Table of Contents

Overview

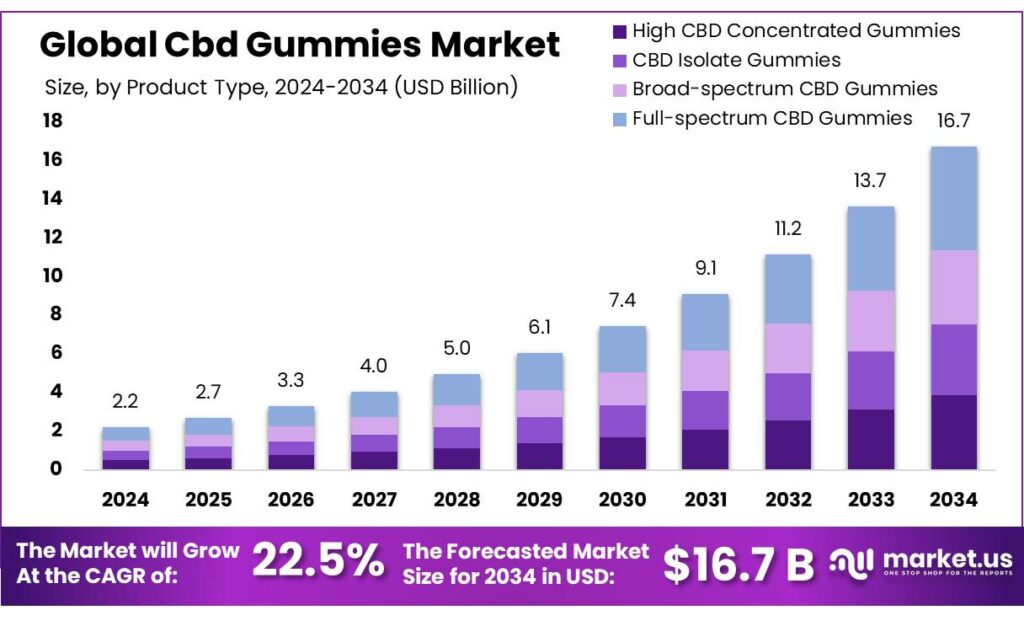

New York, NY – October 01, 2025 – The Global CBD Gummies Market is projected to reach approximately USD 16.7 billion by 2034, growing from USD 2.2 billion in 2024, at an impressive CAGR of 22.5% between 2025 and 2034. In 2024, North America emerged as the leading region, accounting for 47.8% of the total market share.

In India, rising cases of stress, anxiety, and sleep disorders have significantly influenced demand for CBD gummies, as consumers increasingly prefer natural solutions for mental wellness. The market is also witnessing diversification, with product innovations such as vegan-friendly and low-sugar formulations to cater to varied consumer lifestyles. Government regulations have been pivotal in shaping industry dynamics.

In the U.S., the 2018 Farm Bill legalized hemp cultivation and the production of hemp-derived CBD products containing less than 0.3% THC, creating a clearer framework for growth and investment. However, regulatory uncertainty persists, as the U.S. Food and Drug Administration (FDA) has not yet approved CBD in food or dietary supplements due to safety concerns, including potential risks of liver damage and drug interactions.

These challenges have triggered calls for stricter guidelines to ensure consumer safety and product quality. Despite these concerns, market momentum remains strong. The U.S. CBD market expanded dramatically, from just USD 108 million in 2014 to around USD 1.9 billion in 2022. This growth is fueled by increasing awareness of mental health issues, with the Anxiety and Depression Association of America reporting that 40 million U.S. adults are affected by anxiety disorders.

Consumers are drawn to CBD gummies because they are non-psychoactive, offering therapeutic relief without the intoxicating effects associated with cannabis. Overall, the CBD gummies market is positioned for rapid expansion, driven by consumer demand for safe, convenient, and plant-based wellness alternatives alongside ongoing regulatory evolution.

