Table of Contents

Overview

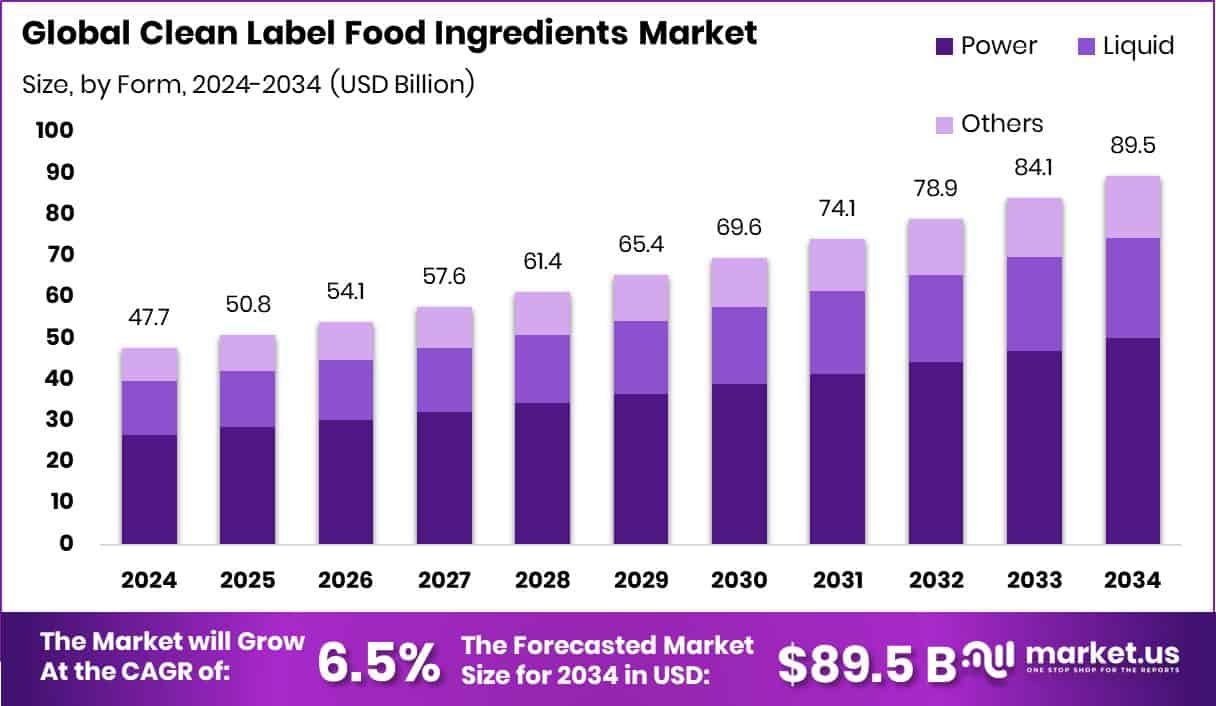

New York, NY – Aug 11, 2025 – The global clean label food ingredients market is projected to reach approximately USD 89.5 billion by 2034, rising from USD 47.7 billion in 2024, with a compound annual growth rate (CAGR) of 6.5% between 2025 and 2034. North America remains a key growth driver, fueled by increasing consumer awareness and demand for transparent food labeling, accounting for about USD 23.5 billion of the market value.

Clean label food ingredients are made from natural, simple sources that consumers can easily recognize and understand. They exclude artificial additives, synthetic chemicals, and complex-sounding names, instead favoring ingredients like fruits, vegetables, herbs, spices, and plant-based colorings. The clean label trend is centered around transparency making it easy for consumers to trust what they’re eating and feel confident that their food is safe, wholesome, and authentic.

The clean label food ingredients market supports the growing demand for natural and health-focused products. This includes natural preservatives, sweeteners, emulsifiers, and colors that help brands meet consumer expectations for clean, minimally processed foods. As shoppers increasingly check product labels, food manufacturers are adapting by reformulating with ingredients that have a more natural image. The market’s growth reflects how health-conscious behavior is influencing food production and marketing strategies.

Post-pandemic health concerns have strengthened interest in cleaner diets, prompting more brands to replace synthetic ingredients with natural alternatives. Regulatory initiatives supporting transparent labeling further encourage this shift. Consumers especially millennials and Gen Z are leading the demand for clear, trustworthy ingredient lists in food and beverages.

There’s rising potential in segments like plant-based products, dairy alternatives, snacks, and ready-to-eat meals. As producers work to maintain flavor, shelf life, and texture using clean ingredients, new opportunities for innovation are emerging.

According to the USDA NASS, U.S. milk production stood at 226 billion pounds in 2024, showing a minor 0.2% decline from the previous year. Meanwhile, clean-label beverage company Olipop raised $50 million in Series C funding, valuing the brand at $1.85 billion. Now profitable, the company achieved over $400 million in annual sales demonstrating how strong consumer demand is shaping the future of clean-label food and drink products.

