Table of Contents

Overview

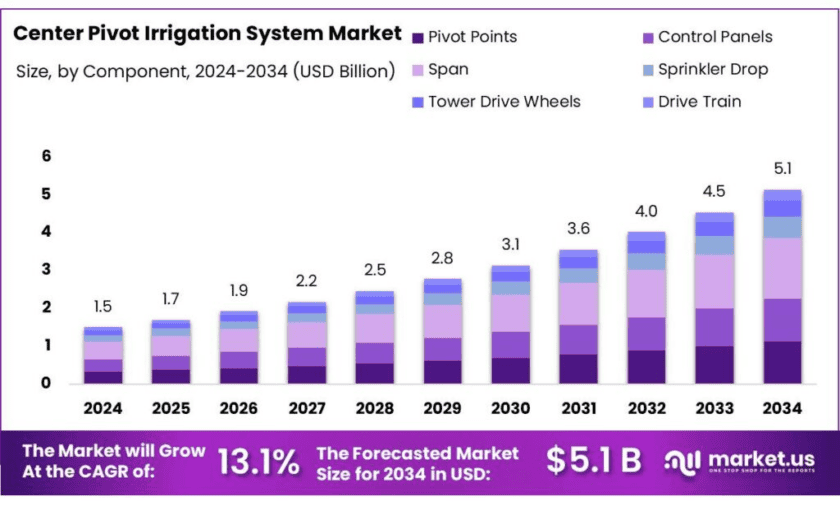

New York, NY – Nov 04, 2025 – The global Center Pivot Irrigation System (CPIS) market is projected to reach USD 5.1 billion by 2034, growing from USD 1.5 billion in 2024 at a strong CAGR of 13.1% between 2025 and 2034. In 2024, North America led the global market with a 42.5% share, generating approximately USD 0.6 billion in revenue. CPIS technology is transforming modern agriculture by delivering efficient, uniform, and large-scale water distribution. These systems utilize rotating sprinkler arms mounted on wheeled towers, enabling circular irrigation patterns around a central pivot.

In India, the adoption of CPIS aligns closely with government policies promoting sustainable water management. The Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), launched in 2015, was introduced to expand cultivated land with assured irrigation and minimize water wastage. Under the Accelerated Irrigation Benefit Programme (AIBP), 99 major and medium irrigation projects were prioritized in 2016–17, targeting an irrigation potential of 7.603 million hectares (76.03 lakh ha).

Further, state-level efforts are reinforcing this momentum. In Uttar Pradesh, the government offers a subsidy of ₹52,000 to farmers for constructing farm ponds and provides additional grants for ISI-marked pump sets to promote rainwater harvesting and improve irrigation coverage. A successful community-owned CPIS model was introduced in Jalaun district, irrigating 75 acres and benefiting 26 farmers. Moreover, over the past eight years, the Uttar Pradesh government has implemented 29 irrigation projects, expanding irrigation capacity by 1.91 million hectares and improving agricultural productivity for more than 4.35 million farmers.

Key Takeaways

- Center Pivot Irrigation System Market size is expected to be worth around USD 5.1 Billion by 2034, from USD 1.5 Billion in 2024, growing at a CAGR of 13.1%.

- Span held a dominant position in the center pivot irrigation system market, capturing more than 31.3% of the overall market share.

- Stationary systems held a dominant position in the center pivot irrigation market, capturing more than 67.7% of the market share.

- Oilseeds & Pulses held a dominant position in the center pivot irrigation system market, capturing more than 59.9% of the market share.

- North America held a dominant share of 42.5% in the center pivot irrigation system market, valued at approximately USD 0.6 billion.

➤ For a deeper understanding, click on the sample report link: https://market.us/report/center-pivot-irrigation-system-market/free-sample/

Report Scope

| Market Value (2024) | USD 1.5 Bn |

| Forecast Revenue (2034) | USD 5.1 Bn |

| CAGR (2025-2034) | 13.1% |

| Segments Covered | By Component (Pivot Points, Control Panels, Span, Sprinkler Drop, Tower Drive Wheels, Drive Train), By Mobility (Stationary, Mobile), By Crop Type (Oilseeds And Pulses, Cereals, Others) |

| Competitive Landscape | Valmont Industries, Lindsay Corporation, T-L Irrigation Company, Reinke Manufacturing Company, Jain Irrigation Systems Ltd., Netafim, Rivulis Irrigation, Hunter Industries, Pierce Corporation, EPC Industries Limited (EPCO), Rain Bird Corporation, Metzer, OCMIS Irrigation |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=159264

Key Market Segments

By Component Analysis – Span Dominates with 31.3% Share in 2024

In 2024, the Span segment led the global center pivot irrigation system market, accounting for 31.3% of total market share. The span serves as the key structural component, forming the main framework that supports and rotates the sprinkler lines for even water distribution. Its dominance arises from its vital role in maximizing irrigation coverage with minimal maintenance and operational downtime. Designed for durability and adaptability, spans are widely utilized across diverse agricultural landscapes, ensuring consistent performance across different soil types, terrains, and crop varieties.