Key Takeaways

- The Global Cbd Gummies Market size is expected to be worth around USD 16.7 billion by 2034, from USD 2.2 billion in 2024, growing at a CAGR of 22.5%.

- Full-spectrum CBD gummies held a dominant market position, capturing more than a 31.4% share of the CBD gummies market.

- Chocolate-flavored CBD gummies secured a dominant position in the Indian market, capturing over 34.8% of the total market share.

- Pain relief application segment held a significant position in the CBD gummies market, capturing over 28.6% of the total market share.

- Supermarket/Hypermarket distribution channel held a dominant position in the CBD gummies market, capturing more than a 42.2% share.

- North America emerged as the dominant region in the global CBD gummies market, capturing approximately 47.8% of the total market share.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/cbd-gummies-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 2.2 Billion |

| Forecast Revenue (2034) | USD 16.7 Billion |

| CAGR (2025-2034) | 22.2% |

| Segments Covered | By Product Type (High CBD Concentrated Gummies, CBD Isolate Gummies, Broad-spectrum CBD Gummies, Full-spectrum CBD Gummies), By Flavor (Fruity, Mint, Chocolate, Sour, Mixed Berry, Others), By Application (Pain Relief, Anxiety Relief, Sleep Aids, Anti-Inflammatory, General Wellness, Others), By Distribution Channel (Conventional, Supermarket/Hypermarket, Local Health Stores, Online Retailing, Others) |

| Competitive Landscape | CV Sciences, Inc., BellRock Brands, Sunday Scaries, Green Roads, Medix CBD, NextEvo Naturals, Purekana LLC, Diamond CBD, PJ Marketing LLC, Charlotte’s Web, Inc. |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157652

Key Market Segments

By Product Type Analysis

Full-Spectrum CBD Gummies Lead with 31.4% Market Share in 2024

In 2024, full-spectrum CBD gummies commanded a leading 31.4% share of the CBD gummies market in India. Their dominance stems from growing consumer preference for holistic wellness products that harness the entourage effect, combining multiple cannabinoids and terpenes. Increased awareness of their potential to alleviate stress, anxiety, and sleep issues has driven demand, as consumers favor natural alternatives with minimal side effects over pharmaceuticals.

By Flavor Analysis

Chocolate-Flavored CBD Gummies Top Market with 34.8% Share in 2024

Chocolate-flavored CBD gummies captured a leading 34.8% market share in India in 2024, driven by their rich, indulgent flavor that appeals to a wide audience. Consumers increasingly seek functional edibles that blend enjoyable taste with CBD’s therapeutic benefits. The rising demand for health-conscious yet palatable wellness products has solidified chocolate-flavored gummies as a top choice.

By Application Analysis

Pain Relief Segment Dominates CBD Gummies Market with 28.6% Share in 2024

In 2024, the pain relief segment accounted for 28.6% of the CBD gummies market share, fueled by growing demand for natural solutions to manage chronic conditions like arthritis, neuropathy, and fibromyalgia. CBD’s anti-inflammatory and analgesic properties, combined with the convenience and precise dosing of gummies, have made them a popular choice. This trend reflects a broader shift toward holistic health and wellness routines.

By Distribution Channel Analysis

Supermarkets and Hypermarkets Lead CBD Gummies Market with 42.2% Share in 2024

Supermarkets and hypermarkets held a commanding 42.2% share of the CBD gummies market in 2024, driven by their convenience and accessibility. These retail formats offer a wide product selection, enabling easy comparison of brands and formulations. Consumers trust established retail chains for authenticity and reliability, while strategic product placement alongside other wellness items boosts visibility and encourages impulse purchases.

Regional Analysis

North America Commands 47.8% of the CBD Gummies Market in 2024

In 2024, North America solidified its position as the leading region in the global CBD gummies market, holding a substantial 47.8% market share. This dominance is largely driven by the widespread legalization of cannabis-derived products, including CBD edibles, in the United States and Canada. The U.S. market, in particular, has been a key contributor, fueled by growing consumer awareness and acceptance of CBD’s potential wellness benefits.