Key Takeaways

- The global market for clean label food ingredients is projected to reach approximately USD 89.5 billion by 2034, up from USD 47.7 billion in 2024, reflecting a steady CAGR of 6.5% throughout the forecast period (2025-2034).

- Powdered ingredients continue to dominate the market, making up about 56.2% of global clean label ingredient usage due to their convenience and stability in food formulations.

- Among the various ingredient types, natural flavors stand out with a 23.6% share, driven by growing consumer demand for taste transparency and authentic sensory experiences.

- Plant-based sources now account for nearly 62.3% of the market, underscoring a significant shift toward sustainability and health-focused product choices.

- Food applications represent the largest end-use segment, holding a 45.3% share, as more consumers opt for clean label choices in their everyday meals.

- Regionally, North America led the market with a valuation of USD 23.5 billion in 2024, driven by heightened clean label awareness and regulatory support for transparent food labeling.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/clean-label-food-ingredients-market/free-sample/

Report Scope

| Market Value (2024) | USD 47.7 Billion |

| Forecast Revenue (2034) | USD 89.5 Billion |

| CAGR (2025-2034) | 6.5% |

| Segments Covered | By Form (Powder, Liquids, Others), By Ingredients Type (Natural Flavors, Natural Colors, Fruit and Vegetable Ingredients, Starch and Sweeteners, Flour (Wheat Flour, Corn Flour, Rice Flour, Others), Malt, Others), By Source (Plant-based Source, Animal-based Source, Others), By Application (Food (Bakery, Confectionery, Cereals and Snacks, Processed Food, Others), Pet Food, Dairy, Non-Dairy, and Fermented Beverages, Others) |

| Competitive Landscape | Ajinomoto Co. Inc., Archer Daniel Midland Company, Brisan Group Cargill, Cargill Incorporated, Novonesis Group, Corbion, DSM-Firmenich, Exberry, Ingredion, International Flavors & Fragrances Inc., Kerry Group PLC, Limagrain Ingredients, Sensient Technologies Corporation, Tate & Lyle PLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=144482

Key Market Segments

By Form Analysis

Powder format remains dominant, accounting for 56.20% of the global market share.

In 2024, the powder form led the clean label food ingredients market, holding a commanding 56.20% share. Its popularity stems from extended shelf life, ease of handling, and adaptability across various food products. Powdered ingredients such as natural preservatives, colors, and emulsifiers are preferred in food processing due to their compatibility with dry blends and minimal impact on product texture or flavor.

This format is especially prevalent in bakery, snack, and ready-to-eat products, where consistency, stability, and processing convenience are key. Powdered options also reduce transportation and storage costs, supporting both efficiency and sustainability in the supply chain. Moreover, advancements in spray and freeze-drying technology have improved the quality and functional performance of these ingredients, expanding their use in dairy, beverages, and confectionery products.

By Ingredient Type Analysis

Natural flavors lead ingredient choices, representing 23.60% of global usage.

Natural flavors dominated the ingredient type segment in 2024, capturing 23.60% of the market. Consumer demand for transparency and recognizable components continues to drive this growth. Derived from fruits, herbs, spices, and other plant-based sources, natural flavors are seen as healthier and more authentic alternatives to synthetic additives.

Food and beverage companies especially in the dairy, beverage, and bakery sectors are incorporating natural flavors to meet clean label standards while maintaining appealing taste profiles. Their versatility, clean perception, and alignment with wellness trends make them a preferred choice for reformulations and new product development worldwide.

By Source Analysis

Plant-based sources dominate, accounting for 62.30% of the market.

In 2024, plant-derived ingredients held a majority share of 62.30% in the clean label food ingredients market. This dominance is fueled by increasing demand for natural, sustainable, and vegan-friendly options. Ingredients sourced from fruits, vegetables, grains, and legumes are becoming the foundation for many clean-label product formulations.

As consumers, particularly in North America and Europe, prioritize ethical and environmentally conscious eating habits, food companies are reformulating products to rely more heavily on plant-based inputs. Regulatory backing for natural alternatives and the rapid growth of the plant-based food sector further support this trend across multiple food categories.

By Application Analysis

Food applications remain the largest segment, making up 45.30% of market share.

The food segment led the clean label market by application in 2024, with a 45.30% share. Rising awareness of health and nutrition is pushing consumers to seek out clean-label alternatives in everyday food products ranging from bakery goods and cereals to snacks and frozen meals.

Manufacturers are actively responding by removing artificial additives and embracing clean, naturally derived ingredients. The trend is especially strong in North America and Europe, where shoppers are highly attentive to ingredient lists and labeling claims. The push for clean formulations has become a strategic priority in reformulating legacy brands and innovating new, health-focused offerings.

Regional Analysis

North America leads the global clean label food ingredients market, accounting for approximately 49.40% of the total share. In 2024, the region reached a market valuation of USD 23.5 billion, driven by growing consumer preference for transparent labeling, natural additives, and health-forward food choices.

In the United States and Canada, major food companies are actively reformulating products to meet clean label standards, further accelerating market expansion. Europe follows closely as a well-established market, supported by robust regulations and high levels of consumer awareness, particularly around product safety and ingredient sourcing.

