Table of Contents

Overview

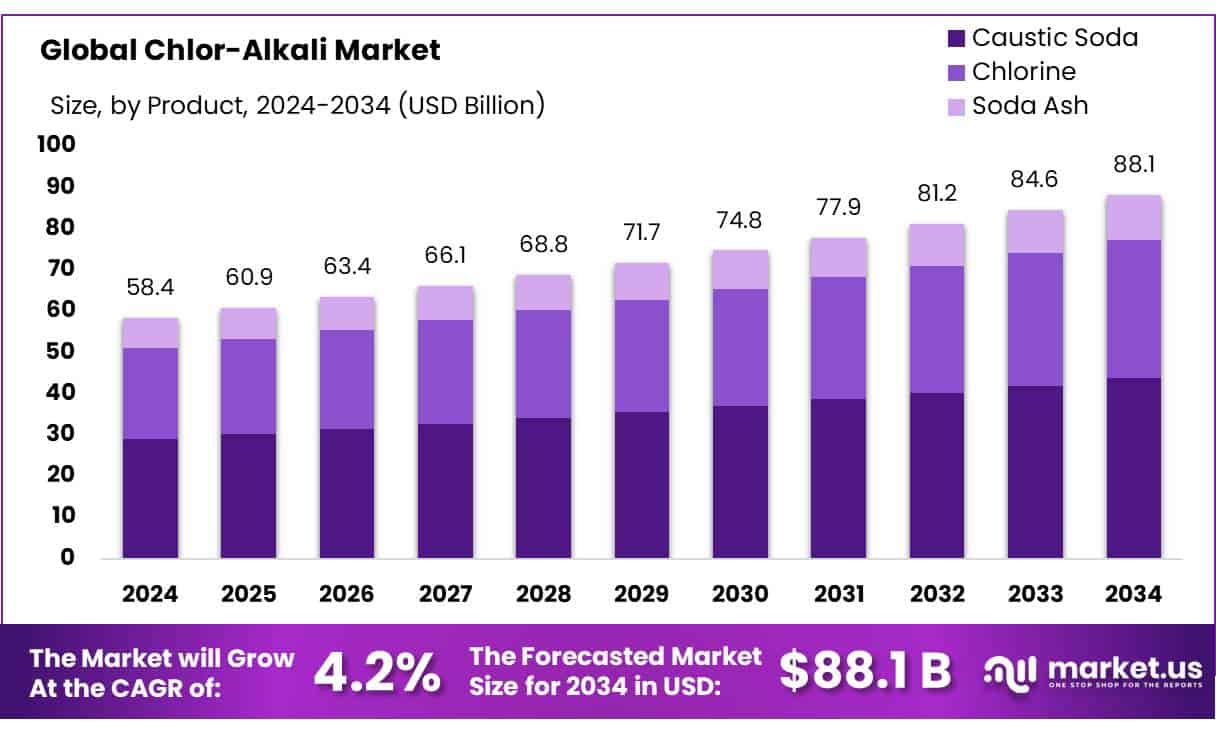

New York, NY – Aug 01, 2025 – The Global Chlor-Alkali Market is projected to grow from USD 58.4 billion in 2024 to approximately USD 88.1 billion by 2034, expanding at a CAGR of 4.2% over the forecast period. In 2024, the Asia-Pacific (APAC) region dominated the market, accounting for over 38.9% share with USD 22.7 billion in revenue. The chlor-alkali process, which electrolyzes sodium chloride brine to produce chlorine, caustic soda, and hydrogen, is crucial across various industries such as water treatment, chemicals, pharmaceuticals, pulp and paper, textiles, and the production of PVC and detergents. With global chlorine production reaching nearly 97 million tonnes in 2022, the process’s industrial scale is immense, albeit energy-intensive, consuming about 2,500 kWh of electricity per tonne of NaOH produced.

Market growth is primarily driven by rising urbanization, expanding wastewater and water treatment initiatives, and increased demand in downstream sectors like PVC, alumina, textiles, and disinfectants. India, in particular, is witnessing 8–9% CAGR growth in sectors like pulp and paper, textiles, and alumina, further driving caustic soda usage. Globally, governments have introduced stringent regulations to eliminate mercury based production, encouraging adoption of membrane cell technologies through incentives and tax benefits, as seen in programs like India’s National Programme on Use of Membrane Cells. By 2020, the U.S. had nearly eliminated mercury cell usage, aligning with environmental policies such as the Mercury Monitoring and Mitigation Act, contributing to a 92% reduction in mercury usage from 1990 to 2006.