The regulatory environment in North America has significantly influenced market growth. Notably, the 2018 U.S. Farm Bill legalized hemp-derived CBD products with less than 0.3% THC, enabling a reliable supply chain for raw materials and establishing a clear legal framework that supports both manufacturers and consumers.

Top Use Cases

- Stress and Anxiety Management: Many people pop a CBD gummy during busy days to ease racing thoughts and promote a sense of calm. Unlike traditional meds, these tasty treats offer a natural way to dial down daily worries without grogginess, fitting easily into routines like work breaks or evening wind-downs for better emotional balance.

- Better Sleep Support: Struggling to nod off? CBD gummies can help quiet the mind and relax the body, making bedtime smoother for those with restless nights. Users often report deeper, more restorative rest after taking one before bed, turning sleep troubles into a thing of the past without heavy sedatives.

- Pain and Inflammation Relief: For nagging aches from workouts or daily strain, CBD gummies provide gentle soothing by targeting discomfort at its root. They’re a go-to for active folks seeking natural ease for sore muscles or joints, offering steady comfort throughout the day in a fun, chewable form.

- Mood and Focus Boost: Feeling off-kilter? These gummies may lift spirits and sharpen concentration, helping with focus during tasks or creative work. Ideal for anyone juggling life’s ups and downs, they support a steadier outlook and clearer headspace, all from a simple, enjoyable snack that fits any schedule.

- Wellness and Relaxation Aid: As part of a self-care routine, CBD gummies encourage overall chill vibes, aiding recovery after tough days. They’re popular for unwinding post-exercise or during travel, delivering subtle peace that enhances daily well-being without fuss, making them a staple in modern healthy habits.

Recent Developments

1. Almond Breeze

Almond Breeze, a brand of Blue Diamond Growers, has not launched CBD-infused gummies or beverages. As a leading almond milk producer, its focus remains on core dairy-free products. The company has not announced any plans to enter the cannabinoid market, prioritizing its established line of refrigerated and shelf-stable beverages. Any CBD products using the Almond Breeze name are from unofficial, third-party sources.

2. Ben & Jerry’s

Ben & Jerry’s has been a vocal advocate for cannabis justice and has publicly explored CBD-infused ice cream. However, they have not released any CBD gummies. The primary barrier remains the complex federal legal landscape, especially with the FDA’s stance on food products. The company continues to call for legal clarity, suggesting that a compliant CBD edible could be a future possibility once regulations are established.

3. Danone

Danone has not entered the CBD gummy market. The global food giant maintains a strict focus on its core health and nutrition portfolios, including dairy, plant-based products, and specialized medical nutrition. Given the uncertain regulatory environment for CBD in food and beverages across key markets, Danone has shown no indication of deviating from its core strategy to develop cannabinoid-based consumer products like gummies at this time.

4. Elmhurst 1925

Elmhurst 1925 has ventured into the cannabinoid space with its Milked line, which includes water-soluble CBD and CBN powders designed to mix into drinks. However, they have not extended this into a ready-to-eat CBD gummy product. Their innovation focuses on leveraging their expertise in emulsification to create effective, fast-acting powder supplements for functional beverages, rather than confectionery edibles like gummies.

5. General Mills

General Mills has not developed or launched any CBD-infused gummies under its major brands, like Nature Valley or Betty Crocker. The company adopts a cautious approach, citing the need for clearer FDA regulations before considering such products. Their current strategy emphasizes their core snack and cereal businesses, with no public plans to enter the cannabinoid market, focusing instead on trends like protein and fiber fortification.

Conclusion

CBD Gummies evolve from a niche wellness pick to a beloved everyday essential, blending convenience with natural appeal. With shifting attitudes toward holistic health and clearer rules paving the way, these chewy delights are set to thrive, drawing in more folks eager for simple stress relief, restful nights, and vibrant days. Expect fresh flavors and tailored options to keep the buzz alive, solidifying their spot in self-care arsenals worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)