Table of Contents

Overview

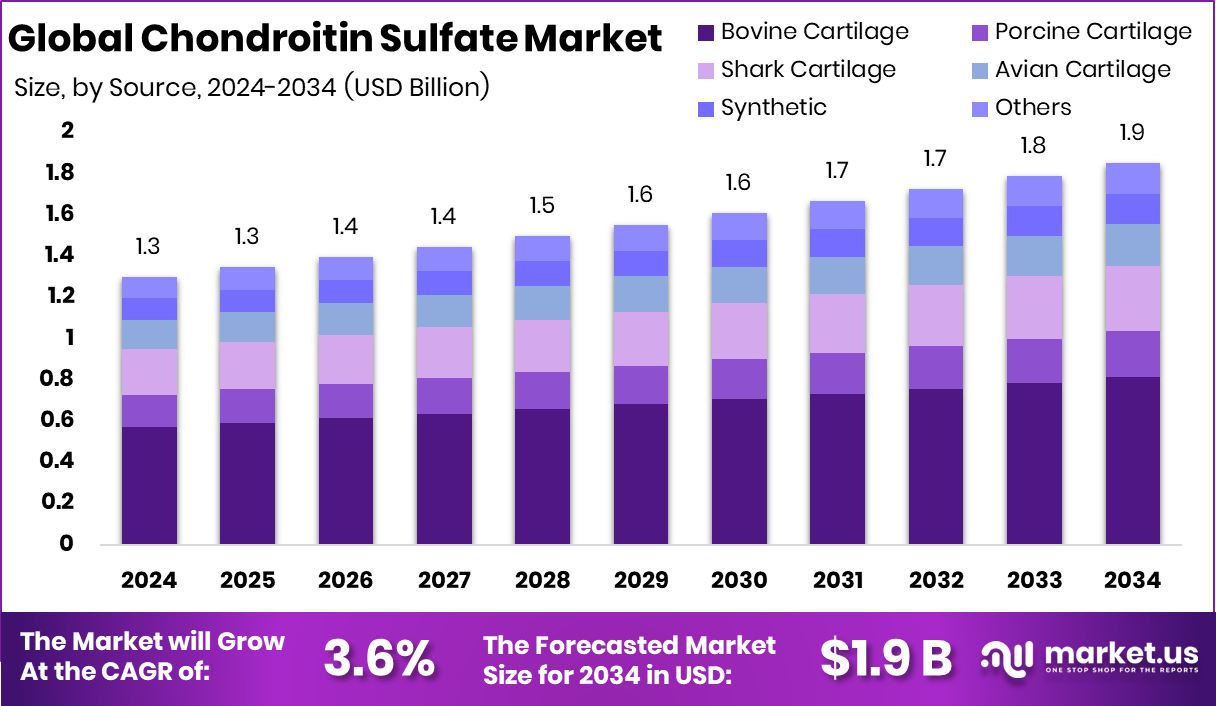

New York, NY – October 07, 2025 – The Global Chondroitin Sulfate Market is projected to reach approximately USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, expanding at a CAGR of 3.6% between 2025 and 2034. North America led the market with a 43.8% share, valued at USD 0.5 billion in 2024, driven by a strong focus on joint health and nutraceutical innovation.

Chondroitin sulfate is a naturally occurring compound in joint cartilage, essential for maintaining elasticity and cushioning. It plays a vital role in reducing osteoarthritis pain, improving mobility, and enhancing cartilage repair, making it widely used in dietary supplements and pharmaceuticals. As the population ages, demand for preventive and joint-support products continues to rise globally.

The market encompasses production, trade, and consumption across nutraceuticals, pharmaceuticals, healthcare, and cosmetics. Growing consumer preference for natural and preventive healthcare solutions has accelerated product development combining chondroitin sulfate with glucosamine, collagen, or hyaluronic acid. Moreover, the compound’s application in skincare for hydration and anti-aging is expanding its reach beyond traditional use.

Increasing arthritis and osteoporosis cases are strengthening market demand, supported by awareness of holistic wellness. A notable initiative includes Oregon State University’s $250 million investment to build a world-class veterinary teaching hospital, highlighting the broader applications of joint and cartilage research. Alongside aging populations, younger consumers engaged in fitness and sports recovery are fueling growth. Opportunities lie in innovative nutraceutical blends and pharmaceutical formulations, setting the stage for sustained global expansion.

