Table of Contents

Report Overview

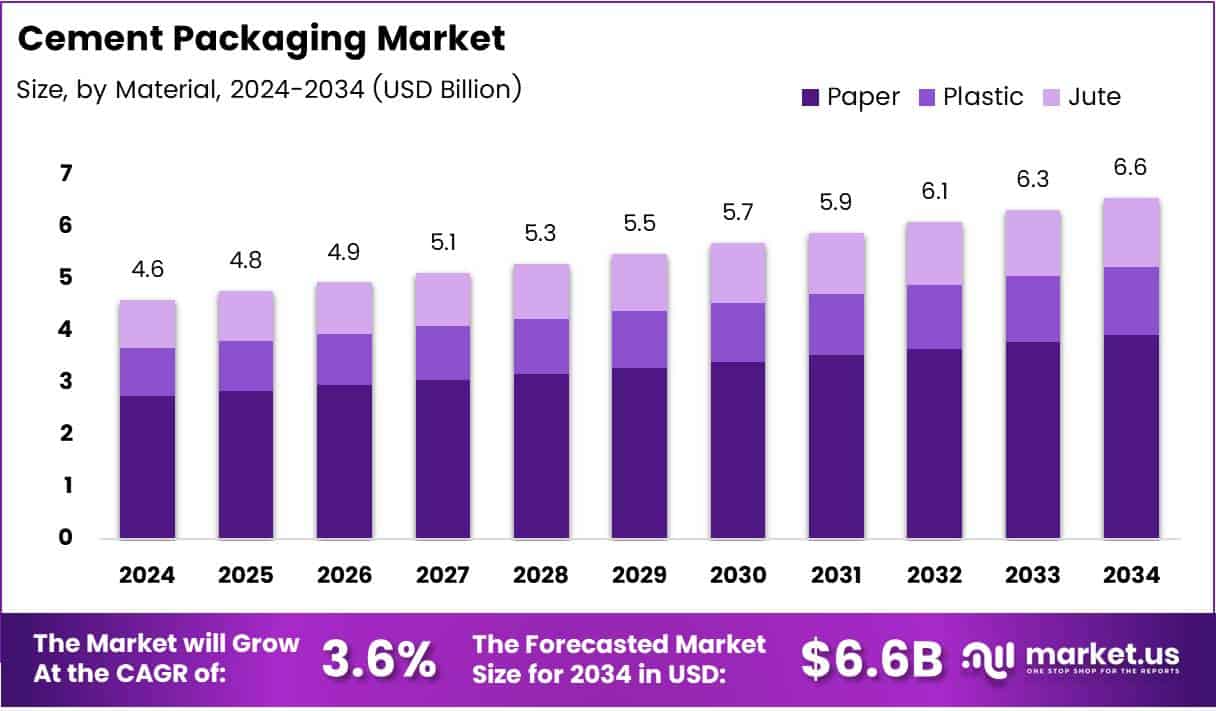

The Global Cement Packaging Market size is expected to be worth around USD 6.6 Billion by 2034, from USD 4.6 Billion in 2024, growing at a CAGR of 3.6% during the forecast period from 2025 to 2034

This growth is primarily fueled by increasing construction activity, rapid urbanization, and a strong global push toward sustainable, efficient, and automated packaging solutions in the cement industry.The global cement packaging market is experiencing steady growth, fueled by robust construction activities across emerging and developed economies. Infrastructure development projects, urbanization, and the rising demand for residential and commercial spaces are significantly contributing to increased cement consumption, thereby boosting the need for reliable packaging solutions.

One of the key growth drivers is the shift toward sustainable and eco-friendly packaging materials. Manufacturers are increasingly adopting recyclable and biodegradable materials to reduce their carbon footprint and comply with environmental regulations. Additionally, innovations in packaging technology such as moisture-resistant bags and high-strength sacks are improving the shelf life and handling efficiency of cement products, further supporting market expansion.Asia Pacific remains the dominant region due to rapid industrialization and ongoing infrastructure developments in countries like China, India, and Southeast Asian nations. Meanwhile, markets in the Middle East, Africa, and Latin America are also witnessing moderate to high growth, driven by government investments in housing and transportation sectors.

Key Takeaways

- The global cement packaging market is projected to reach USD 6.6 Billion by 2034, up from USD 4.6 Billion in 2024.

- The market is expected to grow at a CAGR of 3.6% from 2025 to 2034.

- Paper held a dominant 59.4% share in the By Material segment in 2024 due to its sustainability and cost-effectiveness.

- Bags with capacity above 30 kg led the By Capacity segment in 2024, accounting for 48.6% of the market.

- Asia Pacific is the largest regional market with a 40.2% share, valued at USD 1.84 Billion in 2024.

- Producing 1 ton of Portland cement consumes over 60% of a cement plant’s power for grinding 3 tons of raw material.

- China, producing around 2,100,000 metric tons of cement in 2023, heavily influences global packaging standards.

