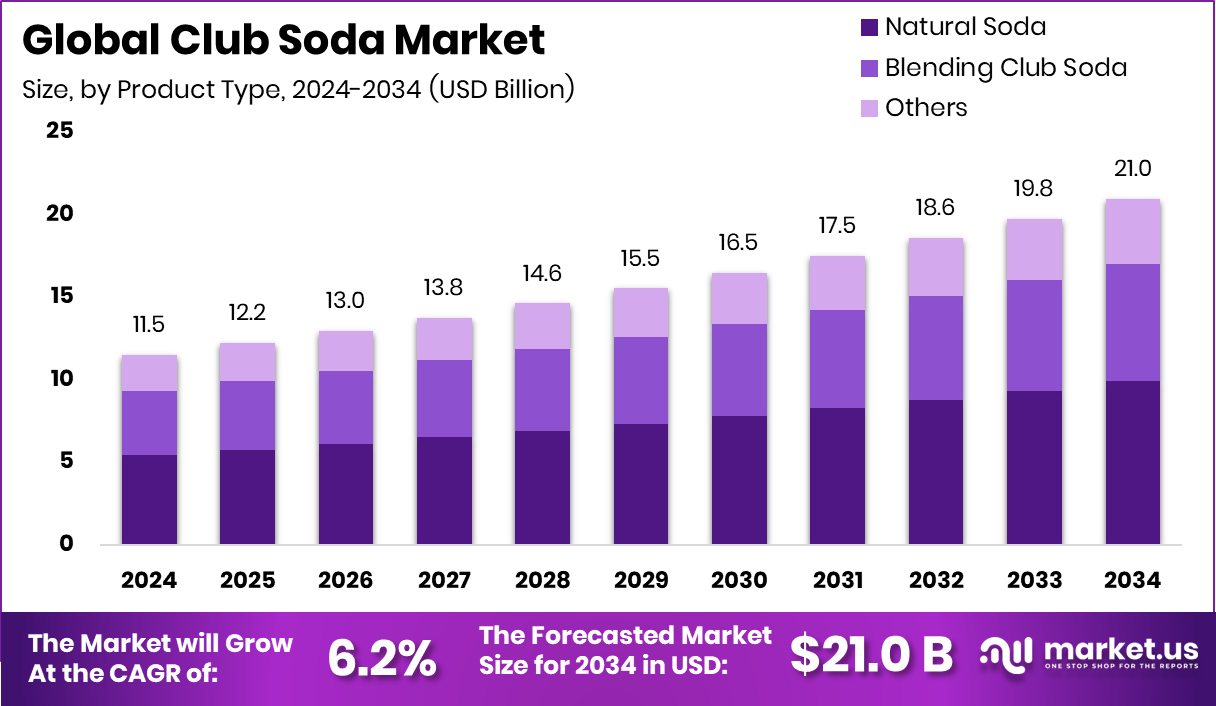

New York, NY – October 06, 2025 – The Global Club Soda Market is projected to reach USD 21.0 billion by 2034, up from USD 11.5 billion in 2024, growing at a CAGR of 6.2% between 2025 and 2034. With revenues of USD 4.5 billion, North America led the market, accounting for a 39.7% share in 2024.

Club soda is a type of carbonated water infused with minerals such as sodium bicarbonate, potassium sulfate, and sodium chloride, which lend it a crisp and mildly salty flavor. Unlike natural sparkling water, club soda is artificially carbonated and mineral-enriched, making it a preferred choice both as a standalone drink and as a mixer in cocktails and other beverages. Its refreshing, clean taste and versatility have long made it a favorite in households, restaurants, and bars.

The club soda market is expanding steadily, supported by a consumer shift toward healthier, low-calorie drinks. Growing aversion to sugary sodas and artificial additives has boosted demand for mineral-based carbonated beverages. The rise of mixology culture and at-home cocktail trends is amplifying its appeal as a premium mixer. Brand innovation plays a vital role in shaping market trends. Manufacturers are launching naturally flavored, clean-label, and functional variants that align with wellness-driven consumption.