The Asia-Pacific region is gaining momentum, fueled by rising disposable income, urbanization, and increased attention to food quality and nutrition. Although detailed figures are limited, the region shows strong potential for future growth.

Meanwhile, Latin America and the Middle East & Africa are emerging markets, where interest in wellness and healthier eating habits is gradually increasing. These regions are still developing compared to more mature markets but represent valuable growth opportunities over the long term.

Top Use Cases

- Clean Label Bakery Products: Brands use plant-based powders like fruit, vegetable, and grain-derived ingredients to replace synthetic sweeteners and preservatives. These ingredients enhance texture and flavor naturally, helping bakeries market cleaner labels while maintaining shelf stability in cookies, breads, and pastries.

- Clean Beverage Formulations: Beverage makers use natural extracts, fruit powders, and non‑artificial colorants to replace synthetic additives. This allows beverage labels to feature claims like “no artificial flavors or colors,” meeting consumer demand for transparency and clean ingredients in juices, teas, and functional drinks.

- Dairy Alternatives & Plant‑based Foods: Manufacturers of non‑dairy yogurts, milks, and cheeses integrate clean label stabilizers and natural flavors sourced from plants. These ingredients support ingredient clarity and health positioning while preserving texture and taste in plant-based dairy alternatives.

- Snack & Convenience Foods: Companies reformulate snacks such as chips, bars, and ready meals using clean label ingredient blends like upcycled flours or natural hydrocolloids. These help deliver recognizable ingredient lists, clean flavor profiles, and better shelf life without synthetic additives.

- Functional & Health Drinks: Producers of protein drinks, prebiotic beverages, and wellness shots incorporate clean label sweeteners, colors, and flavorings. These meet demand for transparent nutrition, catering to millennials and Gen Z focused on low‑additive, ingredient‑skill clarity in health products.

- Clean Pet Food & Treats: Pet food brands are increasingly integrating plant-based clean label ingredients such as pea protein or fruit fibers to replace artificial preservatives. These shifts allow cleaner nutrition claims and ingredient transparency in pet nutrition.

- Color and Flavor Systems in Confectionery: Sweet and confectionery brands adopt natural dyes and flavors from fruits, spices, or botanical extracts. These clean label components satisfy regulations and consumer expectations for simple, recognizable ingredient lists in chocolate, candies, and coatings.

Recent Developments

- Ajinomoto Co. Inc.

- Ajinomoto Health & Nutrition has entered into a collaboration with biotech firm Shiru, combining AI-driven protein discovery with fermentation expertise. This project focuses on developing novel sweet proteins to replace sugar in beverages clean-label ingredients that support reduced-sugar formulations. It marks Ajinomoto’s strategic entry into the emerging sugar‑reduction space through sustainable, label-friendly proteins.

2.Cargill Incorporated

- At Food Ingredients Europe 2024, Cargill launched a new suite of sustainable ingredient innovations: advanced plant-based proteins, a sugar-reduction sweetener (EverSweet stevia), and chocolate alternatives. These clean-label solutions are targeted for applications in bakery, confections, ice cream, and cereals aligning taste, nutrition, and label transparency at scale.

3. DSM‑Firmenich

- DSM‑Firmenich partnered with Meala FoodTech to introduce Vertis PB Pea, a clean-label pea-based texturizer designed to replace complex binders like hydrocolloids in plant-based meat alternatives. Additionally, it launched Dry Vitamin A Palmitate NI, a stable, clean-label vitamin A format for fortified foods. These innovations support simplified labels and functional nutrition. Its flavor trend for 2025 “Milky Maple” also reflects clean, familiar taste preferences.

4. Ingredion

- Ingredion has expanded its clean-label portfolio with Sustagrain NOVATION® Pulse, a plant-based starch ingredient delivering fiber and protein. This solution helps food and beverage firms develop clean-label, allergen-free formulations while maintaining texture and stability.

5. Archer-Daniels Midland Company

- ADM has launched Naturally Simple Colors, a line of natural colorants designed for clean-label applications in beverages, confectionery, and bakery products, enabling manufacturers to replace synthetic dyes with simplified, recognizable ingredients.

Conclusion

The clean label food ingredients market is undergoing a significant transformation driven by evolving consumer preferences, regulatory support, and industry innovation. Increasing demand for natural, recognizable, and minimally processed ingredients is prompting food manufacturers to reformulate products and develop new offerings aligned with clean label standards. Ingredients such as natural flavors, plant-based colorants, and powdered formats are gaining traction across diverse applications including bakery, beverages, dairy alternatives, and ready-to-eat meals.

North America continues to dominate the market, supported by high health awareness and proactive labeling practices, while Asia-Pacific is rapidly emerging due to growing disposable income and urbanization. Companies across the value chain are investing in R&D and partnerships to expand clean label portfolios and enhance product transparency. Additionally, advances in food processing technologies like fermentation and freeze-drying are enabling scalable, stable, and functional clean ingredients. As this trend strengthens, the global food industry is shifting toward greater authenticity, simplicity, and sustainability.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)