Table of Contents

Overview

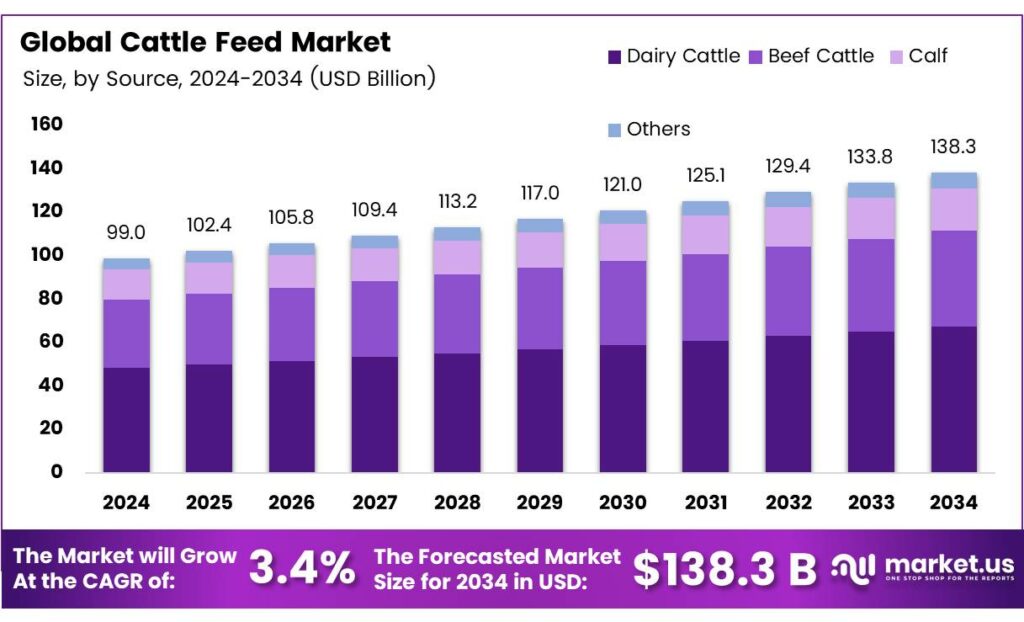

New York, NY – September 29, 2025 – The Global Cattle Feed Market is projected to reach USD 138.3 billion by 2034, up from USD 99.0 billion in 2024, registering a CAGR of 3.4% between 2025 and 2034. Cattle feed plays a vital role in modern livestock management, directly impacting milk yield, meat quality, and herd health. With the rising demand for dairy and beef worldwide, the sector is expanding as farmers adopt nutrient-rich, cost-effective feed solutions to maximize productivity.

The market’s growth is strongly supported by increasing livestock populations, especially across emerging economies. Among feed options, maize is widely used for its high metabolisable energy and low fibre content, containing 8–13% crude protein and around 85% total digestible nutrients (TDN). Crushed maize is commonly used for cattle, while flaked maize alters rumen fermentation patterns, reducing butterfat levels in milk.

Oats (Avena sativa), with 12–16% crude fibre and 7–15% crude protein, are another important cereal feed. Although low in amino acids such as methionine and tryptophan, they are rich in glutamic acid and are generally fed in crushed or bruised form. Barley (Hordeum vulgare), often used for fattening in the UK, provides 6–14% crude protein, high fibre, but limited lysine and oil content.

Since feed represents nearly 60% of milk production costs, careful ration balancing is essential. Nutrient supply must meet both maintenance and milk production requirements. Feeding strategies vary with lactation stage, often including green fodder and concentrates. High-yielding cows benefit from challenge feeding, where concentrate levels are gradually increased before and after calving to support peak milk yield.

Efficient feeding practices, such as mixing roughages and concentrates or using complete feed systems, help maintain optimal rumen fermentation, prevent acidosis, and enhance overall efficiency. Minerals like calcium and phosphorus remain critical for skeletal health, enzyme function, and metabolism. Deficiencies can lead to conditions such as rickets, reduced fertility, and milk fever. To prevent this, supplementation through bone meal, limestone, or green forages ensures balanced mineral intake and sustained herd performance.