Key Takeaways

- The global chlor-alkali market is expected to expand from USD 58.4 billion in 2024 to USD 88.1 billion by 2034, registering a steady CAGR of 4.2% during the forecast period.

- Caustic soda was the leading product segment in 2024, capturing 49.6% of the market, owing to its extensive use across various industrial applications.

- Membrane cell technology accounted for over 59.5% of the total chlor-alkali production in 2024, favored for its energy efficiency and eco-friendly operation.

- The pulp and paper industry represented the largest end-use segment, holding a 26.7% market share, due to the sustained need for caustic soda and chlorine in the paper manufacturing process.

- The Asia-Pacific region led the global market in 2024, with a 38.9% share and a value of around USD 22.7 billion, driven by rapid industrialization and infrastructure growth across the region.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/global-chlor-alkali-market/free-sample/

Report Scope

| Market Value (2024) | USD 58.4 Billion |

| Forecast Revenue (2034) | USD 88.1 Billion |

| CAGR (2025-2034) | 4.2% |

| Segments Covered | By Product (Caustic Soda, Chlorine, Soda Ash), By Production Process (Membrane Cell, Diaphragm Cell, Others), By Application (Pulp and Paper, Organic Chemical, Inorganic Chemical, Soap and Detergent, Alumina, Textile, Others) |

| Competitive Landscape | Olin Corporation, Westlake Chemical Corporation, Tata Chemicals Limited, Occidental Petroleum Corporation, Formosa Plastics Corporation, Solvay SA, Tosoh Corporation, Hanwha Solutions Corporation, AGC, Inc., Dow Inc., Xinjiang Zhongtai Chemical Co. Ltd., INOVYN, Wanhua-Borsodchem |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=153197

Key Market Segments

By Product Analysis:

- In 2024, caustic soda led the chlor-alkali market with a 49.6% share, driven by its widespread industrial usage across sectors such as pulp and paper, textiles, water treatment, alumina refining, and detergent manufacturing. Its essential role in neutralizing acids and processing raw materials has ensured steady demand globally, particularly in emerging markets like Asia-Pacific where infrastructure and chemical manufacturing are expanding rapidly.

By Production Process Analysis:

- Membrane cell technology dominated the production process segment in 2024, accounting for over 59.5% of the market due to its superior energy efficiency, environmental safety, and ability to produce high purity caustic soda. As global industries shift toward cleaner technologies, this method has become the preferred alternative to mercury and diaphragm cells, supported by regulatory mandates and sustainability goals.

By Application Analysis:

- The pulp and paper industry was the largest application segment in 2024, holding a 26.7% market share, reflecting the high consumption of caustic soda and chlorine in processes like bleaching, fiber treatment, and paper production. With increasing demand for paper-based and recyclable packaging materials especially in APAC and North America this sector continues to drive significant chlor-alkali consumption and is expected to maintain its leading position in the coming years.

Regional Analysis

- In 2024, the Asia-Pacific (APAC) region stood out as the largest market for chlor-alkali products, securing a substantial 38.9% share and reaching a market value of around USD 22.7 billion. This leadership was fueled by rapid industrialization, growing manufacturing sectors, and strong demand from major end-use industries including textiles, pulp and paper, construction, and chemicals.

- China remained the primary contributor to regional chlor-alkali output, driven by its thriving PVC, water treatment, and aluminum sectors. Its expansive infrastructure development and leading role in global manufacturing have made it a key consumer of chlorine and caustic soda. Meanwhile, India experienced robust growth supported by rising demand from the textile and detergent industries, as well as government-led initiatives like the Jal Jeevan Mission, which significantly increased chlorine use for rural water purification.

- In Southeast Asia, growing investments in food processing, packaging, and urban sanitation are further enhancing chlor-alkali consumption. The region is also making a swift transition from mercury cells to membrane cell technology, motivated by regulatory pressure and energy efficiency targets, thereby improving overall production efficiency across key APAC markets.

Top Use Cases

- Water Treatment (Disinfection & pH Control): Chlorine and caustic soda serve as essential agents to disinfect municipal and industrial water supplies, eliminating harmful pathogens and adjusting pH levels efficiently. Their continued demand is powered by global urbanisation and tightening clean water regulations, making them vital for sustainable public health systems.

- PVC and Vinyl Production (Construction & Automotive): Chlorine is a fundamental raw material in the manufacture of polyvinyl chloride (PVC), used extensively in pipes, window frames, flooring and vehicle interiors. Rising infrastructure and automotive demand drive growth in this segment, and PVC remains the dominant chlorine end‑use in the global chlor‑alkali market.