Key Takeaways

- The Global Chondroitin Sulfate Market is expected to be worth around USD 1.9 billion by 2034, up from USD 1.3 billion in 2024, and is projected to grow at a CAGR of 3.6% from 2025 to 2034.

- In the Chondroitin Sulfate Market, bovine cartilage leads with a 43.9% share due to wide availability.

- Pharmaceutical grade dominates the market at 56.4%, highlighting its trusted role in healthcare and supplements.

- Powder form holds a 39.3% share, reflecting a strong preference for easy formulation in diverse health applications.

- Pharmaceuticals and OTC drugs account for 47.2%, making them the largest application segment in this market.

- The Chondroitin Sulfate Market in North America, valued at USD 0.5 Bn, held a 43.8% share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-chondroitin-sulfate-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.3 Billion |

| Forecast Revenue (2034) | USD 1.9 Billion |

| CAGR (2025-2034) | 3.6% |

| Segments Covered | By Source (Bovine Cartilage, Porcine Cartilage, Shark Cartilage, Avian Cartilage, Synthetic, Others), By Grade (Pharmaceutical Grade, Food Grade, Cosmetics Grade), By Form (Powder, Granules, Tablets and Capsules, Injectable / Solution), By Application (Pharmaceuticals and OTC Drugs, Dietary Supplements, Cosmetics and Personal Care, Veterinary Medicine, Others) |

| Competitive Landscape | Bioiberica S.A.U., Changzhou Qianhong Bio-pharma Co., Ltd., Focus Chem Biotech, Gnosis by Lesaffre, IBSA Institut Biochimique SA, Jiaxing Hengtai Pharma Co., Ltd., Kraeber & Co. GmbH, Pacific Rainbow International Inc., Qingdao WanTuMing Biological Co., Ltd., Seikagaku Corporation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158545

Key Market Segments

By Source Analysis

Bovine cartilage commands a 43.9% share of the chondroitin sulfate market in 2024, leading the By Source segment. Its dominance stems from the abundant supply of bovine raw materials and cost-effective extraction processes, ensuring high-quality chondroitin sulfate with reliable yields. Widely used in nutraceuticals and pharmaceuticals, particularly for joint health and osteoarthritis management, bovine cartilage benefits from strong consumer confidence in its efficacy, driving consistent demand growth.

By Grade Analysis

Pharmaceutical grade holds a commanding 56.4% share of the chondroitin sulfate market in 2024, dominating the By Grade segment. Its prominence is driven by extensive use in prescription drugs and advanced nutraceuticals for osteoarthritis, joint pain, and cartilage repair. Valued for its purity and compliance with strict regulatory standards, pharmaceutical-grade chondroitin sulfate is favored in medical applications. Growing demand for clinically validated ingredients and increasing adoption of high-quality supplements among aging populations solidify its market leadership.

By Form Analysis

Powder form accounts for a 39.3% share of the chondroitin sulfate market in 2024, leading the By Form segment. Its versatility, ease of use in dietary supplements, functional foods, and pharmaceuticals, and benefits like stability and long shelf life drive its preference. Powdered chondroitin sulfate enables precise dosing for capsules, tablets, and blended products, meeting rising consumer demand for joint health solutions and reinforcing its market dominance.

By Application Analysis

Pharmaceuticals and OTC drugs capture a 47.2% share of the chondroitin sulfate market in 2024, dominating the By Application segment. Chondroitin sulfate’s widespread use in treating osteoarthritis, joint pain, and cartilage disorders, supported by its clinically proven benefits in improving mobility and reducing inflammation, drives its prominence in both prescription and over-the-counter medications. The aging population and growing preference for natural, safe compounds in healthcare further fuel demand for this segment.

Regional Analysis

In 2024, North America leads the chondroitin sulfate market with a 43.8% share, valued at USD 0.5 billion. This dominance is driven by an aging population, high osteoarthritis prevalence, and strong demand for dietary supplements and pharmaceutical-grade products. Robust healthcare infrastructure and consumer awareness bolster its position. Europe follows with steady growth, fueled by preventive healthcare and nutraceutical demand in countries like Germany and France.