Key Takeaways

- The Global Cattle Feed Market is expected to reach USD 138.3 billion by 2034 from USD 99.0 billion in 2024, with a CAGR of 3.4%.

- The Dairy cattle segment led in 2024, holding a 48.7% share due to high demand for nutrient-rich feed for milk production.

- Cereals dominated in 2024 with a 42.3% share, valued for their high carbohydrate content and digestibility.

- Offline channels held an 83.4% share in 2024, driven by local distributors and agricultural cooperatives.

- North America accounted for 42.5% of market revenue in 2024 (USD 42 billion), led by the U.S. and Canada’s beef and dairy sectors.

➤ Curious about the content? Explore a sample copy of this report – https://market.us/report/global-cattle-feed-market/request-sample/

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 99.0 Billion |

| Forecast Revenue (2034) | USD 138.3 Billion |

| CAGR (2025-2034) | 3.4% |

| Segments Covered | By Animal Type (Dairy Cattle, Beef Cattle, Calf, Others), By Ingredient (Cereals, Cakes and Mixes, Food Wastages, Feed Additives, Others), By Distribution Channel (Offline, Online) |

| Competitive Landscape | ADM Animal Nutrition, Alltech, Cargill, Incorporated, Charoen Pokphand Foods PCL, De Heus Animal Nutrition, Godrej Agrovet Limited, J.R. Simplot Company, Kent Nutrition Group, KSE Limited, Nutreco, Purina Animal Nutrition LLC |

➤ Directly purchase a copy of the report – https://market.us/purchase-report/?report_id=157408

Key Market Segments

By Animal Type

Dairy cattle led the global cattle feed market in 2024, holding a 48.7% share. This dominance stems from the high demand for nutrient-rich feed to support milk production, as dairy herds require specialized diets to optimize yield and health. Rising milk and dairy product consumption, especially in developing countries, drives this trend.

Farmers are increasingly adopting formulated feed blends to enhance milk productivity and herd efficiency. Supported by government initiatives promoting balanced livestock nutrition for food security, the dairy cattle segment will continue to dominate, reinforcing its vital role in the global food supply chain.

By Ingredient

Cereals captured a 42.3% share of the cattle feed market in 2024, serving as the primary energy source due to their high carbohydrate content and digestibility. Maize, barley, wheat, and sorghum are staples for meeting the energy needs of dairy and beef cattle, supporting healthy growth and productivity.

Their widespread availability and cost-effectiveness ensure strong demand, as producers prioritize energy-dense feed options. Cereals will remain central to feed formulations, bolstering cattle health and sustaining high milk and meat outputs in the years ahead.

By Distribution Channel

Offline channels accounted for an 83.4% share of the cattle feed market in 2024, driven by the widespread presence of local distributors, retail stores, and agricultural cooperatives. Farmers favor offline purchases for bulk buying, immediate supply, direct seller interaction, credit access, and quality inspection.

This channel’s strength persists in rural and semi-urban areas with limited digital infrastructure. Long-standing supplier relationships and local availability ensure offline channels remain the primary distribution method, despite the gradual rise of online sales.

Regional Analysis

North America Leads with 42.5% Share (USD 42.0 Billion)

North America held a 42.5% revenue share of the global cattle feed market in 2024, valued at USD 42.0 billion, driven by its robust beef and dairy sectors. The U.S., with its extensive fed-cattle industry and feedlot infrastructure, leads demand, while Canada contributes through dairy-focused provinces and growing beef programs.

Corn-soymeal-based feeds, supplemented by distillers’ dried grains (DDGS), forage enhancers, and additives like vitamin-mineral premixes and probiotics, are widely used to improve feed efficiency and milk solids. Stringent regulations, such as the U.S. FSMA and Canada’s CFIA, ensure feed safety.