Notably, FirstClub secured USD 8 million in seed funding in 2024, led by Accel and RTP Global, signaling strong investor confidence in the evolving beverage landscape. Health trends are a powerful market catalyst. Consumers increasingly prefer beverages with low sugar, digestive benefits, and natural ingredients. The success of prebiotic and probiotic sodas such as Olipop, valued at USD 1.85 billion, illustrates how functional hydration is reshaping beverage innovation. This trend overlaps with the club soda segment, encouraging manufacturers to introduce gut-friendly and mineral-enhanced formulations.

Urbanization and premiumization are also driving factors. City consumers seek drinks that balance refreshment with natural authenticity. The emergence of regional and artisanal sodas like the Mizoram all-natural soda brand, achieving a USD 1.25 million valuation, demonstrates growing enthusiasm for locally crafted, sustainable beverages. Such developments help club soda penetrate both premium urban and mass-market channels globally. Investment momentum continues as beverage startups focus on authenticity and function.

Soda, a European brand, raised €11.5 million in Series A funding to expand operations and product lines. These funding rounds highlight the sector’s scalability and its alignment with long-term wellness and sustainability goals. Future opportunities lie in functional innovations, diverse flavor portfolios, and e-commerce expansion. By embracing natural mineral blends and eco-conscious packaging, club soda brands can solidify their position in the next generation of health-oriented beverages.

Key Takeaways

- The Global Club Soda Market is expected to be worth around USD 21.0 billion by 2034, up from USD 11.5 billion in 2024, and is projected to grow at a CAGR of 6.2% from 2025 to 2034.

- In 2024, natural soda held a 47.2% share, highlighting consumer preference for authentic club soda choices.

- Glass bottles captured 41.7% of the packaging share, showing strong demand for premium and eco-friendly club soda formats.

- Supermarkets and hypermarkets dominated with a 43.5% share, reflecting their central role in distributing club soda globally.

- In 2024, the Club Soda Market in North America reached USD 4.5 Bn, accounting for 39.7%.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/club-soda-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 11.5 Billion |

| Forecast Revenue (2034) | USD 21.0 Billion |

| CAGR (2025-2034) | 6.2% |

| Segments Covered | By Product Type (Natural Soda, Blending Club Soda, Others), By Packaging (Glass Bottles, Cans, Plastic Bottles), By Distribution Channel (Supermarket/Hypermarket, Online Retail, Departmental Stores, Others) |

| Competitive Landscape | Fever-Tree, White Rock Beverages, Inc., Dr Pepper Snapple Group, Danone, East Imperial, SodaStream Inc., Strong’s Market, JONES SODA CO., Coca-Cola Company, Hansen Beverage |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158297

Key Market Segments

By Product Type Analysis

Natural Soda led the club soda market in 2024, capturing a 47.2% share. Its dominance stems from growing consumer demand for clean-label beverages free from artificial additives. Health and wellness trends have fueled the preference for natural sodas, which offer reduced sugar content and a refreshing taste. The segment’s appeal is enhanced by its compatibility with functional and prebiotic blends, popular among urban, health-conscious consumers. This trend toward authenticity and natural sourcing continues to drive long-term growth in the global club soda industry.

By Packaging Analysis

Glass Bottles held a leading 41.7% share of the club soda market in 2024. Their prominence is driven by consumer preference for premium, eco-friendly packaging that better preserves freshness and carbonation. Perceived as healthier and more sustainable, glass bottles address concerns about plastic waste and chemical leaching. Their upscale appearance also makes them a top choice for restaurants, bars, and hospitality settings, where presentation matters. With rising environmental awareness and demand for recyclable packaging, glass bottles remain a key factor in shaping the club soda market’s future.

By Distribution Channel Analysis

Supermarkets and Hypermarkets dominated the club soda market in 2024, accounting for a 43.5% share. Their leadership is driven by wide product availability, bulk purchase options, and strong brand visibility. Consumers favor these outlets for their convenience, competitive pricing, and diverse range of club soda brands and packaging formats. Promotional discounts and in-store marketing further boost sales, solidifying this channel’s influence. The growth of modern retail infrastructure globally ensures supermarkets and hypermarkets continue to effectively reach a broad and diverse consumer base.

Regional Analysis

North America led the market, commanding a 39.7% share valued at USD 4.5 billion. This dominance is driven by strong demand for low-sugar, functional beverages and widespread access to modern retail channels like supermarkets and hypermarkets. Heightened consumer awareness of clean-label and sustainable products has further boosted the popularity of natural and premium club soda options.