Asia Pacific shows rapid growth potential, driven by rising elderly populations, increasing incomes, and joint health awareness in China, Japan, and India. The Middle East & Africa and Latin America are emerging markets, supported by improving healthcare access and growing interest in natural health supplements, with North America maintaining its lead while Europe and the Asia Pacific contribute significantly to future growth.

Top Use Cases

- Joint Health Supplements: Chondroitin sulfate is commonly used in dietary supplements to support cartilage health and ease joint discomfort from everyday wear. It helps maintain the cushioning between bones, making it popular among active adults seeking natural ways to stay mobile without relying on heavy medications. This use drives steady demand in wellness products for preventive care.

- Osteoarthritis Management: In treating osteoarthritis, chondroitin sulfate works by slowing cartilage breakdown and reducing inflammation in affected joints like knees and hips. Often paired with other natural compounds, it promotes better movement and less pain over time, appealing to those wanting gentle, long-term relief from age-related joint issues.

- Pharmaceutical Formulations: Chondroitin sulfate features in prescription and over-the-counter drugs aimed at joint repair and pain relief. Its role in improving synovial fluid quality and limiting tissue damage makes it a key ingredient for therapies targeting chronic conditions, supporting broader healthcare options for mobility challenges.

- Eye Care Applications: During eye surgeries such as cataract procedures, chondroitin sulfate acts as a protective agent to keep tissues moist and stable. It also appears in drops for dry eye relief, helping soothe irritation and maintain clarity, which extends its value beyond joints into specialized medical uses.

- Veterinary Joint Support: In animal health, chondroitin sulfate is added to pet foods and supplements to aid dogs and horses with joint stiffness from activity or aging. It fosters healthier cartilage in pets, aligning with growing trends in pet wellness where owners prioritize natural aids for their companions’ active lifestyles.

Recent Developments

1. Bioiberica S.A.U.

Bioiberica is advancing chondroitin sulfate through a “Science-Backed Solutions” approach. Their recent focus is on the patented Mobilee ingredient, a complex of HA, chondroitin sulfate, and other polymers, supported by new clinical research for joint function and mobility in aging adults and athletes. They emphasize high-purity, traceable raw materials and are investing in scientific marketing to differentiate their products in the market.

2. Changzhou Qianhong Bio-pharma Co., Ltd.

Qianhong Bio-pharma continues to invest in enzymatic production technologies for chondroitin sulfate, aiming for superior purity and sustainability compared to traditional methods. A key recent development is the expansion of their cGMP-certified facilities to increase output and meet rising global demand, particularly from the pharmaceutical sector. They are strengthening their position as a leading global supplier of high-grade, pharmaceutical-level chondroitin sulfate.

3. Focus Chem Biotech

Focus Chem Biotech has been actively promoting its high-purity, pharmaceutical-grade chondroitin sulfate (meets USP/EP standards) for nutraceutical and cosmetic applications. A recent development is their increased focus on marketing chondroitin sulfate potassium, highlighting its role in joint health supplements. They are expanding their international B2B distribution network, targeting markets in North America and Europe with competitively priced, quality-guaranteed products.

4. Gnosis by Lesaffre

Gnosis by Lesaffre applies its fermentation expertise to chondroitin sulfate, recently promoting its non-animal, bio-fermented chondroitin as a sustainable and allergen-free alternative. A key development is positioning their ingredient for broader health applications beyond joints, including gut health and skincare, leveraging its high purity and GMO-free status. This aligns with consumer trends for vegan and excipient-free supplements.

5. IBSA Institut Biochimique SA

IBSA specializes in pharmaceutical applications and recently advanced its chondroitin sulfate leadership through novel drug delivery systems. A significant development is the promotion of their Condrotide (CS+HA) in bio-engineered, pre-filled syringes for intra-articular viscosupplementation. They continue to invest in clinical studies to reinforce the efficacy and safety of their prescription-grade products for treating osteoarthritis, differentiating from food supplements.

Conclusion

Chondroitin Sulfate stands out as a versatile natural compound gaining traction in the health and wellness sectors. Its role in supporting joint function and preventive care resonates with aging populations and active lifestyles, fostering innovation in supplements and therapies. Emerging uses in cosmetics and veterinary products broaden its appeal, promising sustained growth amid rising focus on natural, effective solutions for mobility and vitality.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)