Table of Contents

Overview

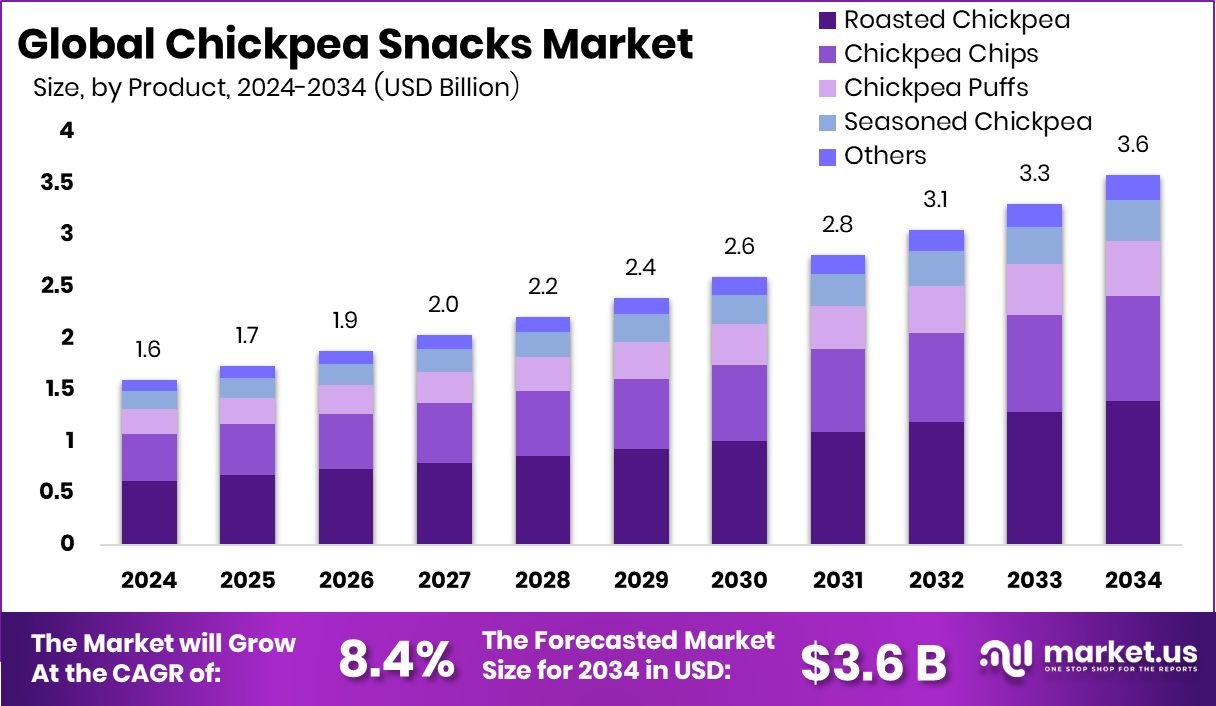

New York, NY – October 06, 2025 – The Global Chickpea Snacks Market is projected to reach USD 3.6 billion by 2034, rising from USD 1.6 billion in 2024, at a CAGR of 8.4% (2025–2034). North America leads the market with a 39.4% share, generating USD 0.6 billion in 2024, supported by a strong retail presence.

Chickpea-based snacks are gaining popularity as consumers look for healthier, plant-based, and convenient options. Made from roasted, puffed, or processed chickpeas, these products are high in protein and fiber, often gluten-free, and positioned as better alternatives to traditional chips. Growing awareness of health issues like diabetes, obesity, and heart disease further boosts demand.

Shifts toward vegan, vegetarian, and flexitarian diets are fueling the market’s expansion. In India, government initiatives such as the “Mission for Aatmanirbharta in Pulses” (₹1,000 crore for procurement and storage), the Pradhan Mantri Kisan Sampada Yojana (PMKSY) (₹6,520 crore for food processing), and the Production Linked Incentive Scheme for Food Processing (PLISFPI) (₹10,900 crore over six years) provide strong support for chickpea supply and value-added product development.