Europe follows as a strong contender, supported by its established beverage culture and growing interest in healthier carbonated alternatives. Asia Pacific is experiencing rapid growth, fueled by urbanization, an expanding middle class, and increasing adoption of global beverage trends.

Latin America and the Middle East & Africa are emerging markets, gaining momentum due to improving retail infrastructure and a young consumer base seeking modern, refreshing beverage options. North America’s leadership underscores the impact of health-conscious consumer trends, innovative product offerings, and robust distribution networks, setting a standard for sustained growth in the global club soda market.

Top Use Cases

- Cocktail Mixing: Club soda serves as a key mixer in drinks like gin rickeys or Tom Collins, adding fizz and lightness without extra sugar. Its neutral taste balances spirits and juices, making beverages refreshing and low-calorie. Health-focused consumers appreciate it for creating lighter cocktails at home or in bars, aligning with trends toward mindful drinking.

- Baking Aid: In recipes for tempura or pancakes, club soda lightens batters by releasing carbon dioxide bubbles during cooking. This creates crisp, airy textures for fried foods or fluffy breakfast items. Home bakers use it to replace water or milk, enhancing volume and tenderness while keeping ingredients simple and natural.

- Stain Removal: Pour club soda on spills like wine or pet urine to lift stains from fabrics or carpets through its carbonic acid action. The fizz breaks down particles without harsh chemicals, making it a quick household fix. It’s ideal for immediate treatment to prevent setting, keeping clothes and rugs fresh.

- Glass Cleaning: Spray club soda on windows, mirrors, or drinkware to dissolve smudges and fingerprints effortlessly. The minerals and bubbles cut through grime for a streak-free shine, serving as an eco-friendly alternative to commercial cleaners. It’s handy for daily upkeep in kitchens or cars.

- Plant Nourishment: Water houseplants with club soda weekly to supply minerals like potassium and phosphorus for healthier growth. The carbonation aerates soil and boosts vitality without over-fertilizing. Gardeners favor it for potted herbs, promoting lush greenery in urban homes.

Recent Developments

1. Fever-Tree

Fever-Tree is aggressively expanding in the US, now the world’s largest mixer market. Recent developments include launching a lower-calorie “Light” range and a Yuzu & Lime soda to capitalize on the RTD trend. They are also investing heavily in marketing and a new US production facility to localize supply chains and compete directly with domestic brands, aiming to double their US revenue.

2. White Rock Beverages, Inc.

As the owner of the historic White Rock brand, the company continues to leverage its legacy while expanding its modern portfolio. A key recent development is the national rollout and distribution expansion of its popular Sriracha Soda and other innovative, spicy mixer lines. They are focusing on unique flavor profiles to stand out in the competitive craft mixer and non-alcoholic beverage space.

3. Dr Pepper Snapple Group (Keurig Dr Pepper)

Under Keurig Dr Pepper, the Canada Dry brand remains a club soda leader. A significant recent development is the nationwide launch of Canada Dry Lemonade Ginger Ale, expanding the brand beyond traditional mixers. The company is also focusing on package innovation, like smaller cans and multi-pack formats, to drive growth in the carbonated soft drink and mixer aisle, leveraging its immense distribution network.

4. Danone

Danone’s recent developments in carbonated water are centered on its international brand, Badoit. The company has been emphasizing Badoit’s premium, naturally sparkling mineral water credentials through sleek packaging and positioning it as a sophisticated pairing for wine and spirits. Efforts focus on expanding its availability in premium on-trade venues (restaurants, bars) and retail in key European and Asian markets, capitalizing on the premiumization trend.

5. East Imperial

East Imperial, a premium mixer brand, is focusing on significant global distribution partnerships. A key recent development is their expansion into major US retailers like Total Wine & More and Kroger, making their authentic Thai-style Ginger Beer and other mixers more accessible. They are also strengthening their position in the Asia-Pacific region, targeting high-end bars and restaurants to build brand authority as a superior cocktail ingredient.

Conclusion

Club soda stands out as a versatile product with broad appeal in beverages and home care. As a market research analyst, I observe that its rising popularity stems from health trends favoring low-sugar options and natural ingredients. Its multi-purpose nature supports steady demand across households and hospitality, promising sustained growth through innovative flavors and sustainable packaging.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)