Table of Contents

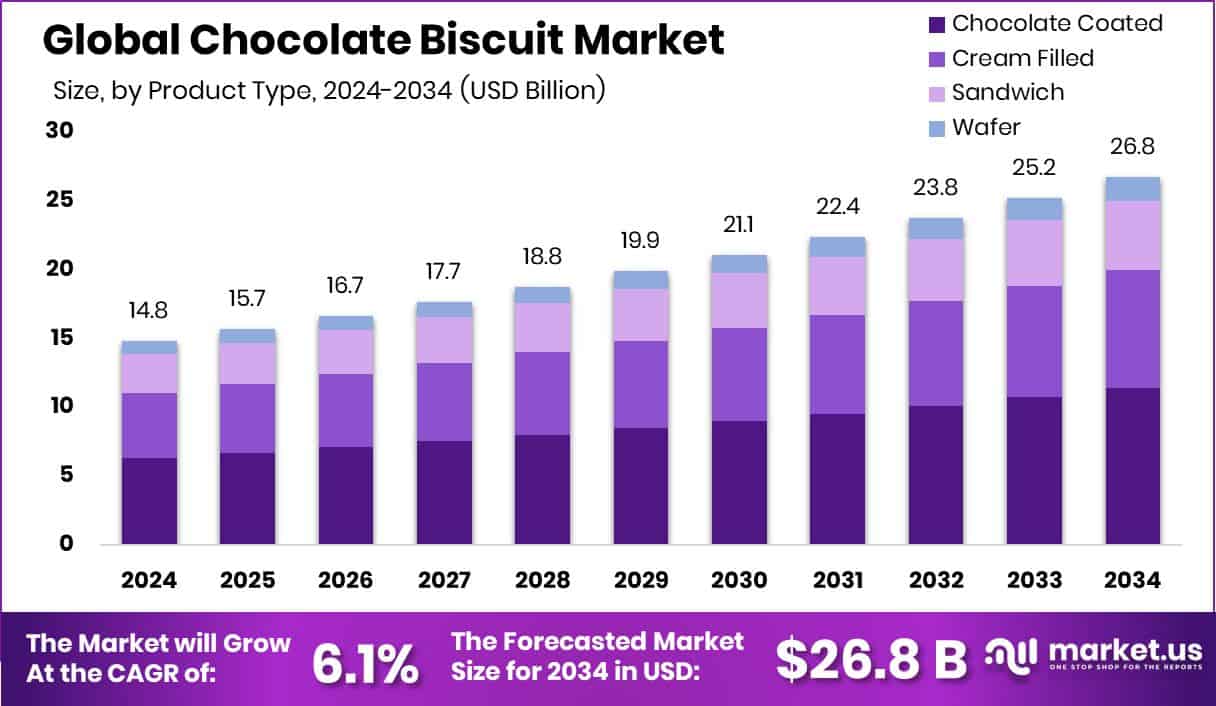

New York, NY – July 29, 2025 – The Global Chocolate Biscuit Market is expected to be worth around USD 26.8 billion by 2034, up from USD 14.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

The chocolate biscuit market represents a dynamic global industry focused on biscuits featuring chocolate in forms such as coatings, chips, or fillings. These products are widely consumed across all age groups for their sweet taste and convenience, often enjoyed as snacks or paired with beverages.

Market growth is driven by increasing urbanization and demand for on-the-go, ready-to-eat foods. Product innovations and youth-focused packaging further contribute to rising sales. Health-conscious trends are gaining momentum, highlighted by Jnck Bakery surpassing its £200k funding goal to expand its healthy cookie line.

Similarly, MOSH secured $3 million in Series A funding to strengthen its healthier snack offerings. Nestlé’s planned investment of R$2.7 billion in its chocolate and biscuit operations by 2026 underlines strong confidence in market expansion. The availability of flavor diversity, seasonal variants, and online and offline retail accessibility continues to attract children, millennials, and health-aware consumers alike, reinforcing the market’s steady and diversified growth.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/chocolate-biscuit-market/request-sample/

Key Takeaways

- The Global Chocolate Biscuit Market is expected to be worth around USD 26.8 billion by 2034, up from USD 14.8 billion in 2024, and is projected to grow at a CAGR of 6.1% from 2025 to 2034.

- Chocolate-coated biscuits lead the Chocolate Biscuit Market with 42.6% share due to their indulgent appeal.

- Milk flavor dominates the Chocolate Biscuit Market at 48.5%, driven by widespread consumer preference and taste.

- Supermarket hypermarket segment holds a 33.2% share, making it the key retail channel in this market.

- The European chocolate biscuit market was valued at approximately USD 7.0 billion overall.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 14.8 Billion |

| Forecast Revenue (2034) | USD 26.8 Billion |

| CAGR (2025-2034) | 6.1% |

| Segments Covered | By Product Type (Chocolate Coated, Cream Filled (Chocolate Cream, Strawberry Cream, Vanilla Cream), Sandwich, Wafer), By Flavor (Milk, Dark, White, Mixed), By Distribution Channel (Supermarket Hypermarket, Online, Specialty Store, Convenience Store, Others) |

| Competitive Landscape | Balocco S.p.A, Britannia Industries Limited, Ferrero SpA, Grupo Bimbo, S.A.B. de C.V., ITC Limited, Kellogg Company, Lotus Bakeries NV, Mondelēz International, Inc., Nestlé S.A., Parle Products Private Limited, Pladis Global Limited, Tatawa Industries(M) Sdn. Bhd. |

➤ Directly purchase a copy of the report— https://market.us/purchase-report/?report_id=153693

Key Market Segments

By Product Type Analysis

In 2024, chocolate-coated biscuits led the chocolate biscuit market by product type, accounting for a 42.6% share. This dominance stems from their broad appeal as indulgent yet convenient snacks that blend biscuit crunch with rich chocolate flavor. Favored by both children and adults, these products are commonly consumed alone or with beverages. Their popularity is further supported by rising demand for premium snacks in urban areas, where taste and convenience influence buying choices.