Innovation is also reshaping the market, with younger consumers and millennials driving demand for new flavors, formats (chips, bars, puffs), and clean-label sustainable options. At the same time, expanding online and offline retail networks are opening access to smaller towns and rural markets.

Key Takeaways

- The Global Chickpea Snacks Market is expected to be worth around USD 3.6 billion by 2034, up from USD 1.6 billion in 2024, and is projected to grow at a CAGR of 8.4% from 2025 to 2034.

- In 2024, roasted chickpeas held a 38.9% share, dominating the Chickpea Snacks Market segment.

- Savory flavors captured 42.3% share, showcasing strong consumer preference in the global Chickpea Snacks Market.

- Supermarkets and hypermarkets accounted for a 33.8% share, driving retail growth within the Chickpea Snacks Market globally.

- Rising health awareness in North America supported its 39.4% market share, valued at USD 0.6 Bn.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/chickpea-snacks-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 1.6 Billion |

| Forecast Revenue (2034) | USD 3.6 Billion |

| CAGR (2025-2034) | 8.4% |

| Segments Covered | By Product (Roasted Chickpea, Chickpea Chips, Chickpea Puffs, Seasoned Chickpea, Others), By Flavor (Savory, Sweet, Spicy, Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Grocery Stores, Online Retailers, Others) |

| Competitive Landscape | PepsiCo, Inc., Nestlé S.A., Mondelez International, Inc., Calbee, Inc., Campbell Soup Company, Conagra Brands, Inc., The Hain Celestial Group, Inc., Kraft Heinz Company, Kellogg Company, Biena Snacks |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=158139

Key Market Segments

By Product Analysis

Roasted chickpeas dominated the chickpea snacks market in 2024, capturing a 38.9% share. Their popularity stems from strong consumer demand for high-protein, fiber-rich snacks that cater to health-conscious lifestyles. As a crunchy, guilt-free alternative to fried snacks, roasted chickpeas appeal to vegan and gluten-free consumers with their versatile flavors, ranging from savory spices to sweet coatings. Enhanced accessibility through supermarkets, online platforms, and health stores, combined with innovative packaging and seasonings, drives repeat purchases and market expansion.

By Flavor Analysis

Savory flavors led the chickpea snacks market in 2024 with a 42.3% share. Their dominance reflects consumer preference for bold, spiced, and tangy profiles like chili, garlic, herbs, and masala, which align with regional tastes and serve as healthier alternatives to traditional salty snacks. Savory chickpea snacks attract both health-focused and mainstream consumers, benefiting from increased visibility through retail and online channels. Their nutritional value and appealing taste ensure consistent demand and market leadership.

By Distribution Channel Analysis

Supermarkets and hypermarkets accounted for 33.8% of the chickpea snacks market in 2024. Their leadership is driven by extensive product availability, diverse brand and flavor offerings, and strategic shelving that encourages impulse buys. Competitive pricing, promotional discounts, and in-store marketing, such as sampling and prominent displays, enhance consumer trust and drive sales. The growing presence of these retail outlets in urban and semi-urban areas further strengthens their role as the primary distribution channel for chickpea snacks.

Regional Analysis

North America led the chickpea snacks market with a 39.4% share, valued at USD 0.6 billion. This dominance is fueled by robust grocery retail, strong private-label presence, and high demand for protein-rich, gluten-free snacks. Widespread availability of roasted and baked chickpeas, efficient e-commerce, and clean-label branding in club stores and natural channels bolster the region’s market.

Europe sees steady growth, driven by transparent labeling, retailer sustainability efforts, and a growing flexitarian consumer base favoring legume-based snacks. Asia Pacific is gaining traction as urban consumers shift to convenient, ready-to-eat formats, supported by modern retail and quick-commerce platforms. In the Middle East & Africa, chickpea snacks benefit from cultural familiarity, with modern packaging and regional flavors boosting demand beyond traditional markets.

Latin America shows potential through supermarket expansion and interest in plant-based snacking, with local co-packers enabling diverse flavor offerings and competitive pricing. Across all regions, marketing emphasizing fiber, plant protein, and minimal processing, alongside multichannel distribution (mass retail, specialty stores, and direct-to-consumer), drives household penetration and market growth.

