Table of Contents

Overview

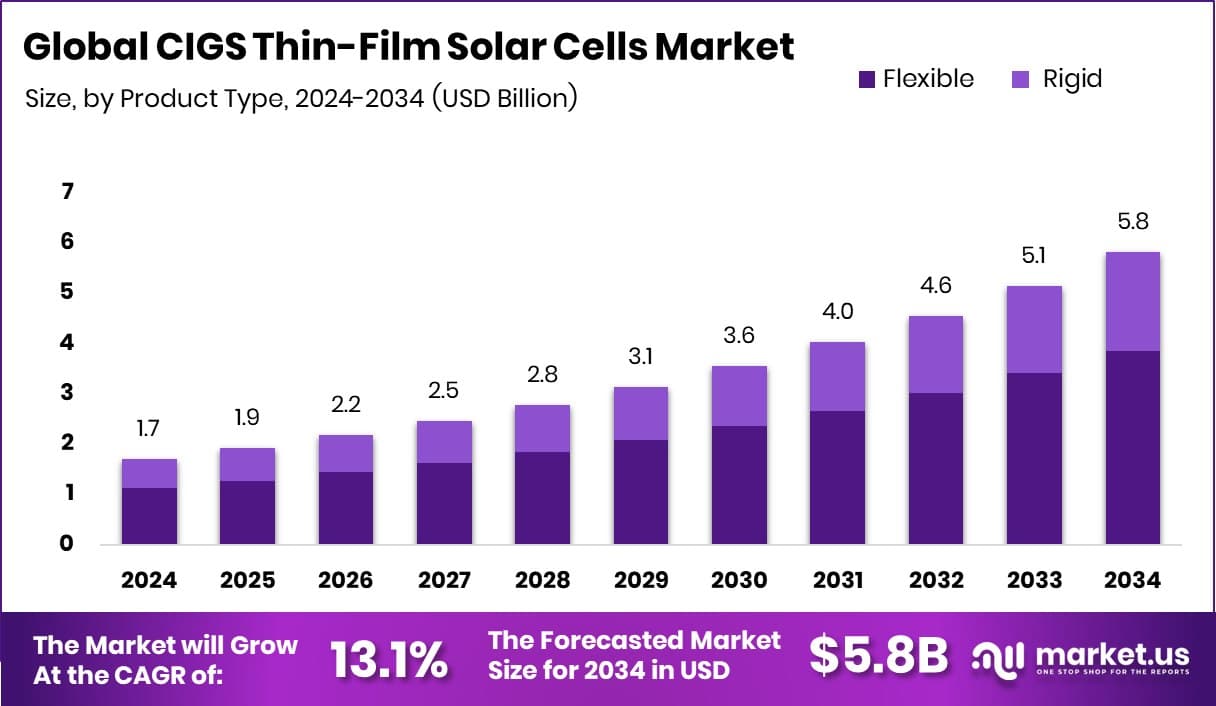

New York, NY – Nov 24, 2025 – The global CIGS thin-film solar cells market is expected to reach USD 5.8 billion by 2034, rising from USD 1.7 billion in 2024, at a 13.1% CAGR from 2025–2034. North America remains influential, holding a 32.90% share valued at USD 0.5 billion. CIGS modules are lightweight, flexible, and perform well under heat or low-light, making them suitable for rooftops, curved surfaces, mobility systems, and building-integrated solar.

Momentum grows as governments and industries expand clean-energy spending. India plays a key role, with Tata Power investing ₹25,000 crore, REC funding ₹7,500 crore, and additional sector financing like Hero Future Energies’ ₹1,000 crore and Core Energy Systems’ ₹200 crore. The rise of storage-linked solar also accelerates interest, supported by projects like Oriana Power’s ₹212 crore BESS project. Together, these developments strengthen demand for adaptable, high-efficiency, and lightweight CIGS solutions across distributed and hybrid energy setups.