By Mobility Analysis – Stationary Systems Lead with 67.7% Share in 2024

In 2024, Stationary systems held the top position in the mobility segment of the center pivot irrigation market, capturing 67.7% of the global share. These systems remain fixed around a single pivot point, offering cost-effective, reliable, and easy-to-maintain irrigation solutions. Their popularity stems from their suitability for small to medium-sized farms and water-limited regions, where movement of equipment is less frequent. Due to their long operational life and minimal mechanical complexity, stationary systems continue to attract widespread adoption. As global demand for efficient and affordable irrigation grows, stationary systems are expected to maintain their strong position through 2025.

By Crop Type Analysis – Oilseeds & Pulses Dominate with 59.9% Share in 2024

In 2024, the Oilseeds and Pulses segment emerged as the leading crop application for center pivot irrigation systems, securing a 59.9% market share. The increasing global demand for protein-rich pulses and oilseed crops has driven higher adoption of precision irrigation technologies to optimize yields. CPIS technology ensures uniform water application—crucial for the growth of crops like soybeans, lentils, and groundnuts. Rising food demand from a growing global population and the need for sustainable, water-efficient cultivation methods further enhance this segment’s growth. As a result, oilseeds and pulses are projected to remain key beneficiaries of center pivot irrigation through 2025 and beyond.

List of Segments

By Component

- Pivot Points

- Control Panels

- Span

- Sprinkler Drop

- Tower Drive Wheels

- Drive Train

By Mobility

- Stationary

- Mobile

By Crop Type

- Oilseeds & Pulses

- Cereals

- Others

Regional Analysis

North America Holds 42.5% Share of Global NFC Juice Market in 2024

In 2024, North America dominated the center pivot irrigation system market, holding a substantial 42.5% share valued at approximately USD 0.6 billion. The region’s leadership is driven by highly mechanized agricultural practices, extensive farming areas, and growing emphasis on water-efficient irrigation technologies. The United States accounts for the majority of this share, supported by large tracts of farmland dedicated to corn, wheat, and soybeans, which are high water-demand crops. As water scarcity and irrigation costs continue to rise, North American farmers are increasingly adopting center pivot systems to ensure optimized water usage and higher crop productivity.

Top Use Cases

Converting from gravity/flood to save water: Growers switch from flood/“border” irrigation to center pivots to cut applied water and improve uniformity. FAO’s engineering guide lists typical application efficiency ~85% for well-designed pivots, versus ~60% for many surface systems; on coarse soils, studies show ~30% less water can be applied with a pivot compared with border systems at 60% efficiency—without reducing crop evapotranspiration needs. These savings help farms extend scarce allocations and stabilize yields in dry years.

Scaling across large acreages with fewer labor hours: Center pivots dominate U.S. sprinkler irrigation because they cover big fields with minimal labor. USDA’s latest national irrigation survey reports 109,184 farms using center pivots on 31,656,895 acres in open fields (2018), underscoring how automation and consistent passes reduce manual set-move time compared with hand-lines or furrows. The same dataset shows total sprinkler acres in the open at 26.8 million (non-center-pivot also reported), highlighting pivots’ leading footprint.

Meeting conservation-program goals (cost-share eligible): Upgrading to efficient pivots (or improving drop nozzles/pressure packages) fits U.S. conservation programs. USDA-NRCS EQIP provides technical and financial assistance for irrigation efficiency, and its WaterSMART priority areas explicitly support conversions from furrow to sprinklers that use ~30% less water. Some state and NRCS documents detail cost-share support for replacing aging pivots or converting to low-energy spray application (LESA/LEPA) drops to boost efficiency. These incentives de-risk capital spend and accelerate payback.

Improving distribution uniformity for fertigation/chemigation: Pivots apply water evenly over circular paths, which supports chemigation and fertigation with more uniform nutrient placement than many gravity setups. USDA-ARS technical materials and FAO guidance describe pivot hydraulics and nozzle packages that achieve consistent application along the span; uniformity reduces leaching “hot spots,” improves nitrogen-use efficiency, and simplifies in-season corrections.