Top Use Cases

- Healthy Snacking Alternative: Roasted chickpea snacks offer a crunchy, flavorful option for people seeking better-for-you treats over chips or nuts. Packed with plant-based protein and fiber, they help curb hunger and support steady energy levels throughout the day, making them ideal for busy lifestyles focused on wellness.

- Salad and Bowl Topper: Adding roasted chickpeas to salads or grain bowls brings extra texture and nutrition without extra calories. Their nutty taste pairs well with veggies, greens, and dressings, turning simple meals into satisfying, balanced dishes that promote digestive health and fullness.

- Trail Mix Ingredient: Mix roasted chickpeas into homemade trail mixes with nuts, dried fruits, and seeds for a portable snack. This combination provides sustained energy and variety in flavors, appealing to those wanting convenient, on-the-go options that align with active routines and plant-forward eating.

- Vegan Protein Boost: Chickpea snacks serve as a versatile source of complete protein for vegans and vegetarians, easily incorporated into meals or eaten alone. Their high nutrient profile supports muscle maintenance and overall vitality, fitting seamlessly into diets emphasizing ethical and health-conscious choices.

- Flavorful Recipe Enhancer: Use seasoned chickpeas in recipes like soups, stir-fries, or as a base for dips to elevate taste and nutrition. Their adaptability to spices and cuisines makes them a go-to for creative cooking, helping home cooks build wholesome meals that cater to diverse dietary needs.

Recent Developments

1. PepsiCo, Inc.

PepsiCo continues to expand its Off the Eaten Path brand, which features chickpea-based crisps. A key recent development is the brand’s focus on variety and cleaner labels, emphasizing simple, plant-based ingredients. Their strategy leverages the growing consumer demand for better-for-you snacks, positioning these chickpea products as a premium alternative within the broader Frito-Lay portfolio. This expansion is part of PepsiCo’s global “Pep Positive” sustainability and nutrition initiative.

2. Nestlé S.A.

Nestlé has been innovating under its Garden Gourmet brand, launching new vegan products that cater to the flexitarian market. While not exclusively a chickpea snack, they have introduced products like chickpea-based falafel and veggie bites. Their recent focus on snacking is on high-protein, plant-based alternatives, utilizing chickpeas as a core ingredient to improve the nutritional profile and texture of their new product launches across various global markets.

3. Mondelez International, Inc.

Through its venture arm, SnackFutures, Mondelez has been acquiring and investing in brands aligned with well-being. A recent development is the heightened focus on brands like Hu (which offers chickpea-based “Grain-Free” crackers). Mondelez is leveraging its distribution power to scale these better-for-you brands, directly placing chickpea-based snacks into mainstream retail channels, capitalizing on the grain-free and clean-label trends.

4. Calbee, Inc.

Calbee, a leader in healthy snacking in Japan, has been actively developing and marketing harami-woyashi (hull-eating) snacks, which often use whole chickpeas. A recent development is the increased promotion of their “Furugura” line of roasted beans and peas, including chickpeas, directly targeting health-conscious consumers seeking high-fiber, protein-rich snacks. They emphasize the simple, natural preparation of roasting to enhance the inherent nutritional value of the chickpea.

5. Campbell Soup Company

Under its Snyder’s of Hanover brand, Campbell’s has expanded its “P3” (Protein, Pick, Pack) platform to include more plant-based options. A recent development is the incorporation of roasted chickpeas as a protein component within these kits. This move directly responds to the trend of portable, high-protein snacking, positioning chickpeas as a central, on-the-go ingredient alongside nuts and crackers in their established product line.

Conclusion

Chickpea Snacks stand out as a versatile powerhouse in the evolving snack landscape, driven by rising interest in plant-based and nutrient-rich options. As consumers prioritize health, convenience, and sustainability, these snacks continue to gain traction through innovative flavors and easy integration into daily routines, promising steady growth for brands embracing clean, wholesome trends.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)