➤ Click the sample report link for complete industry insights: https://market.us/report/global-cigs-thin-film-solar-cells-market/request-sample/

Key Takeaways

- The Global CIGS Thin-Film Solar Cells Market is expected to be worth around USD 5.8 billion by 2034, up from USD 1.7 billion in 2024, and is projected to grow at a CAGR of 13.1% from 2025 to 2034.

- In the CIGS thin-film solar cells market, flexible products dominate strongly with a 66.2% share today.

- Film thickness of 2-3 micrometers leads the CIGS Thin-Film Solar Cells Market with 48.8% overall.

- Chemical vapor deposition holds 31.40% inside the CIGS Thin-Film Solar Cells Market, enabling scalable production.

- Energy and power applications dominate the CIGS thin-film solar cells market, with 58.3% driving expansion.

- Strong renewable adoption supports North America’s 32.90% share worth USD 0.5 Bn.

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=165520

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.7 Billion |

| Forecast Revenue (2034) | USD 5.8 Billion |

| CAGR (2025-2034) | 13.1% |

| Segments Covered | By Product Type (Flexible, Rigid), By Film Thickness (1-2 Micro Meters, 2-3 Micro Meters, 3-4 Micro Meters), By Deposition Technique (Chemical Vapour Deposition, Electrospray Deposition, Coevaporation, Film production), By End-use (Energy and Power, Automobiles, Electronics and Electrical, Others) |

| Competitive Landscape | Solar Frontie, MiaSolé, Nanosolar, Avancis GmbH, Solibro GmbH, Hanergy Thin Film Power Group, Siva Power, Saint-Gobain Solar, Sharp Corporation |

Key Market Segments

By Product Type Analysis

In 2024, Flexible products led the CIGS Thin-Film Solar Cells Market with a dominant 66.2% share, showing a strong shift toward adaptable solar formats. This segment benefits from its lightweight structure, which supports easy installation on rooftops, curved building elements, portable power systems, and areas unsuitable for rigid panels. The reduced structural load and simplified mounting make flexible designs attractive for both residential and commercial deployment.

Performance advantages also drive this leadership. Flexible CIGS modules maintain efficiency under heat, partial shading, and low-light environments, making them suitable for regions with variable weather or space constraints. Their durability and compatibility with emerging building-integrated photovoltaics and mobility power systems further reinforce their position.

As industries prioritize efficiency and installation flexibility, the flexible category remains the primary force shaping product demand, influencing innovation trends and expanding possibilities for future applications across infrastructure, portable energy, and distributed solar solutions.

By Film Thickness Analysis

In 2024, the 2–3 micrometer film thickness segment led the CIGS Thin-Film Solar Cells Market with a 48.8% share, making it the most adopted manufacturing range. This thickness is preferred because it offers an ideal balance between material usage and high light-absorption efficiency, helping producers maintain performance without increasing production steps or cost.

Its ability to generate consistent power under different lighting environments supports commercial and residential deployment, especially where shading or variable sunlight is common. The 2–3 μm layer also improves flexibility and durability, aligning well with lightweight and bendable solar designs used in portable systems, BIPV projects, and curved installations. Due to these functional and manufacturing advantages, this thickness continues to guide product standards and remains the benchmark for scalable CIGS production across global applications.

By Deposition Technique Analysis

In 2024, Chemical Vapour Deposition led the CIGS Thin-Film Solar Cells Market’s deposition technique segment with a 31.40% share, reflecting its strong acceptance in industrial production. This technique is widely applied because it delivers highly uniform and stable thin films with excellent adhesion, enabling reliable long-term efficiency in CIGS modules.

Its controlled deposition environment helps manufacturers maintain consistent material composition, which is critical for performance repeatability across large production batches. The scalability of CVD further strengthens its dominance, as it supports continuous fabrication without compromising structural quality. These combined advantages make Chemical Vapour Deposition the preferred method for producing high-performance CIGS cells, reinforcing its leadership and shaping future process optimisation within the ecosystem.