Eye-catching packaging, extended shelf life, and strong visibility in both retail and online channels enhance their market position. Seasonal spikes during festive occasions also contribute to higher sales. As consumers continue to seek indulgent yet accessible snack options, chocolate-coated biscuits are expected to retain their lead, with manufacturers focusing on new product variants and limited-edition offerings to sustain interest and growth.

By Flavor Analysis

In 2024, the milk flavor segment led the Chocolate Biscuit Market by flavor, capturing a 48.5% share. This strong position reflects the widespread preference for the smooth, creamy taste of milk chocolate, which appeals to both children and adults. Its familiar and comforting profile makes it a go-to choice for everyday snacking, gifting, and family consumption.

The segment’s growth is further supported by its year-round demand, broad demographic appeal, and strong retail presence, aided by attractive packaging and affordability. Manufacturers continue to innovate around this classic flavor, offering new variations that retain the core taste. Given its timeless appeal and consistent consumer preference, the milk flavor segment is expected to sustain its leadership in the coming years.

By Distribution Channel Analysis

In 2024, supermarkets and hypermarkets dominated the Chocolate Biscuit Market’s distribution channel segment with a 33.2% share. This strong presence is driven by their ability to offer diverse product ranges, appealing shelf displays, and a mix of premium and budget-friendly options in one location. These outlets attract bulk buyers through regular discounts and promotional deals, particularly for household consumption.

Strategic product placement, especially near snack aisles and checkout counters, boosts impulse purchases and brand recall. The ongoing rise in urbanization and the development of modern retail infrastructure have further reinforced their role as key purchase points. As consumers continue to prioritize convenience and product variety, supermarkets and hypermarkets are expected to retain their dominant market position.

Regional Analysis

In 2024, Europe led the global chocolate biscuit market, commanding a 47.8% share valued at USD 7.0 billion. This dominance is fueled by the region’s high per capita consumption of chocolate snacks, well-established retail infrastructure, and a strong tradition of biscuit production. European consumers consistently favor indulgent and premium offerings, boosting sales across supermarkets, hypermarkets, and specialty stores.

North America remains an important market due to its mature food sector and strong demand for convenient snacking options. Meanwhile, Asia Pacific is experiencing rapid growth, driven by urban expansion and rising disposable incomes, especially in developing nations. The Middle East & Africa and Latin America are also progressing steadily, supported by improving access to products and evolving dietary patterns.

Although Europe and North America currently lead in market share, all regions offer growth opportunities. Europe’s performance highlights the need for product strategies that reflect regional tastes and retail behaviors to succeed in this competitive global market.

Top Use Cases

- Chocolate Biscuit Cake (Royal Favorite / Tiffin Variant): A traditional British “fridge cake” made with chocolate, butter, sugar, cream, and crumbled Rich Tea or digestive biscuits. Mixed, set in a loaf shape, and chilled, it is cut into slices and served cold. It gained fame as the groom’s cake at a royal wedding.

- Chocolate Biscuit Balls: A simple three‑ingredient recipe: crushed biscuits, cocoa powder, and sweetened condensed milk are combined and rolled into bite‑sized balls. They are sometimes coated with coconut or biscuit crumbs. No baking is required, and preparation takes only about ten minutes—perfect for quick desserts or snacks.

- No‑Bake Desserts (Tiffin / Biscuit Cake): Crushed chocolate biscuits are mixed with melted chocolate, condensed milk or syrup, and optional mix‑ins like raisins or nuts. The mixture is pressed into a pan and chilled to set. This no-bake dessert (also called tiffin or biscuit cake) is easy and popular as a sweet treat.

Recent Developments

- In May 2025, at the TuttoFood exhibition, Balocco introduced a new wafer line with a lemon‑flavored variant. This launch is part of a broader brand refresh and has been aimed at expanding global reach. As of that time, exports accounted for approximately 13 % of total revenue.

- In January 2025, Ferrero introduced Kinderini, crunchy shortbread cookies with fun faces, in the U.S. market. They are cocoa‑flavored, lightly sweetened, and now available in nationwide retail and online. This marks Ferrero’s entry into the U.S. cookie category under the Kinder brand.

- In May 2024, a Partnership with Oobli to integrate sweet proteins into baked goods. While specific chocolate biscuit products were not yet named, Group Bimbo announced that cookie (biscuit) applications would appear in the first products launched around year-end 2024 or early 2025. These new cookies aim to reduce sugar content while retaining taste.

Conclusion

The chocolate biscuit category can be expected to continue expanding steadily. Growth has been supported by innovation in flavors, formats, and healthier formulations, which have attracted consumers across different age groups. Consumer preference for convenient and indulgent snacks during urban, on‑the‑go lifestyles has increased demand, and online and offline retail channels remain robust.

Regional strength in Asia Pacific and Europe lends further momentum, while brands continue to invest in product development and premiumisation. In summary, chocolate biscuits are poised for sustained popularity with ongoing innovation and evolving consumer tastes.