Key Market Segments

Material Analysis

In 2024, paper emerged as the most preferred material in the cement packaging market, capturing 59.4% of the market share. This is mainly because paper is cost-effective, easy to recycle, and seen as an eco-friendly choice. With growing global regulations favoring sustainable packaging, both manufacturers and consumers are choosing paper more often. While plastic is still used due to its strength and moisture resistance making it reliable for transport it is losing ground because of environmental concerns. Jute, although not widely used, is gaining interest as a biodegradable and strong natural fiber, especially in niche eco-friendly markets. Overall, the market is leaning towards materials that offer a good mix of sustainability, functionality, and affordability, with paper leading the way.

Capacity Analysis

In terms of bag size, cement packaging is dominated by bags larger than 30 kg, which held a 48.6% market share in 2024. These large bags are popular for bulk transportation and are ideal for large construction projects because they reduce the number of packages needed, making logistics more efficient. Mid-size bags (15 kg to 30 kg) are also commonly used, especially by regional suppliers and smaller-scale construction works. Meanwhile, smaller bags ranging from 5 kg to 15 kg and below serve specific needs like retail use or minor repairs. Although these smaller sizes have a smaller share, they are essential for customer convenience and targeted use. The overall trend shows a clear preference for larger bags in commercial construction, while smaller capacities fill important but niche roles.

Drivers

1. Rising Adoption of Sustainable Packaging Solutions

The global cement packaging market is witnessing robust growth driven by an increasing emphasis on sustainability. Consumers and manufacturers are prioritizing eco-friendly alternatives, such as recyclable and biodegradable packaging materials, to reduce environmental impact. This shift aligns with global sustainability goals and is fostering innovation in green packaging technologies.

2. Rapid Growth in Construction Activities

The expanding construction sector, particularly in emerging economies, is fueling demand for durable and efficient cement packaging. Urbanization, industrialization, and large-scale infrastructure development projects are accelerating the need for secure packaging that protects cement during transportation and storage. This, in turn, is propelling the growth of the cement packaging market.

Major Challenges

- High costs of sustainable and advanced packaging materials deter smaller manufacturers.

- Lack of global standardization in packaging formats complicates logistics and automation integration.

- Vulnerability to damage from moisture and mishandling during transit leads to product loss.

- Volatility in raw material prices adds uncertainty to production costs and profit margins.

Business Opportunities

- Development of biodegradable and compostable packaging materials to meet global sustainability goals.

- Use of smart packaging technologies, such as RFID and QR codes, to enhance supply chain transparency.

- Expansion into ready-mix and specialty cement segments that require tailored packaging solutions.

- Investments in infrastructure by governments across Asia, Africa, and Latin America to meet urbanization demands.

Regional Analysis

Asia Pacific

Asia Pacific is the largest market for cement packaging, holding 40.2% of the global share, valued at around USD 1.84 billion. This strong position is mainly due to fast industrial growth and major construction projects in countries like China and India. Rapid urban development and high demand for modern infrastructure are pushing the need for eco-friendly and efficient cement packaging solutions.

North America

The cement packaging market in North America is growing steadily, supported by advanced packaging technologies and strict environmental rules that encourage sustainable materials. The region has a strong construction industry and is increasingly adopting automation in packaging, helping companies improve productivity and reduce waste.

Europe

Europe’s cement packaging market is influenced by strict regulations promoting sustainability and recycling. Many companies are investing in green packaging options, such as biodegradable and recyclable materials. While market growth is moderate, it remains steady due to developed infrastructure and the widespread use of automated packaging systems.

Restraints

High Costs and Lack of Standardization Challenge Market Expansion

The cement packaging market faces notable constraints that hinder its growth. A key challenge is the high cost of eco-friendly and advanced packaging materials, which limits adoption particularly in cost-sensitive regions. Additionally, fluctuations in the prices of raw materials like paper and plastic create instability in production costs and impact profit margins.

Another major restraint is the lack of standardization in packaging sizes and formats across regions. This inconsistency complicates logistics and disrupts the efficiency of automated packaging systems. Moreover, maintaining the durability and integrity of cement bags during long-distance transportation remains a concern, as they are susceptible to moisture, tearing, and rough handling. These factors collectively restrict the broader implementation of modern packaging solutions in the cement industry.

Recent Developments

- In July 2025, the Rwandan government signed a 15-year quarry agreement with Cimerwa for a US$190 million clinker plant.

This strategic deal aims to boost Rwanda’s domestic cement production and reduce import dependency. - In March 2025, UltraTech Cement retained its top credit ratings from Care Ratings, reaffirming its financial strength.

The rating reflects the company’s consistent performance, strong balance sheet, and market leadership in the cement industry. - In January 2025, brokerage reports highlighted UltraTech Cement receiving multiple rating upgrades, while Citi expressed bullish sentiment on Indus Towers and issued a ‘sell’ on Dr Reddy’s.

These changes reflect shifting investor confidence based on quarterly performance and market outlooks. - In May 2025, a report explained how using Filler Masterbatch significantly reduces manufacturing costs in plastic cement bags.

The material optimizes resin usage and improves the strength-to-cost ratio in packaging production.

Conclusion

The cement packaging market is evolving in response to global environmental imperatives, construction sector growth, and technological innovation. With demand surging in Asia Pacific and investments flowing into sustainable materials and automation, the market presents substantial opportunities for manufacturers, suppliers, and investors alike. As the industry moves toward greener and more efficient packaging systems, key players are well-positioned to shape the future of cement logistics and infrastructure supports.