By End-use Analysis

In 2024, the Energy and Power segment led the CIGS Thin-Film Solar Cells Market with a 58.3% share, highlighting strong adoption across utility-scale, distributed generation, and building-integrated systems. This dominance reflects the industry’s growing preference for lightweight and high-efficiency solar solutions capable of supporting evolving renewable infrastructure needs.

CIGS modules are especially valuable in large and small power applications because they maintain stable performance under low-light and temperature variations, making them suitable for diverse climates. Their flexibility, easier mounting, and compatibility with modern installation formats help accelerate deployment across grids, rooftops, and hybrid energy systems.

With these functional strengths and installation benefits, the Energy and Power category continues to guide market expansion and remains the core driver of CIGS commercialisation.

Regional Analysis

North America led the CIGS Thin-Film Solar Cells Market with a 32.90% share valued at USD 0.5 billion, driven by strong investment in advanced solar systems and growing demand for lightweight and flexible photovoltaic formats. The region’s interest in decentralised power, commercial rooftops, and weather-resilient modules further strengthens its leadership.

Europe continues to adopt newer thin-film technologies as part of its energy transition, while Asia Pacific maintains momentum through renewable expansion in fast-growing economies.

Meanwhile, the Middle East & Africa and Latin America are slowly evaluating CIGS for projects requiring low-weight and adaptable modules. Although global participation varies, North America remains the most significant contributor, reflecting the rising value of performance-driven thin-film innovation.

Top Use Cases

- Building-Integrated Photovoltaics (BIPV): These solar modules can be embedded into building facades, roofs, or windows instead of being simply mounted on top. Because CIGS thin-films are lightweight and flexible, they adapt well to architectural surfaces. For example, they’re used in retrofitting older apartments for renewable power without major structural change.

- Curved or Irregular Surfaces & Portable Applications: CIGS modules can be applied to non-flat, curved or mobile surfaces such as domed roofs, vehicles, boats, tents or portable packaging. Their thin-film nature allows bending and light installation.

- Lightweight & Low-Load Rooftop Installations: Because the materials and structure are thinner and weigh less than traditional panels, CIGS modules are suitable when weight or structural load is constrained—e.g., older rooftops, lightweight buildings or temporary setups.

- Performance in Hot Climates / Low-Light Conditions: CIGS technology shows better resilience under high temperatures and partial shading compared to some other PV types. One source notes CIGS panels “work well in hot weather and when some shade is present.”

- Off-Grid & Mobile Energy Systems: Because of their flexibility and lightweight nature, CIGS modules are a strong fit for off-grid applications (e.g., remote cabins, mobile shelters, disaster relief), portable solar chargers, or vehicles and other mobility platforms.

- Retrofitting Existing Structures: Rather than new builds, CIGS modules can be used for retrofitting older buildings—adding solar capability without major structural overhaul, thanks to the lightweight and flexible attachment possibilities. For example, a study explored CIGS integration in older residential buildings’ facades and windows.

Recent Developments

- In October 2025, one profile noted Nanosolar had raised approximately. USD 520 million in funding.

- In April 2024, MiaSolé announced a continued global partnership with TRAILAR, “offering market-leading solar transportation solutions.”

- In April 2024, Product launch at Glasstec: AVANCIS announced at the 2024 glasstec 2024 trade fair the launch of a new BIPV (building-integrated photovoltaics) module called SKALA Matrix. This is a new high-performance module based on silicon-wafer PV technology, complementing their existing CIGS-based SKALA line. The launch reflects the company’s broadening product portfolio, even though its core remains CIGS thin-film.

Conclusion

The CIGS thin-film solar cells market is moving toward greater adoption as industries and governments focus on lighter, adaptable, and efficient solar technologies. These cells stand out for their flexibility, durability, and reliable performance in low-light or high-temperature environments, making them suitable for rooftops, portable energy solutions, buildings, and mobility platforms.

As clean-energy priorities grow globally, more investment is flowing toward advanced solar materials that support decentralised and innovative system designs. The future outlook suggests steady progress, shaped by product improvements, integration with energy storage, and growing interest in building-integrated and off-grid solutions that benefit from thin-film solar capabilities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)