Weather challenges and herd rebuilding increase reliance on total mixed rations and precision feeding. Sustainability efforts, including methane reduction and digital ration optimization, align with retailer and processor demands, positioning North America as a leader in premium cattle feed despite input cost volatility and antibiotic stewardship pressures.

Top Use Cases

- Dairy Production Boost: Farmers use nutrient-packed cattle feed to keep dairy cows healthy and producing more milk every day. This feed includes easy-to-digest grains and proteins that support strong lactation cycles. By feeding these blends regularly, herders see better cow condition and higher yields, making it a go-to choice for milk farms worldwide. This simple approach helps meet growing family needs for fresh dairy without extra stress on animals.

- Beef Finishing in Feedlots: In busy feedlots, cattle get high-energy feeds like corn mixes to quickly build muscle and weight before market. These feeds turn grazing animals into prime beef cuts faster, saving time and space for ranchers. It’s a smart way to handle large herds efficiently, ensuring a steady supply to butchers and stores while keeping costs in check.

- Calving and Early Growth Support: New moms and baby calves rely on special starter feeds rich in vitamins to recover fast after birth and grow strong. These gentle formulas prevent weakness and boost immunity right from the start. Herders mix them with fresh grass for balanced meals, helping young stock thrive and reducing early losses on the farm.

- Dry Season Forage Replacement: When pastures dry up, farmers switch to stored feeds like hay or silage to keep cattle full and active year-round. This keeps herds from wandering or getting thin during tough weather. It’s an easy backup plan that maintains steady health and productivity, letting operations run smoothly no matter the season.

- Health Add-On for Disease Prevention: Blended feeds with natural boosters like probiotics help cattle fight off common bugs and stay robust. Added to daily rations, they improve gut health and energy use without harsh meds. This keeps vet visits low and animals lively, a practical pick for worry-free herding in any setup.

Recent Developments

1. ADM Animal Nutrition

ADM is advancing cattle nutrition through its innovative postbiotic feed additive, NutriPass L. This solution helps protect dietary proteins from rumen degradation, increasing the supply of essential amino acids for improved milk yield and component yield in dairy cows. This development supports dairy farmers in enhancing productivity and operational efficiency through better nutrient utilization.

2. Alltech

Alltech is integrating its Planet of Plenty vision into cattle feed solutions, focusing on sustainability and efficiency. Recent initiatives include carbon footprint modeling for farms using its E-CO2 software and promoting the use of algae-based Optigen as a non-protein nitrogen source to reduce reliance on conventional ingredients. This helps lower the environmental impact of cattle production while maintaining animal performance.

3. Cargill, Incorporated

Cargill is expanding its sustainability-linked offerings, such as the RegenConnect program, which now includes incentives for cattle producers adopting regenerative grazing practices. In nutrition, they continue to advance methane-reducing feed additives, collaborating with partners to make solutions like silvamine-based products more accessible to the dairy and beef industries to reduce greenhouse gas emissions from enteric fermentation.

4. Charoen Pokphand Foods PCL (CPF)

CPF is focusing on smart farming and sustainable feed formulations. Recent developments include using alternative proteins, such as insect meal, in their animal feed to promote a circular economy. The company is also implementing advanced feed mill technology to enhance production efficiency and traceability, aligning with its global goal of achieving carbon neutrality for its operations in the future.

5. De Heus Animal Nutrition

De Heus is strengthening its global presence and local support for cattle farmers. A key recent development is the opening of new, state-of-the-art feed mills in key markets like Serbia and Indonesia, ensuring high-quality, tailored feed solutions. They are also focusing on knowledge transfer through local partnerships and digital tools to help farmers optimize feeding strategies for improved herd health and milk production.

Conclusion

Cattle Feed is the quiet hero powering modern farming. With more folks craving quality meat and milk, farmers are leaning on smarter feeds to grow healthier herds without waste. Shifts toward green ingredients and tech tweaks promise even better results ahead, blending old ranch know-how with fresh ideas. This keeps food on tables reliably while easing farm pressures, setting up a brighter path for everyone in the chain.