Managing energy use and pumping efficiency: Because pivots operate at low to medium pressure and avoid the land-leveling required by flood systems, they can lower energy per unit of water delivered. Extension guidance shows that moving from sprinklers “on top” to drops reduces droplet evaporation and wind drift, trimming consumptive use in semi-arid climates; NRCS/ATTRA resources add practical steps for reducing kWh via pressure management, pump efficiency checks, and scheduling tools.

Stabilizing yields and enabling precise irrigation scheduling: Research in the U.S. Corn Belt links optimized irrigation schedules under pivots to measurable yield gains (e.g., +13% and +3% in two trial years) by better matching ET and minimizing stress at critical growth stages. Long-term agronomy work also shows higher water productivity for well-managed irrigated maize relative to suboptimal practices—evidence that precise, repeatable pivot applications help capture genetic yield potential.

Recent Developments

Rivulis, a global micro- and drip-irrigation provider, reported its Indian subsidiary’s provisional revenue at ₹ 225.07 crore in FY 2023, up from ₹ 157.49 crore in FY 2022. The company also completed the acquisition of Jain Irrigation Systems Ltd.’s international irrigation business in April 2023, signalling a push to scale its global pivot/center-pivot and precision irrigation offerings.

Hunter Industries, active in irrigation solutions including center-pivot-compatible controllers and smart-irrigation systems, is estimated to have reached annual revenue of approximately US$500 million in 2024. The company emphasizes smart control systems and integration for agricultural applications, positioning itself for growth as precision and automation become more important in large-field irrigation practices.

Jain Irrigation Systems Ltd.: In fiscal year ended March 31 2024, Jain Irrigation reported ₹ 61,470 million in net sales, up 6.95% over FY 2023’s ₹ 57,480 million. The company continues advancing its center-pivot and sprinkler irrigation offerings in India, emphasising micro-irrigation and farm-as-industry models, aiming to reach more than 10 million farmers globally.

Netafim (part of Orbia Precision Agriculture): In 2023 the Orbia group—which includes Netafim—generated approximately US$ 8.2 billion in revenue, with Netafim positioned as the global leader in precision irrigation systems across over 110 countries. Netafim’s thrust includes center-pivot and field-scale irrigation solutions complemented by digital monitoring, targeting growers seeking “grow more with less” water usage.

T‑L Irrigation Company: In 2023, T-L Irrigation, headquartered in Hastings, Nebraska and active for 70+ years, reported estimated annual revenue of US$35 million and employed about 76 staff. The company manufactures center-pivot and corner-pivot systems and continues to focus on quality and local manufacturing, positioning itself as a smaller, niche player compared with large global brands.

Reinke Manufacturing Company: In 2024, Reinke Manufacturing—based in Deshler, Nebraska and family-owned since 1954—announced a US$12 million investment in robotic automation to expand production of its center-pivot irrigation systems. While specific yearly revenue wasn’t publicly detailed for 2024, earlier estimates placed annual revenue around US$42.6 million. The move highlights Reinke’s strategic focus on manufacturing scale, precision agriculture integration, and global dealer expansion.

Valmont Industries, Inc.: In 2024, Valmont reported full-year net sales of US$4.08 billion with an operating margin of 12.9%, up from 7.0% in the prior year. While its Agriculture (center-pivot/linear irrigation) segment faced headwinds and declined about 8.3% in Q4, the company reinforced its global presence in irrigation equipment and precision agriculture technologies.

Lindsay Corporation: For the irrigation business of Lindsay, during Q4 of fiscal 2024 the irrigation segment reported revenues of US$125.9 million, down 12% year-over-year; North America irrigation revenues were US$61.7 million, up ~2%. Their international irrigation revenue and projects grew in focus, even as replacement-parts demand in mature markets softened.

Conclusion

In conclusion, the adoption of center pivot irrigation systems represents a major shift toward more efficient and precise water management in agriculture. In the United States, farmers irrigated 49.6 million acres of harvested cropland in the open in 2023, and they reported that sprinkler systems accounted for 12.6 million more irrigated acres than gravity systems. By enabling more uniform water delivery, less labour-intensive operation, and greater resilience against drought variability, center pivots are helping growers sustainably manage scarce water resources while stabilising yields and reducing costs. As regulatory pressures grow and climate uncertainty increases, investments in pivot technology are proving to be more than equipment—they are strategic tools for long-term viability in irrigated agriculture.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)