- Pulp & Paper Manufacturing: Caustic soda (sodium hydroxide) is deeply integrated into pulp processing to remove lignin and bleach fibers. As e‑commerce and packaging volumes grow, paper mills worldwide rely on chlor‑alkali derivatives to enhance output and quality. This sector accounts for roughly one third of global caustic soda usage in the market.

- Textiles Industry (Processing & Dyeing): In textile manufacturing, caustic soda is used to soften fibers, assist in dye penetration, and treat cotton and man made textiles. This supports consistent coloration, fabric strength, and scale. Textiles remain a significant end user of chlor‑alkali chemicals, especially in large production hubs across Asia-Pacific.

- Alumina Refining & Soap & Detergents: Caustic soda plays a critical role in extracting alumina from bauxite during aluminium refining. It is also foundational in soap and detergent formulation, where it helps saponify fats into cleaning agents. This dual utility makes it a high volume product across metals processing and home care segments.

- Hydrogen and Derived Chemicals (Energy & Industrials): Hydrogen gas, generated as a byproduct in chlor‑alkali production, is increasingly used in fuel cells, hydrogen peroxide manufacturing, hydrochloric acid synthesis, and as an industrial heat source. Its emerging role aligns with global moves toward clean energy strategies and circular resource use.

Recent Developments

1. Westlake Chemical Corporation:

- Westlake recently restarted operations at its Calvert City, Kentucky chlor‑alkali complex following planned turnarounds. Additionally, it received Diamond Level recognition from the Chlorine Institute for safety excellence in its chlor‑alkali unit. Westlake is also constructing a new chlor‑alkali facility at Geismar, Louisiana, expanding annual chlorine capacity by ~55 million pounds. These developments boost production resilience and capacity for meeting customer demand across North America.

2. Tata Chemicals Limited:

- In Q1 FY26 (quarter ended June 30, 2025), Tata Chemicals posted a 68–87% year‑on‑year rise in net profit, primarily due to cost efficiencies and reduced power/fuel expenses despite falling soda ash prices. They also commissioned a state of the art chlor‑alkali plant in India around mid‑2024, with improved energy efficiency and sustainability metrics driving future competitiveness.

3. Occidental Petroleum Corporation (Oxy/OxyChem):

- Occidental’s chemical business, OxyChem, remains a leading chlor‑alkali producer. While not reporting recent new chlor‑alkali capacity, the company’s subsidiary 1PointFive signed a 25‑year CO₂ offtake agreement (≈2.3 million tonnes/year) and is exploring a direct air capture (DAC) JV with ADNOC’s XRG in South Texas, highlighting a pivot toward low carbon chemistries. This strategy underpins future alignment of chlor‑alkali operations with decarbonization initiatives.

4. Formosa Plastics Corporation:

- Formosa Plastics USA’s chlor‑alkali production unit recently earned Platinum level recognition for operational excellence and safety in its USA facility. While they lifted an earlier force majeure for chlor‑alkali (from a past weather disruption), that recovery reflects strong operational resilience. No new greenfield chlor‑alkali capacity reported but ongoing focus remains on supplying bleach, caustic soda, EDC and HCl reliably.

5. Solvay SA:

- Solvay signed a technology license agreement with Guangxi Chlor‑Alkali Chemical in April 2023 to enable a hydrogen‑peroxide megaplant in Qinzhou (Guangxi, China), serving propylene oxide and other derivatives. Solvay is also collaborating with ENOWA (NEOM) to develop a large carbon‑neutral soda ash plant (up to 1.5 Mt by 2035) in the Middle East using renewable energy and seawater brine. These moves integrate chlor‑alkali flows into sustainable industrial ecosystems.

6. Tosoh Corporation:

- As one of Asia’s largest chlor‑alkali producers, Tosoh recently announced an AI‑powered supply chain transformation in partnership with Kinaxis, deploying the Maestro platform to enhance inventory visibility, sales operations planning, and resilience across its global operations. Additionally, Tosoh has ceased production of sodium sulfate by end‑2024 to streamline chemical portfolio. These steps strengthen operational efficiency in its chlor‑alkali segment.

Conclusion

The global chlor-alkali market is showing steady growth, driven by increasing demand across industries such as water treatment, construction, paper, textiles, and chemicals. Major companies like Olin, Westlake, Tata Chemicals, and Solvay are enhancing efficiency through technology upgrades, sustainability initiatives, and regional capacity expansion. While some firms are adjusting production due to market pressures, others are investing in eco-friendly processes and AI-powered operations. The shift toward cleaner energy, better safety standards, and integrated chemical value chains will shape the future of this market. Overall, the chlor-alkali industry remains a vital link in the global industrial supply chain with promising long-term prospects.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)